Advanced Payload System Market Size (2024 – 2030)

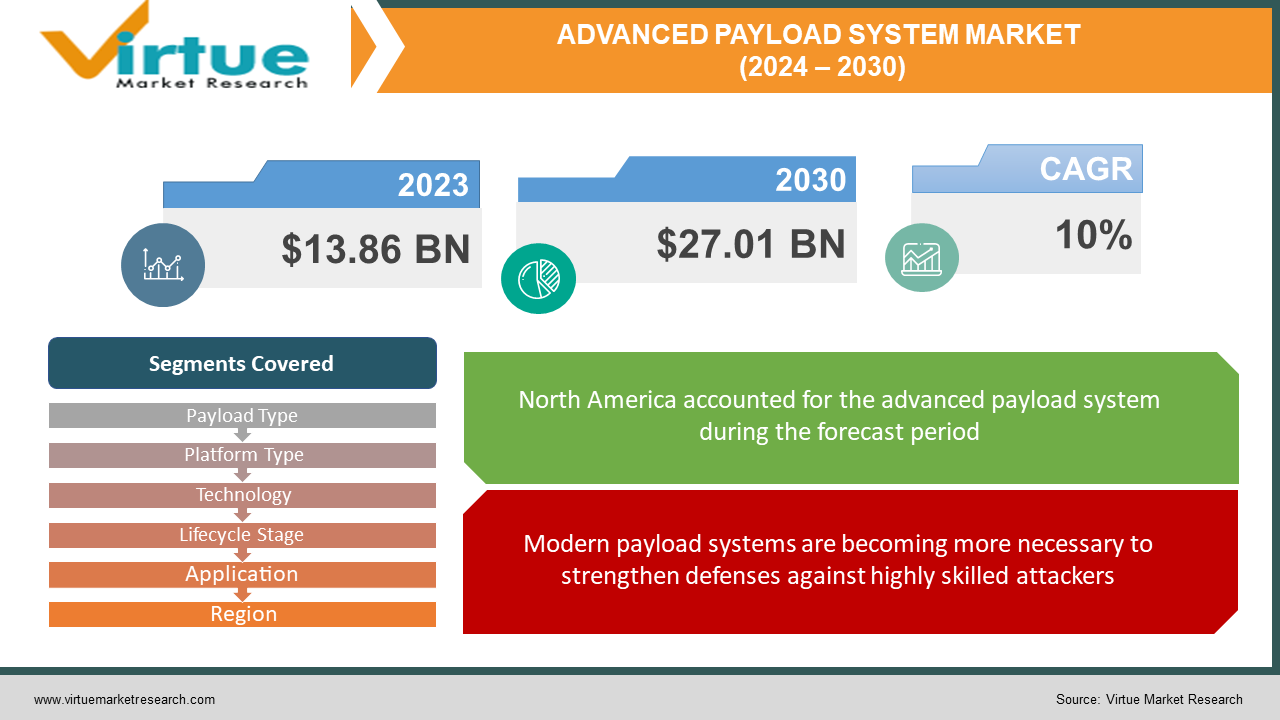

Global demand for sophisticated payloads is rising swiftly. The market, which was valued at USD 13.86 billion in 2023, is anticipated to expand to USD 27.01 billion by 2030, with a predicted CAGR of 10% from 2024 to 2030.

The global market for advanced payload systems includes the sophisticated hardware found in satellites, unmanned aerial vehicles (UAVs), and ground-based systems. Electronic warfare payloads for countermeasures, navigation payloads for accurate position, payloads for surveillance and reconnaissance using state-of-the-art sensors, and communication payloads for secure data transfer are all part of these systems. Important elements include advanced sensor technology, cutting-edge communication systems, and strong data processing capabilities. Applications range from scientific research and crisis management to military operations supporting communication and surveillance. In this field, there have been rapid technological advancements in areas like miniaturization, autonomy, and artificial intelligence integration. The market is growing as a result of consumers' increased need for international connectivity and teamwork; leading the way in this regard are new entrants and aerospace and defense companies.

Key Market Insights:

Significant market insights demonstrate how active the advanced payload system market is on a worldwide level. Modern communication and surveillance systems are in greater demand in the market due to military modernization initiatives and expanding commercial space. Technological advances like miniaturization and artificial intelligence integration are changing payload capabilities. Leading defense and aerospace contractors are at the forefront, employing state-of-the-art sensor and communication technologies. The market is witnessing an increase in the need for connectivity, which is promoting global collaboration for integrated development initiatives.

Rapid innovation is driving the business ahead, and a mix of established players and newcomers defines the competitive landscape. The growing requirement for safe and independent systems is driving the market's expansion and impacting developments in data processing and navigational components. The market is growing as a result of civilian applications, including environmental monitoring and catastrophe management. The influence of geopolitical considerations on regional demands and collaborations is also significant. Stakeholders are recommended to read through in-depth market analysis and industry reports to remain abreast of changing technical trends and geopolitical changes and navigate this dynamic market.

Global Advanced Payload System Market Drivers:

Modern payload systems are becoming more necessary to strengthen defenses against highly skilled attackers.

Concerns about international security and escalating threats have dominated discussions on how to upgrade payload systems. The need for advanced and cutting-edge secure payload solutions has grown due to the ever-changing landscape of security threats, electronic warfare, and geopolitical tensions. Globally, military and defense organizations are becoming increasingly aware of the need for effective communication, surveillance, and reconnaissance capabilities to counter emerging threats. Advanced payload systems with their modern sensors, communication capabilities, and electronic warfare countermeasures are essential for enhancing situational awareness and strengthening defense infrastructures against a variety of sophisticated security threats.

Defense modernization projects are facilitating the expansion.

The development of complex payload systems is guided by worldwide defense policies that prioritize initiatives aimed at modernizing the armed services. Huge military modernization initiatives being undertaken by countries all around the world are ushering in a new era of technical might. Advanced payload systems are crucial in this situation because they offer cutting-edge observation, reconnaissance, and communication capabilities. The military's modernization of arsenals is putting more and more focus on incorporating cutting-edge technologies into complex payload systems. Encouraging the integration of state-of-the-art sensors, communication protocols, and electronic warfare capabilities, these initiatives assure that armed forces have the most powerful and advanced weapons available to meet the demands of the modern battlefield while also stimulating innovation. Modernizing the armed forces is now synonymous with technological advancement, making the development of advanced payload systems crucial to the objective of strengthening national security. Modernizing the armed forces is now synonymous with technological advancement, making the development of advanced payload systems crucial to the objective of strengthening national security.

Growth is being driven by communication-driven advancements in advanced payload systems.

In an increasingly interconnected world, one of the primary driving forces behind advancements in advanced payload systems is the need for global communication. The unprecedented need for simple and safe cross-border communication has influenced the development of cutting-edge technology. Because sophisticated payload systems offer dependable solutions for data relay, satellite communication, and secure information sharing, they are crucial to meeting these requirements. These networks serve as the foundation for worldwide connection, facilitating both commercial and military pursuits as well as disaster relief initiatives. The creation of advanced payload systems is influencing a future where boundaries are no longer an obstacle to dependable and efficient communication, as nations and businesses recognize how important it is to stay connected.

Frontiers in space exploration and commercial satellite launches are being unlocked by cutting-edge payload systems.

Space exploration and the increase in commercial satellite launches have significantly hastened the development of enhanced payload systems. The need for ever-more sophisticated payloads has increased as humanity has ventured further from Earth. Payloads are crucial to many space exploration projects, ranging from scientific missions to planetary exploration. The booming market for commercial satellite launches, which is driven by telecommunications, Earth observation, and satellite-based services, has also contributed to developments in payload technology. These systems must not only resist the harsh environment of space but also operate accurately and consistently. As private companies and space agencies continue to push the boundaries of space research, sophisticated payload systems will be crucial to unlocking cosmic riddles and sustaining the growing commercial space economy.

Advanced Payload System Market Restraints and Challenges:

Managing regulatory barriers is a challenging aspect.

One major problem facing the advanced payload system industry is navigating the complicated web of strict regulatory regimes. As these systems are essential to the aerospace and defense industries, stringent laws concerning security, export control, and spectrum allotment must be followed. Adding compliance can affect the worldwide adoption of advanced payload systems, in addition to adding levels of complexity to the research and manufacturing processes. To make sure that their products match international standards, companies must invest in in-depth legal and regulatory expertise, which lengthens the development cycle and increases costs. One of the ongoing challenges facing industry participants is the demand for constant monitoring and adaptation to changing regulatory requirements.

Complex payload systems struggle with limited spectrum availability.

One of the main challenges facing the industry for improved payload systems is the availability of spectrum. With the increasing demand for high-bandwidth communication systems, including those integrated into advanced payload systems, the finite frequency spectrum becomes a major bottleneck. In crowded bands, competition for available spectrum causes barriers to optimal functionality. Data transmission becomes more challenging as a result of this constraint, which also has an impact on communication payload performance and efficacy. As more and more industries rely on sophisticated payload systems for a range of applications, the industry is compelled to look into innovative solutions, spectrum-sharing technologies, and regulatory measures to address the lack of available frequency spectrum. These measures must ensure that these systems can operate with the necessary bandwidth and reliability.

Geopolitical differences can cause losses.

Geopolitical instability is one important external factor influencing the demand for sophisticated payload systems. The uncertainties arising from the intricate nature of global politics have the potential to disrupt the dynamics of the sector. Trade disputes, diplomatic problems, and geopolitical shifts might affect the supply chain, which can affect the purchase and application of advanced payload systems. This volatility can have an impact on multinational defense and aerospace firms, as well as lead to project schedule delays and cross-border joint ventures. Industry participants must exercise caution in this volatile geopolitical environment, modifying strategies to reduce potential losses and ensure the robustness of supply networks. It becomes imperative to resolve geopolitical difficulties in advance if current payload technologies are to continue expanding and reaching new markets worldwide.

Advanced Payload System Market Opportunities:

Cutting-edge technologies are driving the boom in 5G network development.

The launch of 5G networks is one important aspect driving potential in the market for sophisticated payload systems. With the increasing demand for high-speed, low-latency communication, advanced payload systems are critical to the upkeep and enhancement of 5G infrastructure. Payloads designed to facilitate satellite communication and transfer data contribute to the expansion of connections to hard-to-reach locations by filling in gaps in terrestrial networks. These technologies not only facilitate seamless communication for commercial applications but also play critical roles in disaster relief, humanitarian efforts, and defense. As the global rollout of 5G networks picks up speed, the market for advanced payload systems is well-positioned to benefit from the rising demand for dependable, high-performance communication solutions in a connected and data-driven world.

AI changes payloads by showcasing its intelligent capabilities for precision and adaptability.

Artificial intelligence (AI) integration signals a breakthrough era for advanced payload systems. AI is now a game-changer, enabling these systems to perform in ways never before possible. In complex and dynamic environments, autonomous decision-making, real-time data processing, and adaptive reactions are critical capabilities made possible by artificial intelligence (AI) algorithms integrated into payloads. In military applications, artificial intelligence-powered payloads aid in enhancing situational awareness, enabling quicker and more informed decision-making during operations. In civilian applications such as environmental monitoring and disaster response, artificial intelligence (AI)-driven systems can process large datasets rapidly, providing valuable insights for prompt actions. The seamless incorporation of AI into advanced payload systems increases their performance and positions them at the forefront of innovation, fulfilling the shifting demands of numerous sectors in the industry.

As unmanned systems gain importance, advanced payload systems are soaring.

The growing significance of unmanned systems in various industries has led to a greater demand for advanced payload solutions. Unmanned spacecraft and aerial vehicles (UAVs) are becoming more and more crucial in a range of operations, from military reconnaissance and surveillance to scientific study. Contemporary payload systems are designed for unmanned systems, incorporating sophisticated sensors, communication technologies, and autonomous capabilities. These payloads boost the effectiveness of autonomous systems by enhancing their capability for data collection, communication, and navigation. With the growing application of unmanned systems in industries such as defense, agriculture, and environmental monitoring, there will likely be a large need for innovative and efficient advanced payload systems. This will offer opportunities for both market expansion and technological advancements.

ADVANCED PAYLOAD SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10% |

|

Segments Covered |

By Payload Type, Platform Type, Technology, Lifecycle Stage, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The Boeing Company, Thales S.A. , Lockheed Martin Corporation, MDA Corporation, Mitsubishi Electric Corporation Honeywell International, Inc., Space Exploration Technologies Corporation Raytheon Technologies, Airbus Defense and Space, L3 Harris Corporation, ISRO |

Advanced Payload System Market Segmentation: By Payload Type

-

Communication System

-

Surveillance and Reconnaissance

-

Electronic Warfare

-

Navigation and Positioning

Because they enable safe and effective data transfer for a variety of uses, such as data relay systems and satellite communication, communication systems are crucial, making them the largest growing segment. Modern military, economic, and scientific realms require state-of-the-art communication payloads since we live in an era driven by information interchange. Surveillance and reconnaissance are the fastest-growing categories. Payloads for surveillance and reconnaissance are essential for obtaining intelligence and maintaining situational awareness. These payloads include environmental monitoring, disaster assistance, border security, and military activities. They have high-definition imaging systems, radar, and sensors installed. The continuous advancement of payload technology for surveillance and reconnaissance is propelled by the emphasis on accuracy and real-time data collection. Surveillance and reconnaissance are the most adaptable payload types, with multiple applications in security, military, and environmental monitoring. Its ability to provide real-time intelligence and enhance situational awareness, which makes it an essential part of mission-critical circumstances, is what drives its ongoing significance in the sector.

Advanced Payload System Market Segmentation: By Platform Type

-

Airborne

-

Space

-

Ground

The space is the largest growing segment in this market. Space-based platforms, which are necessary for uses like scientific study, telecommunication, and Earth observation, are made up of satellites and other spacecraft. Payloads on space platforms must be able to endure difficult conditions and provide consistent performance over extended periods. The space segment's growing need for small but powerful payloads emphasizes the need for cutting-edge technologies in this area. It is vital to science exploration, international networking, and strategic communication. The need for better payloads in space applications is growing as a result of ongoing space exploration missions, the growth of the commercial space industry, and satellite-based services. The airborne category is the fastest-growing. A few examples of airborne platforms that are essential for sophisticated payloads are manned aircraft and unmanned aerial vehicles (UAVs). These systems support communication, surveillance, and reconnaissance in dynamic operating environments. The military, commercial, and emergency response sectors are driving an increased demand for lightweight, high-performing payloads for airborne platforms.

Advanced Payload System Market Segmentation: By Technology

-

Sensor

-

Communication

-

Data Processing

Communication technology is the largest growing segment. This, which focuses on data transfer across numerous platforms, is a crucial field. Advanced communication payloads include things like data relay systems, satellite communication, and secure communication systems. In an era of widespread connectivity, the efficiency and reliability of communication networks are essential for military, economic, and scientific applications. Data processing is the fastest-growing. Complex payload systems are powered by data processing technology. It involves using, interpreting, and analyzing data that has been gathered by sensors. The advancements in artificial intelligence and machine learning have led to significant improvements in data processing efficiency by enabling instantaneous decision-making, recognition of patterns, and adaptive responses. By enhancing the system's responsiveness, autonomy, and adaptability through the use of artificial intelligence, data processing becomes more valuable and important in the quickly evolving field of advanced payload technologies.

Advanced Payload System Market Segmentation: By Lifecycle Stage

-

Development

-

Manufacturing

-

Integration and Maintenance

Integration and maintenance is the largest growing segment. The integration and maintenance stage's objective is to bring all the components together to form a cohesive and functional system. This step is crucial for seamless interoperability, optimal performance, and ongoing dependability. Upgrading and repairing complex payload systems are part of the maintenance activities that provide them with a prolonged operational life. The developmental stage is the fastest-growing. Throughout the development stage, new features and technologies are conceived through study, design, and prototyping. The payload system's features and capabilities are defined during this phase. As a product moves into the production phase, its assembly and manufacture become its top priorities. These components were designed in the development phase. The improved payload system's physical shape will need to be precise, QA-compliant, and meet specifications. It is the responsibility of manufacturers to guarantee that the finished product satisfies the exacting standards for durability and performance.

Advanced Payload System Market Segmentation: By Application

-

Military Application

-

Civilian Application

Military applications are the largest growing segment. For military applications to improve defense capabilities, advanced payload systems are crucial. Since these technologies enable electronic warfare, secure communication, surveillance, and reconnaissance, they are crucial for modernizing military operations and preserving national security. Because military operations have severe requirements for accuracy, adaptability, and security, new technologies are needed. Leading the way in technological innovation, military-grade enhanced payload systems are driving industry growth. Civilian applications are considered to be the fastest-growing. In the civilian sector, improved payload systems are used in many different businesses. Numerous aspects of civilian life are supported by these systems, including environmental monitoring, disaster management, scientific research, and telecommunications. Advanced payloads support broadband connectivity and data relay services in telecoms and aid in precision farming in agriculture.

Advanced Payload System Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The global market for sophisticated payload systems is regionally heterogeneous, with North America controlling 36% of the market in 2023. North America's dominance is a result of its substantial investment in military modernization projects, robust presence of major defense contractors, and technologically advanced aerospace sectors. Furthermore, the region's focus on satellite communication, space exploration, and advanced surveillance applications raises the requirement for cutting-edge payload systems.

With a sizable 22% global market share for advanced payload systems, Asia-Pacific is the fastest-growing region. Strong multinational alliances and a well-established aerospace and defense industry support the Asian-Pacific market. The region's commitment to military modernization initiatives and continuous technical advancements is driving the need for sophisticated payload systems. Europe's concentration on space research and development, which concentrates on cutting-edge payloads for Earth observation and scientific missions, further propels the market. These regional divisions highlight North America's, Asia-Pacific's, and Europe's technological superiority, leadership in the aerospace and defense sectors, and strategic significance in the global market for advanced payload systems.

COVID-19 Impact Analysis on the Global Advanced Payload System Market:

The COVID-19 pandemic significantly impacted the global market for advanced payload systems, as it did for many other enterprises. The pandemic created supply chain interruptions, production schedule delays, and funding uncertainties, which had an impact on both the research and manufacturing phases of complex payload systems. It was challenging to collaborate and adopt new technologies because of lockdown procedures and travel limitations, particularly in the defense sector, where cross-border cooperation is typical. The decision to invest in state-of-the-art payload technology was influenced by the financial fallout, which also led to budgetary limits on defense spending in several areas.

However, the pandemic has also brought about certain reforms within the industry. The emphasis on remote and unmanned systems has increased the demand for complex payload systems to support these technologies. The reliability of communication and surveillance systems was critical, particularly in times of restricted physical presence, which underscored the tactical use and versatility of advanced payload systems. As the world heals from the pandemic, it is expected that the aerospace and military industries will overcome these challenges by giving adaptation, digitization, and shifting global dynamics top importance.

Latest Trends/ Developments:

Businesses emphasize innovation to gain a competitive advantage, which drives a strong focus on research and development in the dynamic market for advanced payload systems. These companies aim to differentiate themselves from the competition and encourage the creation of complex payload systems that are more competent and perform better by investing in cutting-edge technology and researching new features. This trend propels technical advancement and allows market participants to expand their market share and meet the evolving demands of sectors reliant on sophisticated payload solutions.

The development of strategic partnerships and collaborations is a significant trend that has emerged in response to the complex opportunities and difficulties found in the market for sophisticated payload systems. Companies are aware of the importance of establishing alliances with end-user organizations, academic institutions, technology providers, and other companies operating in the same sector. Because of these partnerships, it is possible to construct complex payload systems by combining resources, exchanging information, and working together. These collaborations enable companies to leverage one another's advantages to strengthen their competitive position, increase their market share, and reach a wider audience.

Furthermore, a customer-centric approach emphasizes bespoke solutions and personalization, which represent the third significant trend in the advanced payload systems industry. In response to the diverse demands of end users and industries, businesses are increasingly offering flexible and customized payload solutions. This trend is consistent with the growing demand for tailored solutions that address specific issues and applications in several industries. Companies strategically position themselves to increase their market share by providing tailored solutions that appropriately answer the unique needs of their target audiences and industries.

Key Players:

-

The Boeing Company

-

Thales S.A.

-

Lockheed Martin Corporation

-

MDA Corporation

-

Mitsubishi Electric Corporation

-

Honeywell International, Inc.

-

Space Exploration Technologies Corporation

-

Raytheon Technologies

-

Airbus Defense and Space

-

L3 Harris Corporation

-

ISRO

Chapter 1. Advanced Payload System Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Advanced Payload System Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Advanced Payload System Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Advanced Payload System Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Advanced Payload System Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Advanced Payload System Market – By Payload Type

6.1 Introduction/Key Findings

6.2 Communication System

6.3 Surveillance and Reconnaissance

6.4 Electronic Warfare

6.5 Navigation and Positioning

6.6 Y-O-Y Growth trend Analysis By Payload Type

6.7 Absolute $ Opportunity Analysis By Payload Type, 2024-2030

Chapter 7. Advanced Payload System Market – By Platform Type

7.1 Introduction/Key Findings

7.2 Airborne

7.3 Space

7.4 Ground

7.5 Y-O-Y Growth trend Analysis By Platform Type

7.6 Absolute $ Opportunity Analysis By Platform Type, 2024-2030

Chapter 8. Advanced Payload System Market – By Technology

8.1 Introduction/Key Findings

8.2 Sensor

8.3 Communication

8.4 Data Processing

8.5 Y-O-Y Growth trend Analysis By Technology

8.6 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 9. Advanced Payload System Market – By Lifecycle Stage

9.1 Introduction/Key Findings

9.2 Development

9.3 Manufacturing

9.4 Integration and Maintenance

9.5 Y-O-Y Growth trend Analysis By Lifecycle Stage

9.6 Absolute $ Opportunity Analysis By Lifecycle Stage, 2024-2030

Chapter 10. Advanced Payload System Market – By Application

10.1 Introduction/Key Findings

10.2 Military Application

10.3 Civilian Application

10.4 Y-O-Y Growth trend Analysis By Application

10.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 11. Advanced Payload System Market, By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Payload Type

11.1.2.1 By Platform Type

11.1.3 By Technology

11.1.4 By Application

11.1.5 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Payload Type

11.2.3 By Platform Type

11.2.4 By Technology

11.2.5 By Lifecycle Stage

11.2.6 By Application

11.2.7 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Payload Type

11.3.3 By Platform Type

11.3.4 By Technology

11.3.5 By Lifecycle Stage

11.3.6 By Application

11.3.7 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Payload Type

11.4.3 By Platform Type

11.4.4 By Technology

11.4.5 By Lifecycle Stage

11.4.6 By Application

11.4.7 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Payload Type

11.5.3 By Platform Type

11.5.4 By Technology

11.5.5 By Lifecycle Stage

11.5.6 By Application

11.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Advanced Payload System Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 The Boeing Company

12.2 Thales S.A.

12.3 Lockheed Martin Corporation

12.4 MDA Corporation

12.5 Mitsubishi Electric Corporation

12.6 Honeywell International, Inc.

12.7 Space Exploration Technologies Corporation

12.8 Raytheon Technologies

12.9 Airbus Defense and Space

12.10 L3 Harris Corporation

12.11 ISRO

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global advanced payload system market was valued at USD 13.86 million in 2023 and is projected to reach USD 27.01 billion by 2030, with a projected CAGR of 10% during the forecast period from 2024 to 2030.

The primary drivers of the better payload system market include growing space exploration applications, a rise in military modernization initiatives, and a growing need for improved communication systems.

The market for sophisticated payload systems faces several challenges, such as high research expenses, stringent laws, and a dearth of available frequency spectrum.

In 2023, North America held the largest share of the global advanced payload system market.

Some of the major players are the Boeing Company, Thales S.A., MDA Corporation, Raytheon Technologies, Space Exploration Technologies Corporation, Airbuses and Space, L3 Harris Corporation, and ISRO.