Advanced Composites Market Size (2025 – 2030)

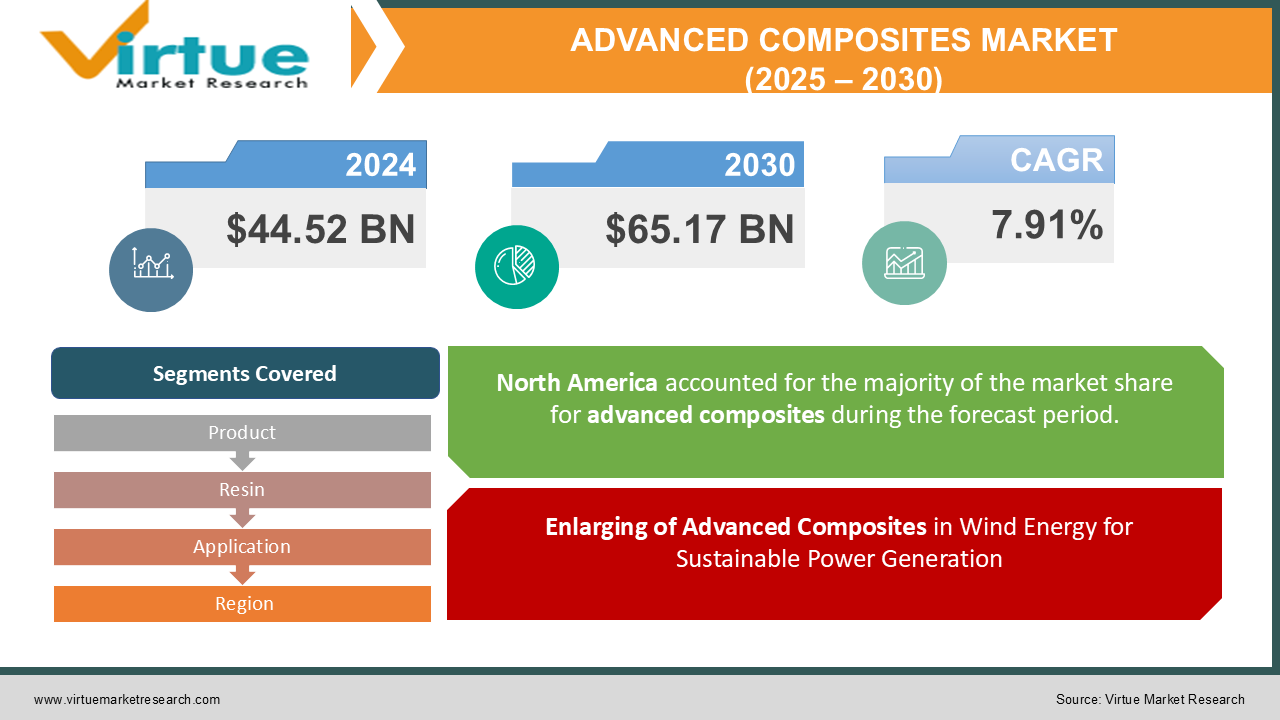

The Global Advanced Composites Market was valued at USD 44.52 billion in 2024 and is projected to reach a market size of USD 65.17 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.91%.

The global advanced composite market is experiencing remarkable growth, driven by its widespread adoption across various industries such as aerospace, automotive, defense, construction, and renewable energy. Advanced composites, also known as high-performance composites, offer exceptional strength-to-weight ratios, superior durability, and enhanced thermal and chemical resistance, making them important for applications that demand lightweight yet high-strength materials. With the increasing emphasis on fuel efficiency, sustainability, and performance optimization, industries are shifting toward advanced composites to replace traditional materials like metals and conventional polymers. Additionally, rapid advancements in manufacturing processes, such as automated fiber placement (AFP) and 3D printing of composites, are further propelling the market's expansion. As governments and corporations worldwide focus on reducing carbon emissions and improving energy planning, the demand for lightweight, high-performance composite materials is expected to proceed its upward trajectory, shaping the future of material science and engineering.

Key Market Insights:

-

The advanced composite market is experiencing significant expansion, driven by expanding demand from aerospace, automotive, and renewable energy sectors. The aerospace industry remains the largest consumer, with advanced composites accounting for over 50% of modern aircraft structures, significantly reducing weight and ameliorating fuel efficiency. In the automotive sector, the adoption of advanced composites is rising at an annual rate of approximately 7%, as manufacturers endeavor to reach stringent emission regulations and improve vehicle performance.

-

The wind energy sector is also a major contributor, with over 60% of modern wind turbine blades made from advanced composite materials, authorized, skilled turbine designs. Additionally, thermoplastic composites are escalating, growing at a CAGR of nearly 9%, as industries prioritize recyclability and cost-effective manufacturing. The defense sector is leveraging advanced composites in ballistic protection and lightweight armor, with demand increasing by nearly 6% annually due to rising global security concerns.

-

Furthermore, nanocomposites and smart composites are emerging as game-changers, offering self-healing properties allowing structural monitoring capabilities, which are significant in aerospace and infrastructure applications. As research and development efforts continue to innovate material formulations and manufacturing techniques, the market for advanced composites is poised for sustained double-digit growth in the coming years.

Advanced Composites Market Drivers:

Raising Demand for Lightweight and High-Strength Materials in Aerospace and Automotive Industries is Driving the Market Growth

The aerospace and automotive sectors are among the largest consumers of advanced composites, utilizing them to improve fuel efficiency, safety, and performance. Over 50% of modern aircraft structures now incorporate composite materials, remarkably reducing weight while maintaining strength. In the automotive industry, advanced composites facilitated up to 40% weight reduction in vehicles, promoting superior fuel economy and lower carbon emissions. As governments implement stricter emission regulations and fuel efficiency standards, the demand for lightweight, high-strength materials continues to rise, leading innovation and adoption.

Enlarging of Advanced Composites in Wind Energy for Sustainable Power Generation

The renewable energy sector, particularly wind power, is a key driver for the advanced composite market. More than 60% of modern wind turbine blades are currently made from composite materials, leading larger and more enhanced turbines that can generate more power. These materials provide high strength, durability, and corrosion resistance, resulting ideal for harsh environmental conditions. As countries worldwide aim to increase their renewable energy capacity and reduce reliance on fossil fuels, the wind energy sector’s adoption of composites is expected to grow exponentially.

Advancements in Composite Manufacturing Technologies for Cost Efficiency and Mass Production

Innovations in automated fiber placement (AFP), 3D printing, and resin transfer molding (RTM) are revolutionizing composite manufacturing, making production faster, more cost-effective, and scalable. The rise of thermoplastic composites further fueling growth, as they offer recyclability and shorter production cycles compared to thermoset composites. These advancements are promoting mass production in industries like construction, consumer goods, and defense, further broadening the market for advanced composites.

Growing Adoption of Composites in Defense and Infrastructure for Durability and Performance

The defense sector is increasingly using ballistic-grade composites for armor and lightweight protective gear, enhancing mobility without compromising safety. Infrastructure projects are also embracing fiber-reinforced polymer (FRP) composites for bridges, buildings, and tunnels due to their high durability, corrosion resistance, and cost-effective maintenance. As urbanization expands and security concerns rise, the demand for composites in these applications will continue to accelerate, making them a critical material in next-generation engineering solutions.

Advanced Composites Market Restraints and Challenges:

Exorbitant Production Costs, Recycling Challenges, and Limited Supply Chain Hurdles in the Advanced Composites Market

The costly production of advanced composites remains one of the biggest challenges, as raw materials like carbon fiber and aramid fibers are expensive to manufacture and process.

Additionally, the complex fabrication techniques and labor-intensive manufacturing further increase costs, making composites less accessible for cost-sensitive industries or regions. Another major concern is the lack of efficient recycling methods, particularly for thermoset composites, which do not easily break down and pose environmental disposal challenges. The limited global supply chain and dependency on specific regions for raw materials also create vulnerabilities, leading to fluctuations in pricing and supply shortages. Without cost-effective production and sustainable recycling solutions, the widespread adoption of advanced composites faces significant barriers.

Advanced Composites Market Opportunities:

The advanced tourism market is facing unprecedented opportunities driven by the rise of eco-tourism, space tourism, and AI-powered personalized travel experiences. As sustainability foremost, eco-friendly destinations and carbon-neutral travel options are attracting environmentally conscious travelers. Meanwhile, the commercialization of space tourism by companies like SpaceX and Blue Origin is opening an entirely new sector, with high-net-worth individuals eager to experience zero-gravity travel. Additionally, AI, big data, and virtual reality (VR) are transfiguring tourism by offering hyper-personalized travel recommendations, immersive virtual tours, and real-time itinerary optimization. With advancements in technology and growing consumer interest in unique experiences, the future of tourism is set to become more innovative and accessible.

ADVANCED COMPOSITES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.91% |

|

Segments Covered |

By Product, Resin, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Toray Industries, Inc., Hexcel Corporation, Teijin Limited, SGL Carbon SE, Solvay S.A., Mitsubishi Chemical Holdings Corporation, Owens Corning, BASF SE, Huntsman Corporation, Gurit Holding AG, Royal DSM N.V., Hyosung Advanced Materials, Nippon Graphite Fiber Corporation |

Advanced Composites Market Segmentation: By Product

-

Aramid Fiber

-

Carbon Fiber

-

Glass Fiber

Carbon fiber is the dominant in the advanced composites market due to its exceptional strength-to-weight ratio, high stiffness, and widespread use in aerospace, automotive, and wind energy industries. It is majorly used in aircraft structures, sports equipment, and high-performance vehicles, making it a key material in lightweight engineering.

Aramid fiber is the fastest-growing, because of its superior heat resistance, impact strength, and increasing demand in defense, protective gear, and ballistic applications. Its usage in body armor, firefighter suits, and aerospace components is expanding rapidly as industries seek high-performance, durable materials.

Glass fiber, widely used in construction, marine, and infrastructure, remains a cost-effective option for reinforcing composites, offering high corrosion resistance and durability in structural applications.

Advanced Composites Market Segmentation: By Resin

-

Advanced Thermosetting Composites

-

Advanced Thermoplastic Composites

Advanced Thermosetting Composites are the mostly used due to their high strength, excellent heat resistance, and durability, making them widely used in aerospace, wind energy, and automotive industries. These composites, provide lightweight yet structurally strong solutions for aircraft, wind turbine blades, and high-performance vehicles.

Advanced Thermoplastic Composites are growing rapidly, driven by their recyclability, impact resistance, and ease of processing. Unlike thermosets, thermoplastic composites can be remolded and reshaped, making them majorly attractive for automotive, transportation, and consumer electronics applications. Their rapid adoption in lightweight vehicle manufacturing and sustainable material solutions is fueling significant market expansion.

Advanced Composites Market Segmentation: By Application

-

Aerospace & Defense

-

Automotive

-

Wind Energy

-

Sporting Goods

-

Others

Aerospace & Defense is the most used in the advanced composites market, as lightweight and strong materials like carbon fiber composites are important for fuel efficiency, structural integrity, and enhanced performance in aircraft and military applications. The aerospace sector relies heavily on advanced composites for aircraft fuselages, wings, and spacecraft components, driving significant demand.

Wind Energy is the fastest-growing, influenced by the global transition to renewable energy and the increasing adoption of large, lightweight, and durable wind turbine blades made from glass and carbon fiber composites. As governments and industries focus on sustainable energy solutions, the demand for advanced composites in wind power generation continues to grow.

Automotive composites are also growing steadily, as manufacturers seek lightweight materials to enhance fuel efficiency and satisfy strict emission regulations. Sporting goods, such as tennis rackets, golf clubs, and bicycles, utilize advanced composites for enhanced durability and performance.

Advanced Composites Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the dominant region in the advanced composites market, contributing approximately 35% of the global share. The region's strong aerospace, defense, and automotive industries, along with high R&D investments and technological advancements, drive high demand. The presence of major composite manufacturers and stringent fuel efficiency regulations in the automotive and aerospace sectors further strengthen North America's leadership.

Asia-Pacific is the fastest-growing region, fueled by rapid industrialization, increasing wind energy projects, and expanding automotive production. Countries like China, India, and Japan are witnessing a surge in demand for lightweight and high-performance materials in automotive, construction, and renewable energy sectors. The region's growing investments in aerospace and infrastructure development are further accelerating the adoption of advanced composites.

COVID-19 Impact Analysis on the Global Advanced Composites Market:

The COVID-19 pandemic highly impacted the global advanced composites market, disturbing supply chains, production facilities, and demand across key industries. The aerospace and automotive sectors, major consumers of advanced composites, faced a major decline in production and sales due to lockdowns and travel restrictions. Aircraft manufacturing delays and reduced airline operations led to lower demand for carbon fiber composites, while the slowdown in automobile production affected composite usage in lightweight vehicle designs.

However, the wind energy and medical sectors provided resilience to the market, with significant adoption of composite materials in renewable energy projects and medical equipment. The construction sector also showed signs of recovery as governments worldwide invested in infrastructure projects to boost economic revival. As industries resumed operations and supply chains stabilized, the demand for lightweight, high-strength, and durable composite materials saw a steady resurgence, driving the market toward recovery.

Latest Trends/ Developments:

The rising demand for lightweight and high-strength materials is driving innovation in the automotive and aerospace sectors, with manufacturers focusing on carbon fiber and thermoplastic composites for enhanced fuel efficiency and performance.

The rise of electric vehicles (EVs) has hastened the adoption of advanced composites for battery enclosures, lightweight chassis, and structural components. Additionally, advancements in automated composite manufacturing technologies, such as 3D printing and robotic layup, are improving production efficiency and reducing costs, making composites more accessible to a wider range of industries.Another key trend is the increasing adoption of advanced composites in renewable energy applications, particularly in wind energy and hydrogen storage. The demand for longer and more durable wind turbine blades has paved the way for high-performance fiber-reinforced composites, improving energy efficiency and sustainability. Additionally, the medical industry is seeing increased use of composites in prosthetics, orthopedic implants, and imaging devices, further expanding the market's potential. With a strong push for sustainability and recycling, companies are also investing in bio-based and recyclable composite materials, aligning with global environmental initiatives.

Key Players:

-

Toray Industries, Inc.

-

Hexcel Corporation

-

Teijin Limited

-

SGL Carbon SE

-

Solvay S.A.

-

Mitsubishi Chemical Holdings Corporation

-

Owens Corning

-

BASF SE

-

Huntsman Corporation

-

Gurit Holding AG

-

Royal DSM N.V.

-

Hyosung Advanced Materials

-

Nippon Graphite Fiber Corporation

Chapter 1. Advanced Composites Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Advanced Composites Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Advanced Composites Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Advanced Composites Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Advanced Composites Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Advanced Composites Market – BY PRODUCT

6.1 Introduction/Key Findings

6.2 Aramid Fiber

6.3 Carbon Fiber

6.4 Glass Fiber

6.5 Y-O-Y Growth trend Analysis BY PRODUCT

6.6 Absolute $ Opportunity Analysis BY PRODUCT, 2025-2030

Chapter 7. Advanced Composites Market – BY RESIN

7.1 Introduction/Key Findings

7.2 Advanced Thermosetting Composites

7.3 Advanced Thermoplastic Composites

7.4 Y-O-Y Growth trend Analysis BY RESIN

7.5 Absolute $ Opportunity Analysis BY RESIN, 2025-2030

Chapter 8. Advanced Composites Market – BY APPLICATION

8.1 Introduction/Key Findings

8.2 Aerospace & Defense

8.3 Automotive

8.4 Wind Energy

8.5 Sporting Goods

8.6 Others

8.7 Y-O-Y Growth trend Analysis BY APPLICATION

8.8 Absolute $ Opportunity Analysis BY APPLICATION, 2025-2030

Chapter 9. Advanced Composites Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 BY PRODUCT

9.1.3 BY RESIN

9.1.4 BY APPLICATION

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 BY PRODUCT

9.2.3 BY RESIN

9.2.4 BY APPLICATION

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 BY PRODUCT

9.3.3 BY RESIN

9.3.4 BY APPLICATION

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 BY PRODUCT

9.4.3 BY RESIN

9.4.4 BY APPLICATION

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 BY PRODUCT

9.5.3 BY RESIN

9.5.4 BY APPLICATION

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Advanced Composites Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Toray Industries, Inc.

10.2 Hexcel Corporation

10.3 Teijin Limited

10.4 SGL Carbon SE

10.5 Solvay S.A.

10.6 Mitsubishi Chemical Holdings Corporation

10.7 Owens Corning

10.8 BASF SE

10.9 Huntsman Corporation

10.10 Gurit Holding AG

10.11 Royal DSM N.V.

10.12 Hyosung Advanced Materials

10.13 Nippon Graphite Fiber Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Advanced Composites Market was valued at USD 44.52 billion in 2024 and is projected to reach a market size of USD 65.17 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.91%.

The Global Advanced Composites Market is influenced by increasing demand for lightweight, high-strength materials in aerospace, automotive, and renewable energy industries.

Based on Product, the Global Advanced Composites Market is segmented into aramid fiber, carbon fiber, and glass fiber.

North America is the most dominant region for the Global Advanced Composites Market.

Toray Industries, Inc., Hexcel Corporation, Teijin Limited, SGL Carbon SE are the key players of the Global Advanced Composites Market.