Acetylene Market Size (2024 – 2030)

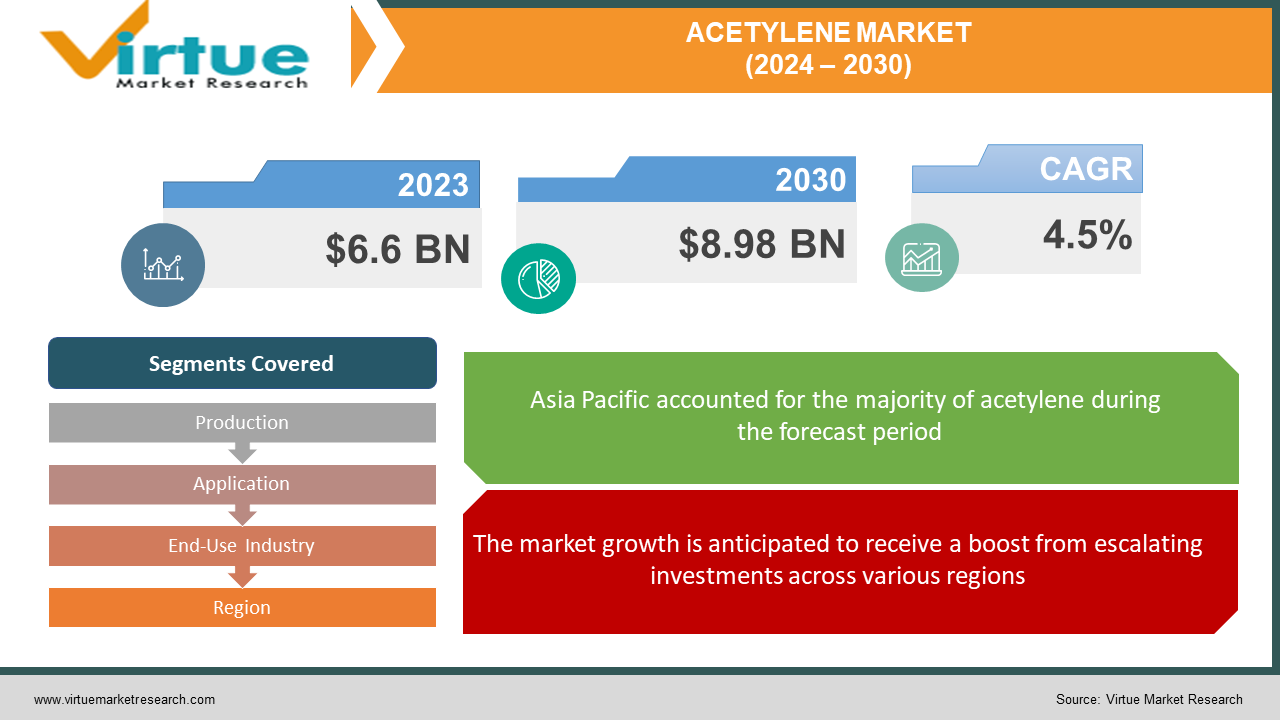

The Global Acetylene Market is expected to grow from USD 6.6 billion in 2023 to reach a valuation of USD 8.98 billion by 2030 at a compound annual growth rate (CAGR) of 4.5% between 2024-2030.

Acetylene serves as a vital ingredient across multiple sectors, including its essential uses in welding, metal fabrication, chemical production, brazing, and the manufacturing of polyethylene plastics. Traditionally, acetylene is synthesized through the reaction between calcium carbide and water, a method that has been fundamental in its production for many years. Nevertheless, the industry is experiencing significant shifts due to environmental considerations, advancements in technology, and changing demands within the sector.

Environmental challenges, particularly the high energy consumption and carbon emissions associated with conventional acetylene production methods, are anticipated to temporarily impede market growth. Meanwhile, the sector is being reshaped by technological innovations that offer new methods for producing and storing acetylene.

These technological developments are enhancing safety and environmental standards, rendering acetylene more appealing, especially in industries bound by strict regulatory frameworks. Furthermore, consistent demand for acetylene is maintained by its applications in welding, cutting, and brazing across various metals and industries. Its role in the chemical sector, especially in the synthesis of a range of chemicals and plastics, further solidifies its consistent market demand.

Key Market Insights:

The acetylene market is undergoing a period of transformation, marked by challenges and opportunities that lie ahead. Acetylene, a combustible gas widely used in diverse applications, holds a crucial role in various sectors, including metal fabrication, chemical production, and welding. The demand for acetylene remains relatively steadfast, primarily propelled by its application in welding and cutting processes within the construction and automotive industries. Additionally, the chemical sector's dependence on acetylene for the synthesis of chemicals and plastics contributes significantly to the ongoing growth of the acetylene market. Nonetheless, the market faces substantial challenges, particularly in terms of supply.

The production of acetylene involves the reaction between calcium carbide and water, making it susceptible to disruptions in the supply chain and fluctuations in prices. Any disruptions in the supply of calcium carbide or logistical challenges have the potential to exert a significant impact on the forthcoming acetylene market projections. Moreover, the increasing apprehension regarding the environmental consequences of acetylene production is compelling major acetylene manufacturers to invest in innovative and environmentally friendly technologies, aiming to alleviate their carbon footprint.

Global Acetylene Market Drivers:

The market growth is anticipated to receive a boost from escalating investments across various regions.

The increasing demand for acetylene gas, attributed to its diverse advantages such as low moisture content suitable for critical heating processes, has led to a rise in its popularity across different industrial applications. Recent years have witnessed a notable surge in investments within this sector, a trend expected to drive the expansion of the Acetylene Gas Market. For example, in May 2022, Orion Engineered Carbons, a specialty chemical company, unveiled plans to construct the sole U.S. plant producing acetylene-based conductive additives—an essential component in the value chain for lithium-ion batteries, high-voltage cables, and other products contributing to the global shift toward electrification and renewable energy. The facility in La Porte, Texas, south of Houston, is backed by a long-term agreement for acetylene supply from a neighboring site owned by Equistar Chemicals LP, a subsidiary of LyondellBasell. The investment, ranging from $120 million to $140 million, is projected to commence operations in the second half of 2024, increasing the company’s conductive additives capacity by approximately 12 kilotons per year.

The thriving automotive industry, coupled with extensive acetylene gas usage, stands as a prominent factor propelling the market growth.

The robust growth of the automotive industry, combined with the widespread utilization of acetylene gas in manufacturing various automotive and precision parts, is poised to drive market expansion in the coming years. Additionally, government initiatives to boost automotive manufacturing are expected to further fuel market growth. In March 2022, the production-linked incentive scheme for the automobile and automotive component sectors attracted a proposed investment of ₹74,850 crore, as disclosed by the heavy industries ministry. The estimated investment target was ₹42,500 crore over five years. The PLI scheme, initiated on September 23, 2022, aims to stimulate manufacturing, attract investments, overcome cost challenges, create economies of scale, develop a robust supply chain in advanced automotive technology (AAT) products, and generate employment.

Increasing demand for polymers and resins is also supporting the market growth.

Polymers and resins find widespread application across diverse industries, serving as essential components in the shaping and construction of plastics. Acetylene, a commonly utilized element in the synthesis of robust and durable polymers and resins, contributes to their use in various sectors, including construction materials, automotive components, and medical devices. The escalating utilization of these polymers is expected to drive the demand for polymers and resins. Consequently, the growing demand for these materials is poised to enhance market growth in the foreseeable future.

Global Acetylene Market Restraints and Challenges:

Environmental and health hazards associated with Acetylene may impede market growth.

Acetylene, classified as an asphyxiant and highly unstable in nature, poses significant risks as it can strongly react with impurities and oxygen, leading to hazardous situations. The concentration of acetylene, exceeding the safe upper pressure limit of 15 psig, can result in severe consequences, including death or loss of consciousness. The emissions of highly unstable acetylene in open surroundings can have substantial health and negative environmental impacts. Acetylene is designated as a controlled product, falling under Hazard Classes A, B1, and F according to the controlled product regulations of the Canadian Workplace Hazardous Materials Information System (WHIMS). Moreover, the manufacturing and processing of acetylene demand meticulous care and precautions, translating into substantial expenditures on handling and safety measures, thereby creating a challenge within the market.

Stringent government regulations in terms of Acetylene usage are another growth-impeding factor.

In response to increasing awareness, governments worldwide are implementing regulations and amendments aimed at ensuring workplace safety where acetylene gas is utilized. Consequently, acetylene gas is encountering growing challenges in aligning with these new rules and regulations. The stringent regulatory environment stands as a significant obstacle hindering the expansion of the acetylene gas market. These factors collectively contribute to restricting the growth of the acetylene gas market.

Global Acetylene Market Opportunities:

The Acetylene market presents lucrative opportunities driven by increasing demand in welding, metal fabrication, and chemical synthesis. Technological advancements, especially in eco-friendly production methods and storage solutions, enhance market potential. With a rising focus on safety and environmental regulations, manufacturers investing in innovative practices stand to benefit. The automotive industry's growth and the demand for acetylene-based products in renewable energy sectors further contribute to market expansion. As global infrastructure development persists, the construction industry's reliance on acetylene adds to the market's favorable outlook, creating diverse avenues for stakeholders to explore and capitalize on the growing demand.

ACETYLENE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Production, Application, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Dongxiang Gas, Xinlong Group, Rexarc, BASF, SINOPEC, Dow, Ho Tung Chemicals, Linde AG, Energas, Toho Acetylene |

Global Acetylene Market Segmentation: By Production

-

Calcium Carbide

-

Thermal Cracking

-

Hydrocarbon Pyrolysis

In the Acetylene Market, the segment based on the production process is led by hydrocarbon pyrolysis, holding over 30% of the market share in 2023. This dominance is projected to continue due to the process's advantages, including the generation of valuable by-products, cost-effectiveness, and superior yields. The shift towards using heavier hydrocarbon raw materials like natural gasoline and propane for acetylene production is noteworthy. These non-aromatic hydrocarbons offer enhanced chemical reactivity compared to their partially aromatic counterparts. Consequently, the hydrocarbon pyrolysis process, with its benefits of higher yields and valuable by-products, is poised to capture a significant portion of the acetylene market.

Global Acetylene Market Segmentation: By Application

-

Chemical Synthesis

-

Metal Working

-

Welding and Cutting

-

Carbon Coatings

-

Acetylic Alcohols

-

Others

In terms of application, the chemical synthesis segment shows remarkable growth, accounting for over 35% of the market in 2023. Acetylene is extensively utilized as an intermediate in producing various chemicals, including 1,4-butanediol and acetylenic alcohols. It is also crucial in synthesizing certain vitamins like A and E. Furthermore, acetylene is combined with chemicals like hydrochloric acid and chlorine to manufacture plastics such as PVDF and PVC. The China Plastic Processing Industry Association noted an increase in PVC resin production capacity from 23.47 million tons to 25.19 million tons between 2015 and 2019.

Global Acetylene Market Segmentation: By End-Use Industry

-

Chemical Industry

-

Glass and Material Processing Industry

-

Aerospace

-

Automotive

-

Pharmaceuticals

-

Others

Regarding end-use industry segmentation, the chemical sector emerges as the predominant segment, with a share exceeding 30% in 2023. Acetylene's role as a fundamental building block in the chemical industry is underscored by its high reactivity and simple structure. It is integral in creating a diverse array of products, including polymer additives, solvents, perfume components, and active compounds. Post-pandemic recovery in the chemical industry has further amplified the demand for acetylene. The World Bank reported a 16.3% increase in U.S. manufacturing value in the chemical industry compared to 2018. The growing production of chemicals and the expansion in synthesis applications suggest the chemical industry's significant role in the global acetylene market.

Global Acetylene Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Geographically, the Asia Pacific region leads the global acetylene market because of the presence of major end-use industries. In 2023, this region was instrumental in expanding the market size, which is projected to grow by 41% in the upcoming period. Key factors contributing to this growth include the burgeoning chemical processing sector, the dominant automotive industry, and the expanding pharmaceuticals sector. Additionally, the increasing use of acetylene in metalworking across Asia Pacific enhances its demand. The automotive industry's growth, particularly in countries like China and India, is driving the need for acetylene in the manufacturing of automotive components and metal processing. Given these expanding sectors, the acetylene market in the Asia Pacific region is poised for significant growth and numerous opportunities shortly.

In the forecast period, the acetylene market in North America is expected to experience the most rapid growth compared to other global regions. This expansion is primarily driven by the booming aircraft and automobile manufacturing sectors. Additionally, the increasing vehicle sales in the United States and Canada, combined with the upsurge in welding and metal fabrication industries, are anticipated to further enhance the growth of the acetylene market in North America within the stipulated timeframe.

COVID-19 Impact Analysis on the Global Acetylene Market:

The COVID-19 pandemic had a significant impact on the acetylene market, primarily used in chemical synthesis, welding, metalworking, and various other applications. Its role in the chemical industry involves producing inorganic compounds and synthesizing chemical components. However, the pandemic-induced lockdowns, scarcity of raw materials, and disruptions in the supply chain led to a decline in these applications. The chemical sector, in particular, experienced setbacks with manufacturing halts, global shutdowns of chemical plants, and logistical disruptions causing a contraction in the global chemical industry. According to the National Bureau of Statistics, China's chemical manufacturing sector witnessed a notable decline of 21%. Consequently, the demand for acetylene, integral to chemical synthesis and intermediate processes in chemical manufacturing, faced a downturn. Similarly, the demand for acetylene in metalworking applications suffered during the pandemic due to suspended manufacturing, remote work, and closures in metal welding and assembly activities, adversely affecting the global acetylene industry's growth prospects amid COVID-19.

Recent Trends and Developments in the Global Acetylene Market:

A joint venture agreement was signed between SCG Chemicals Public Company Limited and Denka Company Limited in Oct 2022 to establish an acetylene black manufacturing business in Rayong province, Thailand. The joint venture is currently in the process of constructing a plant with an annual production capacity of around 11,000 metric tons, and it is scheduled to commence operations by 2025.

Orion Engineered Carbons, in May 2022 unveiled plans to construct a production plant dedicated to acetylene-based conductive additives in the United States. This facility is intended for applications in lithium-ion batteries, high-voltage cables, and other products supporting electrification and the renewable energy industry.

Key Players:

-

Dongxiang Gas

-

Xinlong Group

-

Rexarc

-

BASF

-

SINOPEC

-

Dow

-

Ho Tung Chemicals

-

Linde AG

-

Energas

-

Toho Acetylene

Chapter 1. Acetylene Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Acetylene Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Acetylene Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Acetylene Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Acetylene Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Acetylene Market – By Production

6.1 Introduction/Key Findings

6.2 Calcium Carbide

6.3 Thermal Cracking

6.4 Hydrocarbon Pyrolysis

6.5 Y-O-Y Growth trend Analysis By Production

6.6 Absolute $ Opportunity Analysis By Production, 2024-2030

Chapter 7. Acetylene Market – By Application

7.1 Introduction/Key Findings

7.2 Chemical Synthesis

7.3 Metal Working

7.4 Welding and Cutting

7.5 Carbon Coatings

7.6 Acetylic Alcohols

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Acetylene Market – By End-Use Industry

8.1 Introduction/Key Findings

8.2 Chemical Industry

8.3 Glass and Material Processing Industry

8.4 Aerospace

8.5 Automotive

8.6 Pharmaceuticals

8.7 Others

8.8 Y-O-Y Growth trend Analysis By End-Use Industry

8.9 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 9. Acetylene Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Production

9.1.3 By Application

9.1.4 By End-Use Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Production

9.2.3 By Application

9.2.4 By End-Use Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Production

9.3.3 By Application

9.3.4 By End-Use Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Production

9.4.3 By Application

9.4.4 By End-Use Industry

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Production

9.5.3 By Application

9.5.4 By End-Use Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Acetylene Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

10.1 Dongxiang Gas

10.2 Xinlong Group

10.3 Rexarc

10.4 BASF

10.5 SINOPEC

10.6 Dow

10.7 Ho Tung Chemicals

10.8 Linde AG

10.9 Energas

10.10 Toho Acetylene

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Acetylene Market size is valued at USD 6.6 billion in 2023.

The worldwide Global Acetylene Market growth is estimated to be 4.5% from 2024 to 2030.

The Global Acetylene Market is segmented By Production (Calcium Carbide, Thermal Cracking, and Hydrocarbon Pyrolysis); By Application (Chemical Synthesis, Metal Working, Welding and Cutting, Carbon Coatings, Acetylic Alcohols, and Others); By End-Use Industry (Chemical Industry, Glass and Material Processing Industry, Aerospace, Automotive, Pharmaceuticals and Others).

Future trends in the Global Acetylene Market may revolve around sustainable production methods, increased applications in renewable energy, and advancements in acetylene-based products. Opportunities lie in evolving industry demands and technological innovations.

The COVID-19 pandemic significantly impacted the acetylene market, causing disruptions in chemical synthesis, metalworking, and other applications. Lockdowns, raw material shortages, and supply chain disruptions led to a downturn, especially in the chemical sector, resulting in a global industry contraction.