Adhesive Tapes Market Size (2024 – 2030)

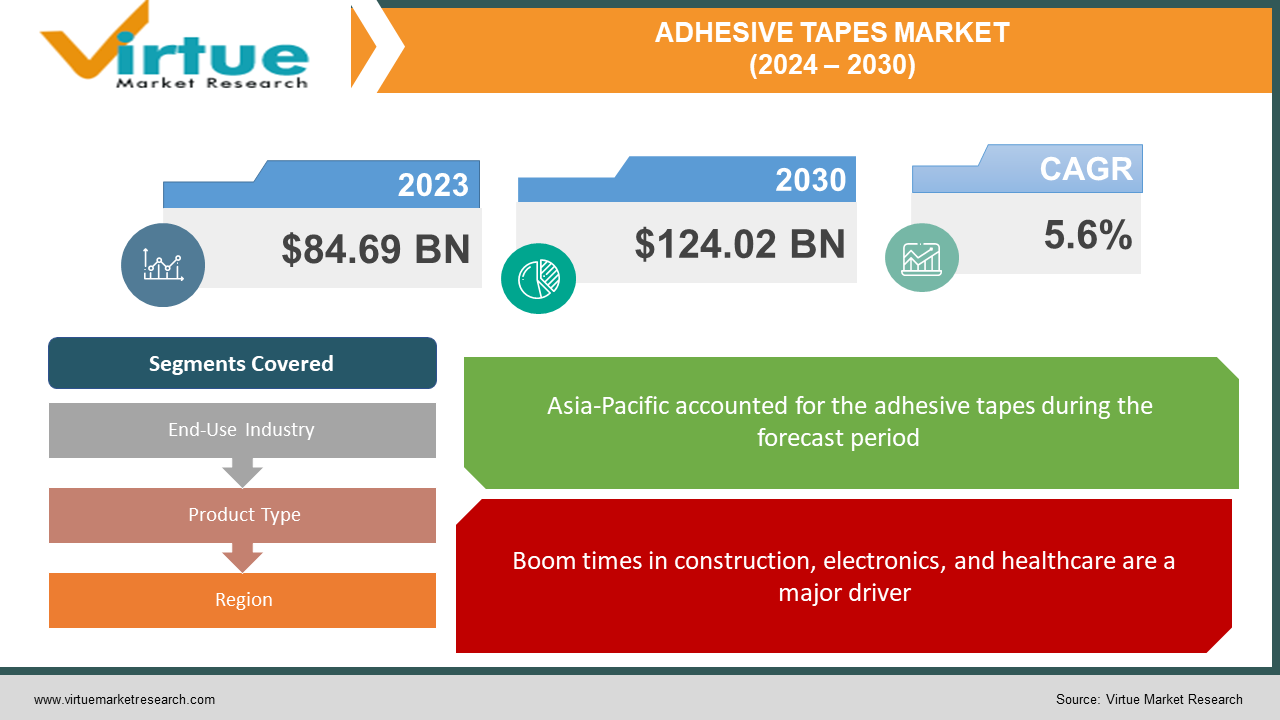

The Global Adhesive Tapes Market was valued at USD 84.69 billion in 2023 and will grow at a CAGR of 5.6% from 2024 to 2030. The market is expected to reach USD 124.02 billion by 2030.

Key Market Insights:

The Adhesive Tapes market is sticking strong, driven by a perfect blend of innovation and versatility. Demand from construction (high-rise buildings), electronics (smartphones), and healthcare (bandages) fuels steady growth. However, the market isn't a one-size-fits-all. Specialty tapes with unique features like heat resistance, conductivity, or removability are gaining traction. Sustainability is also a hot topic, with eco-friendly adhesives and recycled backing materials taking center stage. Looking ahead, the future is bright for this sticky business. Expect continued advancements in adhesive technology alongside a focus on eco-conscious solutions.

Global Adhesive Tapes Market Drivers:

Boom times in construction, electronics, and healthcare are a major driver

Construction sites are a prime example of how flourishing industries drive the adhesive tape market. Builders rely on various tapes for tasks like sealing windows and doors for weatherproofing, adhering insulation for temperature control, and even bonding building materials for increased structural strength. Similarly, the booming electronics industry utilizes conductive tapes for efficient circuit board assembly and heat-resistant tapes for safeguarding delicate components within devices. The healthcare sector is another major consumer, using medical-grade adhesive tapes for everything from securing bandages and dressings to holding catheters and other medical devices in place. Essentially, the success of these industries creates a ripple effect, driving demand for the diverse applications of adhesive tapes.

Eco-conscious consumers and manufacturers alike are driving the development of tapes with eco-friendly adhesives and recycled backing materials

The tide is turning towards sustainable solutions in the adhesive tape market. Eco-conscious consumers are demanding greener alternatives, and manufacturers are responding with innovation. This translates to a focus on eco-friendly adhesives formulated with bio-based materials or waterborne solutions that reduce reliance on harsh chemicals. Additionally, recycled materials are finding their way into backing materials, minimizing virgin plastic use and lowering the environmental footprint. This shift towards sustainability isn't just a fad; it's a sign of a responsible industry adapting to meet the needs of a greener future. By embracing eco-friendly practices, the adhesive tape market ensures its long-term growth while minimizing its environmental impact.

Innovation in tapes is driving the market growth

The adhesive tape market has shed its "duct tape mentality." Today, it's all about specialization. Industries have specific needs, and tapes are evolving to meet them. For scorching hot environments in steel mills, there are high-temperature-resistant tapes that won't melt or degrade. The electronics industry relies on conductive tapes that seamlessly integrate into circuits for flawless connections. Even delicate surfaces like works of art or freshly painted walls can find a friend in removable tapes that offer a secure bond without damaging the underlying material. This drive for specialty solutions pushes the boundaries of innovation, with manufacturers constantly developing new and improved tapes to tackle ever more specific applications. The result is a dynamic market brimming with possibilities.

Global Adhesive Tapes Market challenges and restraints:

Volatility in Raw Material Prices is restricting the market growth

The adhesive tape industry grapples with the volatility of raw material prices. These tapes are a blend of various materials, from rubber and paper to silicone and adhesives. If the cost of just one of these components spikes, it can significantly inflate overall production costs and squeeze manufacturer profits. For example, a mere 18% increase in rubber prices in 2021, as reported by the International Rubber Study Group, would have pressured manufacturers to either absorb the additional expense or raise their prices, potentially impacting sales. This uncertainty surrounding raw material costs presents a challenge for the adhesive tape market.

Stringent Regulatory Policies are restricting the market growth

Regulatory bodies like the European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and the US Environmental Protection Agency (EPA) impose strict regulations on the production and use of adhesive tapes. These regulations aim to reduce emissions of Volatile Organic Compounds (VOCs) and other potentially harmful substances. This can make it challenging for manufacturers to develop compliant products and increase production costs due to reformulation or adopting new technologies like water-based adhesives instead of solvent-based ones, which offer wider applications but may not meet environmental regulations.

Market Opportunities:

The adhesive tape market presents a multitude of exciting growth opportunities. Fueled by the ever-expanding packaging industry, particularly in e-commerce, the demand for strong, reliable tapes for sealing boxes continues to rise. This creates an opportunity for manufacturers to develop innovative sealing solutions with features like tamper-evident properties or temperature resistance for specific shipping needs. Furthermore, the growing focus on sustainability presents an opportunity for eco-friendly tapes made from recycled materials, water-based adhesives, or biodegradable components. This caters to the rising environmental consciousness of consumers and businesses alike. The increasing adoption of electronic devices across various industries like automotive and consumer electronics opens doors for the development of specialized adhesive tapes for thermal management, electrical insulation, and high-performance bonding within these devices. Additionally, the booming construction sector creates a demand for strong, durable tapes for applications like seaming, waterproofing, and structural reinforcement. By capitalizing on these trends, manufacturers can expand their product lines, target specific industry needs, and cater to the evolving demands of a global market. Investing in research and development to create high-performance, sustainable, and application-specific tapes will position industry leaders for continued success in the thriving adhesive tapes market.

ADHESIVE TAPES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.6% |

|

Segments Covered |

By End-Use Industry, Product Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Shurtape Technologies LLC, Henkel AG & Co. KGAA, Saint-Gobain, The Dow Chemical Company, Berry Global Group, Inc., Colfax Corporation, H.B. Fuller Company, Scapa Group, Lohmann GmbH & Co. KG, 3M Company, Avery Dennison Corporation, Nitto Denko Corporation |

Adhesive Tapes Market Segmentation - by End-Use Industry

-

Construction

-

Electronics

-

Healthcare

Construction is generally considered the industry using the most adhesive tapes. From weatherproofing windows and doors to bonding building materials and installing insulation, construction relies heavily on various tapes throughout the building process. This high-volume usage makes it a dominant driver of the adhesive tapes market.

Adhesive Tapes Market Segmentation - By Product Type

-

Double-sided tapes

-

Single-sided tapes

-

Specialty tapes

-

Masking tapes

Single-sided tapes likely reign supreme in terms of usage. Their dominance stems from high-volume applications like sealing boxes in packaging and countless everyday tasks in homes and offices. While double-sided tapes play a vital role in construction and signage, their use is likely outpaced by the constant demand for single-sided solutions in everyday life. Specialty tapes and masking tapes, though essential for specific purposes, cater to niche markets or temporary applications, suggesting a lower overall volume compared to the ever-present need for single-sided tapes.

Adhesive Tapes Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is likely the fastest-growing region in the adhesive tapes market. This growth is fueled by factors like a booming e-commerce sector, rapid industrialization, and a rising middle class with increasing disposable income. Conversely, North America, a well-established market with high penetration, might hold the largest market share currently. However, its growth is expected to be slower compared to the rising demand in Asia-Pacific. Europe is another mature market with strong players, but its growth is likely to be moderate. South America and Middle East & Africa hold potential for future growth, but their current market share is likely on the smaller side.

COVID-19 Impact Analysis on the Global Adhesive Tapes Market

The COVID-19 pandemic produced a mixed bag of impacts on the global adhesive tapes market. While some sectors experienced a decline, others thrived. The initial lockdowns and operational challenges disrupted production and supply chains, leading to temporary shortages of certain tapes. However, the surge in e-commerce due to stay-at-home restrictions significantly boosted the demand for packaging tapes, creating a growth opportunity for manufacturers who could meet this critical need. Additionally, the increased focus on hygiene in healthcare settings drove the demand for medical tapes for wound dressings and personal protective equipment. On the other hand, industries like construction and automotive faced a slowdown, leading to a decrease in demand for tapes used in those sectors. Overall, the adhesive tape market exhibited resilience, with the rise in e-commerce and healthcare applications largely offsetting the decline in other sectors. The pandemic also highlighted the importance of adaptable manufacturing and a diversified product portfolio. Moving forward, manufacturers who can cater to the evolving needs of various industries and prioritize sustainable practices will be well-positioned to capitalize on the post-pandemic recovery and growth potential of the global adhesive tapes market.

Latest trends/Developments

The adhesive tapes market is buzzing with advancements driven by innovation and sustainability. One key trend is the development of high-performance tapes with specialized functionalities. These include double-coated tapes offering superior bonding strength for replacing traditional fasteners in automotive and aerospace applications. Additionally, advancements in pressure-sensitive adhesives (PSAs) are leading to tapes with improved temperature resistance, conformability, and clean removability, catering to the needs of the electronics and construction industries. Sustainability is another major force shaping the market. Manufacturers are increasingly using recycled materials like PET plastic and paper for backing liners, along with water-based adhesives and bio-based components to reduce the environmental footprint of their products. This caters to the growing demand for eco-friendly solutions from both consumers and businesses. Furthermore, research and development are focused on creating self-healing tapes with the ability to repair minor tears or punctures, extending their lifespan and reducing waste. The rise of automation and digitalization in various industries is also driving the development of smart tapes embedded with sensors that can monitor temperature, pressure, or other environmental factors, providing valuable data for predictive maintenance and process optimization. By embracing these advancements and staying attuned to evolving market needs, adhesive tape manufacturers can ensure their products remain relevant and competitive in the dynamic global marketplace.

Key Players:

-

Shurtape Technologies LLC

-

Henkel AG & Co. KGAA

-

Saint-Gobain

-

The Dow Chemical Company

-

Berry Global Group, Inc.

-

Colfax Corporation

-

H.B. Fuller Company

-

Scapa Group

-

Lohmann GmbH & Co. KG

-

3M Company

-

Avery Dennison Corporation

-

Nitto Denko Corporation

Chapter 1. ADHESIVE TAPES MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. ADHESIVE TAPES MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. ADHESIVE TAPES MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. ADHESIVE TAPES MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. ADHESIVE TAPES MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. ADHESIVE TAPES MARKET – By End-Use Industry

6.1 Introduction/Key Findings

6.2 Construction

6.3 Electronics

6.4 Healthcare

6.5 Y-O-Y Growth trend Analysis By End-Use Industry

6.6 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 7. ADHESIVE TAPES MARKET– By Product Type

7.1 Introduction/Key Findings

7.2 Double-sided tapes

7.3 Single-sided tapes

7.4 Specialty tapes

7.5 Masking tapes

7.6 Y-O-Y Growth trend Analysis By Product Type

7.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 8. ADHESIVE TAPES MARKET, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By End-Use Industry

8.1.3 By Product Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By End-Use Industry

8.2.3 By Product Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By End-Use Industry

8.3.3 By Product Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By End-Use Industry

8.4.3 By Product Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By End-Use Industry

8.5.3 By Product Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. ADHESIVE TAPES MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Shurtape Technologies LLC

9.2 Henkel AG & Co. KGAA

9.3 Saint-Gobain

9.4 The Dow Chemical Company

9.5 Berry Global Group, Inc.

9.6 Colfax Corporation

9.7 H.B. Fuller Company

9.8 Scapa Group

9.9 Lohmann GmbH & Co. KG

9.10 3M Company

9.11 Avery Dennison Corporation

9.12 Nitto Denko Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Adhesive Tapes Market was valued at USD 84.69 billion in 2023 and will grow at a CAGR of 5.6% from 2024 to 2030. The market is expected to reach USD 124.02 billion by 2030.

Boom times in construction, electronics, and healthcare, and Innovation in tapes are the reasons that are driving the market.

Based on the end user industry it is divided into three segments – Construction, Electronics, and Healthcare.

North America is the most dominant region for the Adhesive Tapes Market.

Shurtape Technologies LLC, Henkel AG & Co. KGAA, Saint-Gobain, The Dow Chemical Company