Global Aerospace and Defense Springs Market Size (2023 – 2030)

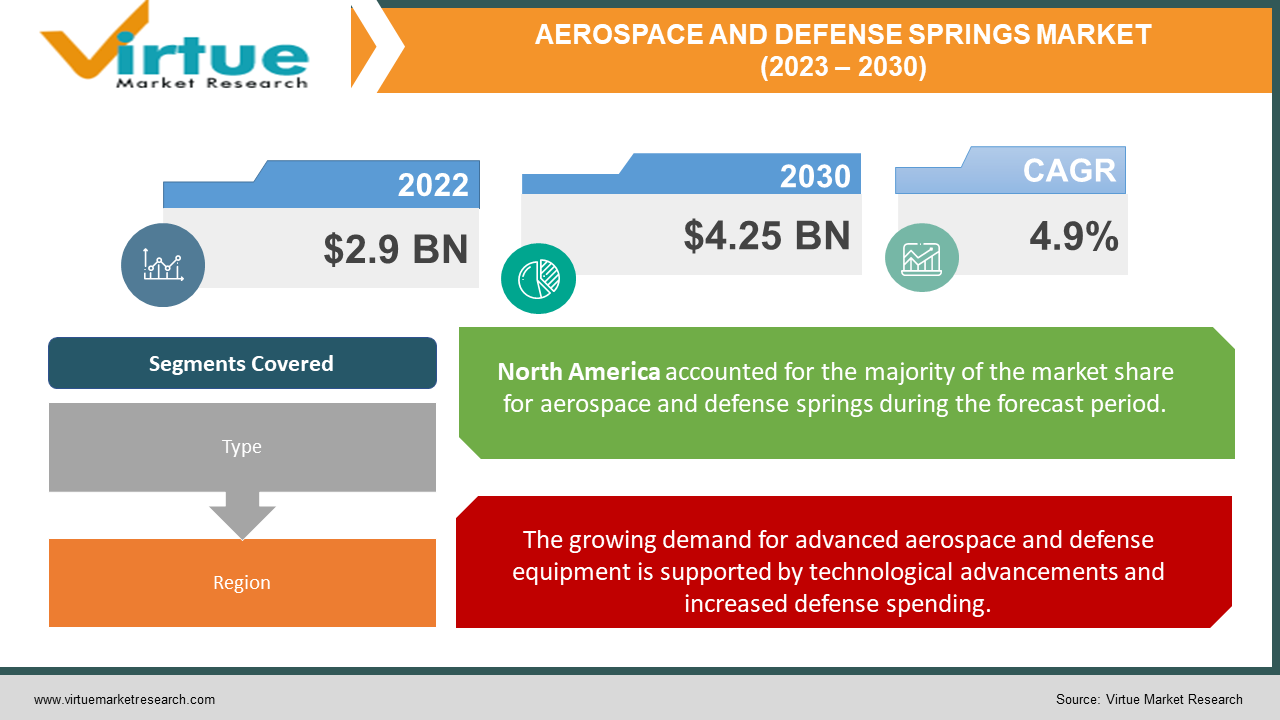

The Global Aerospace and Defense Springs Market was valued at USD 2.9 billion and is projected to reach a market size of USD 4.25 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 4.9%.

The Aerospace and Defense Springs Market is a dynamic sector within the aerospace and defense industries, experiencing its unique evolution and growth. With the aerospace and defense sectors constantly evolving to meet global security and technological demands, the demand for specialized springs used in aircraft, missiles, and other defense applications has been on the rise. This market attracts attention from both academic researchers and industry professionals who recognize the critical role of springs in ensuring the safety, functionality, and durability of aerospace and defense equipment. As these sectors continue to expand, driven by technological advancements and geopolitical factors, the Aerospace and Defense Springs Market is poised to witness increased career opportunities and innovations. Leaders in this field must remain at the forefront of technology and materials science to address the macro and micro factors influencing the production and performance of springs, all while maintaining a strategic view of the industry's broader landscape.

Key Market Insights:

The Aerospace and Defense Springs Market offers key market insights that are essential for industry stakeholders. Firstly, it is characterized by a strong demand for high-performance springs that meet stringent safety and reliability standards, given their critical role in aerospace and defense applications. Secondly, the market is witnessing a shift toward lightweight materials and advanced manufacturing techniques to enhance efficiency and reduce the weight of springs, contributing to fuel efficiency and performance optimization. Thirdly, innovation in materials, such as the use of advanced alloys and composites, is driving improvements in the durability and fatigue resistance of springs, critical for the demanding conditions of aerospace and defense operations. Lastly, the market is influenced by the global geopolitical landscape, as government defense budgets, international collaborations, and security threats play a significant role in shaping the demand for aerospace and defense springs. These insights highlight the need for industry players to stay abreast of technological advancements, materials science, and geopolitical factors to thrive in the Aerospace and Defense Springs Market.

Aerospace and Defense Springs Market Drivers:

The growing demand for advanced aerospace and defense equipment is supported by technological advancements and increased defense spending.

The Aerospace and Defense Springs Market is driven by several key factors. Firstly, the growing demand for advanced aerospace and defense equipment, including aircraft, missiles, and unmanned systems, fuels the need for high-performance springs. These springs are crucial for ensuring the functionality, safety, and reliability of these sophisticated systems. Secondly, technological advancements in materials and manufacturing processes are driving the development of lightweight and durable springs, contributing to improved fuel efficiency and performance of aerospace and defense equipment. Thirdly, the global security landscape and geopolitical tensions are leading to increased defense spending by governments, further propelling the demand for springs used in defense applications. Additionally, the market benefits from ongoing research and development efforts to enhance spring designs and capabilities, meeting the evolving needs of the aerospace and defense industries. These drivers collectively underscore the importance of the Aerospace and Defense Springs Market in supporting the advancement of aerospace and defense technologies.

The continuous innovation in materials and manufacturing processes led to the development of lightweight and durable springs for enhanced performance in aerospace and defense equipment.

Continuous innovation in materials and manufacturing processes is a crucial driver in the Aerospace and Defense Springs Market. As technological advancements continue to reshape the aerospace and defense industries, there is a growing emphasis on developing springs that are not only lightweight but also exceptionally durable. Aerospace and defense equipment must perform reliably under extreme conditions, and the springs used within these systems play a vital role in ensuring their functionality. Therefore, the relentless pursuit of advanced materials, such as specialized alloys and composite materials, coupled with cutting-edge manufacturing techniques, is essential. These innovations not only contribute to the reduction of overall system weight but also enhance the fatigue resistance and longevity of springs, which is critical for withstanding the demanding operational environments in which they are deployed. This relentless drive for excellence in materials and manufacturing processes remains pivotal in meeting the ever-evolving demands of the aerospace and defense sectors.

The increasing government support for defense spending and research initiatives is instrumental in bolstering the market drivers.

Governments play a significant role in supporting the Aerospace and Defense Springs Market drivers through various means. Firstly, government defense budgets and procurement policies directly influence the demand for aerospace and defense equipment, including the springs used within them. Increased defense spending, often driven by national security concerns and geopolitical factors, creates a robust market for springs in defense applications. Additionally, governments promote research and development initiatives, often through partnerships with defense contractors and academic institutions, to advance materials science and manufacturing technologies. These investments lead to innovations in spring materials and production methods, aligning with the market's driver of technological advancement. Furthermore, governments may implement policies that prioritize the use of lightweight and sustainable materials, which further encourages the development of advanced springs to meet these requirements. Overall, government support and defense policies play a pivotal role in bolstering the Aerospace and Defense Springs Market drivers.

Aerospace and Defense Springs Market Restraints and Challenges:

The stringent quality standards, supply chain disruptions, intense competition, skilled labor shortages, and the transition to sustainable materials and processes.

The Aerospace and Defense Springs Market, while promising, is not without its restraints and challenges. Stringent quality and safety standards in the aerospace and defense sectors require manufacturers to meet rigorous requirements, adding both time and cost to production processes. Supply chain disruptions, often triggered by global events like the COVID-19 pandemic, can lead to delays in acquiring critical raw materials and components, impacting production timelines and financial performance. Fierce competition within the market places pressure on pricing and profit margins, challenging manufacturers to maintain profitability while delivering high-quality products. Moreover, the specialized nature of aerospace and defense springs demands a skilled workforce, and shortages of skilled labor can constrain production capacity. Lastly, the industry's commitment to reducing its environmental footprint introduces challenges in adopting sustainable materials and processes without compromising performance standards. To thrive in this market, adaptability, innovation, and stringent quality control are essential.

Aerospace and Defense Springs Market Opportunities:

The Aerospace and Defense Springs Market presents exciting opportunities amid its challenges. As governments worldwide prioritize national security and defense, increased defense budgets are expected to drive the demand for advanced aerospace and defense equipment, including specialized springs. Innovations in materials and manufacturing processes offer opportunities to create lighter, more durable springs, aligning with the industry's need for high-performance components. Additionally, growing interest in sustainable aerospace solutions opens doors for the development of eco-friendly springs. Moreover, international collaborations and technological advancements hold the potential to expand market reach and foster innovation. Navigating these opportunities requires adaptability, research, and a commitment to maintaining the industry's stringent quality and safety standards.

AEROSPACE AND DEFENSE SPRINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

4.9% |

|

Segments Covered |

By Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Argo Spring Manufacturing Co., Inc., M. Coil Spring Manufacturing Company, Myers Spring Co. Inc., Ace Wire Spring & Form Co., Inc, Vulcan Spring & Mfg. Co., Myers Spring Co. Inc., MW Industries Inc., Nordia Springs Ltd, John Evans’ Sons Inc. |

Aerospace and Defense Springs Market Segmentation: By Type

-

Flat Spiral/Power Springs

-

Coil Springs

-

Torsion, Torque Coil, & Clutch Springs

-

Others

In the Aerospace and Defense Springs Market, coil springs hold the largest market share. These versatile springs find extensive use in various applications within aerospace and defense equipment, owing to their capacity to store and release energy efficiently. Coil springs offer reliability and precision, making them a preferred choice for critical functions in these industries. On the other hand, the segment with the fastest growth is the Flat Spiral/Power Springs category. This growth is driven by the increasing demand for compact, lightweight, and energy-efficient solutions, especially in small and portable aerospace and defense devices. Flat spiral/power springs are known for their high energy density and are well-suited for applications where space and weight constraints are paramount, making them a key contributor to the market's growth.

Aerospace and Defense Springs Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America holds the largest market share in the Aerospace and Defense Springs Market. The region's dominance can be attributed to its robust aerospace and defense sectors, with major players and significant government investments in military and space programs. As a result, the demand for high-performance springs is consistently high in North America. In terms of the segment with the fastest growth, the Asia-Pacific region is witnessing rapid expansion. This growth is propelled by the increasing defense budgets of countries like China and India, along with a rising aerospace manufacturing sector. As the region becomes a hub for aerospace and defense production, there is a growing need for specialized springs, driving the segment's rapid growth.

COVID-19 Impact Analysis on the Global Aerospace and Defense Springs Market:

The COVID-19 pandemic had significant but mixed impacts on the Aerospace and Defense Springs Market. While the initial phases witnessed disruptions in supply chains, production delays, and reduced demand due to lockdowns, the latter stages showed resilience. Governments continued to invest in defense, which supported the market's recovery. Additionally, the emphasis on remote warfare technologies and unmanned systems accelerated, boosting the demand for specialized springs. However, the market also faced challenges related to workforce restrictions and adapting to new safety protocols, making agility and innovation vital in navigating these turbulent times.

Latest Trends/ Developments:

The Aerospace and Defense Springs Market serves as a linchpin supporting diverse industries. Its precision-engineered springs, initially developed for aerospace and defense applications, have far-reaching impacts. These high-performance springs enhance vehicle suspension systems in the automotive sector, contributing to safety and comfort. They play a crucial role in renewable energy systems, ensuring the reliability and longevity of wind turbines and solar panels. In the medical field, these springs enable delicate movements in surgical instruments and diagnostic equipment. Additionally, they find utility in telecommunications and electronics, from satellite communications to consumer electronics. In essence, this market's technological innovation, precision engineering, and high-quality materials benefit a spectrum of industries, bolstering their efficiency, reliability, and sustainability.

Key Players:

-

Argo Spring Manufacturing Co., Inc.

-

M. Coil Spring Manufacturing Company

-

Myers Spring Co. Inc.

-

Ace Wire Spring & Form Co., Inc

-

Vulcan Spring & Mfg. Co.

-

Myers Spring Co. Inc.

-

MW Industries Inc.

-

Nordia Springs Ltd

-

John Evans’ Sons Inc.

Chapter 1. Aerospace and Defense Springs Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aerospace and Defense Springs Market– Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aerospace and Defense Springs Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aerospace and Defense Springs MarketEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aerospace and Defense Springs Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aerospace and Defense Springs Market– By Type

6.1 Introduction/Key Findings

6.2 Flat Spiral/Power Springs

6.3 Coil Springs

6.4 Torsion, Torque Coil, & Clutch Springs

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 7. Pure Magnesium Metal Market , By Geography – Market Size, Forecast, Trends & Insights

7.1 North America

7.1.1 By Country

7.1.1.1 U.S.A.

7.1.1.2 Canada

7.1.1.3 Mexico

7.1.2 By Type

7.1.3 Countries & Segments - Market Attractiveness Analysis

7.2 Europe

7.2.1 By Country

7.2.1.1 U.K

7.2.1.2 Germany

7.2.1.3 France

7.2.1.4 Italy

7.2.1.5 Spain

7.2.1.6 Rest of Europe

7.2.2 By Type

7.2.3 Countries & Segments - Market Attractiveness Analysis

7.3 Asia Pacific

7.3.1 By Country

7.3.1.1 China

7.3.1.2 Japan

7.3.1.3 South Korea

7.3.1.4 India

7.3.1.5 Australia & New Zealand

7.3.1.6 Rest of Asia-Pacific

7.3.2 By Type

7.3.3 Countries & Segments - Market Attractiveness Analysis

7.4 South America

7.4.1 By Country

7.4.1.1 Brazil

7.4.1.2 Argentina

7.4.1.3 Colombia

7.4.1.4 Chile

7.4.1.5 Rest of South America

7.4.2 By Type

7.4.3 Countries & Segments - Market Attractiveness Analysis

7.5 Middle East & Africa

7.5.1 By Country

7.5.1.1 United Arab Emirates (UAE)

7.5.1.2 Saudi Arabia

7.5.1.3 Qatar

7.5.1.4 Israel

7.5.1.5 South Africa

7.5.1.6 Nigeria

7.5.1.7 Kenya

7.5.1.8 Egypt

7.5.1.9 Rest of MEA

7.5.2 By Type

7.5.3 Countries & Segments - Market Attractiveness Analysis

Chapter 8. Aerospace and Defense Springs Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 Argo Spring Manufacturing Co., Inc.

8.2 M. Coil Spring Manufacturing Company

8.3 Myers Spring Co. Inc.

8.4 Ace Wire Spring & Form Co., Inc

8.5 Vulcan Spring & Mfg. Co.

8.6 Myers Spring Co. Inc.

8.7 MW Industries Inc.

8.8 Nordia Springs Ltd

8.9 John Evans’ Sons Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Aerospace and Defense Springs Market was valued at USD 2.9 billion and is projected to reach a market size of USD 4.25 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 4.9%.

It supports automotive, renewable energy, medical equipment, telecommunications, and electronics industries through precision engineering, high-quality materials, and technological innovation

Coil springs are versatile and widely used in aerospace and defense applications due to their energy storage and release capabilities

North America holds the largest market share, driven by robust aerospace and defense sectors and significant government investments

The pandemic initially caused supply chain disruptions and reduced demand but later demonstrated resilience, driven by ongoing defense investments and remote warfare technologies.