Advanced Polyimide Materials Market Size (2024 – 2030)

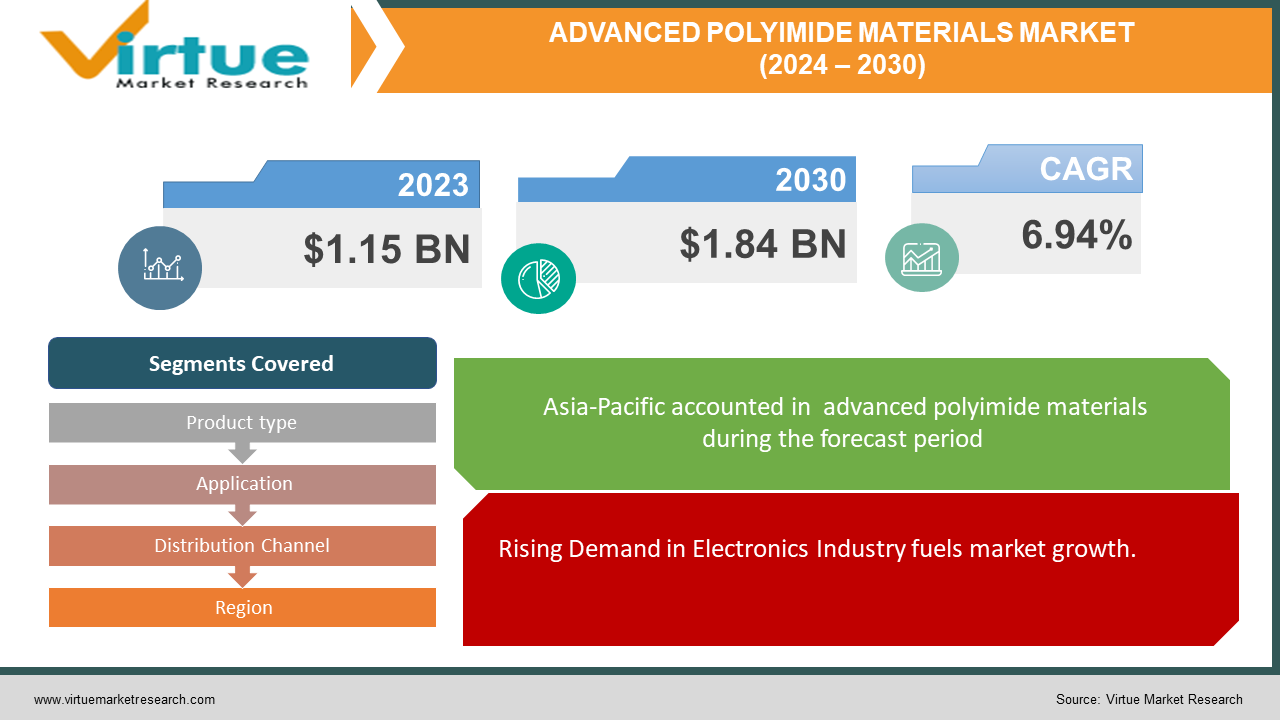

The Global Advanced Polyimide Materials Market was valued at USD 1.15 billion in 2023 and is projected to reach a market size of USD 1.84 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.94%.

Advanced polyimide materials represent the pinnacle of polymer chemistry and are known for their exceptional thermal stability, mechanical strength, and chemical resistance. This information comes from the condensation reaction of dianhydrides and diamines that leads to the synthesis of polymer materials. Their properties make them important in many industries such as aerospace, electronics, and automotive.

In addition to their thermal and chemical properties, advanced polyimide materials exhibit exceptional mechanical strength, maintaining structural integrity under high-stress conditions. This attribute, combined with their lightweight nature, makes them invaluable for manufacturing lightweight yet durable components in aerospace and automotive engineering.

Key Market Insights:

One remarkable characteristic of advanced polyimides is their ability to withstand extreme temperatures, often surpassing 500°C without significant degradation. This thermal resilience makes them ideal for applications in harsh environments where conventional materials would falter. Moreover, their excellent chemical resistance ensures longevity even when exposed to corrosive substances. Collaborations and partnerships among key players in the industry are fostering innovation and accelerating the adoption of advanced polyimide materials in diverse applications across various sectors. Emerging economies in regions such as Asia Pacific, South America, and the Middle East & Africa present significant opportunities for market expansion due to rapid industrialization, urbanization, and infrastructure development projects.

Advanced Polyimide Materials Market Drivers:

Rising Demand in Electronics Industry fuels market growth.

The electronics industry is the main driver of advanced polyimide products due to their good thermal stability and electrical insulation. As electronic devices such as smartphones, tablets, and technology continue to grow, so does the demand for advanced polyimide films used in printed circuit boards (PCBs), leads, and semiconductor encapsulation. These materials allow companies to create lighter, thinner, and more durable electronic products that meet consumer demand for compact devices and high performance.

Expanding the Aerospace Sector accelerates the market growth.

The aerospace industry relies on advanced polyimide materials for their lightweight, heat resistance, and overall durability. The aerospace industry continues to grow as air travel increases and demand for commercial and military aircraft drives demand for advanced polyimide materials for applications such as aircraft interiors, engine components, and thermal shielding. This information helps improve fuel efficiency, reduce maintenance costs, and increase the overall safety of aircraft operations.

The emergence of Electric Vehicles (EVs) will drive the Advanced Polyimide Materials market forward.

The transition to electric vehicles is another important driver for advanced polyimide products. With governments worldwide implementing stringent emissions regulations and consumers gravitating towards sustainable transportation options, there's a rapid growth in EV production. Advanced polyimide materials are important in manufacturing products such as motor insulation, batteries, and thermal management in electric vehicles. Their thermal performance, lightness, and chemical stability play an important role in improving the performance, efficiency, and safety of electric vehicles.

Advanced Polyimide Materials Market Restraints and Challenges:

High Cost of Production restrains the market growth.

One of the biggest problems facing advanced polyimide products is the high cost of production. Polyimide synthesis affects the chemical composition of the chemical and the specialized processing techniques, resulting in increased production costs. Additionally, raw materials such as dianhydrides and diamines required for polyimide production can be expensive and subject to varying costs. Therefore, the high production costs of advanced polyimide products often mean higher prices for end users and limit their widespread use, especially in terms of business value.

Competition from Substitute Materials hinders market growth.

Advanced polyimide products face competition from other materials that offer similar or better performance at lower cost. For example, other high-performance polymers such as polyetheretherketone (PEEK) and liquid crystal polymers (LCP) compete with polyimides in some applications, offering advantages such as easier processability or lower material costs. Moreover, advancement in research materials and the development of new polymers or compounds pose a threat to the advanced polyimide market. To remain competitive, manufacturers must continue to innovate and differentiate their products to meet consumer and market needs.

Limited Processability and Formability prove to be a challenge in the Advanced Polyimide Materials sector

Although advanced polyimide products have excellent stability and mechanical properties, they generally appear to have limited processability and formability compared to other polymers. Polyimides typically have high glass transition temperatures (Tg) and require elevated temperatures for processing, this makes them difficult to mold into complex shapes or form films using traditional methods such as injection molding or extrusion. This limitation restricts their applicability in some industries that require fine designs or processes, such as consumer electronics and medical devices.

Advanced Polyimide Materials Market Opportunities:

The global advanced polyimide materials market is ripe with opportunities, driven by several key factors. The rapid growth of the electric vehicle (EV) market is a remarkable opportunity. As the world moves to efficient transportation options, the demand for electric vehicles is increasing. Advanced polyimide materials are extremely durable and lightweight and are essential for many automotive components, including batteries, motors, and thermal management. This offers manufacturers the opportunity to capitalize on the emerging EV market by offering advanced polyimide products that meet the specific needs of EV manufacturers.

Additionally, the expanding aerospace segment presents another good opportunity for advanced polyimide materials. As the demand for air travel increases and aerospace technology advances, the demand for lightweight, high-performance materials in aircraft construction increases. Advanced polyimides are known for their excellent strength and thermal stability and are widely used in aerospace parts such as aircraft interiors, engine parts, and heat shields. Companies that meet the demand for advanced polyimide materials in the aerospace industry can capitalize on this profitable business opportunity and stimulate global growth in the field of high-quality polyimide products.

ADVANCED POLYIMIDE MATERIALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.94% |

|

Segments Covered |

By Product type, Application, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DuPont, Kaneka Corporation, UBE Corporation, Toray Industries, Inc., Evonik Industries AG, Taimide Tech Inc., Arakawa Chemical Industries, Ltd. , Shengjun Plastic Tech. Co. Ltd., SABIC, RTP Company |

Advanced Polyimide Materials Market Segmentation by Product Type

-

Films

-

Fibers

-

Resins

-

Coatings

-

Adhesives

In 2023, based on the Product Type, Films holds the largest market share with over 50% of the market. Polyimide film is widely used in the production of flexible printed circuit boards (PCBs), electronic displays, insulating tapes, and other electronic products. The demand for lightweight, flexible, and high-performance electronic materials has led to significant growth in polyimide films. Polyimide coatings and resins also have a wide market, especially in aerospace, automotive, and industrial applications, where their excellent thermal stability and chemical resistance are highly valued.

Advanced Polyimide Materials Market Segmentation by Application

-

Electronics

-

Aerospace

-

Automotive

-

Healthcare

-

Industrial

-

Others

In 2023, based on the Application, Direct Sales holds a significant portion of the market share and is expected to grow at an 8.41% CAGR during the forecast period. The importance of advanced polyimide materials in the electronics industry is obvious and is widely used in printed circuit boards (PCBs), electronics, insulating films, and semiconductor packaging. The demand for lightweight, flexible, and high-performance electronic materials has led to the growth of advanced polyimide materials in this field.

Polyimide films, in particular, are utilized in electronics manufacturing due to their good thermal stability, electrical insulation properties, and ability to withstand harsh operating conditions. Moreover, polyimide coatings and adhesives are also crucial components in electronic devices, further solidifying the dominance of advanced polyimide materials in the electronics industry.

While Electronics dominate other applications, it must be acknowledged that other applications such as aerospace, automotive, healthcare, and industrial also play an important role in reaching different customers and growing the business.

Advanced Polyimide Materials Market Segmentation by Distribution Channel

-

Direct Sales

-

Distributors/Wholesalers

-

Other Channels

In 2023, based on the Distribution Channel, Direct Sales holds the largest market share with over 60% of the market. Direct selling allows companies to build relationships with end-users or industrial customers, providing opportunities for customized solutions, technical support, and tailored pricing arrangements. This section gives companies more control over the sales process, product positioning, and customer relations. Direct sales are particularly important for high-volume, specialty-use, and profitable businesses, especially in industries such as aerospace, automotive, and electronics.

Distributors/Wholesalers play an important role in expanding the business and providing logistical support, while direct selling provides manufacturers with more direct contact with customers and greater opportunities in their sales strategies.

Advanced Polyimide Materials Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023 based on Region, Asia-Pacific has the largest market share, with over 30% market share. The Asia-Pacific region is the world's largest and fastest-growing region for the advanced polyimide materials market. Countries such as China, Japan, South Korea, and Taiwan have benefited from rapid economic growth, urbanization, and economic expansion and played a key role in business growth. The region's dominance is due to its strong manufacturing base, particularly in the electronics, automotive, and aerospace sectors, which are the main consumers of advanced polyimide materials. In addition, the Asia-Pacific region also benefits from lower labor costs, strong demand for consumer electronics, and government measures to support technology innovation and business development. These factors have contributed to Asia Pacific's leading position in the world's advanced polyimide materials market.

In the advanced polyimide materials market, North America has a strong market driven by technological innovation and has a strong presence in the aerospace, electronics, and automotive sectors. The United States and Canada lead in research, development, and production, and strict standards ensure product quality. Mature economies in Europe are developing thanks to countries, especially Germany, England, and France. These countries are performing well in the aerospace and automotive industries and are increasing the demand for advanced polyimide materials due to their better thermal stability and mechanical properties. Demand is increasing in the Middle East and Africa, driven by infrastructure investments and industrialization efforts in emerging markets such as the United Arab Emirates and South Africa. South America offers opportunities in areas such as automobiles and renewable energy; Countries such as Brazil and Argentina show potential for economic expansion. Although at different stages of development, each region is contributing to the global growth of advanced polyimide materials through a variety of applications.

While Asia-Pacific leads the Global Advanced Polyimide Materials market, other regions such as North America and Europe are experiencing rapid growth and present huge opportunities for Advanced Polyimide Materials market vendors.

COVID-19 Impact Analysis on the Global Advanced Polyimide Materials Market:

The COVID-19 pandemic has had a significant impact on Global Advanced Polyimide Products, disrupting supply chains, reducing demand in key industries, and indeed creating economic uncertainty. Widespread shutdowns and travel restrictions during the pandemic have disrupted production and delayed the production and distribution of advanced polyimide materials. Industries that rely on advanced polyimide products, such as aerospace, automotive, and electronics, have experienced a decline in demand due to lower consumer spending and disruptions in global markets. However, the market recovered with the gradual reopening of the economy and return to normal, the resumption of production, increased demand for electronics and medical devices, and growing investments in infrastructure and renewable energy projects. Moving forward, the market is expected to rebound as vaccination efforts progress, although ongoing supply chain challenges and market volatility may continue to influence growth prospects.

Latest Trends/ Developments:

The global advanced polyimide materials market is seeing some of the latest trends and developments shaping its trajectory. One of the key trends is the increasing demand for flexible electronics driven by the growth of wearable technologies, foldable displays, and Internet of Things (IoT) devices. Advanced polyimide materials have become important in the production of flexible electronic devices due to their good thermal stability, flexibility, and electrical insulation. Another trend is the emphasis on sustainability and environmental responsibility, which leads to the production of bio-based polyimide materials from renewable resources. Moreover, advances in manufacturing techniques and material formulations are enabling the production of high-performance polyimide materials with enhanced properties such as improved heat resistance, mechanical strength, and chemical resistance. In addition, collaboration and partnerships between key players in the industry are driving innovation and accelerating the production of advanced polyimide materials in a variety of applications across a wide range of industries.

Key Players:

-

DuPont

-

Kaneka Corporation

-

UBE Corporation

-

Toray Industries, Inc.

-

Evonik Industries AG

-

Taimide Tech Inc.

-

Arakawa Chemical Industries, Ltd.

-

Shengjun Plastic Tech. Co. Ltd.

-

SABIC

-

RTP Company

Chapter 1. Advanced Polyimide Materials Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Advanced Polyimide Materials Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Advanced Polyimide Materials Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Advanced Polyimide Materials Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Advanced Polyimide Materials Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Advanced Polyimide Materials Market – By Product Type

6.1 Introduction/Key Findings

6.2 Films

6.3 Fibers

6.4 Resins

6.5 Coatings

6.6 Adhesives

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Advanced Polyimide Materials Market – By Application

7.1 Introduction/Key Findings

7.2 Electronics

7.3 Aerospace

7.4 Automotive

7.5 Healthcare

7.6 Industrial

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Advanced Polyimide Materials Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Direct Sales

8.3 Distributors/Wholesalers

8.4 Other Channels

8.5 Y-O-Y Growth trend Analysis By Distribution Channel

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Advanced Polyimide Materials Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Application

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Application

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Application

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Application

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Application

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Advanced Polyimide Materials Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 DuPont

10.2 Kaneka Corporation

10.3 UBE Corporation

10.4 Toray Industries, Inc.

10.5 Evonik Industries AG

10.6 Taimide Tech Inc.

10.7 Arakawa Chemical Industries, Ltd.

10.8 Shengjun Plastic Tech. Co. Ltd.

10.9 SABIC

10.10 RTP Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Advanced Polyimide Materials Market was valued at USD 1.15 billion in 2023 and is projected to reach a market size of USD 1.84 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.94%.

The segments under the Global Advanced Polyimide Materials Market by Product Type are Films, Fibers, Resins, Coatings, and Adhesives.

Asia-Pacific is the dominant region in the Global Advanced Polyimide Materials Market.

DuPont, Kaneka Corporation, UBE Corporation, Toray Industries, Inc., Evonik Industries AG, Taimide Tech Inc., etc.

The COVID-19 pandemic has had a significant impact on Global Advanced Polyimide Products, disrupting supply chains, reducing demand in key industries, and indeed creating economic uncertainty. Widespread shutdowns and travel restrictions during the pandemic have disrupted production and delayed the production and distribution of advanced polyimide materials. Industries that rely on advanced polyimide products, such as aerospace, automotive, and electronics, have experienced a decline in demand due to lower consumer spending and disruptions in global markets.