Advanced Authentication Market in the Financial Service Industry Size (2023 - 2030)

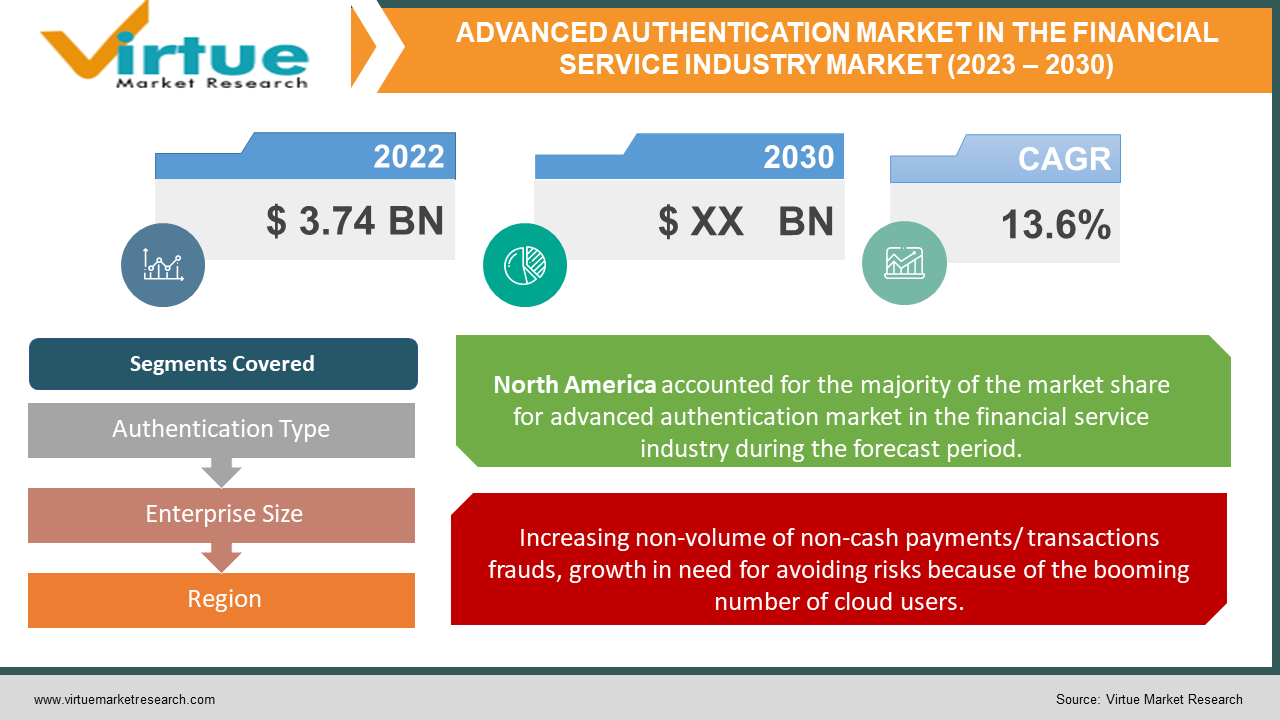

The global advanced authentication market in the financial services industry is expected to grow from USD 3.74 billion in 2022 and is projected to grow with a CAGR of 13.6% from 2022-2030.

The financial services sector provides flawless services to its end-users and needs to share its sensitive and often regulated information across organizations and corporates.

COVID-19 Impact on Advanced Authentication Market in the Financial Service Industry

The novel coronavirus (COVID-19) has brought the world to a standstill. Many organizations including every business sector are severely affected exhibiting a downfall in the global economy. During the COVID-19 pandemic crisis, advanced authentication in the financial sector is scheduled to grow for online assessments and processing of finance preventing a data breach and protecting all authenticated cases and policies of the organization.

MARKET DRIVERS

Increasing non-volume of non-cash payments/ transactions frauds, growth in need for avoiding risks because of the booming number of cloud users. The rise in the number of security breaches and recognized theft threats drive the global market growth. Online frauds, rising technology perforation, and changing consumer dynamics are driving advanced authentication in financial services market growth. The market players in the global advanced authentication in financial services market represent a prominent share and focus on extending their customer base. For example, Gemalto disclosed PURE white-label payment solution services to GhIPSS (Ghana Interbank Payment and Settlement Systems), a subsidiary of Ghana's central bank that manages the country's interbank payment processing system. Financial services institutions and software companies are processing artificial intelligence to superior soothe risks, providing online chatbots, etc.

MARKET RESTRAINS

However, privacy issues related to the authentication vendor and the expensive nature of the tokens are likely to limit the market growth throughout the period.

ADVANCED AUTHENTICATION MARKET IN THE FINANCIAL SERVICE INDUSTRY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

13.6% |

|

Segments Covered |

By Authentication Type, Enterprise Size, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Fujitsu Ltd, Thales Group, NEC Corporation, CA Technologies Inc., Safran Identity and Security SAS, Dell Technologies Inc., Lumidigm Inc., Validsoft Ltd, Pistolstar Inc., SecurEnvoy Ltd. |

Segmentation Analysis

The global advanced authentication in the financial services market has been segmented and sub-segmented based on the Authentication type, enterprise size.

Advanced Authentication Market in the Financial Service Industry - By Authentication Type

-

Smartcards

-

Biometrics

-

Mobile Smart Credentials

-

Tokens

-

Others

By authentication type, the biometrics segment is accounted to hold the largest and major share in the advanced authentication in the financial services market. Biometrics examine and validate based on human physical characteristics like the retina, fingerprint, speech, etc. The biometrics method of authentication is widely adopted due to the advantages it offers such as non-repudiation, and non-identifiable nature.

Advanced Authentication Market in the Financial Service Industry - By Enterprise Size

-

Large Enterprise

-

Small & Medium Enterprises

Regional Analysis:

-

Regional-wise, North America is anticipated to hold a major share ascribed to the growing dependency of organizations on computer networks and electronic data to conduct their routine operations.

-

Europe is considered to record promising growth in the advanced authentication market in the financial services market. The growth is observed in the increasing number of cyber-attacks has resulted in the majority of organizations shifting towards reliable and efficient security systems. The factor is driving the market growth primarily.

Top key players in the global market

-

Fujitsu Ltd

-

Thales Group

-

NEC Corporation

-

CA Technologies Inc.

-

Safran Identity and Security SAS

-

Dell Technologies Inc.

-

Lumidigm Inc.

-

Validsoft Ltd

-

Pistolstar Inc.

-

SecurEnvoy Ltd.

Recent Market Developments

-

On June 06, 2021, NEC payments is a quickly growing digital banking and payment technology with big plans. NEC payments connected with Netcetera via connects as Mastercard.

Chapter 1. Advanced Authentication Market in the Financial Service Industry – Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sour

1.5 Secondary Sources

Chapter 2. Advanced Authentication Market in the Financial Service Industry – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2023 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. Advanced Authentication Market in the Financial Service Industry – Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. Advanced Authentication Market in the Financial Service Industry - Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 .Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. Advanced Authentication Market in the Financial Service Industry - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Advanced Authentication Market in the Financial Service Industry - By Authentication Type

6.1 Smartcards

6.2 Biometrics

6.3 Mobile Smart Credentials

Chapter 7. Advanced Authentication Market in the Financial Service Industry - By Enterprise Size

7.1 Large Enterprise

7.2 Small & Medium Enterprises

Chapter 8. Advanced Authentication Market in the Financial Service Industry – By Region

8.1 North America

8.2 Europe

8.3 Asia-Pacific

8.4 Latin America

8.5 The Middle East

8.6 Africa

Chapter 9. Advanced Authentication Market in the Financial Service Industry – Key players

9.1 Fujitsu Ltd

9.2 Thales Group

9.3 NEC Corporation

9.4 CA Technologies Inc.

9.5 Safran Identity and Security SAS

9.6 Dell Technologies Inc.

9.7 Lumidigm Inc.

9.8 Validsoft Ltd

9.9 Pistolstar Inc.

9.10 SecurEnvoy Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900