Aerodynamics Market Size (2025 – 2030)

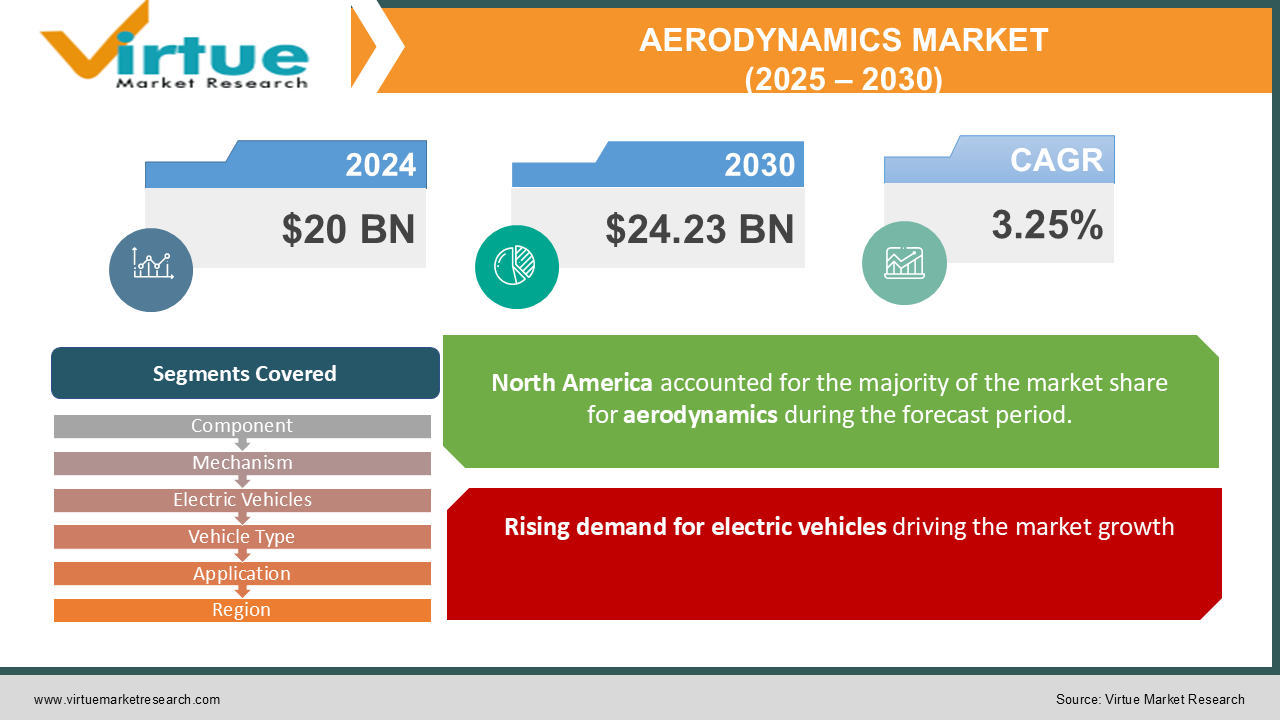

The Aerodynamics Market was valued at USD 20 Billion and is projected to reach a Market size of USD 24.23 Billion by the end of 2030. Over the forecast period of 2025-2030, the Market is projected to grow at a CAGR of 3.25%.

Aerodynamics is nothing but the study of how objects move through the air and what type of forces are exerted on them by the air while moving. The study of aerodynamics has several applications. Prominently in the field of automotive engineering, aerodynamics plays a very crucial role. Using knowledge of core aerodynamics, several shapes and designs are made in order to streamline the appearance as well as the aerodynamic utility of vehicles, spaceships, airplanes, and even marine ships. But, the primary application of aerodynamics is in the domain of automotive design. Making cars more aerodynamic can help boost their speeds, save fuel, increase running efficiency, and reduce operating costs. The Aerodynamics market is focused on several designs, applications, components, parts, software, and services for improvement in design and manufacturing.

Key Market Insights:

-

Currently, the aerodynamics market is focusing more and more on biomimicry. Emulating the natural swimming and flying ability of several creatures is being studied for this purpose. Birds such as pigeons, condors, fishes such as mako sharks, demersal fish, and female boxfish are under study.

-

According to some studies, about a 10% reduction in aerodynamic drag (coefficient) can lead to a 5% to 7% increase in fuel efficiency, highlighting the significant impact of aerodynamics on a car's overall efficiency, particularly at highway speeds.

-

McLaren Speedtail, Vauxhall Calibra, Tesla Model 3, and Porsche Taycan are the four top cars that have implemented state-of-the-art aerodynamics.

-

India, being one of the largest markets for consumer vehicles, has Hindustan Aeronautics Limited (HAL), Tata Advanced Systems (part of the Tata Group), Mahindra Aerospace (part of the Mahindra Group), and Airbus working on several key projects in aerodynamics.

-

Customizing designs of vehicles is also a very big business where one studies the OEM design of the vehicle and decides what implementations can be changed. This way a new component is manufactured and then fitted to the vehicle. This allows the vehicle to get the most out of the fuel of the vehicle, through aerodynamic improvements.

-

Using Computational Fluid Dynamics and high-end graphical computer simulations, designers are able to design aerodynamic components in less time, with more collaboration, iterations, and easy manufacturing by means of 3D printing wherever possible.

Aerodynamics Market Drivers:

Rising demand for electric vehicles driving the market growth

The increasing demand for electric vehicles (EVs) is a major driver in the aerodynamics market. With environmental concerns on the rise and government projects and initiatives supporting EV adoption, manufacturers are focusing on aerodynamic designs to enhance efficiency, reduce drag, and extend the range of EVs. For example, One of the most reputed vendors, Stellantis, has invested in wind tunnel technology to optimize aerodynamics for their electric vehicles.

Technological advancements in aerodynamics fuelling the market growth

Due to the advancements in computational fluid dynamics, it is now easily possible to make a complicated design, test its aerodynamic feasibility, and produce prototypes with additive manufacturing, tunnel testing, and virtual experiments by means of advanced computer simulations. Designing, modeling, wireframing, particle simulations, fluid simulations, and analysis of forces can be easily done using software and high-end render farms. These technological advancements are major drivers in modern designing in aerodynamics.

Regulatory Pressures for Emissions Reduction

Stricter emissions regulations are pushing automakers to adopt aerodynamic solutions that improve fuel efficiency and reduce carbon footprints. This regulatory environment is driving the development of aero-efficient designs and lightweight materials that contribute to lower emissions and better overall vehicle performance.

Aerodynamics Market Restraints and Challenges:

High costs of the implementation

The use of advanced aerodynamic features and technologies can be costly. The research, design, and manufacturing costs for aerodynamic components can be quite high, thereby limiting market growth, especially among smaller manufacturers. For high-end and iterative computational models, the designer needs to digitize the concept and process it through render farms for rendering and simulations. These simulations need computing and graphical bandwidth, which is pretty expensive. Also, if one wants to manufacture and test prototypes by means of additive manufacturing, the cost of 3D printing is also high. This poses a challenge to this industry to reduce the costs of novel designs.

Complex Regulatory Compliance

Stringent emissions and safety regulations can be hard to meet for smaller manufacturers. Automakers face complex regulatory environments that can hinder the development and implementation of new aerodynamic technologies. Newer designs or implementations often come with nuances where they cannot be fitted into regulatory compliance and hence face challenges to bring up to manufacturing.

Balancing Aesthetics and Functionality

Nowadays, the market not only runs on the utility aspect of a product but also on the presentation aspect. If the products are made keeping a very practical perspective, they may have very good utility, but the least preference for visual aspects. When it comes to vehicles, it is essential that visual appearance be appealing. It may be difficult to design vehicles that not only are aerodynamically efficient but also aesthetic. Sometimes it is a real challenge for manufacturers to incorporate those aerodynamic elements without losing aesthetics and market appeal.

AERODYNAMICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

202 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

3.25% |

|

Segments Covered |

By Component, Mechanism, Electric Vehicles, Vehicle Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Valeo S.A., Bosch Group, Gentex Corporation, Daimler AG, Magna International Inc., Honeywell International Inc., Toyota Motor Corporation, Ford Motor Company, 3M Company, ZF Friedrichshafen AG |

Aerodynamics Market Segmentation: by Component

-

Services

-

Software

The automotive aerodynamics market by component is divided into Services, Software, and Physical Components like spoilers, side skirts, etc. The services segment includes consulting, testing, and design optimization services offered by firms to improve vehicle aerodynamics. The software segment involves tools and applications used for aerodynamic simulations and analysis, helping manufacturers design more efficient vehicle shapes. The most significant segment is components, which include physical products such as spoilers, side skirts, and diffusers installed on vehicles to reduce drag and improve fuel efficiency. Services and software make up a small percentage of the market, but components drive the bulk of the market demand. In recent years, the global market of aerodynamic components has grown to approximately USD 10-12 billion, and its value is expected to grow in proportion to increased vehicle efficiency.

Aerodynamics Market Segmentation: by Mechanism

-

Active Systems

-

Passive Systems

The market is segmented based on the mechanism of the aerodynamic systems also into Active Systems and Passive Systems. The term 'Passive' describes 'Fixed components'; such as spoilers, side skirts, and air dams where the aerodynamics are enhanced from drag reduction through improved stability in general. Active systems, which include adjustable spoilers, active grille shutters, and active air dams, alter shape or position during different driving conditions to improve aerodynamics to save fuel or maintain stability at high speeds. However, since they are usually more expensive, passive systems currently have a greater market share; active systems, though, are becoming increasingly popular as car manufacturers compete in increasingly fuel-efficient and low-emission markets. Systems using active aerodynamics are anticipated to grow more significantly, where active aerodynamics feature in many high-end variants of vehicles.

Aerodynamics Market Segmentation: by Electric Vehicles

-

BEV

-

HEV

-

PHEV

-

FCEV

This segment of electric vehicles has four subcategories: BEV (Battery Electric Vehicle), HEV (Hybrid Electric Vehicle), PHEV (Plug-in Hybrid Electric Vehicle), and FCEV (Fuel Cell Electric Vehicle). BEVs are all-electric vehicles, but as people have gradually started to shift toward adaptation to EVs, these vehicles need enhanced aerodynamics to gain the most overall range and performance. HEVs and PHEVs combine internal combustion engines with electric motors, so their aerodynamic needs focus on fuel efficiency and emissions reductions. FCEVs use hydrogen fuel cells and, like BEVs, require aerodynamics to maximize the driving range. The top segment for electric vehicle adoption at the moment is BEVs. Recent studies also indicated that BEVs would foresee major growth with an estimated market share of over 60% of the global EV market by 2030.

Aerodynamics Market Segmentation: by Vehicle Type

-

Passenger Cars

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

This market segmentation divides the market into vehicle types, including Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles. Passenger cars have a higher share in the automotive aerodynamics market due to the high volume and the growing demand for fuel efficiency and reduced emissions. LCVs are generally used for deliveries and goods transportation and benefit from aerodynamics in order to save fuel, while HCVs need advanced aerodynamics in order to improve efficiency over long-haul transportation. Recently, passenger cars have been the largest share of the automotive aerodynamics market, comprising around 60-70% of the entire market share while LCVs and HCVs have also shown gradual growth lately as more emphasis has been put on logistics and cost optimization.

Aerodynamics Market Segmentation: by Application

-

Air Dam

-

Diffuser

-

Gap Fairing

-

Grille Shutter

-

Side Skirts

-

Spoiler

-

Wind Deflector

-

Other Applications

The various aerodynamic parts under segmentation by application are Air Dam, Diffuser, Gap Fairing, Grille Shutter, Side Skirts, Spoiler, Wind Deflector, and Other Applications. Air dams, diffusers, and spoilers are often applied to handle airflow around the vehicle to decrease drag and improve stability at higher speeds. Grille shutters and side skirts ensure optimized airflow around the underbody of the vehicle, thus minimizing drag, especially to save fuel. Wind deflectors are utilized in trucks, buses, and SUVs in order to cut the air resistance that develops at a high speed. Every application contributes to a particular aspect of enhancing aerodynamics for the vehicle, although spoilers and side skirts lead in terms of commercial popularity due to their appearance on sports and luxury models. Air dams and diffusers are gaining usage in commercial applications. As per recent data, spoilers and side skirts typically occupy 20-30% of the overall market, and air dams and diffusers are considered a major segment in commercial uses.

Aerodynamics Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America has emerged as one of the main contributors to the world's automotive aerodynamics market with its well-developed automobile sector. The United States, with one of the world's major automobile markets, also provides fuel efficiency. Its emphasis is particularly based on regulations pertaining to fuel efficiency, coupled with growing demands for electric and hybrid automobiles. Manufacturers in North America are looking to improve the fuel efficiency of their vehicles, and this has resulted in an increased demand for advanced aerodynamic components such as active grille shutters, spoilers, and air dams. North America is estimated to hold around 30% of the global market share.

Europe is another leading region in the automotive aerodynamics market due to strong regulations regarding fuel efficiency, emissions, and environmental sustainability. The European Union is at the forefront of implementing stricter CO2 emission targets for consumer vehicles and commercial vehicles, which has made automakers integrate advanced aerodynamic technologies into their vehicle designs. The other big reason is the European market for electric vehicles, with leaders such as Germany, France, and Norway leading in the adoption of electric vehicles. It also hosts a large number of premium car manufacturers such as BMW, Audi, and Mercedes-Benz, where aerodynamic optimization is heavily focused. Europe captures around 35% of the global market share.

The Asia-Pacific region, particularly China, Japan, and South Korea, is booming in the automotive aerodynamics market. China is the world's biggest automotive market and reports a high demand for fuel-efficient type automobiles as well as electric vehicles. In the case of Japan, being home to Toyota and Honda, the firm is strictly focusing on hybrid technologies and aerodynamics to improve fuel economy. South Korea also plays a role with strong innovation in automotive technologies. The demand for commercial vehicles, particularly in developing economies such as India and Southeast Asia, is further increasing the need for better aerodynamics to reduce fuel consumption and increase vehicle performance. This makes the region the top global region. Asia-Pacific shares around 40% of the global market share.

South America represents a relatively smaller segment of the global aerodynamics market. The automotive industry in South America is gradually shifting towards more energy-efficient vehicles as demand for fuel economy rises due to high fuel costs in many countries. However, the overall adoption of advanced aerodynamic technologies is slower in this region compared to more developed regions like North America and Europe. Brazil and Argentina are the largest markets in this region for both passenger and commercial vehicles, but the focus on aerodynamics is primarily on passive systems like spoilers and air dams. This region shares about 7% of the total market.

The Middle East and Africa region is relatively small in the global aerodynamics market but is growing slowly. The market for aerodynamics in this region is driven by the demand for fuel-efficient vehicles in countries such as the UAE, Saudi Arabia, and South Africa, where fuel efficiency and environmental sustainability are becoming more important because of rising fuel costs and environmental regulations. In this region, a huge market of premium and sports cars is on the increase which majorly uses advanced aerodynamics for superior speed performance. This market shares about 8% of the total aerodynamics market.

COVID-19 Impact Analysis on the Aerodynamics Market:

The COVID-19 pandemic had a significant impact on the aerodynamics industry, primarily due to disruptions in manufacturing, supply chains, and changes in consumer patterns worldwide. The automotive sector experienced production drops, factory closures, and a slowdown in overall sales, particularly during the lockdown periods. This caused delays in the development and implementation of advanced aerodynamic technologies. Also, the demand for new vehicles, especially commercial and electric vehicles declined. However, as the market started to recover, the focus on fuel efficiency and environmental sustainability grew stronger, with a sheer shift toward electric vehicles (EVs) and hybrid models, again demanding aerodynamic solutions. The pandemic also forced manufacturers and vendors to increase digitalization, and demand for aerodynamic simulation software saw growth as companies sought ways to continue development remotely. While the industry faced short-term challenges, it gradually rebounded as consumer preferences shifted toward more efficient and sustainable vehicles.

Latest Trends/ Developments:

The aerodynamics market is observing a new era of computational fluid simulation technology, integrated with cloud and AI. New research is ongoing by several vendors to improve vehicle aerodynamic efficiency. Stellantis has invested USD 29.5 million in Moving Ground wind tunnel technology to enhance aerodynamics for electric vehicles. Ford has utilized a 322 km/h wind tunnel to optimize the aerodynamics of its next-generation electric, hybrid, and petrol vehicles. Leading solar electric vehicle manufacturer Aptera has validated its aerodynamic shape in the Pininfarina wind tunnel. New NASCAR Cup cars must pass aerodynamic approval before competition, ensuring they meet stringent performance standards. Additive manufacturing has accelerated the development of the Mustang Dark Horse Cup car by allowing rapid prototyping and testing of aerodynamic components. The latest-generation Porsche 911 (992.2) GTS, featuring a hybrid powertrain, won the Vehicle Dynamics International Award for its innovative aerodynamic and performance enhancements.

Key Players:

-

Valeo S.A.

-

Bosch Group

-

Gentex Corporation

-

Daimler AG

-

Magna International Inc.

-

Honeywell International Inc.

-

Toyota Motor Corporation

-

Ford Motor Company

-

3M Company

-

ZF Friedrichshafen AG

Chapter 1. Aerodynamics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Aerodynamics Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Aerodynamics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Aerodynamics Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Aerodynamics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Aerodynamics Market – BY MECHANISM

6.1 Introduction/Key Findings

6.2 Active Systems

6.3 Passive Systems

6.4 Y-O-Y Growth trend Analysis BY MECHANISM

6.5 Absolute $ Opportunity Analysis BY MECHANISM, 2025-2030

Chapter 7. Aerodynamics Market – BY COMPONENT

7.1 Introduction/Key Findings

7.2 Services

7.3 Software

7.4 Y-O-Y Growth trend Analysis BY COMPONENT

7.5 Absolute $ Opportunity Analysis BY COMPONENT, 2025-2030

Chapter 8. Aerodynamics Market – BY ELECTRIC VEHICLES

8.1 Introduction/Key Findings

8.2 BEV

8.3 HEV

8.4 PHEV

8.5 FCEV

8.6 Y-O-Y Growth trend Analysis By Electric Vehicles

8.7 Absolute $ Opportunity Analysis By Electric Vehicles, 2025-2030

Chapter 9. Aerodynamics Market – By Vehicle Type

9.1 Introduction/Key Findings

9.2 Passenger Cars

9.3 Light Commercial Vehicles

9.4 Heavy Commercial Vehicles

9.5 Y-O-Y Growth trend Analysisby Vehicle Type

9.6 Absolute $ Opportunity Analysisby Vehicle Type, 2025-2030

Chapter 10. Aerodynamics Market – BY APPLICATION

10.1 Introduction/Key Findings

10.2 Air Dam

10.3 Diffuser

10.4 Gap Fairing

10.5 Grille Shutter

10.6 Side Skirts

10.7 Spoiler

10.8 Wind Deflector

10.9 Other Applications

10.10 Y-O-Y Growth trend Analysis BY APPLICATION

10.11 Absolute $ Opportunity Analysis BY APPLICATION, 2025-2030

Chapter 11. Aerodynamics Market, By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 BY MECHANISM

11.1.2.1 BY COMPONENT

11.1.3 BY ELECTRIC VEHICLES

11.1.4 BY APPLICATION

11.1.5 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 BY MECHANISM

11.2.3 BY COMPONENT

11.2.4 BY ELECTRIC VEHICLES

11.2.5 By Vehicle Type

11.2.6 BY APPLICATION

11.2.7 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 BY MECHANISM

11.3.3 BY COMPONENT

11.3.4 BY ELECTRIC VEHICLES

11.3.5 By Vehicle Type

11.3.6 BY APPLICATION

11.3.7 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 BY MECHANISM

11.4.3 BY COMPONENT

11.4.4 BY ELECTRIC VEHICLES

11.4.5 By Vehicle Type

11.4.6 BY APPLICATION

11.4.7 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 BY MECHANISM

11.5.3 BY COMPONENT

11.5.4 BY ELECTRIC VEHICLES

11.5.5 By Vehicle Type

11.5.6 BY APPLICATION

11.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Aerodynamics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Valeo S.A.

12.2 Bosch Group

12.3 Gentex Corporation

12.4 Daimler AG

12.5 Magna International Inc.

12.6 Honeywell International Inc.

12.7 Toyota Motor Corporation

12.8 Ford Motor Company

12.9 3M Company

12.10 ZF Friedrichshafen AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Aerodynamics Market was valued at USD 20 Billion and is projected to reach a Market size of USD 24.23 Billion by the end of 2030. Over the forecast period of 2025-2030, the Market is projected to grow at a CAGR of 3.25%.

Increasing demand for electric vehicles, improved aerodynamics technology, the rise of additive manufacturing, improvements in simulation technologies, regulatory enforcement, etc. are key market drivers in aerodynamics.

By Mechanism, Active Systems and Passive Systems are the segments in the Aerodynamics market.

Asia Pacific is the most dominant region for the Aerodynamics Market.

Valeo S.A., Bosch Group, Gentex Corporation, Daimler AG, Magna International Inc., Honeywell International Inc., Toyota Motor Corporation, Ford Motor Company, 3M Company, ZF Friedrichshafen AG