GLOBAL AEROSPACE 4.0 MARKET SIZE (2023 -2030)

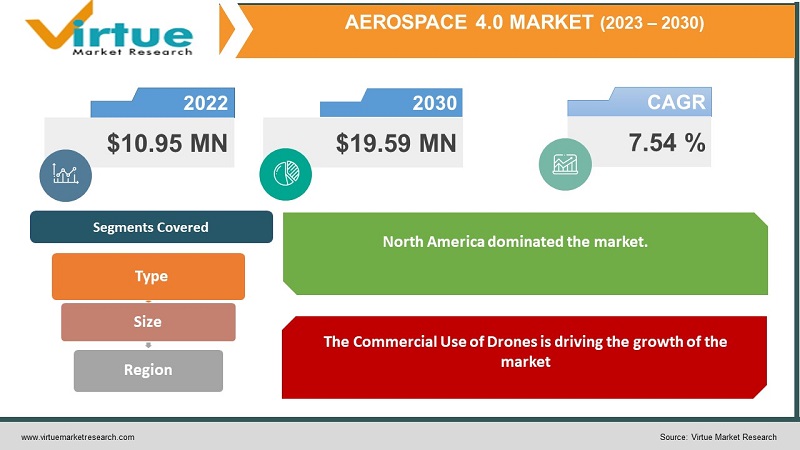

The global Aerospace 4.0 Market size is estimated to grow from USD 10.95 million in 2023 to USD 19.59 billion by 2030. The market is witnessing a healthy CAGR of 7.54 % from 2023 - 2030. The commercial use of drones in many industries is the major factor that is driving the growth of the industry.

Industry Overview:

Aerospace 4.0 in truth applies all the new digital applied sciences coming into the electronics manufacturing enterprise however thru the lens of the aerospace sector. These new applied sciences consist of Big Data, 3D printing, cell, and facet computing, augmented reality, desktop gaining knowledge, and the Internet of Things.

Prior to these, aerospace businesses had trouble offering facts lower back to the product’s design, upkeep, and manufacturing methods autonomously and in real-time, and from all components of the price chain - which includes in-service data. Today’s digital applied sciences make certain product lifestyles cycle facts are on hand in real-time and are adaptive and optimized. Aerospace four applies the new digital applied sciences getting into the electronics manufacturing industry, but thru the lens of the aerospace sector

Aerospace businesses want to remain cutting-edge in order to compete in the international market. To gain that, they ought to enhance merchandise faster, more cost-effective, and better. The sole way to make certain that is workable is to include the new digital equipment that Aerospace four has to offer. By adopting this digital approach, organizations can keep away from previous troubles and cross to an extra wonderful way of working that meets closing dates and satisfies customers. The equipment that shapes Aerospace four will allow organizations to decrease costs, enhance quality, reduce inventory, up the work rate, minimize waste, enhance time to market and expand the chance to introduce new products.

COVID-19 impact on the Aerospace 4.0 Market

The outbreak of the COVID-19 pandemic has negatively impacted the market during the period. Pandemics like COVID-19 are fortuitously rare; however, they have an effect on the aerospace enterprise is large, in particular for small-to-midsize suppliers.

The contemporary COVID-19 disaster hits an already challenged dealer panorama that - particularly in the North American market - is burdened via the Boeing 737 Max situation. The impact is a discount in demand, grant interruptions, economic stress, and personnel impairment ensuing in one of the biggest international shocks in the industry’s history.

With the disaster in full swing and nations in shutdown mode, the financial rebound situations are uncertain. A speedy recuperation will become not likely by means of the day. The shock of COVID-19 is impacting international GDP and provides a vast assignment to aerospace OEM and suppliers’ revenue, EBIT, and cash flow.

MARKET DRIVERS:

The Commercial Use of Drones is driving the growth of the market

Legal authority permitting the use of drones for industrial use is being prolonged greater extensively growing a plausible income channel for plane manufacturers. Drone pilots working underneath Part 107 may additionally fly at night, over human beings, and transfer automobiles except for a waiver as long as they meet the necessities described in the rule. Airspace authorizations are nevertheless required for nighttime operations in managed airspace underneath four hundred feet. Relaxation of the guidelines is predicted to resource the market for industrial drones in the forecast period. Many other international locations observe the FAA’s regulatory lead to clear business drones for take-off now not simply in the USA, but worldwide. Combined with the launch of dependable and improved drones, especially for industrial use, such as the drones manufactured by way of a Chinese organization DJI and public income of industrial drones are predicted to force a fast boom in the drone phase of the aerospace market.

MARKET RESTRAINTS:

A rise in cases of bankruptcy is restraining the growth of the market

Rising financial ruin instances amongst price range airways are predicted to preclude the increase of the aerospace market. In March 2019, Wow Air, an Icelandic price range airline, shut down its operations after it failed to tightly close funding for the company. Since Summer 2018, Wow Air had been the eighth European airline working on small earnings margins that shut down owing to “fluctuating gas costs, over-capacity, and a continent-wide fare war”, following the Danish finances airline Primera Air that shut down in October 2018, and Swiss airline SkyWork and the Belgian airline VLM that shut down in August-September 2018.

AEROSPACE 4.0 MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

7.54% |

|

Segments Covered |

By Type, Size and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Airbus, BOing Company, United Technologies Corporation, General Electric Company, Safran S.A., General Dynamics Corp., Honeywell International, Rolls Royce Holdings plc, Embraer S.a, Northop Grumman Corp. , BrahMos Aerospace |

This research report on the global Aerospace 4.0 Market has been segmented and sub-segmented based on the Type, Size, and region.

Aerospace 4.0 Market - By Type:

-

-

Commercial Aircraft

-

Aircraft Maintenance, Repair, and Overhauling Services

-

Aerospace Support and Auxiliary Equipment

-

Based on Type, the industrial plane market used to be the greatest section of the aerospace market segmented through type, accounting for 69.7% of the complete in 2021, and going ahead it is predicted to be the quickest developing phase in the aerospace market, at a CAGR of 8.4%.

The market is further sub-segmented into various other parts in which the passenger aircraft market used to be the biggest section of the industrial plane market, accounting for 53.5% of the complete in 2021. Going forward, the industrial gliders and drones’ section is anticipated to be the quickest developing phase in the industrial plane market, at a CAGR of 28.2%. The business aircraft MRO offerings market used to be the greatest phase of the plane maintenance, restoration, and overhauling offerings market, accounting for 62.9% of the whole in 2021. Going forward, the industrial gliders and drones MRO services section is anticipated to be the quickest developing section in the plane maintenance, restore, and overhauling offerings market, at a CAGR of 49.9%.

Aerospace 4.0 Market - By Size:

-

Narrow

-

Wide

-

others

Based on Size The narrow-body phase used to be the greatest phase of the aerospace market segmented with the aid of size, accounting for 71.5% of the whole in 2021. Going forward, the narrow-body phase is predicted to be the quickest developing section in the aerospace market, at a CAGR of 8.4%. Both narrow and wide body types are estimated to grow during the forecast period.

Aerospace 4.0 Market - By Region:

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East

-

Africa

Geographically, North America dominated the aerospace components manufacturing market and accounted for the biggest income share of extra than 51% in 2021 owing to the presence of key plane components producers and the well-established plane manufacturing enterprise in the region. Ascending demand for the new-generation planes is anticipated to enhance the market increase in the place over the forecast period. The market in the U.S. is characterized by using the ascending demand for touchdown tools and different help components, on account of the upward vogue of changing ancient touchdown gears with superior systems. In addition, the rising demand for fixed-wing planes in the U.S. is estimated to pressure the market over the forecast period.

Asia Pacific is estimated to be the fastest-growing market for aerospace components manufacturing with a CAGR of 7.3% owing to the fast enlargement of the aviation enterprise and the increase of the Maintenance, Repair, and Overhaul (MRO) quarter in the region. This is predicted to have a wonderful effect on regional market growth. The balance of investments in R&D in the aerospace and protection area in Europe is anticipated to positively have an effect on the plane components manufacturing enterprise in the region. The enterprise additionally boasts of a rather modern and contemporary lookup approach. The rapid increase in the manufacturing of cabins indoors aspects is predicted to force the market to increase over the forecast period.

Aerospace 4.0 Market Share by Company

-

Airbus

-

BOing Company

-

United Technologies Corporation

-

General Electric Company

-

Safran S.A.

-

General Dynamics Corp.

-

Honeywell International

-

Rolls Royce Holdings plc

-

Embraer S.a

-

Northop Grumman Corp.

-

BrahMos Aerospace

Recently, for example, the US Federal Aviation Authority issued an Operations Over People rule which became effective on April 21, 2021. Drone pilots operating under Part 107 may fly at night, over people and moving vehicles without a waiver as long as they meet the requirements defined in the rule.

The enterprise has witnessed improved competition, on account of the speedy increase in the number of Asian manufacturers. The gamers compete on the groundwork of differentiation in technology, design, product performance, and compliance with the purchaser's specifications. In addition, well-timed product delivery, market goodwill, most fulfilling client carrier and support, and rate additionally have an effect on the competition. The key enterprise gamers frequently enter into long-term furnish contracts with plane manufacturers. They additionally grant personalized options to suppliers and plane manufacturers. The plane producers frequently display the element manufacturing in the course of the price chain, from designing the issue to its manufacturing to make sure excessive quality.

NOTABLE HAPPENINGS IN THE GLOBAL AEROSPACE 4.0 MARKET IN THE RECENT PAST:

-

Agreement - In January 2021, Teijin Limited entered into an agreement with Boeing for the supply of unidirectional pre-impregnated tape (TENAX TPUD). This helped the company in its medium-term growth in the aircraft business.

Chapter 1. AEROSPACE 4.0 MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. AEROSPACE 4.0 MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. AEROSPACE 4.0 MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. AEROSPACE 4.0 MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. AEROSPACE 4.0 MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. AEROSPACE 4.0 MARKET – By Type

6.1. Commercial Aircraft

6.2. Aircraft Maintainence, Repair and Overhauling Services

6.3. Aerospace Support and Auxialiary Equipment

Chapter 7. AEROSPACE 4.0 MARKET – By Size

71. Narrow

7.2. Wide

7.3. Others

Chapter 8. AEROSPACE 4.0 MARKET – By Region

8.1. North America

8.2. Europe

8.3. Asia-P2acific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. AEROSPACE 4.0 MARKET – By Companies

9.1. Airbus

9.2. Boing Company

9.3. United Technolgies Corporation

9.4. Safran S.A.

9.5. General Electric Company

9.6. General Dynamic Company

9.7. Honeywell International

9.8. Rolls Royce Holdings Inc.

9.9. Embraer S. A Northop Gurumnn Corp

9.10. Brahmos Corporation

Download Sample

Choose License Type

2500

4250

5250

6900