Acrylic non-woven tape Market Size (2024-2030)

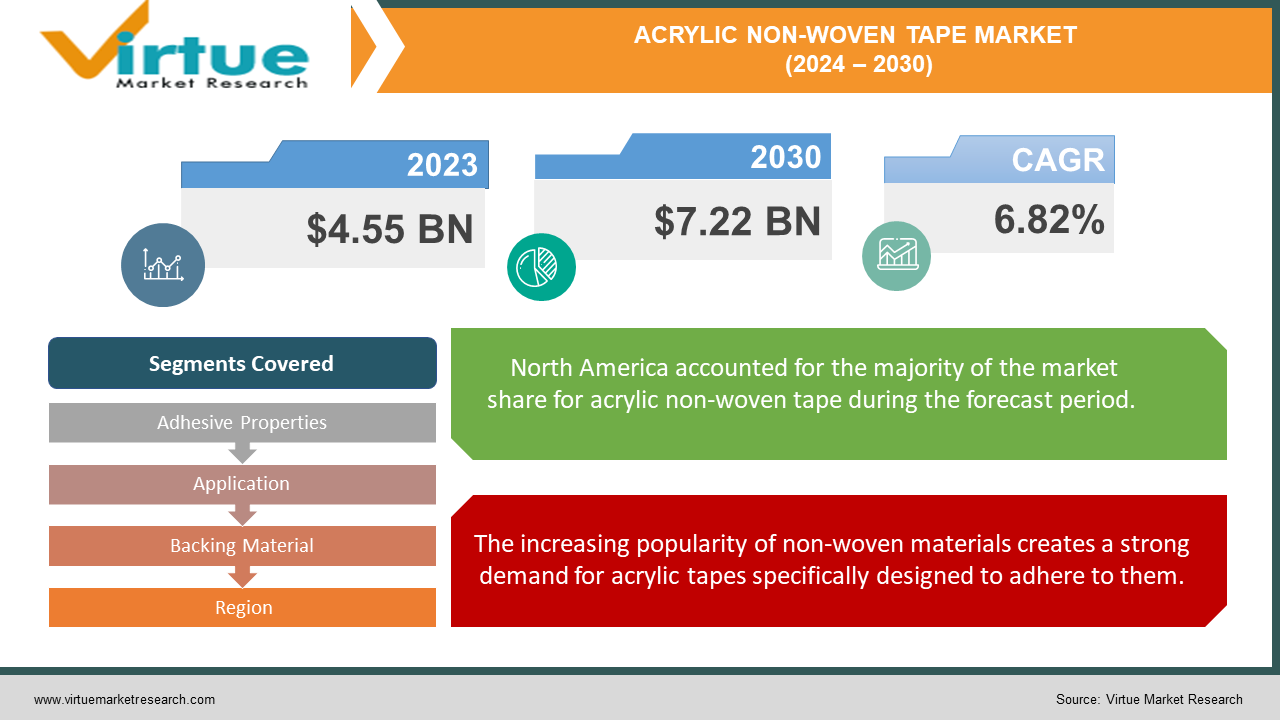

The Acrylic non-woven tape Market was valued at USD 4.55 billion in 2023 and is projected to reach a market size of USD 7.22 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 6.82%.

The acrylic non-woven tape market is a growing segment within the pressure-sensitive adhesive tape industry. These tapes combine a non-woven fabric backing with an acrylic adhesive, making them ideal for use with various non-woven materials. Several factors are propelling this market forward. First, the increasing popularity of non-woven materials across many industries, due to their breathability, disposability, and versatility, creates a strong demand for tapes that can effectively adhere to them.

Key Market Insights:

The acrylic non-woven tape market thrives alongside the booming non-woven materials industry. These tapes, marrying non-woven fabric backings with acrylic adhesives, excel at adhering to these versatile materials. This synergy fuels market growth. The medical and hygiene sector exemplifies this, heavily utilizing these tapes in wound care dressings and surgical gowns. Their gentle adhesive properties and breathability make them ideal for sensitive applications.

Beyond medicine, acrylic non-woven tapes boast impressive application diversity. From supporting car upholstery to harnessing wires in electronics, these tapes offer solutions across various sectors. This versatility, combined with the rising demand for non-woven materials positions acrylic non-woven tapes for a promising future.

Competition among leading manufacturers like 3M and Henkel further fuels innovation. This translates to advancements in adhesive properties, backing materials, and customization options, ensuring a constant stream of improved tape solutions to meet diverse needs.

The Acrylic Non-woven Tape Market Drivers:

The increasing popularity of non-woven materials creates a strong demand for acrylic tapes specifically designed to adhere to them.

The increasing popularity of non-woven materials across diverse industries like medical, hygiene, and construction has created a perfect storm for acrylic non-woven tapes. These tapes are specifically designed to adhere to these versatile yet often delicate non-woven materials, forming a secure yet gentle bond.

The medical and hygiene sector relies heavily on acrylic non-woven tapes due to their gentle adhesive properties and breathability, making them ideal for wound care and surgical applications.

The medical and hygiene sector is a major driving force behind the acrylic non-woven tape market due to its suitability for various critical applications. These tapes, with their breathability and gentle adhesive properties, are ideal for wound care dressings, medical device attachment, and surgical gowns. Their crucial role in the medical field, ensuring patient comfort and safety, further underscores the importance of acrylic non-woven tapes in this sector.

Beyond the medical field, acrylic non-woven tapes offer a wide range of applications in various industries, ensuring a stable and growing market.

While rising disposable income in developing nations fuels the demand for consumer goods that incorporate non-woven materials, the appeal of acrylic non-woven tapes goes far deeper. Their affordability, user-friendliness, and wide range of applications across various economic segments make them a cost-effective and versatile solution. From car upholstery support in the automotive industry to cable or wire harnessing in electronics, these tapes offer a solution for a diverse range of needs, ensuring a stable and continuously growing market.

The affordability and ease of use of these tapes extend beyond the influence of rising disposable income, making them a cost-effective and user-friendly solution across economic segments.

The affordability and ease of use of acrylic non-woven tapes are key drivers that extend beyond the influence of rising disposable income. These tapes offer a cost-effective solution for businesses and consumers alike, making them accessible across various economic segments. Furthermore, their user-friendliness simplifies application processes, reducing reliance on specialized skills or equipment. This combination of affordability and ease of use makes acrylic non-woven tapes a highly attractive option, solidifying their position in the market.

The Acrylic Non-woven Tape Market Restraints and Challenges:

The promising outlook for the acrylic non-woven tape market isn't without its challenges. A growing concern surrounds the environmental impact of non-woven materials, with some lacking biodegradability. This could lead to stricter regulations and consumer resistance towards products that incorporate them, potentially impacting the demand for tapes specifically designed to adhere to these materials. Additionally, competition from alternative pressure-sensitive tapes, such as those with hot melt or rubber adhesives, exists. These alternatives may offer advantages in specific applications, pushing manufacturers of acrylic non-woven tapes to continuously innovate and improve their product offerings to maintain market share. Shelf life and storage considerations also present hurdles. Improper storage can negatively affect the adhesive properties of these tapes, reducing their effectiveness. This necessitates clear and consistent handling and storage guidelines for both manufacturers and users to ensure optimal performance. Finally, while generally gentle, the acrylic adhesive in some tapes may cause skin irritation for certain individuals, particularly those with sensitive skin. This potential drawback could limit their use in some medical and hygiene applications, requiring manufacturers to explore hypoallergenic adhesive formulations or clearer labelling for appropriate use.

The Acrylic Non-woven Tape Market Opportunities:

The future of the acrylic non-woven tape market brims with exciting opportunities. A key focus will be on addressing environmental concerns. Manufacturers can develop tapes utilizing biodegradable or recycled non-woven backings, appealing to eco-conscious consumers and potentially opening doors to markets with stricter sustainability regulations. The medical and hygiene sector remains a prime target, with opportunities to create tapes with specialized functionalities. Imagine wound dressings with antimicrobial properties or improved moisture management! Innovation in adhesive technology is another avenue for growth. Imagine stronger bonds, wider temperature tolerance, and even longer shelf life – these advancements could open doors to demanding environments like construction or industrial settings. Customization is another key. The ability to tailor tape properties like size, thickness, and adhesive strength to specific industry needs can attract new customers and expand market reach. Finally, the booming e-commerce market presents a golden opportunity. Easy online access and clear product information can connect with a wider customer base, particularly smaller businesses and individual consumers who might not have access to traditional distributors. By capitalizing on these opportunities, the acrylic non-woven tape market can solidify its position as a versatile and valuable solution across a diverse range of industries.

ACRYLIC NON-WOVEN TAPE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.82% |

|

Segments Covered |

By Adhesive Properties, Application, Backing Material, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3M, Nitto Denko, Tesa, Lintec, Avery Dennison, Scapa |

Acrylic Non-woven Tape Market Segmentation: By Adhesive Properties

-

Standard Acrylic Adhesive

-

High-Performance Acrylic Adhesive

-

Hot Melt Acrylic Adhesive

-

Hypoallergenic Acrylic Adhesive

Segmenting the acrylic non-woven tape market by adhesive properties reveals two key players: standard acrylic adhesive, dominating the market due to its balanced performance and ease of use, and the high-performance segment experiencing the fastest growth. These high-performance tapes cater to demanding applications with their stronger bonds and improved temperature resistance, making them increasingly sought after in various industries.

Acrylic Non-woven Tape Market Segmentation: By Application

-

Medical & Hygiene

-

Automotive & Transportation

-

Electrical & Electronics

-

Building & Construction

The dominant segment of the acrylic non-woven tape market by application is Medical & Hygiene, utilizing these tapes in wound dressings, surgical gowns, and hygiene products. This sector leverages the breathability and gentle adhesive properties of the tapes. However, the Asia Pacific region is expected to experience the fastest growth due to its booming medical, automotive, and hygiene industries.

Acrylic Non-woven Tape Market Segmentation: By Backing Material

-

Polyester non-woven

-

Rayon non-woven

-

Polypropylene non-woven

-

Blended non-woven

Among backing materials, polyester non-woven is the most dominant segment due to its high strength and dimensional stability, making it ideal for demanding applications across various industries. However, the fastest-growing segment is expected to be blended non-woven. This is because blended materials can combine specific functionalities, like breathability and strength, to cater to the evolving needs of different sectors.

Acrylic Non-woven Tape Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America region boasts a mature acrylic non-woven tape market with a strong demand for high-performance and specialized tapes. Established infrastructure, advanced manufacturing capabilities, and a focus on innovation contribute to this dominance. However, market saturation in some segments is a potential challenge.

Europe’s stringent regulations and a growing focus on sustainability heavily influence the European acrylic non-woven tape market. Manufacturers here prioritize eco-friendly materials and processes to comply with regulations and cater to environmentally conscious consumers. This focus on sustainability presents both opportunities and challenges for market players.

Asia Pacific region is projected to witness the fastest growth in the acrylic non-woven tape market. The booming medical, automotive, and hygiene sectors in countries like China and India are key drivers. Rising disposable income and increasing urbanization also contribute to the market expansion in this region. However, fragmented markets and potential quality inconsistencies are factors to consider.

COVID-19 Impact Analysis on the Acrylic Non-Woven Tape Market:

The COVID-19 pandemic's impact on the acrylic non-woven tape market was a double-edged sword. On the positive side, the surge in demand for medical and hygiene products like face masks, surgical gowns, and wound dressings significantly bolstered the market. Heightened hygiene awareness also led to increased use of disposable wipes and hygiene products that often rely on these tapes for assembly. However, the pandemic wasn't without its challenges. Global lockdowns and travel restrictions disrupted the supply chain for raw materials and finished tapes, causing temporary shortages and price fluctuations. Additionally, shifting priorities in sectors like automotive and construction due to production slowdowns or project delays may have caused a temporary decline in demand. The economic downturn might have also led to reduced consumer spending in some regions, impacting non-essential applications. Despite these initial disruptions, the overall impact leans positive. The surge from the medical and hygiene sector has largely outweighed the temporary slowdowns in other sectors. As the pandemic subsides and economies recover, the market is expected to return to its pre-pandemic growth trajectory, potentially with a lasting rise in demand for hygiene-related applications. In the long run, the pandemic has underscored the need for a resilient and diversified supply chain for these tapes, potentially leading manufacturers to explore regional sourcing strategies. The heightened focus on hygiene and sanitation measures could also translate to a long-term increase in demand for acrylic non-woven tapes in hygiene products.

Latest Trends/ Developments:

The acrylic non-woven tape market is a hive of activity, buzzing with innovation that caters to both environmental consciousness and evolving needs. A major trend is the focus on sustainable materials. Manufacturers are actively exploring the use of biodegradable or recycled non-woven backing materials, venturing into the realm of bio-based adhesives, and striving to reduce their overall environmental footprint. This eco-friendly approach not only appeals to environmentally conscious consumers but also positions manufacturers favourably in markets with stricter sustainability regulations. Beyond environmental responsibility, functionality and customization are taking centre stage. Imagine tapes with specialized properties tailored to specific applications. Wound dressings could benefit from tapes boasting antimicrobial properties to combat infection, while construction projects could leverage tapes with flame-retardant qualities for enhanced safety. The world of sportswear could be revolutionized with moisture-wicking tapes that keep athletes cool and comfortable. These are just a few examples of the exciting possibilities that lie ahead.

Key Players:

-

3M

-

Nitto Denko

-

Tesa

-

Lintec

-

Avery Dennison

-

Scapa

Chapter 1. Acrylic non-woven tape Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Deployment Models

1.5 Secondary Deployment Models

Chapter 2. Acrylic non-woven tape Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Acrylic non-woven tape Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Acrylic non-woven tape Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Acrylic non-woven tape Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Acrylic non-woven tape Market – By Adhesive Properties

6.1 Introduction/Key Findings

6.2 Standard Acrylic Adhesive

6.3 High-Performance Acrylic Adhesive

6.4 Hot Melt Acrylic Adhesive

6.5 Hypoallergenic Acrylic Adhesive

6.6 Y-O-Y Growth trend Analysis By Adhesive Properties

6.7 Absolute $ Opportunity Analysis By Adhesive Properties, 2024-2030

Chapter 7. Acrylic non-woven tape Market – By Application

7.1 Introduction/Key Findings

7.2 Medical & Hygiene

7.3 Automotive & Transportation

7.4 Electrical & Electronics

7.5 Building & Construction

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Acrylic non-woven tape Market – By Backing Material

8.1 Introduction/Key Findings

8.2 Polyester non-woven

8.3 Rayon non-woven

8.4 Polypropylene non-woven

8.5 Blended non-woven

8.6 Y-O-Y Growth trend Analysis By Backing Material

8.7 Absolute $ Opportunity Analysis By Backing Material, 2024-2030

Chapter 9. Acrylic non-woven tape Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Adhesive Properties

9.1.3 By Application

9.1.4 By Backing Material

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Adhesive Properties

9.2.3 By Application

9.2.4 By Backing Material

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Adhesive Properties

9.3.3 By Application

9.3.4 By Backing Material

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Adhesive Properties

9.4.3 By Application

9.4.4 By Backing Material

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Adhesive Properties

9.5.3 By Application

9.5.4 By Backing Material

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Acrylic non-woven tape Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 3M

10.2 Nitto Denko

10.3 Tesa

10.4 Lintec

10.5 Avery Dennison

10.6 Scapa

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Acrylic non-woven tape Market was valued at USD 4.55 billion in 2023 and is projected to reach a market size of USD 7.22 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 6.82%.

Symbiotic Relationship with the Thriving Non-Woven Materials Market, Medical and Hygiene Sector, Beyond Disposable Income, Affordability and Ease of Use.

Medical & Hygiene, Automotive & Transportation, Electrical & Electronics, Building & Construction.

The Asia Pacific region is projected to be the most dominant market for acrylic non-woven tapes due to its booming medical, automotive, and hygiene industries.

3M, Nitto Denko, Tesa, Lintec, Avery Dennison, and Scapa are the leading players in the Acrylic non-woven tape Market.