Acrylic Resin-based Paints & Coatings Market Size (2023 – 2030)

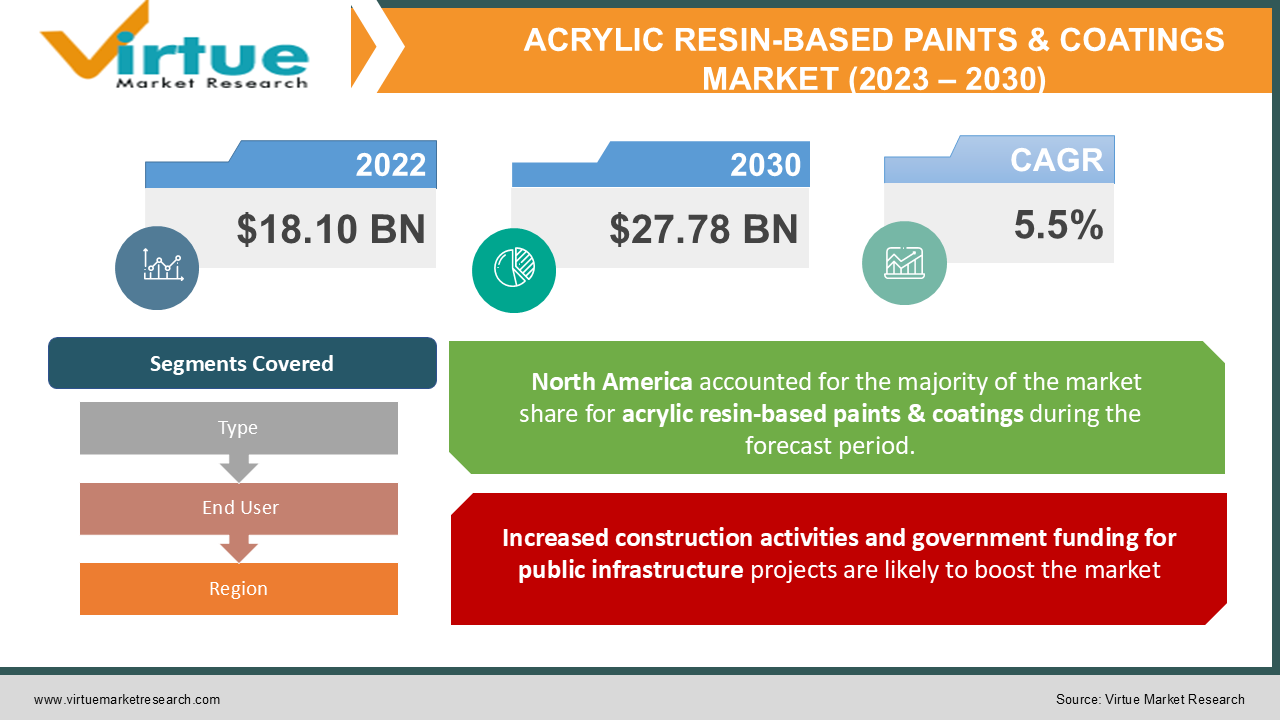

In 2022, the Global Acrylic Resin-based Paints & Coatings Market was valued at USD 18.10 billion and is projected to reach a market size of USD 27.78 billion by 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 5.5%.

Industry Overview:

Acrylates and other materials are combined to form acrylic coating resin. It is used to enhance resistance against scratching, peeling, or fading due to ultraviolet light exposure in exterior paints, wood stains, furniture finishes, and automobile coatings. These resins are also non-toxic, making them environmentally benign. Acrylic resin is essentially a polymeric substance that comprises acrylic monomers and is applied as a solid, dispersion, or solution. Depending on the manufacturer's preferred material for the manufacturing process, the components that make up this compound can either be solvent-based acrylic resin or solid acrylic resin. While solvent-based acrylic resins tend to evaporate more quickly than their solid counterparts, offering a speedier drying time but with less protection from moisture damage, solid acrylic resins have higher water resistance. Due to a variety of characteristics, including good adhesion to non-porous surfaces, excellent gloss, finish, and clarity, superior hardness, improved flow, better storage stability, superb weather ability, improved solubility, and high alkali-resistance and anti-corrosion properties, acrylic resin coatings are used in a variety of applications. The building and construction sector in the Asia Pacific has been growing rapidly due to economic expansion and the consequent rise in the living standards of those in the region's developing nations. The widespread use of paints and coatings in the building, automotive and transportation, and healthcare industries is a major factor driving the global market for acrylic resin-based paints and coatings. The market's leading vendors are consistently working to expand their product portfolios by spending on R&D efforts, which is projected to help the market maintain growth over the forecast period.

COVID-19 pandemic impact on Acrylic Resin based Paints & Coatings Market

The pandemic had caused a temporary halt to residential and commercial construction. During this time of crisis, there was a low to moderate demand from this industry for acrylic resins. A few significant problems included a delay in order delivery, supply chain limitations, a lack of personnel and equipment, and material scarcity. The construction & building industry has suffered as a result of the lockdown in some nations and logistical limitations. The industry has been negatively impacted by supply chain interruptions, manpower shortages, logistical constraints, limited component availability, declining demand, low corporate liquidity, and stoppage of operations due to lockdown in several nations.

MARKET DRIVERS:

Increased construction activities and government funding for public infrastructure projects are likely to boost the market

The building and construction sector is anticipated to expand quickly in the coming years due to the increase in urbanization and population. The worldwide construction industry is anticipated to be driven in the next years by urbanization and shifting lifestyles. The cost of building houses and infrastructure has increased globally as a result of population growth and improving economic conditions. Buildings and infrastructure are frequently decorated and protected with paints and coatings. Some of the architectural improvements used to enhance a home's aesthetics include floor paint, epoxy floor paint, primers, sealers, varnishes, and stains. Architectural paints are low-VOC and scrub-resistant and come in a variety of textures, from semi-gloss to high-gloss polishes. Due to an increase in building activity and government investment in various public infrastructure projects, the market is anticipated to grow.

The growing need for environmentally friendly formulations and an increase in the demand for eco-friendly coating products are driving the market's expansion

The use of low-VOC and environmentally friendly technologies, such as water-based coatings, powder coatings, and UV-curable coatings, is becoming more and more popular in the paints and coatings sector. The change is linked to numerous regions, mainly North America and Europe, passing strict controls on VOC emissions. The Asia Pacific region is becoming more aware of VOC emissions. The demand for low VOC water-based coatings is predicted to increase as a result during the forecast period. The demand for water-based paints and coatings is increasing as people become more conscious of the effects that coating products have on the environment and human health, as well as they place more emphasis on sustainable alternative technologies. Manufacturers are concentrating on water-based paints and coatings because they are more affordable than the more common solvent-based paints and varnishes. Environmental sustainability is the main goal of the production of green or bio-based paints and coating systems. Every stage of the coating's life cycle, including the manufacture of resin and the formulation of raw materials level, is covered by environmental sustainability. The majority of raw materials used in coatings are made from fossil fuels like coal, oil, and natural gas. Misusing these resources has a detrimental effect on the ecosystem due to the release of greenhouse gases. Comparing raw materials made from plant biomass to their traditional counterparts reveals that they have advantageous qualities.

MARKET RESTRAINTS:

Rising raw material costs and environmental and health risks could limit industry expansion.

Concern over the health risks connected to raw materials, as well as their volatile pricing and environmental laws, is growing, which is stifling industry expansion. Acrylics and other plastics pose a threat to marine life because they disintegrate very slowly and enter the ocean and coastal environments. Acrylic is made from petroleum-based materials, which are regarded as harmful to the environment. Not all varieties of acrylic can be recycled. Under typical operating conditions, acrylic does not degas and functions in a way that is equally safe for the environment as glass.

Regulations and strict rules may limit market expansion.

Paint and coatings manufacturers must constantly enhance their processes to conform to the numerous regulatory policies being established by various governments. In nations with severe environmental rules, particularly in Western Europe and North America, products that don't comply with the law are prohibited. Regrettably, some lawmakers still set emission limits based only on the amount of VOC present in exhaust gases. This may result in the certification of procedures that produce high mass emissions although they only need very low airflows to produce low mass emissions. The concentration technique also ignores the decreased air emissions brought on by the use of low-VOC coatings.

ACRYLIC RESIN-BASED PAINTS & COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Dow, BASF SE, AkzoNobel N.V., Arkema, Mitsubishi, Shanghai Legend Chemicals, Nippon Shokubai, Mitsubishi Chemical Group, DSM, Showa Denko Materials, DIC Corporation, Sumitomo |

This research report on the Acrylic Resin based Paints & Coatings market has been segmented based on type, end-user, and region.

Acrylic Resin-based Paints & Coatings Market – By Type

-

Solvent-based

-

Solid Acrylic Resin

-

Others

Based on Type, the market is categorized into Solvent-based, Solid Acrylic Resin, and Others. Water-based acrylic resins are as effective as those made of solvents, but they also have less of an adverse influence on the environment. Because of their simple formulation processes, quick drying times, superior durability, and low odor emission, these resins are currently used more commonly. The global market for acrylic resin coatings is expanding due to the advent of new, cutting-edge technologies, particularly in the water-borne segment. Also, hybrid coatings like epoxy and alkyd acrylic hybrids help to address the drawbacks of traditional acrylic coatings. Hybrid acrylic resins typically combine two practical monomers. These resins were created to blend the positive characteristics of the two resins and counteract their negative qualities to achieve the necessary functionality. These are mostly employed in coating applications because of their superior performance qualities, such as gloss preservation, ultraviolet resistance, and improved adhesion.

Chemicals and solvents are combined in smaller volumes to create solvent-based acrylic resin. It is mostly made of acrylic polymer that has been dissolved in an organic solvent like methyl ethyl ketone (MEK), toluene, acetone, or xylene, among others. Then, for paint and coating applications, additives are often included in the solution before being applied to the substrate surface.

Solid acrylic resin can be produced using both solvents and oils. Despite being one of the most prevalent varieties in this group, it is not as well known or utilized as other types like solvent-based acrylic resins and liquid acrylics. Since solid acrylic resin often comes in solid form (thus the name), it is more adaptable to use for a variety of projects that demand various types of finishing options. Liquid acrylic resin is frequently applied to utilize spray guns.

Acrylic Resin-based Paints & Coatings Market – By End User

-

Building & Construction

-

Industrial Coatings

-

Marine

-

Consumer goods

-

Automotive

-

Others

Based on End User, the market is categorized into Building & Construction Industrial Coatings, Marine, Consumer goods, Automotive, and Others. The Building & Construction segment is projected to capture the largest share of the Acrylic Resin based paints & Coatings Market in terms of revenue. Building exterior surfaces including walls, roofs, and floors are coated with acrylic coating resins as a protective layer. Additionally, they can be used to protect interior surfaces like ceilings or columns. Typically, a high-pressure nozzle on an airless paint sprayer is used to apply the acrylic coating resin to the surface. Due to their capacity to deliver durable performance and easy cleaning features, the use of these items in structures has also increased over time. The demand for acrylic resins in the building and construction sector is being driven by the increase in residential and commercial construction in emerging economies and the restoration of older buildings in developed economies. Acrylic resins are widely used in the industry because of their superior adhesion, UV stability, carbonation resistance, flexibility and elongation, and environmental friendliness.

Furniture coatings for wood utilize acrylic resins. Acrylic resin can be dissolved in solvents that can evaporate, leaving only the solid polymer coating on the surface it was applied to and no solvent residues. Acrylics that have been solidified have depth retention, great gloss, and water resistance capabilities. They are also quite durable.

Car paint uses acrylic coating resin. For automotive paints, acrylics are the most used kind of polyester resin. The acrylic primer surfacer acts as a bridging layer between the underbody panel's bare metal base and the final coat, shielding it from any rust formation during storage or transportation before painting. After being applied to various surfaces including plastics, rubber hoods, glass enamel, or aluminum panels, this product creates a barrier that protects against corrosion and has improved gloss to improve its look. In addition, acrylic coatings can be used to shield repair patches from rusting internally while welding or painting is being done.

Acrylic Resin-based Paints & Coatings Market - By Region:

-

North America

-

Europe

-

Asia-Pacific

-

Rest of the World

The North American region is anticipated to lead the global market for acrylic resin-based paints & coatings over the forecast period due to the increasing disposable income of the population, which increases their purchasing power for more opulent items like vehicles. Europe is anticipated to take second place regarding revenue creation. Europe and North America are two additional significant markets for paints and coatings. These regions have a developed paints and coatings industry. However, the implementation of strict controls on VOC emissions in these areas may affect the market growth.

The Asia Pacific acrylic resins-based paints & coatings market is anticipated to grow at the greatest CAGR during the forecast period. The expanding construction sector, rising consumer expenditure, and rapid economic expansion are the main drivers of demand in APAC. The usage of paints and coatings in several end-use industries, including architectural (residential and non-residential), and industrial, is primarily responsible for the expansion in the area. The Asia Pacific has a significant market for epoxy paint, Clearcoat spray paint, waterproof paint, wood coatings, vinyl ester coatings, and roof coatings.

The Latin American acrylic resins-based paints & coatings market is anticipated to grow at the highest CAGR over the forecast period due to rising demand from Brazil, Mexico, and Argentina. The Middle East and Africa region are forecast to demonstrate a high CAGR due to the growing usage of acrylic coating for exterior paints, furniture finishes, linings, and wood coatings, which are anticipated to be highly profitable markets in this region.

Major Key Players in the Market

The major players in the global Acrylic Resin based Paints & Coatings Market are

-

Dow

-

BASF SE

-

AkzoNobel N.V.

-

Arkema

-

Mitsubishi

-

Shanghai Legend Chemicals

-

Nippon Shokubai

-

Mitsubishi Chemical Group

-

DSM

-

Showa Denko Materials

-

DIC Corporation

-

Sumitomo

Notable happenings in the Acrylic Resin based Paints & Coatings Market in the recent past:

-

Expansion- In May 2022, BASF expanded its Automotive Coatings Application Center at the Mangalore, India, Coatings Technology Center. It is a crucial component of the current R&D facilities for automotive coatings solutions at BASF. In the Asia Pacific, BASF also runs Automotive Coatings Application Centers in Bang Pu, Thailand; Totsuka, Japan; and Shanghai, China.

-

Acquisition- In June 2022, Akzo Nobel and Kansai Paint came to an agreement for Akzo Nobel to purchase their respective paints and coatings businesses.

-

Partnership- In July 2021, Mercedes-Benz and AkzoNobel N.V. renewed their partnership arrangement for an additional four years. This indicates that the business will keep offering services and goods for vehicle refinishing, such as automotive and specialized coatings, in China and as a preferred partner in Indonesia.

Chapter 1. Acrylic Resin-based Paints & Coatings Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Acrylic Resin-based Paints & Coatings Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Acrylic Resin-based Paints & Coatings Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Acrylic Resin-based Paints & Coatings Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Acrylic Resin-based Paints & Coatings Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Acrylic Resin-based Paints & Coatings Market – By Type

6.1. Solvent-based

6.2. Solid Acrylic Resin

6.3. Others

Chapter 7. Acrylic Resin-based Paints & Coatings Market – By End User

7.1. Building & Construction

7.2. Industrial Coatings

7.3. Marine

7.4. Consumer goods

7.5. Automotive

7.6. Others

Chapter 8. Acrylic Resin-based Paints & Coatings Market- By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Acrylic Resin-based Paints & Coatings Market – key players

9.1 Dow

9.2 BASF SE

9.3 AkzoNobel N.V.

9.4 Arkema

9.5 Mitsubishi

9.6 Shanghai Legend Chemicals

9.7 Nippon Shokubai

9.8 Mitsubishi Chemical Group

9.9 DSM

9.10 Showa Denko Materials

9.11 DIC Corporation

9.12 Sumitomo

Download Sample

Choose License Type

2500

4250

5250

6900