Aerospace After Services Market Size (2024 – 2030)

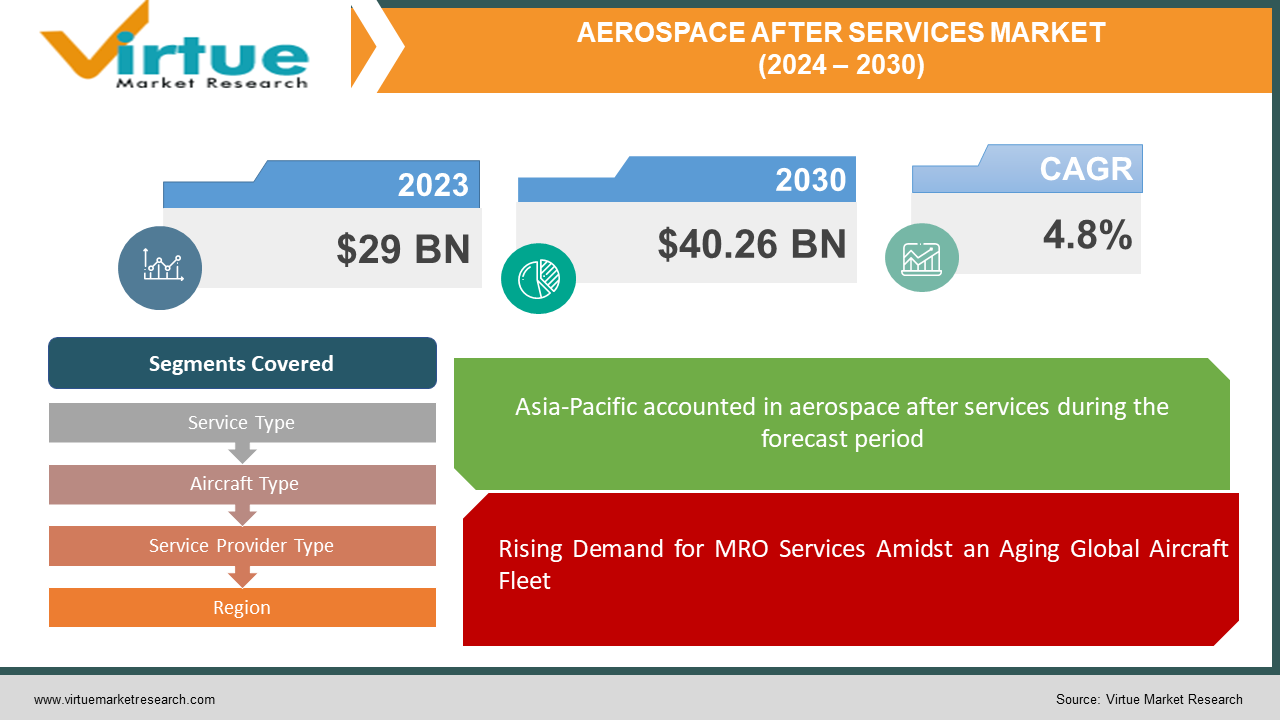

The Global Aerospace After Services Market was valued at USD 29 billion in 2023 and is projected to reach a market size of USD 40.26 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 4.8% between 2024 and 2030.

The aftermarket for the aerospace industry is poised for significant growth due to several compelling factors. Firstly, the increasing age of the global aircraft fleet is driving a substantial demand for replacement parts, maintenance, repair, and overhaul (MRO) services. As aircraft age, the frequency and complexity of required maintenance escalate, ensuring steady demand in this sector. Concurrently, rising demand for air travel is leading to higher aircraft utilization rates, which in turn boosts the need for routine maintenance and inspections to ensure operational safety and efficiency. Additionally, the aerospace industry's continuous innovation and adoption of new technologies, such as advanced materials and avionics, necessitate updated aftermarket services. This includes specialized training for mechanics to handle newer technologies and the development of novel spare parts and tooling to support these advancements. This growth in the aftermarket not only extends the revenue streams for aerospace manufacturers through the sale of spare parts and services but also strengthens the overall health of the aerospace industry, making it a crucial component of its economic stability and expansion.

Key Market Insights:

The aerospace after-services market rebounds alongside air travel recovery, with a projected 20-30% increase in demand for lifespan-extending services compatible with Sustainable Aviation Fuel (SAF).Airlines prioritize cost-containment, potentially increasing remote diagnostics use to reduce maintenance costs amid economic pressures.AI's role expands, particularly in predictive maintenance, aiming for a 10-15% reduction in aircraft grounding time, per industry reports.2-3 major mergers or acquisitions are expected in the next 2-3 years, reflecting ongoing market consolidation.Global sustainability focus drives demand for eco-friendly practices, expected to boost revenue by 5-10% from sustainability-focused services.

Global Aerospace After Services Market Drivers:

Rising Demand for MRO Services Amidst an Aging Global Aircraft Fleet.

The global commercial aircraft fleet is experiencing a notable increase in age, with many aircraft now reaching or even surpassing their originally intended design life expectancy. This aging of the fleet is a key driver for the growing demand in the maintenance, repair, and overhaul (MRO) sector, as airlines and other aircraft operators are compelled to undertake more frequent and extensive maintenance procedures to ensure their fleets remain operational and meet stringent airworthiness standards. The need for such services is critical not only for safety and regulatory compliance but also for operational efficiency, as older aircraft require more meticulous care and updates to stay reliable and efficient. This trend towards increased maintenance is further compounded by the continuous advancements in aviation technology, requiring updates and modifications to older aircraft to keep them competitive with newer models. Consequently, the MRO industry is seeing a significant uptick in activity, becoming an increasingly essential component of the aviation sector, ensuring the longevity and viability of aging aircraft in a fast-evolving market.

Escalating Maintenance Needs Due to Rising Global Air Travel.

As global passenger numbers for air travel continue to climb, the utilization rates of aircraft are correspondingly increasing. This surge in usage naturally leads to more wear and tear on the aircraft, necessitating shorter intervals between maintenance cycles. The heightened frequency of flights not only accelerates the degradation of critical components but also demands more frequent comprehensive inspections to ensure that safety and performance standards are maintained. Moreover, the intensified operational tempo requires a steady supply of replacement parts and components to keep aircraft in optimal flying condition. This dynamic also prompts the need for potential upgrades across fleets, incorporating newer technologies and systems to enhance efficiency, meet newer safety regulations, and improve passenger experience. As a result, airlines and aviation service providers are facing growing pressures to manage larger inventories of parts and to expedite the training of maintenance personnel on the latest aviation technologies. This cycle of increased flight activity and the ensuing requirements for meticulous aircraft maintenance are key factors propelling the expansion of the aviation aftermarket sector, making it an indispensable aspect of the aviation industry's infrastructure.

Global Aerospace After Services Market Restraints and Challenges:

The global aerospace after-services market, while burgeoning with opportunities, faces significant challenges that could impede its growth. A primary concern is the acute shortage of skilled technicians needed to maintain increasingly complex aircraft systems. The industry is currently struggling to match the growing demand for qualified personnel, which could lead to bottlenecks in service provision. Compounding this issue are the unpredictable fluctuations in fuel prices and geopolitical tensions that can disrupt supply chains and escalate maintenance costs unexpectedly. Additionally, stringent environmental regulations are pressuring service providers to invest in developing more sustainable maintenance practices and adopting eco-friendly parts, which could initially increase operational costs. To navigate these hurdles, it will be essential for the sector to invest in workforce development programs to cultivate a new generation of skilled maintenance professionals. Simultaneously, diversifying supply chains and innovating in the development of environmentally sustainable MRO practices will be crucial. These strategic actions will not only address immediate challenges but also enhance the long-term sustainability and resilience of the global aerospace after-services market.

Global Aerospace After Services Market Opportunities:

The global aerospace after-services market presents exciting opportunities driven by technological advancements and a growing focus on efficiency. Firstly, the rise of digital technologies like predictive maintenance offers a chance to optimize MRO processes. By analyzing sensor data from aircraft, service providers can anticipate maintenance needs, reducing downtime and lowering overall costs. Additionally, the adoption of new technologies like additive manufacturing for spare parts holds immense potential. This allows for on-demand production of specific parts, reducing reliance on traditional inventories and minimizing logistics challenges. Furthermore, the increasing focus on sustainability creates a window for companies that develop eco-friendly MRO practices and readily adopt recyclable or bio-based components. By catering to environmentally conscious airlines and addressing regulatory pressures, service providers can gain a competitive edge in this evolving market.

AEROSPACE AFTER SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.8% |

|

Segments Covered |

By Service Type, Aircraft Type, Service Provider Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Airbus, Boeing, Collins Aerospace, Honeywell International Inc., General Electric Company (GE), Eaton Technologies, Meggitt PLC, Safran SA, Textron Aviation |

Global Aerospace After Services Market Segmentation - By Service Type

-

Maintenance, Repair and Overhaul (MRO)

-

Parts & Component Sales

-

Logistics & Support

-

Upgrades & Modifications

The Global Aerospace After Services Market is Segmented by Service Type, Maintenance, Repair and Overhaul (MRO) had the largest market share last year and is poised to maintain its dominance throughout the forecast period. The Maintenance, Repair, and Overhaul (MRO) segment holds a commanding position in the global aerospace after-services market for several key reasons. Firstly, MRO activities are indispensable for maintaining the safety and airworthiness of aircraft, involving everything from routine checks and component repairs to full-scale overhauls required for airworthiness certifications. With the global commercial aircraft fleet aging, the need for comprehensive MRO services is intensifying, as older aircraft demand more frequent and detailed maintenance to manage wear and tear and replace outdated parts. Moreover, the scope of MRO is extensive, covering minor repairs to complex engine overhauls and structural modifications, making it a continual necessity for airlines and a stable revenue source for service providers. MRO requires specialized technical expertise and infrastructure, often beyond the capabilities of airlines, thus they depend on external providers who possess the necessary resources. While other segments like parts & component sales, logistics & support, and upgrades & modifications contribute to the market, they largely support or stem from MRO activities, which is essential for ensuring ongoing aircraft performance and safety, thereby reinforcing MRO's dominance in the aerospace after services sector.

Global Aerospace After Services Market Segmentation - By Aircraft Type

-

Commercial Aircraft

-

Military Aircraft

-

Business Jets

The Global Aerospace After Services Market is Segmented by Aircraft Type, Commercial Aircraft had the largest market share last year and is poised to maintain its dominance throughout the forecast period. The commercial aircraft segment is poised to maintain its dominance in the global aerospace after-services market, driven by several compelling factors. Primarily, the sheer volume of the global commercial aircraft fleet substantially exceeds that of military and business jets, creating a larger base for MRO services, spare parts, and other aftermarket needs. These commercial aircraft also have higher utilization rates, flying more frequently than their military or business counterparts, which accelerates wear and tear and amplifies the demand for frequent maintenance cycles and aftermarket services. Additionally, commercial airlines are subject to stricter safety and regulatory requirements, necessitating more rigorous and frequent MRO activities that further drive demand in this segment. The commercial fleet's diversity, ranging from regional jets to large passenger airliners, requires a broad spectrum of aftermarket services and spare parts to meet the specific needs of each aircraft type. In contrast, the military and business jet segments, though expected to grow, are limited by their smaller fleet sizes and lower utilization rates, and typically face less stringent regulatory demands, which collectively result in a proportionally smaller market for aftermarket services compared to the commercial segment. Thus, the volume, utilization, regulatory rigor, and diversity of the commercial aircraft fleet reinforce its leading position in the aerospace after-services market.

Global Aerospace After Services Market Segmentation - By Service Provider Type

-

Original Equipment Manufacturers (OEMs)

-

Independent MRO Service Providers

-

Component and Parts Suppliers

The Global Aerospace After Services Market is Segmented by Service Provide Type, Original Equipment Manufacturers (OEMs) had the largest market share last year and is poised to maintain its dominance throughout the forecast period.OEMs (Original Equipment Manufacturers) maintain a leading edge in the global aerospace after-services market, particularly for MRO (Maintenance, Repair, and Overhaul) activities, due to their in-depth knowledge and proprietary access to crucial aircraft data. They possess a deep understanding of the aircraft they produce, from systems to components and materials, which enhances their MRO capabilities. OEMs have exclusive access to proprietary technical data, maintenance manuals, and specialized diagnostic tools specific to their models, enabling them to perform efficient and precise MRO work. Their well-established supply chains ensure swift availability of necessary spare parts, reducing downtime and optimizing service turnaround. Additionally, many OEMs offer comprehensive warranty and support programs that often include MRO services or discounted rates, making them an attractive option for airlines. The trust and brand reputation that OEMs have built with airlines further solidify their dominant position in the market. Conversely, independent MRO service providers face significant challenges such as limited access to the latest technical information and difficulties in sourcing OEM-quality parts, which can impact service quality and delay operations, making it harder to compete with OEMs in terms of efficiency, reliability, and trust.

Global Aerospace After Services Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Global Aerospace After Services Market is Segmented by Region, Asia-Pacific had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Asia-Pacific is emerging as the dominant force in the global aerospace after-services market, a trend likely to persist due to several key drivers. The region hosts the fastest-growing commercial aviation sector worldwide, with an exponential increase in air travel fueling a surge in demand for MRO (Maintenance, Repair, and Overhaul) services, spare parts, and aftermarket support. As the regional aircraft fleet expands, it is also aging, necessitating more frequent maintenance and component replacements, further boosting the aftermarket sector. Additionally, many Asian governments are enhancing aviation infrastructure and promoting sector growth, providing a fertile environment for airlines and aftermarket service providers. The region is also attractive due to its growing number of independent MRO providers who offer services at more competitive rates than established OEMs, providing a cost-effective alternative for budget-conscious airlines. However, the region faces challenges such as shortages of skilled technicians and occasional quality concerns with parts from some providers. Despite these hurdles, Asia-Pacific's robust aviation growth, supported by government initiatives and cost-competitive service offerings, ensures its continued leadership in the global aerospace after-services market.

COVID-19 Impact Analysis on the Global Aerospace After Services Market.

The COVID-19 pandemic caused a profound disruption to the global aerospace after-services market, as airlines slashed maintenance spending amid grounded fleets and plummeting passenger traffic. This unprecedented downturn led to a significant decrease in demand for routine maintenance, repairs, and overhaul services, compounded by supply chain disruptions due to lockdown measures. However, as air travel gradually rebounds, the after-services market is poised for a cautious recovery. The industry's focus is shifting towards implementing cost-containment measures and leveraging remote diagnostics to optimize maintenance practices in the face of ongoing uncertainty. Looking ahead, there are promising opportunities for long-term growth, driven by a renewed emphasis on fleet optimization and the potential expansion of cargo aircraft operations, fueled by the rise of e-commerce and changing consumer behaviors. These shifts reflect the industry's resilience and adaptability, as it navigates through the challenges posed by the pandemic and positions itself for future opportunities in a changing global landscape.

Latest Trends/ Developments:

As the global aerospace after-services market takes flight again amidst the recovery of air travel, a notable trend emerges with a growing emphasis on sustainability. Airlines are increasingly prioritizing emissions reduction, leading to heightened demand for maintenance solutions that not only prolong the lifespan of existing aircraft but also integrate compatibility with Sustainable Aviation Fuel (SAF). Moreover, digitalization is playing an increasingly significant role, with predictive maintenance driven by artificial intelligence aiding airlines in optimizing maintenance schedules and minimizing downtime effectively. Concurrently, there's a surge in mergers and acquisitions within the industry, as companies consolidate their operations to offer more comprehensive services packages to their clientele. This collective shift towards data-driven, sustainable, and integrated solutions is not only addressing immediate industry needs but is also shaping the trajectory of the global aerospace after-services market for the foreseeable future, aligning with evolving environmental priorities and technological advancements.

Key Players :

-

Airbus

-

Boeing

-

Collins Aerospace

-

Honeywell International Inc.

-

General Electric Company (GE)

-

Eaton Technologies

-

Meggitt PLC

-

Safran SA

-

Textron Aviation

Chapter 1. Aerospace After Services Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aerospace After Services Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aerospace After Services Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aerospace After Services Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aerospace After Services Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aerospace After Services Market – By Service Type

6.1 Introduction/Key Findings

6.2 Maintenance, Repair and Overhaul (MRO)

6.3 Parts & Component Sales

6.4 Logistics & Support

6.5 Upgrades & Modifications

6.6 Y-O-Y Growth trend Analysis By Service Type

6.7 Absolute $ Opportunity Analysis By Service Type, 2024-2030

Chapter 7. Aerospace After Services Market – By Aircraft Type

7.1 Introduction/Key Findings

7.2 Commercial Aircraft

7.3 Military Aircraft

7.4 Business Jets

7.5 Y-O-Y Growth trend Analysis By Aircraft Type

7.6 Absolute $ Opportunity Analysis By Aircraft Type, 2024-2030

Chapter 8. Aerospace After Services Market – By Service Provider Type

8.1 Introduction/Key Findings

8.2 Original Equipment Manufacturers (OEMs)

8.3 Independent MRO Service Providers

8.4 Component and Parts Suppliers

8.5 Y-O-Y Growth trend Analysis By Service Provider Type

8.6 Absolute $ Opportunity Analysis By Service Provider Type, 2024-2030

Chapter 9. Aerospace After Services Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Service Type

9.1.3 By Aircraft Type

9.1.4 By Service Provider Type

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Service Type

9.2.3 By Aircraft Type

9.2.4 By Service Provider Type

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Service Type

9.3.3 By Aircraft Type

9.3.4 By Service Provider Type

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Service Type

9.4.3 By Aircraft Type

9.4.4 By Service Provider Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Service Type

9.5.3 By Aircraft Type

9.5.4 By Service Provider Type

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Aerospace After Services Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Airbus

10.2 Boeing

10.3 Collins Aerospace

10.4 Honeywell International Inc.

10.5 General Electric Company (GE)

10.6 Eaton Technologies

10.7 Meggitt PLC

10.8 Safran SA

10.9 Textron Aviation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Aerospace Services market is expected to be valued at USD 29 billion.

Through 2030, the global Aerospace After Services market is expected to grow at a CAGR of 4.8 %.

By 2030, the global Aerospace After Services is expected to grow to a value of USD 40.26 billion.

North America is predicted to lead the market globally for Aerospace After Services.

The global Aerospace After Services has segments By Service Type, By Aircraft Type, By Service Provider Type, and Region.