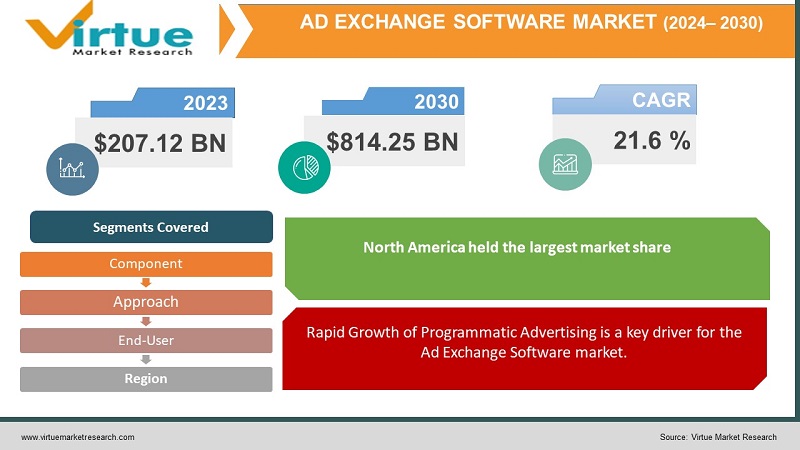

Global Ad Exchange Software Market Size (2024 – 2030)

The Global Ad Exchange Software Market was valued at USD 207.12 Billion and is projected to reach a market size of USD 814.25 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 21.6%.

The Ad Exchange Software market has evolved significantly, becoming a crucial component of the digital advertising landscape. It has witnessed substantial growth driven by the widespread adoption of programmatic advertising and the growing demand for streamlined, real-time transactions in the advertising space. As technology continues to advance, the market is poised for continued expansion, with a focus on enhancing efficiency and precision in ad space transactions. In the future, we can anticipate even more sophisticated tools and strategies that will further shape and optimize the digital advertising ecosystem.

Key Market Insights:

The surge can be attributed to the rapid adoption of programmatic advertising techniques, which accounted for over 80% of digital ad spending in 2020. The Asia-Pacific region emerged as a significant contributor, with China's programmatic ad spending surpassing $41 billion in 2020, making it the world's second-largest programmatic ad market after the United States.

One notable trend in the Ad Exchange Software market is the increasing shift towards mobile advertising. Mobile ad spending exceeded $240 billion globally in 2020, with mobile programmatic ads accounting for a substantial portion. Additionally, the adoption of artificial intelligence and machine learning in ad exchange platforms has become a game-changer. These technologies enable real-time targeting, personalized ad placements, and precise performance analysis. Moreover, the market is witnessing consolidation, with major players like Google's Ad Manager and Facebook's Audience Network dominating the space.

Looking ahead, the Ad Exchange Software market is poised for further expansion. The continued proliferation of e-commerce, video advertising, and connected devices is expected to drive demand for ad exchange solutions. As privacy concerns and regulatory changes become more prominent, the industry will need to adapt by focusing on data protection and user consent mechanisms. Additionally, emerging markets in Latin America and Africa are expected to play an increasingly vital role in global ad exchange growth. The future of this market hinges on its ability to balance innovation with privacy and regulatory compliance while meeting the evolving needs of advertisers and publishers worldwide.

Ad Exchange Software Market Drivers:

Rapid Growth of Programmatic Advertising is a key driver for the Ad Exchange Software market.

Programmatic advertising has revolutionized the way digital ads are bought and sold. Advertisers and publishers are increasingly turning to automated, data-driven processes to streamline their ad campaigns. This shift has fueled the demand for Ad Exchange Software, which acts as the backbone of programmatic advertising. These platforms enable real-time bidding and ad inventory management, allowing advertisers to target specific audiences with precision. The automation and efficiency offered by Ad Exchange Software not only save time and resources but also enhance the effectiveness of advertising campaigns, making it a key driver in the market's growth trajectory.

Increased Digital Advertising Spend Ad Exchange Software becomes essential for optimizing ad placements, ensuring ads reach the right audience at the right time.

With the exponential growth of digital advertising, brands, and marketers are allocating larger budgets to online campaigns. As digital ad spend continues to rise globally, the need to optimize ad placements becomes paramount. Ad Exchange Software plays a critical role in this process by facilitating real-time auctions, ensuring that ads are displayed where they are most likely to generate engagement and conversions. By leveraging data and algorithms, Ad Exchange Software maximizes the value of each ad impression, making it an essential tool for advertisers seeking to make the most of their digital advertising investments.

Growing Demand for Private Ad Exchanges is attracting Advertisers and publishers thus augmenting the growth for the market.

Privacy and data security concerns have led to a surge in the demand for private ad exchanges. Advertisers and publishers are increasingly seeking controlled environments where they can transact with trusted partners, ensuring brand safety and data protection. Private ad exchanges offer a level of transparency and security that public exchanges may not provide. This trend is attracting advertisers and publishers alike, boosting the adoption of Ad Exchange Software tailored for private exchanges. As privacy and brand protection continue to be top priorities in the digital advertising landscape, the growth of private ad exchanges is expected to further propel the Ad Exchange Software market's expansion.

Ad Exchange Software Market Restraints and Challenges:

Ad Fraud and Brand Safety Concerns are the prime challenges faced by Advertisers thus acting as a deterrent for market expansion.

Advertisers in the Ad Exchange Software market are confronted with a persistent challenge in the form of ad fraud and brand safety concerns. Ad fraud, encompassing activities like click fraud and impression fraud, siphons off advertising budgets and reduces the effectiveness of campaigns. Additionally, concerns over ad placements in inappropriate or harmful content can tarnish a brand's reputation. These issues not only result in financial losses but also erode advertiser trust in programmatic advertising platforms. To combat these challenges, Ad Exchange Software providers must continuously develop robust fraud detection and brand safety measures, presenting a significant hurdle to market expansion.

Evolving data privacy regulations impact how user data can be used in programmatic advertising, creating compliance challenges.

The evolving landscape of data privacy regulations, exemplified by the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, has a profound impact on how user data can be utilized in programmatic advertising. These regulations impose strict requirements on data handling, consent mechanisms, and user rights. Ad Exchange Software providers must adapt their platforms to ensure compliance with these regulations, creating a complex compliance landscape that varies across regions. Navigating these regulatory challenges demands ongoing investments in technology and legal expertise, hindering the market's growth as providers grapple with the intricacies of data privacy compliance.

Ad Exchange Software Market Opportunities:

The proliferation of mobile devices presents a significant opportunity for Ad Exchange Software providers to offer mobile-specific solutions.

The widespread adoption of mobile devices presents a substantial growth opportunity for Ad Exchange Software providers. As mobile usage continues to surge, advertisers are keen to engage with consumers on these platforms. Ad Exchange Software tailored for mobile-specific solutions can capitalize on this trend. Mobile-specific solutions can offer advanced targeting options, such as geolocation and device-specific targeting, to help advertisers reach their mobile audiences more effectively. Ad Exchange Software providers that can seamlessly integrate mobile capabilities into their platforms stand to gain a competitive edge and tap into a burgeoning market segment.

AI and Machine Learning Integration into Ad Exchange Software can enhance ad targeting, ad placement, and overall campaign effectiveness.

The integration of artificial intelligence (AI) and machine learning (ML) technologies into Ad Exchange Software offers a compelling opportunity to enhance ad targeting, ad placement, and overall campaign effectiveness. These technologies can analyze vast datasets in real time, enabling advertisers to make data-driven decisions and optimize ad placements with precision. AI and ML can also power predictive analytics, allowing advertisers to anticipate consumer behavior and adjust their strategies accordingly. Ad Exchange Software providers that invest in AI and ML capabilities can offer more sophisticated and effective advertising solutions, attracting advertisers looking to maximize their ROI and gain a competitive edge in the digital advertising landscape.

GLOBAL AD EXCHANGE SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

21.6% |

|

Segments Covered |

By Component, Approach, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Google Ads, AppNexus, Rubicon Project Exchange, OpenX, Smaato, Right Media Exchange, MoPub (Twitter), Pubmatic, Rubicon Project, The Trade Desk, Verizon Media, Xandr |

Ad Exchange Software Market Segmentation: By Component

-

Publishers

-

Advertisers

-

Others

In 2022, Advertisers held the largest market share of 68.4% in the Ad Exchange Software segment. They represent businesses, brands, or agencies that purchase ad inventory to promote their products or services. Advertisers have consistently dominated the market due to their substantial digital advertising budgets. In 2020, global digital ad spending by advertisers reached approximately $333 billion, showcasing their significant presence. The growth of this segment is driven by the increasing shift of advertising budgets from traditional to digital channels and the widespread adoption of programmatic advertising, which allows for more efficient and targeted ad placements.

Moreover, the Publishers segment is the fastest growing. Publishers own digital advertising space, such as websites or apps, and seek to monetize it by selling ad inventory. The proliferation of online content and the growing demand for digital advertising have fueled the expansion of publisher-owned ad inventory. Publishers are continually exploring new ways to optimize their ad space, attracting advertisers and driving revenue growth. With the evolution of the digital landscape and the increasing importance of online presence, publishers are experiencing significant growth, making them the fastest-growing segment in the Ad Exchange Software market.

Ad Exchange Software Market Segmentation: By Approach

-

Software-Based Approach

-

Algorithm-Based Approach

In 2022, the Software-Based Approach dominated the Ad Exchange Software market, holding the largest market share. This approach relies on specialized software platforms to facilitate the buying and selling of advertising space in real time. Ad Exchange Software providers offer sophisticated software solutions that enable publishers and advertisers to efficiently transact ad inventory. This approach has historically been the cornerstone of the market, with a vast majority of digital advertising transactions conducted through software-based platforms. Its market share is significant, as evidenced by the billions of dollars in annual digital ad spending facilitated by these platforms.

Moreover, The Algorithm-Based Approach is the fastest-growing segment with a CAGR of 8.3% in the Ad Exchange Software market. This approach leverages advanced algorithms and machine learning techniques to enhance the precision and effectiveness of ad placements. Ad Exchange Software providers are increasingly integrating AI and ML technologies into their platforms, allowing for real-time data analysis and optimization. Advertisers are drawn to the Algorithm-Based Approach because it offers more sophisticated targeting capabilities, helping them reach their desired audiences with greater accuracy. As advertisers seek to maximize their ROI and improve campaign performance, the adoption of algorithm-based solutions is on the rise, making it the fastest-growing segment in the market.

Ad Exchange Software Market Segmentation: By End-User

-

Retail

-

Finance

-

Healthcare

-

Entertainment

-

Automotive

-

Government

-

Others

In 2022, The Retail sector commands the largest market share in the Ad Exchange Software market. Retail businesses, both online and brick-and-mortar, heavily rely on digital advertising to reach and engage with consumers. They allocate substantial budgets to target specific demographics, promote products, and drive sales. In 2020, the global retail industry spent billions on digital advertising, contributing significantly to the market's size. The retail sector's continued emphasis on digital marketing, especially in the e-commerce domain, solidifies its position as the segment with the largest market share in the Ad Exchange Software market.

Moreover, the Healthcare sector is the fastest-growing segment in the Ad Exchange Software market. Healthcare providers, pharmaceutical companies, and health-related organizations have increasingly recognized the importance of digital advertising in reaching patients, healthcare professionals, and the general public. The COVID-19 pandemic further accelerated this trend, with healthcare organizations focusing on digital channels to disseminate critical information and promote telemedicine services. As the healthcare sector continues to invest in digital advertising to enhance patient engagement and awareness, it is expected to experience rapid growth, positioning it as the fastest-growing end-user segment in the Ad Exchange Software market.

Ad Exchange Software Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2022, North America held the largest market share of 32.7% in the Ad Exchange Software market. The region is a hub for digital advertising, with the United States and Canada leading in terms of ad spending and technological innovation. In 2020, North America accounted for a substantial portion of the global digital advertising spending, exceeding $320 billion. Major advertising technology companies, including some of the largest Ad Exchange Software providers, are headquartered in North America. The region's robust digital infrastructure, mature advertising ecosystem, and high internet penetration contribute to its dominant market share in the Ad Exchange Software segment.

Moreover, the Asia-Pacific region is the fastest-growing segment in the Ad Exchange Software market with a CAGR of 7.4%. It has witnessed explosive growth in digital advertising, driven by countries like China, India, and Southeast Asian nations. The region's burgeoning middle class, expanding smartphone adoption, and growing e-commerce sector have fueled demand for digital advertising solutions. As businesses in Asia-Pacific increasingly recognize the effectiveness of programmatic advertising, the region's Ad Exchange Software market is experiencing rapid growth. The region's market expansion is further accelerated by investments in ad tech and digital infrastructure, making it the fastest-growing region in the Ad Exchange Software market.

COVID-19 Impact Analysis on the Global Ad Exchange Software Market:

The global Ad Exchange Software market experienced a significant impact from the COVID-19 pandemic. In the initial phases, as businesses faced uncertainties, there was a temporary dip in digital ad spending. However, as consumer behavior shifted towards online platforms during lockdowns and social distancing measures, digital advertising regained momentum. Advertisers sought flexibility and efficiency in reaching their audiences, driving increased adoption of programmatic advertising through Ad Exchange Software. This surge in demand for digital advertising solutions, coupled with the need for data-driven targeting, led to a resurgence in the Ad Exchange Software market, ultimately showcasing the industry's resilience and adaptability in the face of unprecedented challenges.

Latest Trends/Developments:

The Ad Exchange Software market has witnessed a notable trend in the integration of advanced AI and machine learning technologies. Ad Exchange platforms are increasingly utilizing these technologies to enhance ad targeting, optimize ad placements, and deliver more personalized and efficient campaigns. AI-driven predictive analytics and real-time data analysis are becoming crucial for advertisers and publishers to make data-driven decisions, ensuring the most effective ad transactions in real time.

The market has seen a wave of consolidation as major players seek to expand their capabilities. Prominent tech giants have acquired or formed strategic partnerships with Ad Exchange Software providers to strengthen their position in the digital advertising ecosystem. These alliances aim to offer comprehensive solutions that span advertising technology, data analytics, and audience insights, allowing for more seamless and integrated ad campaigns.

With increasing privacy concerns and evolving regulations like GDPR and CCPA, there's a growing emphasis on privacy-compliant advertising solutions. Ad Exchange Software providers are developing tools and strategies that prioritize user data protection, consent management, and compliance with data privacy laws. This trend underscores the industry's commitment to ensuring responsible and ethical advertising practices while navigating a complex regulatory landscape.

Key Players:

-

Google Ads

-

AppNexus

-

Rubicon Project Exchange

-

OpenX

-

Smaato

-

Right Media Exchange

-

MoPub (Twitter)

-

Pubmatic

-

Rubicon Project

-

The Trade Desk

-

Verizon Media

-

Xandr

In June 2023, the EU antitrust regulators charged Google with anti-competitive practices in its digital advertising business. This pertains to Google's ad tech business, which accounts for a significant portion of its revenue. Google had previously attempted to settle the case, but the slow progress and lack of significant concessions led to regulatory action.

In December 2020, Ad tech company PubMatic experienced a significant increase in its stock price after its initial public offering (IPO). The company, which provided a sell-side advertising platform for real-time programmatic ad transactions, aimed to raise approximately $115 million. PubMatic's clients included major players like Verizon Media Group and News Corp.

Chapter 1.Ad Exchange Software Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2.Ad Exchange Software Market– Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3.Ad Exchange Software Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4.Ad Exchange Software MarketEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5.Ad Exchange Software Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6.Ad Exchange Software Market– By Component

6.1 Introduction/Key Findings

6.2 Publishers

6.3 Advertisers

6.4 Others

6.5 Y-O-Y Growth trend Analysis By Component

6.6 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7.Ad Exchange Software Market– By Approach

7.1 Introduction/Key Findings

7.2 Software-Based Approach

7.3 Algorithm-Based Approach

7.4 Y-O-Y Growth trend Analysis By Approach

7.5 Absolute $ Opportunity Analysis By Approach, 2024-2030

Chapter 8.Ad Exchange Software Market– By End-User

8.1 Introduction/Key Findings

8.2 Retail

8.3 Finance

8.4 Healthcare

8.5 Entertainment

8.6 Automotive

8.7 Government

8.8 Others

8.9 Y-O-Y Growth trend Analysis By End-User

8.10 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9.Ad Exchange Software Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Component

9.1.3 By Approach

9.1.4 By By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Component

9.2.3 By Approach

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Component

9.3.3 By Approach

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Component

9.4.3 By Approach

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Component

9.5.3 By Approach

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10.Ad Exchange Software Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Google Ads

10.2 AppNexus

10.3 Rubicon Project Exchange

10.4 OpenX

10.5 Smaato

10.6 Right Media Exchange

10.7 MoPub (Twitter)

10.8 Pubmatic

10.9 Rubicon Project

10.10 The Trade Desk

10.11 Verizon Media

10.12 Xandr

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Ad Exchange Software Market was valued at USD 207.12 Billion and is projected to reach a market size of USD 814.25 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 21.6%.

The primary drivers include the rapid growth of programmatic advertising, increased digital advertising spend, and the growing demand for private ad exchanges.

In 2022, Advertisers held the largest market share in the Ad Exchange Software segment. They represent businesses, brands, or agencies that purchase ad inventory to promote their products or services.

North America dominated the Ad Exchange Software market. The region is a hub for digital advertising, with the United States and Canada leading in terms of ad spending and technological innovation.

Google Ads, AppNexus, Rubicon Project Exchange, OpenX, Smaato, and Right Media Exchange, are some of the key players in the Ad Exchange Software market.