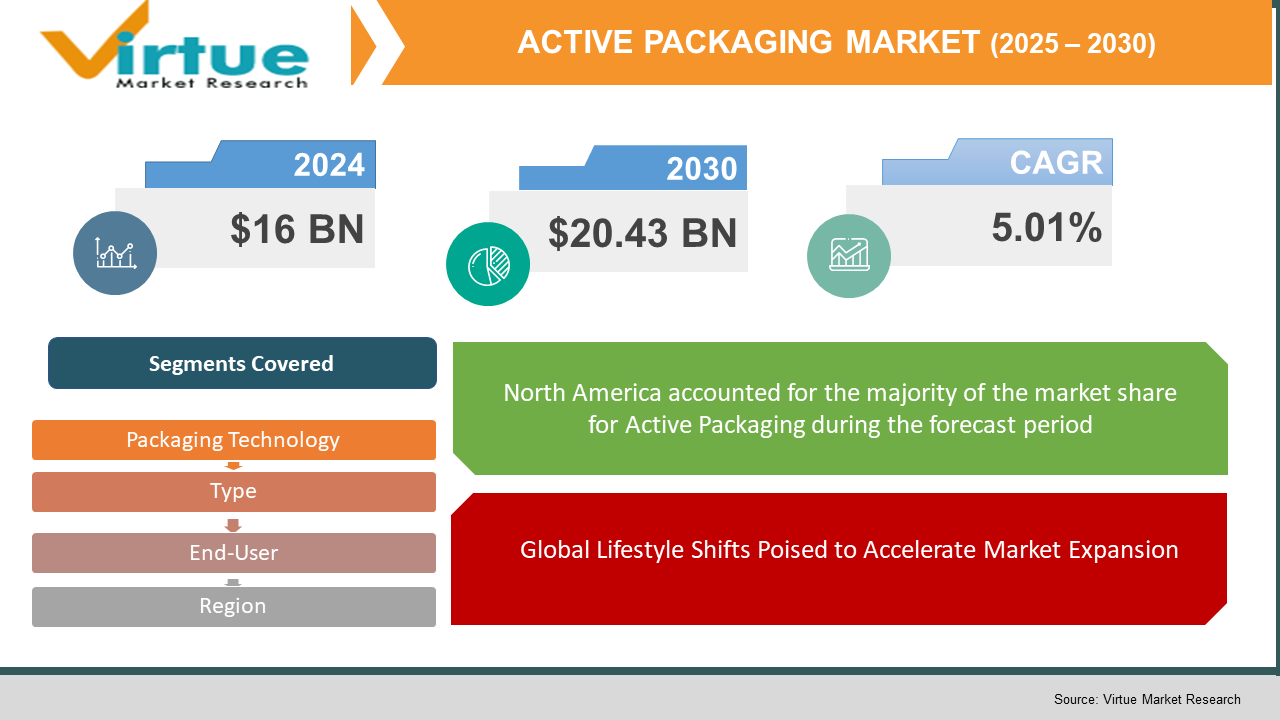

Active Packaging Market Size (2025-2030)

The Active Packaging Market was valued at USD 16 billion in 2024. Over the forecast period of 2025-2030 it is projected to reach USD 20.43 billion by 2030, growing at a CAGR of 5.01%.

The continued expansion of e-commerce and the growing preference for ready-to-eat food products have significantly contributed to the advancement of this market. In alignment with these evolving consumer needs, producers are developing innovative packaging solutions designed not only to preserve product integrity but also to convey information regarding freshness. The heightened focus on sustainability and the utilization of eco-friendly materials in packaging are also encouraging increased investments in active packaging technologies.

Key Market Insights:

As reported by the Food Packaging Institute, 74% of consumers are inclined to spend more on environmentally responsible packaging, highlighting a notable shift in purchasing behavior towards sustainable options.

A major factor fueling advancements within the active packaging industry is the emergence of intelligent packaging technologies. These systems incorporate sensors and indicators to deliver real-time data on the product’s status. Such innovations enhance product safety and quality assurance while offering added convenience to end users. The adoption of intelligent packaging further supports efficient inventory control and contributes to minimizing food waste. To maintain a competitive edge, organizations are increasingly allocating resources toward the integration of these advanced solutions.

Active Packaging Market Drivers:

Global Lifestyle Shifts Poised to Accelerate Market Expansion.

The rapid growth of urban populations, coupled with evolving lifestyle patterns, has significantly increased the demand for packaged, frozen, and ready-to-eat food products. Consumers are exhibiting a rising preference for premium-quality produce, meats, frozen items, and food options that prioritize health and safety. This trend is creating a heightened need for active packaging solutions, thereby contributing to the overall expansion of the market. The ongoing transition from conventional to advanced packaging formats—such as active and intelligent packaging designed to safeguard both internal contents and external integrity—is further expected to support global market growth.

Increased international trade, fueled by globalization, has also played a pivotal role in elevating the demand for such packaging solutions. These packaging formats facilitate improved product tracking and monitoring, thereby enhancing supply chain efficiency and meeting growing consumer expectations. The evolving packaging landscape, combined with modern lifestyle changes and heightened awareness around food safety and convenience, is poised to accelerate market development.

Managing oxygen levels within packaging remains a critical challenge, and oxygen scavengers—commonly referred to as oxygen absorbers—play a vital role in minimizing oxygen presence within the package. This not only helps preserve the freshness and aroma of food items but also extends their shelf life, ultimately driving the sales of active packaging products.

Active Packaging Market Restraints and Challenges:

Elevated Production Costs Expected to Hinder Market Expansion.

The elevated cost of raw materials, which directly impacts overall production expenses, remains a significant barrier to the growth of the global market. Additionally, the rising investments required for research and development activities further constrain market expansion.

Regulatory frameworks, particularly within the European Union, add another layer of complexity. The EU has implemented stringent guidelines governing active materials and articles that come into contact with food, including food packaging, under the European Parliament and Council (EC) framework regulation. These strict regulatory requirements are also expected to limit market development, posing compliance challenges for manufacturers.

Active Packaging Market Opportunities:

Innovations in Bio-Based Active Packaging Anticipated to Drive Market Opportunities.

The growing adoption of biodegradable and bio-based polymers is contributing significantly to the expansion of market share. Pullulan, a water-soluble microbial polysaccharide glucan gum, is produced aerobically through the fermentation of biodegradable, non-toxic fungi. Its increasing popularity is attributed to its diverse applications across the pharmaceutical, chemical, and food industries.

Pullulan’s excellent film-forming capabilities and strong oxygen barrier properties make it a suitable medium for delivering functional biomolecules, thereby enhancing its role in the global active packaging market. The growing consumer preference for fresh produce, driven by the pursuit of healthier lifestyles, is also generating new opportunities for market development. Moreover, the antimicrobial features and preservative effects of pullulan-based film coatings contribute to extending the shelf life of fruits and vegetables. These properties help reduce food spoilage, prevent nutrient degradation, and inhibit microbial contamination—making pullulan a pivotal element in the future of bio-based active packaging.

ACTIVE PACKAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.01% |

|

Segments Covered |

By Type, packaging technology, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amcor Plc, Graham Packaging Company and Avery Dennison. |

Active Packaging Market Segmentation:

Active Packaging Market Segmentation By Packaging Technology:

- Antimicrobial Agent

- Gas Scavenger/Emitter

- Microwave Susceptor

- Moisture Absorber

- Others

The gas scavengers/emitters segment holds a leading position within the active packaging market in 2024. Its dominance is largely attributed to the rising adoption of modified atmosphere packaging (MAP) systems, which are essential for extending product shelf life and preserving food quality. This segment includes a variety of technologies such as oxygen scavengers, carbon dioxide scavengers, and ethylene scavengers—each tailored to address specific preservation challenges across the food and beverage industry. The segment is witnessing significant growth, particularly in applications involving fresh produce, meat, and processed food products, where managing the internal gaseous composition is vital to maintaining safety and freshness.

Meanwhile, the moisture absorber segment is registering the fastest growth rate in the active packaging landscape. This rapid expansion is fueled by increasing usage across pharmaceuticals, electronics, and food sectors, where moisture control plays a crucial role in preserving product stability. Technological advancements in desiccant materials, along with rising demand for longer-lasting packaging solutions, are further supporting the segment’s development. Manufacturers are actively integrating advanced moisture-absorbing technologies into packaging formats, especially for moisture-sensitive products that require strict humidity regulation during storage and distribution.

Active Packaging Market Segmentation By Type:

- Coding and Markings

- Sensors & Output Devices

- Antenna

The coding and markings segment continues to lead the active packaging market, accounting for approximately 43% of the market share in 2024. This segment’s strong position is largely driven by the widespread implementation of barcodes and QR codes across a range of industries for purposes such as product verification and logistical tracking. Heightened concerns about counterfeit goods—particularly in sectors such as pharmaceuticals and luxury products—have significantly amplified the demand for advanced coding and marking technologies. These tools have become essential to modern packaging systems, facilitating efficient distribution, streamlined retail operations, and enhanced security.

The segment is also benefiting from the increasing adoption of augmented reality (AR)-based packaging strategies, as companies aim to create distinctive and interactive consumer experiences. Many beverage brands, for instance, are integrating AR-enabled labels into their packaging designs to attract consumer attention and deliver additional product information, thereby strengthening brand engagement.

The antenna segment, comprising RFID (Radio Frequency Identification) and NFC (Near Field Communication) technologies, is emerging as the fastest-growing area in the intelligent packaging market, with a projected growth rate of around 9%. This surge is being driven by the escalating need for enhanced supply chain security and operational transparency, especially in light of recent global disruptions. Industries with stringent traceability requirements—such as pharmaceuticals and medical devices—are at the forefront of adopting these technologies due to their ability to offer real-time, item-level tracking.

NFC technology, in particular, is gaining traction as it facilitates direct consumer interaction with smart packaging while also supporting brand protection. The widespread use of NFC-enabled smartphones further accelerates this trend, allowing users to engage with packaging without the need for additional hardware or dedicated applications. This convenience is reinforcing consumer interest and supporting the segment's rapid growth trajectory.

Active Packaging Market Segmentation By End-user:

- Pharmaceutical

- Food & Beverages

- Electronics and Electrical

- Agriculture

- Automotive

- Shipping & Logistics

- Personal Care & Cosmetics

- Others

The food segment continues to hold the leading position in the active packaging market in 2024. This dominance is largely fueled by the rising global demand for packaged food products and an increasing focus on food safety, quality assurance, and shelf-life extension. The adoption of intelligent packaging technologies that offer features such as freshness indicators and spoilage detection is helping reduce food waste and enhance consumer confidence. Leading food manufacturers are integrating smart packaging solutions to improve supply chain transparency, verify product authenticity, and boost customer engagement through interactive elements.

The logistics segment is witnessing substantial growth within the active packaging landscape. This rapid expansion is primarily driven by the increasing use of RFID and NFC technologies in inventory control and supply chain optimization. The rise of e-commerce has further intensified the need for advanced packaging solutions that enable real-time visibility and tracking of goods throughout their transit.

Active Packaging Market Segmentation- by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

North America represents a well-established market for active packaging, underpinned by advanced technological infrastructure and a strong presence of leading industry players. The United States and Canada serve as the primary markets within this region, each exhibiting unique growth trajectories and market dynamics. Expansion in North America is largely driven by the widespread adoption of smart packaging technologies across key sectors such as food and beverage, pharmaceuticals, and the rapidly growing e-commerce industry. Additionally, the region’s regulatory frameworks and increasing focus on sustainability have been instrumental in shaping the market landscape in both countries.

In contrast, the Asia Pacific region stands out as a fast-growing and dynamic market for active and intelligent packaging, with China, India, and Japan spearheading regional growth. Economic growth across the region, coupled with rising awareness around food safety and product quality, is creating significant opportunities for market development. The adoption of smart packaging is particularly pronounced within the food and beverage, pharmaceutical, and consumer goods industries.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic led to widespread business shutdowns and significant disruptions in supply chains, which temporarily impeded the production of active packaging products. Despite these challenges, the pharmaceutical sector experienced accelerated growth during this period, thereby exerting a positive influence on the global active packaging market. The heightened demand for vaccines, medications, and other pharmaceutical products essential for COVID-19 treatment generated substantial opportunities, driving increased adoption of active packaging solutions within the industry.

Latest Trends/ Developments:

In February 2024, Aptar CSP Technologies, a subsidiary of AptarGroup, Inc., collaboarted with ProAmpac to introduce their new product, ProActive Intelligence Moisture Protect (MP-1000). This innovative solution delivers superior moisture protection without requiring additional desiccant sachets, enhancing packaging efficiency and product preservation.

In June 2024, DuPont completed the acquisition of Donatelle Plastics Incorporated, a prominent medical device contract manufacturer recognized for its expertise in the design, development, and production of medical components and devices. This strategic acquisition strengthens DuPont’s position in the medical packaging and manufacturing sector.

In June 2023, Amcor plc announced the expansion of its recyclable, high-barrier, paper-based packaging portfolio, AmFiber Performance Paper, across European markets. This development underscores Amcor’s commitment to sustainable packaging solutions and addresses increasing demand for environmentally responsible materials.

Key Players:

These are top 10 players in the Active Packaging Market :-

- Amcor Plc

- Graham Packaging Company

- Avery Dennison

- Amerplast Ltd

- R. Grace and Company

- MicrobeGuard Corporation

- Ampacet Corporation

- Amelco Desiccants Inc.

- Accutech Packaging

- BASF SE & DUPONT

Chapter 1. Active Packaging Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Active Packaging Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Active Packaging Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Packaging TYPE Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Active Packaging Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Active Packaging Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Active Packaging Market – By Type

6.1 Introduction/Key Findings

6.2 Coding and Markings

6.3 Sensors & Output Devices

6.4 Antenna

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. Active Packaging Market – By Packaging Technology

7.1 Introduction/Key Findings

7.2 Antimicrobial Agent

7.3 Gas Scavenger/Emitter

7.4 Microwave Susceptor

7.5 Moisture Absorber

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Packaging Technology

7.8 Absolute $ Opportunity Analysis By Packaging Technology , 2025-2030

Chapter 8. Active Packaging Market – By End-user

8.1 Introduction/Key Findings

8.2 Pharmaceutical

8.3 Food & Beverages

8.4 Electronics and Electrical

8.5 Agriculture

8.6 Automotive

8.7 Shipping & Logistics

8.8 Personal Care & Cosmetics

8.9 Others

8.10 Y-O-Y Growth trend Analysis End-user

8.11 Absolute $ Opportunity Analysis End-user , 2025-2030

Chapter 9. Active Packaging Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Type

9.1.3. By End-user

9.1.4. By Packaging Technology

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Type

9.2.3. By End-user

9.2.4. By Packaging Technology

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Type

9.3.3. By End-user

9.3.4. By Packaging Technology

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By End-user

9.4.3. By Packaging Technology

9.4.4. By Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By End-user

9.5.3. By Type

9.5.4. By Packaging Technology

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Active Packaging Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Amcor Plc

10.2 Graham Packaging Company

10.3 Avery Dennison

10.4 Amerplast Ltd

10.5 R. Grace and Company

10.6 MicrobeGuard Corporation

10.7 Ampacet Corporation

10.8 Amelco Desiccants Inc.

10.9 Accutech Packaging

10.10 BASF SE & DUPONT

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The continued expansion of e-commerce and the growing preference for ready-to-eat food products have significantly contributed to the advancement of this market.

the top players operating in the Active Packaging Market are - Amcor Plc, Graham Packaging Company and Avery Dennison.

The COVID-19 pandemic led to widespread business shutdowns and significant disruptions in supply chains, which temporarily impeded the production of active packaging products.

Innovations in Bio-Based Active Packaging Anticipated to Drive Market Opportunities.

Asia Pacific is the fastest-growing region in the Active Packaging Market.