Advanced Non-Metallic Coatings and Composite Materials Market Size (2024 – 2030)

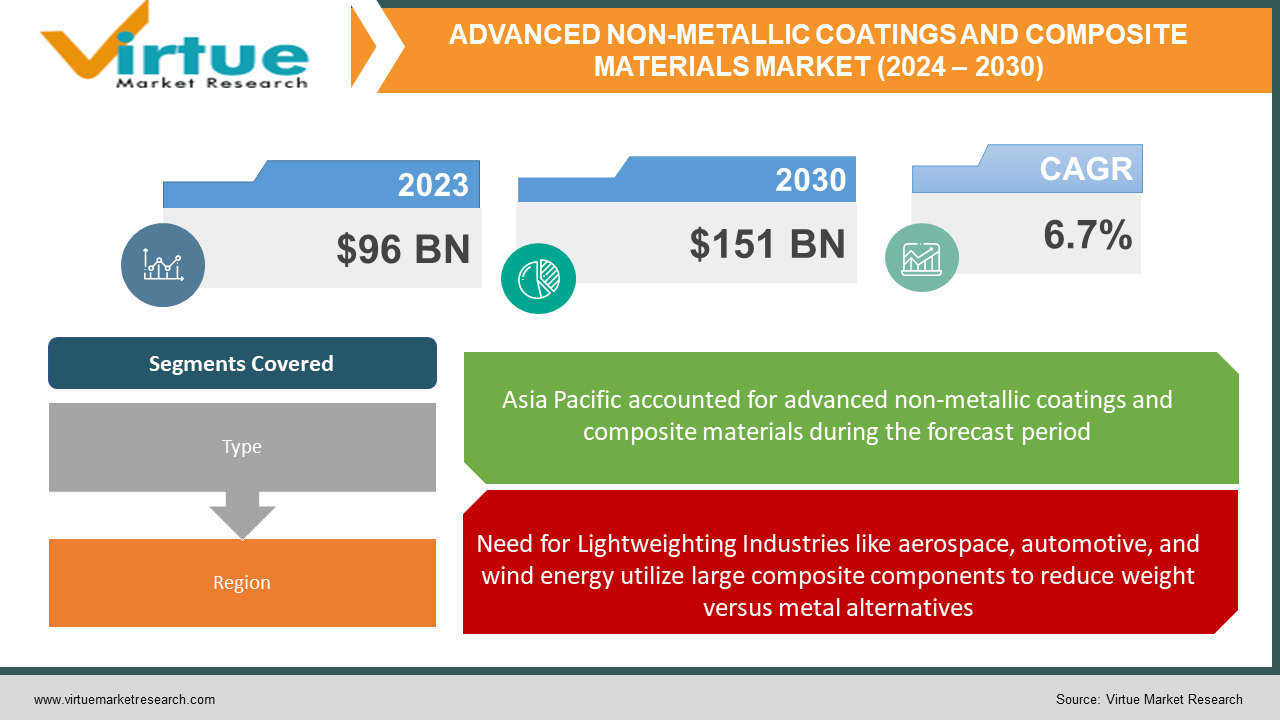

The Advanced Non-Metallic Coatings and Composite Materials Market was valued at USD 96 Billion in 2023 and is projected to reach a market size of USD 151 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.7%.

There is a fundamental change taking place in all industries. Sophisticated non-metallic coatings and composite materials are gradually replacing or improving conventional metal components. Their increasing application areas and higher performance features are driving this transition. The foundation of many sophisticated coatings and composites is made of polymeric materials, which range from robust thermoplastics to high-performance epoxies. Because of its adaptability, characteristics like wear resistance, temperature tolerance, and corrosion resistance can be tailored. In composites, reinforcing fibres are essential because they significantly increase stiffness and strength. For large-scale applications, glass fibres are more affordable, yet carbon fibres provide unparalleled strength-to-weight ratios for demanding constructions. Advanced non-metallic coatings and composites are growing due to the demand for lightweight in transportation, thermal/electrical insulation materials, and alternatives to metals that might corrode or fatigue.

Key Market Insights:

Though they presently only account for 10% of the global materials market, novel non-metallic coatings and composites are expected to increase at a faster rate in the coming years. Until at least 2025, double-digit annual growth is anticipated in the aerospace/defense, building, electronics, medical device, wind energy, and transportation sectors. The requirement for lightweight in various industry verticals to improve performance and fuel efficiency is a significant motivator. Because composite materials are stronger, more rigid, and up to 50% lighter than metals, they can replace metals in some applications. Furthermore, next-generation coatings can occasionally outlast metals in terms of resistance to wear, corrosion, and extreme heat. A significant amount of the world's demand is anticipated to be satisfied by the Asia Pacific area because of China and India's growing infrastructure spending and development. Prominent startups and coating and composite manufacturers including ASM International, Solvay Group, and Huntsman Corporation have made large investments in this extremely promising industry. The introduction of non-metallic, environmentally friendly materials with smaller carbon footprints than conventional materials is also being driven by environmental sustainability. Additionally, composites and coatings enable designs that were previously unfeasible. These cutting-edge materials enable two items that have revolutionised their respective industries: offset printing plates and wind turbine blades. Compared to their metal counterparts, lightweight composites made of fibres, polymers, and sophisticated fillers are substantially lighter. Their popularity is driven by the possibility of weight reduction in industries such as aerospace and automotive, which can lead to improved fuel efficiency, lighter designs, and larger load capacities.

Advanced Non-Metallic Coatings and Composite Materials Market Drivers:

Need for Lightweighting Industries like aerospace, automotive, and wind energy utilize large composite components to reduce weight versus metal alternatives. Lighter weight directly translates into improved fuel efficiency and handling.

Lightweighting has become an urgent priority across transportation sectors like aerospace, automotive, and wind energy as companies pursue efficiency gains and reduced emissions. Advanced composite materials are uniquely positioned to displace traditional dense metals without sacrificing structural integrity. Strategic incorporation of lightweight composites directly enhances fuel economy and handling by reducing inert mass. For instance, replacing an aluminium aircraft component with a carbon fiber reinforced plastic alternative can typically enable over 50% weight reduction for the same strength. Multiplied across the entire vehicle, this equates to billions in annual fuel savings for the industry. Beyond efficiency gains, lightweight non-metallic materials unlock innovative capabilities by facilitating larger, more unconventional designs. Constructing intricate or enormous wind turbine blades from glass and carbon fiber composites would be impossible with metals. The versatility also allows customizing material properties like stiffness across large structures to precisely distribute loads. Additionally, molding or forming complex geometries with composites eliminates many assembly steps needed for metals. Technologies like automated fiber placement and tape laying enable quick fabrication of robust, seamless structures.

Increasingly extreme operating environments in key industries are also accelerating usage. Advanced coatings enable corrosion, wear, heat, and chemical resistance unattainable with metals alone, expanding design possibilities.

Many major industries now expose capital equipment to harsher temperatures, pressures, friction, and chemical exposures during typical operations. Conventional metallic materials hit limitations in these aggressive service environments, accelerating wear, corrosion, and fatigue issues. Advanced non-metallic coatings deliver previously unattainable protection. Next-generation ceramic, polymer, diamond, and boron coatings exponentially improve hardness, heat resistance, corrosion barriers, and lubricity beyond metals alone. For example, ceramic thermal spray coatings allow gas turbine engine components to reliably withstand combustion section temperatures exceeding 1,200°C. Nickel or cobalt superalloys alone cannot endure such extremes. Coating technologies also continue achieving new benchmarks in thickness capabilities, adhesion levels, deposition rates, and coating performance measurement. More robust coatings expand asset lifetimes by reducing erosion, oxidation, fouling, and fatigue crack propagation even in the most punishing operating conditions with temperature fluctuations, dynamic stresses, and reactive chemicals. In addition to damage resistance, these coatings open new possibilities in machine designs and efficiency levels.

Advanced Non-Metallic Coatings and Composite Materials Market Restraints and Challenges:

High Production Costs while dropping, non-metallic solutions remain pricier to manufacture than metals in most cases. Multistep resin and fiber production, the intricacy of combining constituents, plus high costs for pre-and post-processing contribute to inflated prices.

Many advanced materials, such as nylon, draw their building blocks from the petrochemical industry. This dependency makes these materials vulnerable to oil price fluctuations. When crude oil becomes more expensive, the cost of extracting and refining raw materials like adipic acid (a key component for nylon production) also rises. This leads to a cascading effect, where manufacturers of high-performance polymers struggle to maintain profit margins as input costs increase. Unlike mining readily available metals, synthesizing polymers and producing high-quality filaments requires specialized, energy-consuming processes. From reactor energy consumption to specific deposition equipment, this contributes significantly to their higher costs and larger environmental impact. Metal production benefits heavily from established supply chains and massive global volumes, a scale that manufacturers of advanced materials cannot yet match. Smaller production quantities restrict potential production expansion and can push prices up due to limited supply.

Joining and Integration Obstacles, joint durability issues plague structural composites, especially in high vibration environments. Adhesives often degrade prematurely while mechanical fasteners introduce stress concentrations within the composite.

While continuous fiber-reinforced composites demonstrate excellent durability in tension, vulnerabilities emerge when components must be joined or when complex geometries necessitate laminated designs. Adhesives, mechanical fasteners, and secondary bonding techniques traditionally used for metals integration introduce pitfalls that plague composites' performance and longevity. Polymer matrix composites utilize adhesives widely, but these degrade quicker than the reinforced plastic itself, especially in hot or wet operating environments. Mechanical fasteners seem an intuitive solution yet drilling holes through composites innately disturbs fiber continuity, creating internal stress concentrations prone to developing microcracks during loading. Bolted joints thereby become failure origination points regardless of disrupting the lightweight and smoothing benefits of continuous composites. Edge reinforcements only partially alleviate these challenges which become more prevalent as architecture grows more complex. Dissimilar material bonding presents even greater obstacles when composites must integrate with metals in mixed-material assemblies. Differences in thermal expansion, outgassing, and chemical compatibilities between resin matrices and metals introduce new failure modes that surface over long-term use.

Advanced Non-Metallic Coatings and Composite Materials Market Opportunities:

With ambitious emissions reduction targets, transportation equipment manufacturers urgently require lightweight materials solutions. Replacing dense metallic components with composites and high-performance polymer parts can reduce inert mass by over 50% in some assemblies. This confers measurable fuel efficiency and handling improvements critical for next-generation vehicles. The commercial aerospace industry especially represents a prime early adopter of ceramic matrix composites and advanced coatings given extreme operating conditions for engines and airframes. As flight levels rebound post-pandemic, demand for composite cabin components and high-temperature engine materials should accelerate based on lightweight and high heat resistance merits. Corrosion protection coatings will witness heavy demand with the global proliferation of offshore wind power and oil/gas installations. Non-metallic coatings outperform traditional paints in saltwater environments and facilitate simpler, less expensive foundations and structures using common steel versus expensive alloys. Newly industrializing regions still constructing fundamental infrastructure offer greenfield opportunities for non-metallic alternatives to displace initial buildouts of traditional materials. This possibility exists especially across Africa, Southeast Asia, and the Middle East for buildings, electricity transmission, pipes, roads, ports, and bridges among civil structures.

ADVANCED NON-METALLIC COATINGS AND COMPOSITE MATERIALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.7% |

|

Segments Covered |

By Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AkzoNobel, PPG Industries, Sherwin-Williams, Axalta Coating Systems, Nippon Paint Holdings, Toray Industries, Hexcel, Teijin Limited, Solvay, Owens Corning |

Advanced Non-Metallic Coatings and Composite Materials Market Segmentation: By Type

-

Oil & Gas

-

Aerospace & Defense

-

Construction & Infrastructure

-

Automotive

-

Marine

-

Others

Oil and gas holds 25-30% of the market share, and the sheer scale of infrastructure in the oil and gas industry necessitates vast quantities of protective coatings and robust composite materials. The need to resist the harshest chemicals, salt water, and temperature extremes drives the widespread adoption of advanced non-metallic solutions. Aerospace and Defense with 20-25% of the market shares, in aerospace and defense, weight is a critical factor driving the selection of materials. High-performance composites dramatically reduce aircraft weight, boosting fuel efficiency and payload capacity. Advanced coatings enhance durability and thermal protection vital for military applications. Construction and infrastructure hold 15-20% of the market share, this sector is rapidly increasing the adoption of coatings and composites to address aging infrastructure. Composites for bridge repair, pipeline coating for leak prevention, and corrosion-resistant materials for coastal structures are major growth areas. Automotive holds 10 -15% of the market share, and the automotive industry's emphasis on lightweight and electrification propels composite demand. The need for durable yet lightweight EV components and battery enclosures, coupled with improved manufacturing cost-efficiencies, makes composites increasingly attractive for automakers.

Advanced Non-Metallic Coatings and Composite Materials Market Segmentation: Regional Analysis

-

Europe

-

North America

-

Asia Pacific

-

South America

-

Middle East and Africa

North America holds 30-35% of the Market Share in 2023. Demand for advanced materials in the aerospace & defense sector, stringent environmental regulations that favor non-metallic alternatives, and an aging infrastructure in need of innovative coatings and composite solutions. Europe holds 25-30% of the Market Share, a Strong automotive industry with an emphasis on lightweight, advanced manufacturing capabilities, and high adoption of renewable energy technologies favoring coatings and composites. Asia Pacific holds 35-40% of the market share, Rapid industrialization, infrastructure development, and increased consumer spending in markets such as China and India. Growth in shipbuilding, aerospace, and electronics manufacturing also bolsters regional demand. While Europe and North America maintain healthy market shares, their growth is comparatively less dramatic than in the Asia Pacific region. These mature markets have already established extensive non-metallic materials usage. Latin America and the Middle East represent smaller shares at present, though they might offer potential growth and niche opportunities within specific industries. The growth of key Chinese and Southeast Asian manufacturing sectors and their adoption of lightweight composites & durable coatings drives substantial market expansion.

COVID-19 Impact Analysis on the Advanced Non-Metallic Coatings and Composite Materials Market.

The economic slowdown and manufacturing contractions from the COVID-19 pandemic disrupted short-term demand and near-term growth projections across most industrial sectors in 2020 and 2021. The non-metallic coatings and composites marketplace faced similar setbacks. Transportation sectors represent the largest consumer of composite materials globally. Automotive and aerospace industry shutdowns early in the pandemic combined with supply chain complications delayed existing composite component programs by 18-24 months on average. This pushback also postponed qualification testing needed for next-generation designs using improved composite technologies. With global air travel curtailed, commercial aerospace and jetliner production plummeted during 2020, directly impacting composite materials usage. Defense programs sustained composites somewhat but also faced delays. 2021’s aircraft build rate recovery still lags 2019’s pre-pandemic levels by around 20%. This postpones future growth for composites in new designs and aftermarket restorations. Coatings markets dependent on heavy machinery production like agriculture, construction, and general industrial also witnessed double-digit declines in 2020. Lower capital investment compromised near-term coatings demand as companies conserved cashflows. Overall, the pandemic injected delays across the non-metallic coatings and composites value chain, from research programs to product qualifications and assembly integration. Markets anticipate a return to the previously forecasted above-average growth trajectory by 2023-2024.

Latest Trends/ Developments:

There have been several intriguing trends and advancements in the market for composite materials and sophisticated non-metallic coatings in recent years. The transition to more ecologically friendly and sustainable coatings and composites is one significant development. The market for coatings and composites with a smaller carbon footprint than conventional petroleum-based materials is growing. These materials can be recycled or created from renewable resources. These coatings can biodegrade at the end of their lifecycle and are made from ingredients sourced from plants or other renewable resources. Additionally, growing is the use of nanocellulose as a sustainable covering material. Self-healing coatings that can patch up cracks or scratches are a new development in functional technology. When there is damage to the surface, these smart coatings' microcapsules containing a healing ingredient are released. Additionally, slippery liquid-infused porous surfaces or nanostructured surfaces are being employed to develop anti-icing coatings that inhibit ice attachment. Methods for spray coating are also developing to produce thin layers that are more consistent. Composite materials are becoming more and more common in the electronics, building, and transportation sectors.

Key Players:

-

AkzoNobel

-

PPG Industries

-

Sherwin-Williams

-

Axalta Coating Systems

-

Nippon Paint Holdings

-

Toray Industries

-

Hexcel

-

Teijin Limited

-

Solvay

-

Owens Corning

Chapter 1. ADVANCED NON-METALLIC COATINGS AND COMPOSITE MATERIALS MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. ADVANCED NON-METALLIC COATINGS AND COMPOSITE MATERIALS MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. ADVANCED NON-METALLIC COATINGS AND COMPOSITE MATERIALS MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. ADVANCED NON-METALLIC COATINGS AND COMPOSITE MATERIALS MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. ADVANCED NON-METALLIC COATINGS AND COMPOSITE MATERIALS MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. ADVANCED NON-METALLIC COATINGS AND COMPOSITE MATERIALS MARKET – By Type

6.1 Introduction/Key Findings

6.2 Oil & Gas

6.3 Aerospace & Defense

6.4 Construction & Infrastructure

6.5 Automotive

6.6 Marine

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Type

6.9 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. ADVANCED NON-METALLIC COATINGS AND COMPOSITE MATERIALS MARKET , By Geography – Market Size, Forecast, Trends & Insights

7.1 North America

7.1.1 By Country

7.1.1.1 U.S.A.

7.1.1.2 Canada

7.1.1.3 Mexico

7.1.2 By Type

7.1.3 Countries & Segments - Market Attractiveness Analysis

7.2 Europe

7.2.1 By Country

7.2.1.1 U.K

7.2.1.2 Germany

7.2.1.3 France

7.2.1.4 Italy

7.2.1.5 Spain

7.2.1.6 Rest of Europe

7.2.2 By Type

7.2.3 Countries & Segments - Market Attractiveness Analysis

7.3 Asia Pacific

7.3.1 By Country

7.3.1.1 China

7.3.1.2 Japan

7.3.1.3 South Korea

7.3.1.4 India

7.3.1.5 Australia & New Zealand

7.3.1.6 Rest of Asia-Pacific

7.3.2 By Type

7.3.3 Countries & Segments - Market Attractiveness Analysis

7.4 South America

7.4.1 By Country

7.4.1.1 Brazil

7.4.1.2 Argentina

7.4.1.3 Colombia

7.4.1.4 Chile

7.4.1.5 Rest of South America

7.4.2 By Type

7.4.3 Countries & Segments - Market Attractiveness Analysis

7.5 Middle East & Africa

7.5.1 By Country

7.5.1.1 United Arab Emirates (UAE)

7.5.1.2 Saudi Arabia

7.5.1.3 Qatar

7.5.1.4 Israel

7.5.1.5 South Africa

7.5.1.6 Nigeria

7.5.1.7 Kenya

7.5.1.8 Egypt

7.5.1.9 Rest of MEA

7.5.2 By Type

7.5.3 Countries & Segments - Market Attractiveness Analysis

Chapter 8. ADVANCED NON-METALLIC COATINGS AND COMPOSITE MATERIALS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 AkzoNobel

8.2 PPG Industries

8.3 Sherwin-Williams

8.4 Axalta Coating Systems

8.5 Nippon Paint Holdings

8.6 Toray Industries

8.7 Hexcel

8.8 Teijin Limited

8.9 Solvay

8.10 Owens Corning

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

In harsh environments (oil & gas, chemical processing, marine), advanced coatings protect vital infrastructure far longer than traditional materials, translating to less downtime and lower maintenance costs.

Some highly specialized materials, like carbon fiber precursors, can be expensive, hindering broader adoption. Fluctuations in the cost of base chemicals affect some polymer and ceramic coating production.

AkzoNobel, PPG Industries, Sherwin-Williams, Axalta Coating Systems, Nippon Paint Holdings, Toray Industries, Hexcel, Owens Corning.

Asia Pacific holding currently holds the largest market share, estimated at around 40%.

Asia Pacific exhibits the fastest growth, driven by its increasing population, and expanding economy.