Aeroponics Market Size (2024 – 2030)

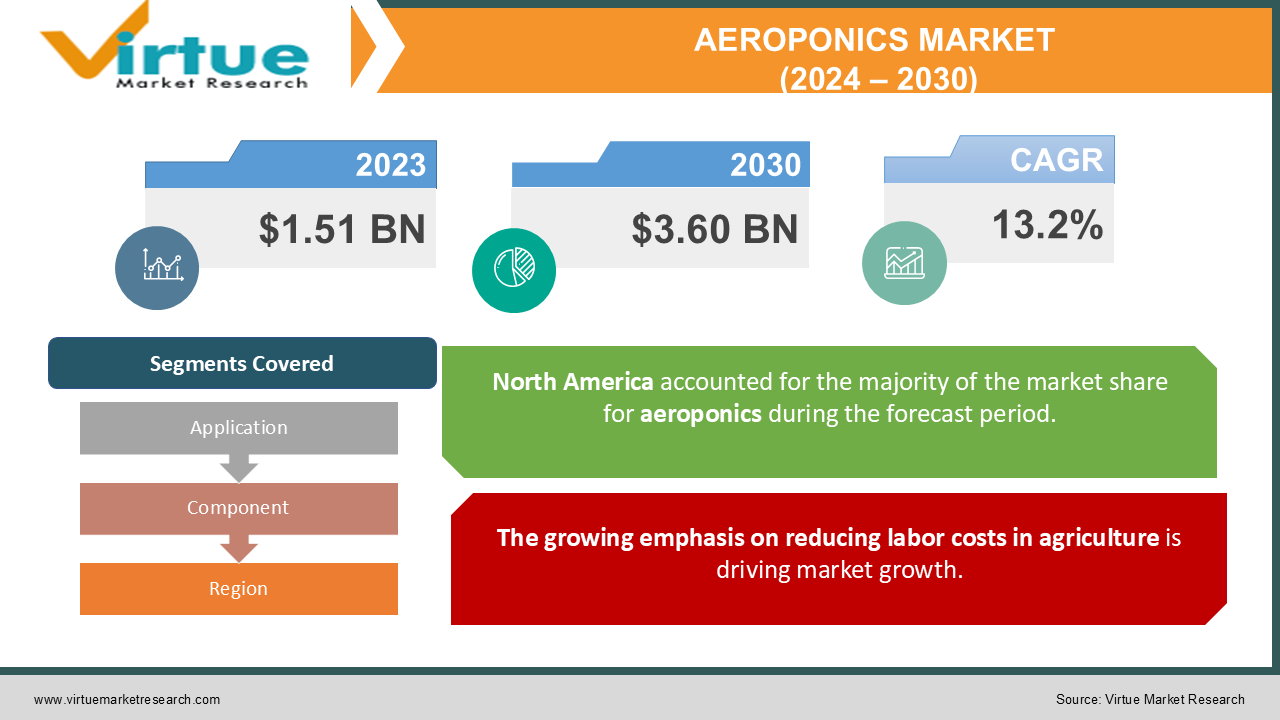

The Aeroponics Market was valued at USD 1.51 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 3.60 billion by 2030, growing at a CAGR of 13.2%.

Aeroponics is an advanced method of hydroponics that involves the cultivation of plants within a precisely controlled mist environment. This technique is employed for the growth of various crops, including fruits, vegetables, leafy greens, climbing plants, and herbs, all without the need for soil-filled pots. In this system, plants are suspended in the air by their root structures and receive periodic sprays of nutrient-rich solutions. Aeroponics utilizes a blend of low-pressure and high-pressure systems, ultrasonic foggers, sensors, along with lighting and climate control technologies. Compared to traditional farming methods, aeroponics delivers greater crop yields while utilizing significantly less water and space, and it produces no toxic waste. Additionally, it encourages accelerated plant growth, minimizes pest problems, allows for continuous year-round cultivation, and requires very little maintenance.

Key Market Insights:

The growing adoption of indoor farming and vertical aeroponics is significantly contributing to market expansion. An increase in health awareness, coupled with a consumer shift towards organic and disease-free food options, has led to a heightened demand for efficient aeroponics systems.

Aeroponics technology is becoming increasingly popular owing to its various health advantages. Additionally, plants cultivated using aeroponics require less space, fewer fertilizers, and minimal water, while eliminating the need for pesticides. Some examples of crops grown using this method include cucumbers, tomatoes, lettuce, strawberries, and herbs such as mint and basil.

Aeroponics technology is gaining momentum due to its numerous health benefits. Additionally, plants cultivated using the aeroponic method require less space, fewer fertilizers, and minimal water, with no need for pesticides. Some of the crops commonly grown using aeroponics include cucumbers, tomatoes, lettuce, strawberries, and herbs such as mint and basil.

One of the unique advantages of aeroponics is its ability to produce a wide variety of crops year-round, regardless of the season. Fluctuating climates present significant challenges to the global food supply chain. Consequently, the increasing adoption of aeroponics systems by farmers in various regions worldwide to ensure consistent yields and alleviate local food shortages is expected to drive the overall growth of the aeroponics market in the coming years.

Aeroponics Market Drivers:

The growing emphasis on reducing labor costs in agriculture is driving market growth.

Aeroponic technologies feature fully automated systems designed for plant cultivation. These innovations enhance crop yields while minimizing labor costs by reducing the need for manual intervention in farming practices. Several vendors provide farm management technologies that utilize software and data services to eliminate unnecessary labor and optimize operational conditions. As a result, manual labor is primarily needed on-site for activities such as planting and packaging crops.

Furthermore, modern aeroponic technologies can lower access costs, which include tasks like traversing rows, extracting crop channels to workbenches, using scissor lifts to reach elevated areas, and bending to access lower levels. Consequently, the increasing emphasis on reducing labor costs in agriculture is expected to propel the growth of the global aeroponics market throughout the forecast period.

Aeroponics Market Restraints and Challenges:

The limitations of aeroponics pose challenges to market growth.

Aeroponics is not suitable for cultivating all types of plants and vegetables. Only a limited selection of fruits and vegetables can be effectively produced in a controlled environment using aeroponics. As a result, farmers are restricted to growing specific crops with this technology, including cucumbers, tomatoes, lettuce, strawberries, and herbs such as mint and basil.

In addition, staple crops like wheat, barley, corn, and rice are primarily grown using traditional farming techniques. Likewise, calorie-dense root vegetables typically thrive only in outdoor farming conditions. Therefore, these limitations associated with aeroponics may hinder market growth during the forecast period.

Aeroponics Market Opportunities:

The increasing need to satisfy the growing demand for food products presents significant opportunities in the market.

Aeroponic technology provides an innovative method for producing substantial quantities of food, independent of favorable climatic conditions. These advanced systems can be integrated with various agricultural practices to achieve higher yields and enhanced crop rotation compared to traditional open-field farming and other methods. As the global population continues to rise, the demand for food is expected to increase correspondingly. Consequently, this growing food demand amplifies the necessity for innovative agricultural technologies, such as aeroponics.

Moreover, aeroponic systems can be implemented in multi-level designs, offering more cultivation area than single-level setups. This capability not only boosts crop yields but also presents a profitable agricultural opportunity for end-users. Therefore, the potential for maximum crop yield with minimal overhead provided by aeroponic technologies positions them to effectively address the increasing demand for food products.

AEROPONICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.2% |

|

Segments Covered |

By Application, Component, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Aerofarms, Ponics Technologies, Saveer Biotech Ltd., AEssenseGrows, General Hydroponics, Alesca Life Technologies Ltd., Living Greens Farm Inc., Hydrogarden, Hanging Hydroponics, Good Life Growing Llc |

Aeroponics Market Segmentation: By Application

-

Indoor Farming

-

Outdoor Farming

Indoor aeroponics is gaining popularity due to its efficient space utilization, particularly in urban areas with limited farmland. This method enables year-round crop production, unaffected by weather conditions, thus ensuring consistent yields. Furthermore, it consumes less water and eliminates the use of pesticides, aligning with the increasing demand for sustainably and organically produced crops. Additionally, advancements in automation and the Internet of Things (IoT) enhance the efficiency and attractiveness of indoor aeroponic systems in the market.

Aeroponics Market Segmentation: By Component

-

Lightning

-

Irrigation Component

-

Sensor

-

Climate Control

-

Building Material

-

Others

The aeroponics sector has experienced an increasing demand for lighting components, as these are essential for enhancing plant growth in controlled environments. Advanced technologies, such as LEDs, provide precise control over light spectra, intensity, and duration, effectively mimicking natural sunlight. This optimization boosts photosynthesis, resulting in accelerated growth, higher yields, and improved crop quality. Moreover, energy-efficient LEDs help reduce operational costs and facilitate year-round cultivation, irrespective of weather conditions. As urban and vertical farming continue to expand, the demand for advanced lighting solutions that support sustainable and efficient aeroponic systems is propelling growth in this segment.

Aeroponics Market Segmentation- by Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America holds a substantial share of the aeroponics market, accounting for approximately 34%. The region is a leader in this sector due to its advanced technologies, significant investments in research and development, and the presence of key market players. Furthermore, the strong consumer demand for organic and pesticide-free crops, along with government support and initiatives promoting sustainable agriculture, drives the adoption of aeroponics across the region. Countries such as the U.S. and Canada are particularly focused on urban and vertical farming solutions, which align well with aeroponic systems, enhancing their widespread implementation. These factors collectively establish North America as a dominant player in the aeroponics market, ensuring continued growth and innovation.

In addition, the Asia-Pacific region is projected to experience significant growth, driven by rapid urbanization, technological advancements, and supportive government policies in nations like China, Japan, and Singapore. These countries are prioritizing investments in sustainable agriculture to address food security concerns. The growing population and limited arable land are further fueling the adoption of space-efficient and high-yield aeroponic systems, thereby accelerating market growth in this area.

Additionally, the world's largest aeroponics farm is currently under construction, featuring 6,400 square meters of soil-less cultivation space. Developed by AeroFarms, this infrastructure will be powered by photovoltaic panels and is expected to produce over 2 million kilograms of vegetables annually. Moreover, the UAE welcomed its first vertical aeroponics farm in January 2018, established by Indoor Farms of America. Located in Dubai, this farm is set to commence operations in the near future.

COVID-19 Pandemic: Impact Analysis

As the pandemic disrupts farming operations and food supply chains, stakeholders in the aeroponics sector have remained optimistic that their innovative food production methods can enhance food security. However, the pandemic has led to challenges in production and marketing due to labor shortages and logistical constraints. Additionally, negative income shocks have limited market access and contributed to rising food commodity prices.

Latest Trends/ Developments:

In May 2024, LettUs Grow announced a partnership with Valoya India aimed at licensing aeroponics technology to key agricultural manufacturers worldwide. This collaboration is anticipated to enhance the adoption of advanced aeroponic technology in both India and the Middle East.

In March 2024, the USDA revealed an investment of $5.2 million in 17 Urban Agriculture and Innovative Production Projects. These grants represent an extension of the USDA's comprehensive support for urban agriculture, facilitated through its Office of Urban Agriculture and Innovative Production (OUAIP). This investment follows a previous commitment of $46.8 million across 186 projects since 2020.

In January 2023, AeroFarms announced the expansion of its Community Farm program, which aims to provide access to fresh and nutritious leafy greens in local settings such as schools, corporate cafeterias, and community centers. This expansion, which includes the addition of nine new farms, addresses the growing demand for small-scale indoor farming technology and signifies the growth of AeroFarms' equipment business.

In November 2022, Wageningen University and Research (Netherlands) partnered with aeroponic technology specialists LettUs Grow (United Kingdom) to conduct side-by-side trials comparing ultrasonic aeroponic and hydroponic irrigation systems.

Key Players:

These are top 10 players in the Aeroponics Market :-

-

Aerofarms

-

Ponics Technologies

-

Saveer Biotech Ltd.

-

AEssenseGrows

-

General Hydroponics

-

Alesca Life Technologies Ltd.

-

Living Greens Farm Inc.

-

Hydrogarden

-

Hanging Hydroponics

-

Good Life Growing Llc

Chapter 1. Aeroponics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aeroponics Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aeroponics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aeroponics Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aeroponics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aeroponics Market – By Component

6.1 Introduction/Key Findings

6.2 Lightning

6.3 Irrigation Component

6.4 Sensor

6.5 Climate Control

6.6 Building Material

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Component

6.9 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Aeroponics Market – By Application

7.1 Introduction/Key Findings

7.2 Indoor Farming

7.3 Outdoor Farming

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Aeroponics Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Component

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Component

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Component

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Component

8.4.3 By Component

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Component

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Aeroponics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Aerofarms

9.2 Ponics Technologies

9.3 Saveer Biotech Ltd.

9.4 AEssenseGrows

9.5 General Hydroponics

9.6 Alesca Life Technologies Ltd.

9.7 Living Greens Farm Inc.

9.8 Hydrogarden

9.9 Hanging Hydroponics

9.10 Good Life Growing Llc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

An increase in health awareness, coupled with a consumer shift towards organic and disease-free food options, has led to a heightened demand for efficient aeroponics systems.

The top players operating in the Aeroponics Market are - Aerofarms, Ponics Technologies, Saveer Biotech Ltd, AEssenseGrows, General Hydroponics, Alesca Life Technologies Ltd., Living Greens Farm Inc., Hydrogarden, Hanging Hydroponics and Good Life Growing Llc.

The COVID-19 pandemic has had a substantial impact on the aeroponics market. As the pandemic disrupts farming operations and food supply chains, stakeholders in the aeroponics sector have remained optimistic that their innovative food production methods can enhance food security.

The advanced systems can be integrated with various agricultural practices to achieve higher yields and enhanced crop rotation compared to traditional open-field farming and other methods.

The Asia-Pacific region is projected to experience significant growth, driven by rapid urbanization, technological advancements, and supportive government policies in nations like China, Japan, and Singapore.