Advanced Ceramics Market Size (2025 – 2030)

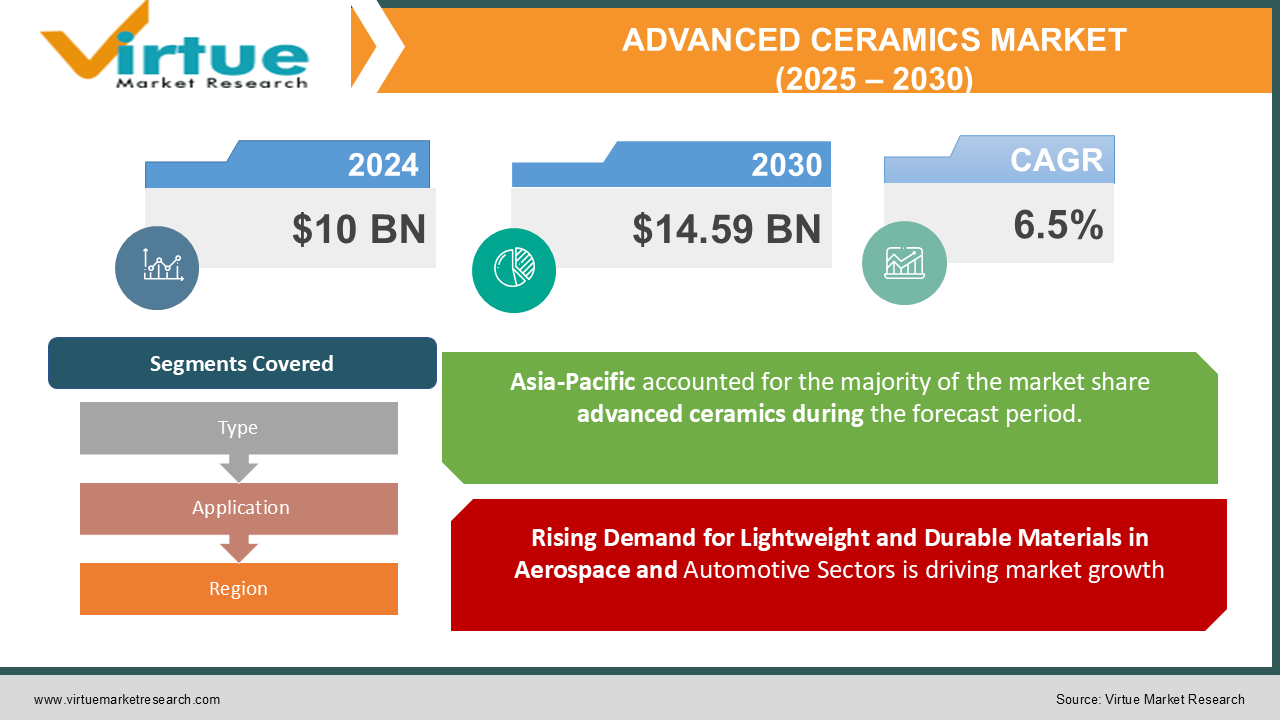

The Global Advanced Ceramics Market was valued at USD 10 billion in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. The market is expected to reach USD 14.59 billion by 2030.

Advanced ceramics are specialized materials known for their superior mechanical, thermal, and chemical properties compared to traditional ceramics. They are widely used in applications such as electronics, healthcare, automotive, and aerospace, driven by their exceptional durability, thermal resistance, and electrical insulation properties. The rising demand for lightweight, high-performance materials across various industries is a key factor fueling the growth of the advanced ceramics market.

Key Market Insights:

-

The electronics industry accounts for the largest share of the advanced ceramics market, driven by their application in semiconductors, capacitors, and insulators. In 2024, the electronics sector represented 35% of the total market demand.

-

Bioceramics, used in orthopedic and dental implants, are expected to witness a CAGR of 7.5% during the forecast period due to the aging global population and advancements in medical technology.

-

Rising adoption of advanced ceramics in the automotive sector for components like sensors, catalytic converters, and heat shields is a significant growth contributor. The segment grew by 4.8% in 2024 alone.

-

Asia-Pacific dominates the global market, with a 45% market share in 2024, owing to rapid industrialization and the presence of key electronics manufacturers in China, Japan, and South Korea.

Global Advanced Ceramics Market Drivers:

Rising Demand for Lightweight and Durable Materials in Aerospace and Automotive Sectors is driving market growth:

The automotive and aerospace industries are increasingly adopting advanced ceramics due to their high strength-to-weight ratio, superior thermal resistance, and corrosion resistance. These materials reduce the overall weight of vehicles and aircraft, enhancing fuel efficiency and reducing emissions. For instance, ceramic matrix composites are replacing traditional alloys in turbine engines to improve heat resistance. Additionally, sensors and actuators in automotive systems benefit from the insulating properties of ceramics. The global push for sustainability and stringent emission regulations further amplify the demand for advanced ceramics, positioning them as vital components for next-generation vehicles and aircraft.

Increasing Applications in Electronics and Semiconductor Industries is driving market growth:

Advanced ceramics are integral to the electronics sector due to their exceptional electrical insulation, thermal conductivity, and dielectric properties. They are widely used in manufacturing capacitors, substrates, and insulators for semiconductors, essential for consumer electronics, industrial devices, and telecommunications. With the rise of 5G technology, IoT devices, and electric vehicles, the demand for advanced ceramics is poised to grow significantly. In addition, their use in energy storage systems and renewable energy components, such as fuel cells and solar panels, adds to their market potential. The electronics industry's rapid technological advancements continuously create new applications for these materials.

Growing Adoption of Bioceramics in Healthcare Applications is driving market growth:

The healthcare sector is a significant driver for the advanced ceramics market, particularly bioceramics, which are utilized in orthopedic and dental implants, joint replacements, and bone graft substitutes. These ceramics are biocompatible and offer superior mechanical properties, such as wear resistance and structural integrity, compared to traditional materials. The aging population worldwide and the increasing prevalence of chronic diseases have created a growing need for medical implants and devices, accelerating the demand for bioceramics. Furthermore, advancements in regenerative medicine and tissue engineering are expanding the scope of bioceramic applications, fostering innovation in the market.

Global Advanced Ceramics Market Challenges and Restraints:

High Manufacturing Costs and Technological Limitations is restricting market growth:

The production of advanced ceramics involves complex processes and high costs, making them less accessible compared to traditional materials. Specialized equipment, precision engineering, and expensive raw materials, such as zirconium and silicon carbide, contribute to these elevated costs. Additionally, while advanced ceramics possess excellent properties, their brittleness can limit their use in certain dynamic applications. Manufacturers face challenges in enhancing the toughness of ceramics without compromising their inherent advantages. These technological and economic constraints hinder the adoption of advanced ceramics, particularly in cost-sensitive industries.

Environmental Concerns Related to Ceramic Processing is restricting market growth:

The manufacturing process of advanced ceramics can have significant environmental impacts, including high energy consumption and the emission of greenhouse gases. The sintering process, a crucial step in ceramic production, requires elevated temperatures, leading to substantial energy usage. Moreover, some raw materials for advanced ceramics are sourced through mining processes that can contribute to ecological degradation. As industries and governments worldwide emphasize sustainability, these environmental challenges pose a constraint on the growth of the advanced ceramics market. Addressing these concerns through sustainable manufacturing practices and the development of eco-friendly ceramics is critical for future growth.

Market Opportunities:

The advanced ceramics market is poised for substantial growth, driven by emerging opportunities across various sectors. One notable area is renewable energy, where ceramics are increasingly used in applications such as wind turbines, fuel cells, and solar panels. As governments worldwide promote green energy initiatives, the demand for efficient and durable materials like advanced ceramics is set to rise. The medical field also presents significant growth potential with bioceramics playing a critical role in bone regeneration and joint replacement technologies. As personalized medicine gains traction, customized ceramic implants tailored to individual patient needs are likely to become more prevalent. Moreover, the development of 3D-printed advanced ceramics is revolutionizing manufacturing, allowing for intricate designs and faster production cycles. Industries such as aerospace and automotive are leveraging these advancements to create innovative components that were previously unattainable with traditional methods. The expansion of 3D printing capabilities promises to open new avenues for advanced ceramics in the coming years. Another promising opportunity lies in the defense industry, where ceramics are used in armor and protective equipment due to their lightweight and impact-resistant properties. The increasing focus on defense modernization by several nations could further boost the demand for advanced ceramics. Overall, the market is ripe with possibilities, provided challenges such as cost and environmental impact are addressed.

ADVANCED CERAMICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

CoorsTek, Kyocera Corporation, 3M, CeramTec, Morgan Advanced Materials, Saint-Gobain, Corning Inc., Rauschert Steinbach GmbH, Murata Manufacturing Co., Ltd., Applied Ceramics |

Advanced Ceramics Market Segmentation: By Type

-

Alumina Ceramics

-

Titanate Ceramics

-

Zirconia Ceramics

-

Silicon Carbide Ceramics

-

Others

Alumina ceramics lead the market due to their widespread use in electronic substrates, medical implants, and industrial applications. Their high strength, corrosion resistance, and affordability make them the most sought-after advanced ceramics material.

Advanced Ceramics Market Segmentation: By Application

-

Electronics

-

Medical

-

Automotive

-

Aerospace

-

Defense

-

Energy & Power

-

Others

The electronics segment dominates the market, accounting for the largest share. Advanced ceramics are extensively used in capacitors, insulators, and semiconductors, essential components in consumer electronics and industrial devices

Advanced Ceramics Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific region's dominance is attributed to its robust electronics manufacturing base in countries such as China, Japan, and South Korea. Additionally, rapid industrialization and urbanization are driving the adoption of advanced materials across various industries in the region. Governments in these countries are also investing heavily in renewable energy and infrastructure projects, creating additional demand for advanced ceramics in energy and construction applications. With its strong manufacturing capabilities and increasing technological advancements, Asia-Pacific is expected to maintain its leadership in the market.

COVID-19 Impact Analysis on the Advanced Ceramics Market:

The COVID-19 pandemic disrupted global supply chains, leading to temporary shutdowns in manufacturing facilities, including those producing advanced ceramics. Sectors such as automotive and aerospace, which are major consumers of advanced ceramics, experienced significant slowdowns due to reduced demand and halted production lines. However, the pandemic also highlighted the importance of advanced ceramics in medical applications, such as bioceramics for implants and diagnostic equipment. The surge in healthcare demands during the pandemic created a short-term boost for the medical segment of the advanced ceramics market. In the post-pandemic era, the market is witnessing a rebound as industries recover and prioritize resilience in their supply chains. The growing emphasis on sustainability and the shift towards renewable energy sources are expected to drive long-term demand for advanced ceramics. Overall, while the pandemic posed challenges, it also underscored the versatility and critical applications of advanced ceramics, paving the way for future growth.

Latest Trends/Developments:

The advanced ceramics market is witnessing several transformative trends that are shaping its future trajectory. One prominent development is the rise of additive manufacturing or 3D printing, which is revolutionizing the production of advanced ceramics. This technology allows for the creation of complex geometries with high precision, opening new possibilities in medical implants, aerospace components, and custom industrial parts. Another significant trend is the integration of advanced ceramics in renewable energy technologies. For instance, ceramic materials are being increasingly used in solid oxide fuel cells, photovoltaic systems, and wind turbines due to their durability and efficiency. This aligns with the global transition towards cleaner and more sustainable energy sources. Additionally, there is a growing focus on environmentally friendly ceramic production processes. Manufacturers are exploring alternative sintering techniques and recyclable materials to reduce the carbon footprint associated with ceramic production. The advent of nanotechnology is also expanding the scope of advanced ceramics by enhancing their mechanical, thermal, and electrical properties. Nano-ceramics are finding applications in high-performance electronics, medical devices, and cutting-edge defense technologies. These advancements are driving innovation and expanding the market potential for advanced ceramics across diverse industries.

Key Players:

-

CoorsTek

-

Kyocera Corporation

-

3M

-

CeramTec

-

Morgan Advanced Materials

-

Saint-Gobain

-

Corning Inc.

-

Rauschert Steinbach GmbH

-

Murata Manufacturing Co., Ltd.

-

Applied Ceramics

Chapter 1. Advanced Ceramics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Advanced Ceramics Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Advanced Ceramics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Advanced Ceramics Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Advanced Ceramics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Advanced Ceramics Market – By Type

6.1 Introduction/Key Findings

6.2 Alumina Ceramics

6.3 Titanate Ceramics

6.4 Zirconia Ceramics

6.5 Silicon Carbide Ceramics

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Advanced Ceramics Market – By Application

7.1 Introduction/Key Findings

7.2 Electronics

7.3 Medical

7.4 Automotive

7.5 Aerospace

7.6 Defense

7.7 Energy & Power

7.8 Others

7.9 Y-O-Y Growth trend Analysis By Application

7.10 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Advanced Ceramics Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Advanced Ceramics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 CoorsTek

9.2 Kyocera Corporation

9.3 3M

9.4 CeramTec

9.5 Morgan Advanced Materials

9.6 Saint-Gobain

9.7 Corning Inc.

9.8 Rauschert Steinbach GmbH

9.9 Murata Manufacturing Co., Ltd.

9.10 Applied Ceramics

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Advanced Ceramics Market was valued at USD 10 billion in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. The market is expected to reach USD 14.59 billion by 2030.

Key drivers include the rising demand for lightweight and durable materials in aerospace and automotive sectors, increasing applications in electronics and semiconductors, and the growing adoption of bioceramics in healthcare.

The market is segmented by product type (e.g., alumina ceramics, zirconia ceramics) and application (e.g., electronics, medical, automotive, aerospace).

Asia-Pacific is the dominant region, holding 45% of the market share in 2024, driven by its strong manufacturing base and rapid industrialization.

Leading players include CoorsTek, Kyocera Corporation, 3M, CeramTec, Morgan Advanced Materials, and Saint-Gobain.