Advanced Alloy Market Size (2024 – 2030)

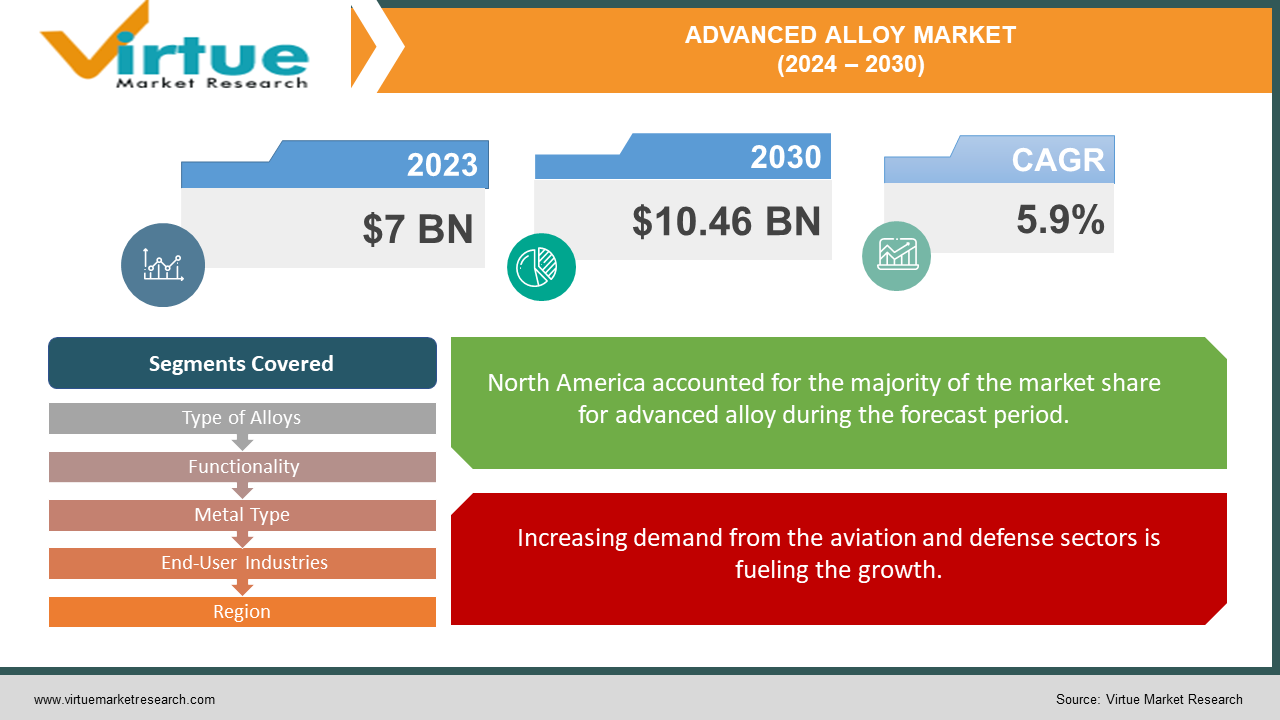

The market for global advanced alloys was estimated to be worth 7 USD billion in 2023 and is expected to increase to 10.46 USD billion by 2030, with a projected compound annual growth rate (CAGR) of 5.9% from 2024 to 2030.

Advanced alloys are mixtures of metals designed to have particular or extreme properties, such as high electrical conductivity, mechanical strength, and heat resistance. Compared to pure metals, alloys are often stronger, harder, more resilient, and occasionally more corrosion-resistant. The kind of base metal and the alloying elements it contains determine an alloy's precise makeup. Steel, brass, and aluminum alloys are a few types of alloys.

Key Insights:

The advanced alloy market is expanding due to rising demand from the aerospace and military industries, an increasing emphasis on lightweight materials in the automotive industry, and ongoing advancements in alloy technology.Advanced alloy demand is being driven by opportunities in the fields of renewable energy applications, healthcare, and the introduction of additive manufacturing (3D printing) technologies.Lightweight alloys are the fastest-growing category, while high-strength alloys are the largest-growing type. The most common and fastest-growing metal is aluminum.Asia-Pacific is growing at the highest rate in the world because of industrialization, infrastructural development, and technological improvements, while North America is the market leader.However, rising raw material costs pose a challenge to market profitability. Implementing efficient supply chain management practices can help mitigate the impact and maintain competitive pricing for advanced alloy products.

Global Advanced Alloy Market Drivers:

Increasing demand from the aviation and defense sectors is fueling the growth.

The aviation and defense segments continue to drive noteworthy demand for advanced alloys due to their exacting execution necessities and requirements for lightweight, high-strength materials. With expanding ventures in aviation investigation, defense modernization programs, and commercial flying, the demand for advanced alloys is anticipated to surge. These businesses depend on advanced alloys for basic applications such as airship structures, motor components, and rocket frameworks, encouraging market development.

The development of lightweight materials in the automobile industry has been contributing to its success.

The car industry's progressing focus on fuel proficiency and emanation lessening has impelled the appropriation of lightweight materials, including advanced alloys. With exacting administrative measures and customer demand for eco-friendly vehicles, automakers are progressively turning to advanced alloys to decrease vehicle weight without compromising on security or execution. As the car division proceeds to grasp lightweight activities, the demand for advanced alloys is balanced to witness relentless development.

Innovations in advanced alloys have been facilitating the expansion.

Fast progress in fabric science and fabricating innovations is driving nonstop advancement in advanced alloys. Analysts and producers are creating modern combination compositions, refining generation forms, and upgrading alloy properties to meet advancing industry needs. Advancements such as additive substance fabrication (3D printing) are also empowering the generation of complex alloy components with uncommon adaptability and productivity. These innovative progressions are opening up modern openings and driving the development of the global advanced alloy market.

Global Advanced Alloy Market Restraints and Challenges:

Navigating raw material costs is a significant challenge.

One of the noteworthy challenges confronting the global advanced alloy market is the toll taken by crude materials. Advanced alloys regularly require uncommon or outlandish components, which can be costly to source and prepare. Vacillations in product costs and supply chain disturbances worsen the toll weights for combination producers, affecting benefit edges and estimating competitiveness.

Rigid administrative compliance increases the complexity.

The advanced alloy market is subject to exacting administrative benchmarks and compliance necessities, especially in businesses such as aviation, cars, and healthcare. Assembly of these measures requires broad testing, certification forms, and adherence to particular fabric determinations, including complexity and costs for alloy generation. Disappointment to comply with controls can result in punishments, item reviews, and reputational harm, posing critical challenges for market players.

Global Advanced Alloy Market Opportunities:

Concentration on renewable sources is beneficial for the market.

The global move towards renewable vitality sources such as wind, sun-based, and hydroelectric control presents noteworthy openings for the advanced alloy market. Advanced alloys are basic for fabricating key components of renewable vitality foundations, including turbine edges, sun-based boards, and hydroelectric hardware. The need for advanced alloys in the renewable energy sector is expected to increase as countries strive to reduce carbon emissions and transition to cost-effective energy regimes. This will present untapped opportunities for combination manufacturers.

Growing applications in restorative gadgets and healthcare provide the market with an ample number of possibilities.

The healthcare division offers promising openings for the advanced alloy market, driven by the expanding demand for high-performance materials in restorative gadgets and hardware. Advanced alloys are utilized in the generation of surgical inserts, demonstrative rebellious prosthetics, and therapeutic devices due to their biocompatibility, erosion resistance, and mechanical properties. With headways in restorative innovation and the maturing populace fueling healthcare expenditure around the world, the demand for advanced alloys within the restorative segment is anticipated to develop, opening up modern roads for market extension.

3D printing is helping the market increase its revenue.

The quick development of added substance fabricating, also known as 3D printing, presents transformative openings for the advanced alloy market. Added substance fabricating empowers the exact creation of complex geometries and customized components utilizing advanced alloys, advertising plan adaptability, diminished fabric squander, and shorter generation lead times. As the appropriation of 3D printing innovation grows across different businesses, including aviation, cars, and gadgets, the demand for advanced alloys optimized for added substance fabricating forms is anticipated to rise. Market players can capitalize on this trend by creating specialized combination powders and alloys custom-made for added substance fabricating applications. In this manner, they can tap into unused markets and drive development within the advanced alloy market.

ADVANCED ALLOY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By Type of Alloys, Functionality, Metal Type, End-User Industries, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Allegheny Technologies Incorporated (ATI), Carpenter Technology Corporation, Haynes International Inc., VSMPO-AVISMA Corporation, Precision Castparts Corp. (PCC), Nippon Steel Corporation, Aperam S.A., TimkenSteel Corporation, Thyssenkrupp AG, Special Metals Corporation |

Advanced Alloy Market Segmentation: By Type of Alloys

-

Ferrous Alloys

-

Non-Ferrous Alloys

-

Superalloys

Since non-ferrous alloys are used more often in the automotive sector, they are the largest growing segment. When automobiles employ these kinds of things, they become lighter and consume less gasoline. The increased demand is probably due to the alloys' greater capacity to recycle the metals utilized in them. Superalloys are the fastest-growing category. They display uncommon mechanical quality, warmth resistance, and erosion resistance, making them crucial in high-performance applications, particularly in aviation, car, and control-era businesses. These combinations keep up their auxiliary astuteness at raised temperatures, making them perfect for components uncovered to extraordinary conditions, such as gas turbine edges, fly motor parts, and atomic reactor components. Additionally, continuous progressions in metallurgical building and alloy plans proceed to improve the properties and capabilities of superalloys, encourage growth in their appropriateness, and strengthen their position as a foundation of progressed material innovation. As businesses thrust the boundaries of execution and proficiency, the demand for superalloys is balanced to stay strong, driving supported development in this fragment of the advanced alloy market.

Advanced Alloy Market Segmentation: By Functionality

-

High-strength alloys

-

High-Temperature Alloys

-

Corrosion-Resistant Alloys

-

Magnetic Alloys

-

Conductive Alloys

-

Lightweight Alloys

-

Shape Memory Alloys

High-strength alloys are the largest growing type. They offer remarkable mechanical properties, including predominant ductile quality, durability, and solidity, making them fundamental for applications across different segments. Businesses such as aviation, cars, and development depend on high-strength alloys for basic components, motor parts, and load-bearing structures where vigor and unwavering quality are foremost. Additionally, headways in combination composition and handling strategies have driven the improvement of ultra-high-strength alloys with noteworthy strength-to-weight proportions. The fastest-growing category is that of lightweight alloys. Aluminum and magnesium alloys, for example, are lightweight materials that are highly sought after in a variety of sectors, including electronics, automotive, and aerospace. These alloys are perfect for situations where reducing weight is essential to boost performance, increase payload capacity, or improve fuel efficiency because they provide the benefit of decreased weight without sacrificing sufficient strength and durability.

Advanced Alloy Market Segmentation: By Metal Type

-

Magnesium

-

Aluminium

-

Titanium

-

Nickel

-

Steel

-

Others

In the market for advanced alloys, aluminum is the largest and fastest-growing metal type. Since aluminum alloys are lightweight, corrosion-resistant, and versatile, they are widely employed in a variety of industries. Aluminum alloys are widely used in a variety of industries, including consumer electronics, automotive, and aerospace.

Advanced Alloy Market Segmentation: By End-User Industries

-

Aerospace & Defense

-

Automotive

-

Oil & Gas

-

Construction

-

Electronics & Electrical

-

Healthcare

-

Marine

-

Energy & Power

-

Others

The aviation and defense sector is the largest and fastest-growing end-user industry. Aviation and defense businesses demand high-performance materials with remarkable strength-to-weight proportions, erosion resistance, and temperature resistance to resist thorough working conditions and guarantee security and reliability. Advanced alloys play an urgent role in the fabrication of basic components such as airplane structures, motor components, rockets, and defense frameworks. With expanding ventures in space investigation, military modernization programs, and commercial flying, the demand for advanced alloys is poised to take off. Additionally, progressing innovative headways and advancements in alloy planning and fabricating forms continue to extend the capabilities and applications of advanced alloys in aviation and defense, fortifying their position as a foundation of material innovation. As these businesses endeavor for improved execution, proficiency, and supportability, the demand for advanced alloys in aviation and defense is anticipated to stay vigorous, driving further development and advancement within the market.

Advanced Alloy Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

North America is the largest growing market. With a vigorous aviation and defense division, North America is a major buyer of advanced alloys, driving demand for high-performance materials in aircraft fabrication, military applications, and space investigation activities. Taking after closely behind, Europe holds a critical 25% share of the market, driven by progressed fabricating capabilities and rigid quality guidelines in industries such as car, aviation, and healthcare. Asia-Pacific is the fastest-growing market. This is because of factors like industrialization, foundation improvement, and innovative headways that are fueling the demand for advanced alloys over different divisions, counting cars, gadgets, and development. South America, the Middle East, and Africa are developing ventures in vitality, foundation, and defense, driving demand for advanced alloys in these locales.

COVID-19 Impact Analysis on the Global Advanced Alloy Market:

COVID-19 has had a significant effect on the global advanced alloy market, disturbing supply chains and housing demand and causing variances in crude fabric costs. With lockdowns, travel limitations, and brief closures of fabricating offices, the generation and dispersion of advanced alloys were essentially influenced, driving delays in extending timelines and arranging fulfillment. The car and aviation businesses, major shoppers of advanced alloys, experienced sharp declines in demand as buyer investment contracted and travel limitations grounded flights. In addition, disturbances in global exchange and coordination encourage exacerbated challenges for market players, hampering the acquisition of crude materials and the shipment of wrapped-up items. Be that as it may, amid the challenges, the widespread development and adjustment inside the industry have led producers to leverage advanced innovations for further collaboration, quicken the appropriation of robotization and added substance fabrication, and expand supply chains to improve versatility. As the world slowly recovers from the widespread and continued financial exercises, the advanced alloy market is anticipated to bounce back, driven by pent-up demand, foundation speculations, and the move towards feasible vitality arrangements.

Latest Trends/ Developments:

The advanced alloy market is seeing an energetic scene molded by the most recent patterns and improvements, driving advancement and market development. One striking slant is the expanding selection of added substance fabricating (3D printing) innovation in alloy generation, empowering the manufacture of complex geometries and customized components with improved productivity and plan adaptability. This slant is revolutionizing the way advanced alloys are fabricated, especially in aviation, cars, and restorative segments, where accuracy and customization are fundamental. Moreover, there's a developing emphasis on feasible materials and forms, driving the advancement of eco-friendly alloys with diminished natural effects. Businesses are investigating elective combination compositions, reusing strategies, and energy-efficient generation strategies to meet maintainability objectives and address developing natural concerns. Besides, headways in alloy planning and metallurgical design are opening unused conceivable outcomes for improving fabric properties such as quality, conductivity, and erosion resistance, growing the applications of advanced alloys over differing businesses. In general, these patterns emphasize the energetic nature of the advanced alloy market and its continuous advancement towards more prominent effectiveness, maintainability, and advancement.

Key Players:

-

Allegheny Technologies Incorporated (ATI)

-

Carpenter Technology Corporation

-

Haynes International Inc.

-

VSMPO-AVISMA Corporation

-

Precision Castparts Corp. (PCC)

-

Nippon Steel Corporation

-

Aperam S.A.

-

TimkenSteel Corporation

-

Thyssenkrupp AG

-

Special Metals Corporation

Chapter 1. Advanced Alloy Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Advanced Alloy Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Advanced Alloy Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Advanced Alloy Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Advanced Alloy Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Advanced Alloy Market – By Type of Alloys

6.1 Introduction/Key Findings

6.2 Ferrous Alloys

6.3 Non-Ferrous Alloys

6.4 Superalloys

6.5 Y-O-Y Growth trend Analysis By Type of Alloys

6.6 Absolute $ Opportunity Analysis By Type of Alloys, 2024-2030

Chapter 7. Advanced Alloy Market – By Functionality

7.1 Introduction/Key Findings

7.2 High-strength alloys

7.3 High-Temperature Alloys

7.4 Corrosion-Resistant Alloys

7.5 Magnetic Alloys

7.6 Conductive Alloys

7.7 Lightweight Alloys

7.8 Shape Memory Alloys

7.9 Y-O-Y Growth trend Analysis By Functionality

7.10 Absolute $ Opportunity Analysis By Functionality, 2024-2030

Chapter 8. Advanced Alloy Market – By Metal Type

8.1 Introduction/Key Findings

8.2 Magnesium

8.3 Aluminium

8.4 Titanium

8.5 Nickel

8.6 Steel

8.7 Others

8.8 Y-O-Y Growth trend Analysis By Metal Type

8.9 Absolute $ Opportunity Analysis By Metal Type, 2024-2030

Chapter 9. Advanced Alloy Market – By End-User Industries

9.1 Introduction/Key Findings

9.2 Aerospace & Defense

9.3 Automotive

9.4 Oil & Gas

9.5 Construction

9.6 Electronics & Electrical

9.7 Healthcare

9.8 Marine

9.9 Energy & Power

9.10 Others

9.11 Y-O-Y Growth trend Analysis By End-User Industries

9.12 Absolute $ Opportunity Analysis By End-User Industries, 2024-2030

Chapter 10. Advanced Alloy Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Type of Alloys

10.1.3 By Functionality

10.1.4 By Metal Type

10.1.5 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Type of Alloys

10.2.3 By Functionality

10.2.4 By Metal Type

10.2.5 By End-User Industries

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Type of Alloys

10.3.3 By Functionality

10.3.4 By Metal Type

10.3.5 By End-User Industries

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Type of Alloys

10.4.3 By Functionality

10.4.4 By Metal Type

10.4.5 By End-User Industries

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Type of Alloys

10.5.3 By Functionality

10.5.4 By Metal Type

10.5.5 By End-User Industries

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Advanced Alloy Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Allegheny Technologies Incorporated (ATI)

11.2 Carpenter Technology Corporation

11.3 Haynes International Inc.

11.4 VSMPO-AVISMA Corporation

11.5 Precision Castparts Corp. (PCC)

11.6 Nippon Steel Corporation

11.7 Aperam S.A.

11.8 TimkenSteel Corporation

11.9 Thyssenkrupp AG

11.10 Special Metals Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for global advanced alloys was estimated to be worth 7 USD billion in 2023 and is expected to increase to 10.46 USD billion by 2030, with a projected compound annual growth rate (CAGR) of 5.9% from 2024 to 2030.

The essential drivers of the global advanced alloy market are increasing demand from aviation and defense businesses, the development of lightweight materials for the automobile sector, and innovations in alloys.

The key challenges confronting the global advanced alloy market are the costs of crude materials and administrative compliance prerequisites.

In 2023, North America held the largest share of the global advanced alloy market.

Allegheny Technologies Incorporated (ATI), Carpenter Technology Corporation, Haynes International Inc., VSMPO-AVISMA Corporation, Precision Castparts Corp. (PCC), Nippon Steel Corporation, Aperam S.A., TimkenSteel Corporation, Thyssenkrupp AG, Special Metals Corporation, Alcoa Corporation, and ArcelorMittal S.A. are the main players.