Account-Based Execution Software Market Size (2024 – 2030)

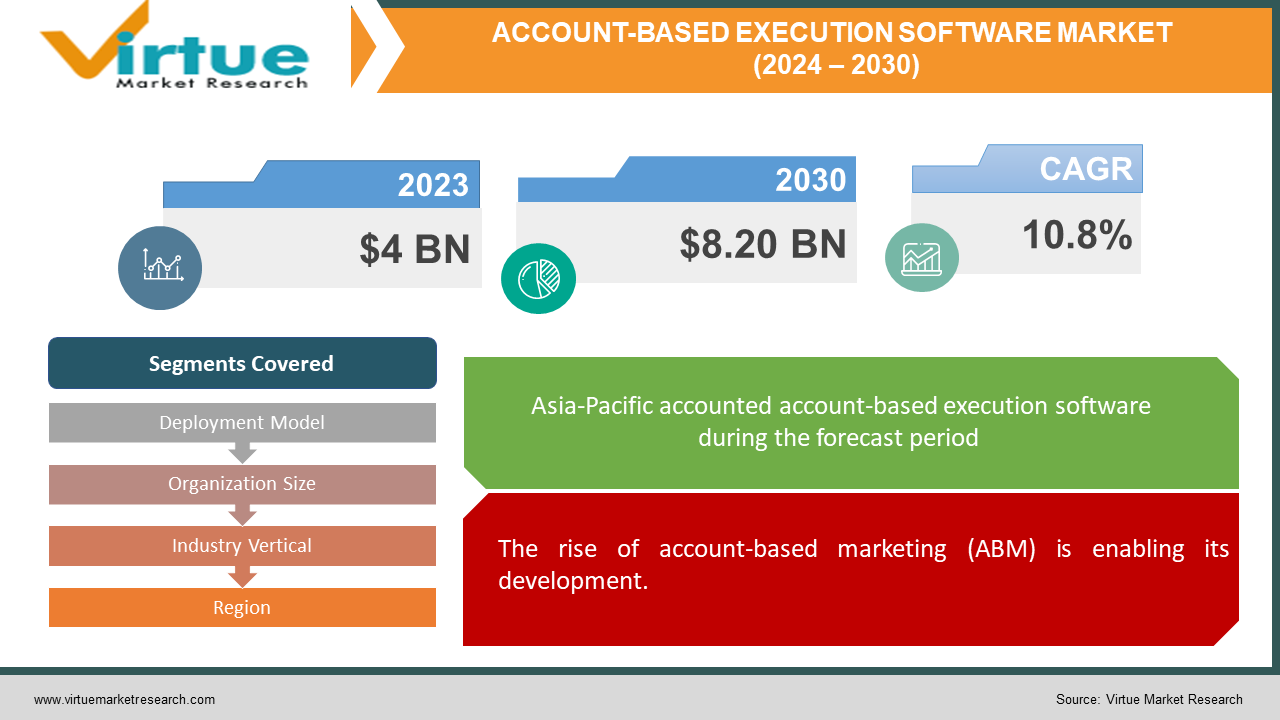

The global account-based execution software market was valued at USD 4 billion in 2023 and will grow at a CAGR of 10.8% from 2024 to 2030. The market is expected to reach USD 8.20 billion by 2030.

Account-based execution software is a comprehensive solution that enables companies to identify, prioritize, and interact with high-value accounts to carry out highly personalized and targeted marketing and sales campaigns. These platforms combine automation tools, multichannel engagement capabilities, and advanced analytics to help organizations coordinate coordinated efforts between marketing and sales teams, which in turn increases revenue and strengthens relationships with key accounts.

Key Market Insights:

94.2% of organizations claim to have an ABM program in place at the moment, as per a report by Usergems. Personalized marketing efforts yield measurable benefits for businesses utilizing account-based execution software. 70% of these organizations claim higher engagement rates and 50% report higher customer retention. ABM is deemed crucial by 61% of B2B marketers for their marketing goal Effective B2B marketers allocate 18% of their budgets to account for acquisition (ABM). Campaign execution delays and operational inefficiencies result from the 25% of firms that report having trouble integrating account-based execution tools with their current CRM systems and marketing automation platforms. To tackle this, companies are standardizing data formats, fields, and naming conventions across CRM.

Account-Based Execution Software Market Drivers:

The rise of account-based marketing (ABM) is enabling its development.

The rise of account-based marketing (ABM) has ignited a demand for account-based execution (ABE) software as companies shift their focus to strategically nurturing high-value accounts. Traditional marketing tactics struggle with the personalized touch and coordinated effort required in ABM. Here's where ABE software steps in. It acts as the conductor for the ABM orchestra, harmonizing the actions of sales and marketing teams. ABE software facilitates this by providing a shared platform for account insights, campaign planning, and multi-channel engagement. It empowers sales reps with real-time engagement data and automates repetitive tasks, allowing them to dedicate more time to building relationships. This level of coordination ensures a seamless experience for targeted accounts, ultimately increasing conversion rates and maximizing the return on investment from ABM initiatives.

Sales & marketing alignment is aiding growth.

Siloed operations between sales and marketing have long been the enemy of effective customer acquisition. ABE software acts as a bridge, fostering a collaborative environment crucial for success in account-based marketing (ABM). It provides a single platform for both teams to access shared data on target accounts, including past interactions, buying committee members, and engagement levels. This fosters a shared understanding of the customer journey, allowing marketing to craft highly personalized content that resonates with specific needs. Sales reps can then leverage these insights to tailor their outreach, ensuring a consistent message across all touchpoints. Additionally, ABE software facilitates real-time communication, enabling sales to provide feedback on marketing campaigns and marketing to adjust messaging based on sales interactions. This collaborative approach ensures a seamless experience for targeted accounts, building trust and ultimately driving higher conversion rates. By eliminating silos and fostering communication, ABE software becomes the secret weapon for successful ABM execution.

Data-driven decision-making is elevating the demand.

In account-based marketing (ABM), data is extremely important. These tools go beyond simple automation, wielding data as a powerful weapon to personalize outreach efforts and measure campaign effectiveness with laser precision. Analyzing a multitude of data points, including website behavior, firmographics, and past interactions, helps identify the specific needs and pain points of key decision-makers within target accounts. This intelligence allows marketing teams to craft highly personalized content like case studies or webinars that resonate deeply with the account's unique challenges. ABE software doesn't stop there. It tracks engagement across various channels, measuring metrics like website visits, email opens, and content downloads. This rich data provides invaluable insights into campaign effectiveness, allowing marketers to optimize messaging and identify the channels that resonate most with target accounts. This data-driven approach ensures that resources are spent wisely, maximizing ROI. Ultimately, by personalizing outreach and measuring campaign effectiveness, ABE software empowers businesses to make data-driven decisions, turning hunches into high-impact ABM strategies.

Global Account-Based Execution Software Market Challenges and Restraints:

Implementation complexity is a major hurdle.

Unlike simpler marketing tools, these solutions necessitate a significant investment of time and resources. First, data integration can be a beast. ABE software relies on a unified view of customer data, which often requires pulling information from various marketing, sales, and customer relationship management (CRM) systems. This process can be complex and requires technical expertise. Secondly, team training is crucial. Sales and marketing teams accustomed to working independently need to adapt to a collaborative workflow. This involves training on the new platform, understanding ABM best practices, and learning how to leverage data for personalized outreach. Finally, don't underestimate the power of change management. Shifting to an ABM strategy requires a cultural shift within the organization. Leaders need to champion the new approach, and clear communication is essential to ensure all teams are on board. For companies with limited resources, these hurdles can be daunting, but the potential ROI of a strategically executed ABM campaign can make the investment worthwhile.

Data quality can be a significant concern.

ABE software is like a precision targeting system; its effectiveness hinges entirely on the quality of its ammunition: data. Inconsistent or incomplete data throws a wrench into the entire ABM strategy. This lack of reliable data makes it impossible to optimize campaigns and improve future efforts. To overcome this challenge, companies need to invest in data cleansing and enrichment initiatives. This ensures a clean and up-to-date customer data foundation, allowing ABE software to truly shine and deliver the personalized outreach and campaign insights crucial for ABM's success.

The high cost of ownership is a major barrier.

The allure of ABE software's potential ROI can be dimmed by its price tag. Unlike free or low-cost marketing tools, ABE solutions come with licensing fees that can vary depending on features, user count, and the specific vendor. These fees can be a significant hurdle for budget-conscious companies. On top of that, ongoing maintenance costs add another layer of expense. These costs cover technical support, software updates, and ensuring the platform integrates smoothly with existing systems. For companies with limited resources, these ongoing expenses can be a strain. However, it's important to consider ABE software as an investment. While the upfront cost might seem hefty, the potential return on investment can be substantial. Through enhanced sales and marketing alignment, data-driven decision-making, and highly targeted campaigns, ABE software may result in higher conversion rates and bigger transactions with high-value clients. The key is to carefully evaluate the potential ROI against the implementation and ongoing costs to determine if ABE software is the right fit for a company's budget and strategic goals.

Global Account-Based Execution Software Market Opportunities:

The market is brimming with opportunities as companies flock to ABM strategies. The rising tide of ABM adoption creates prime ground for ABE software, the engine room for successful ABM execution. By streamlining workflows, fostering sales & marketing collaboration, and enabling data-driven personalization, ABE software empowers companies to maximize their ABM effectiveness. This translates to deeper customer connections, improved conversion rates, and measurable ROI through features like campaign measurement and integrations with marketing automation and CRM tools. As the market matures and user-friendliness improves, ABE software is reaching a wider range of companies, not just large enterprises but mid-market businesses as well. This accessibility, coupled with continuous technological advancements, positions the ABE software market as a key driver in revolutionizing B2B customer acquisition and retention in the ABM era.

ACCOUNT-BASED EXECUTION SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.8% |

|

Segments Covered |

By Deployment Model, Organization Size, Industry Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Terminus, Demandbase, Engagio, Sangram, RollWorks Leadify.ai, 6sense, SalesLoft, SiriusDecisions, Lattice Engines |

Global Account-Based Execution Software Market Segmentation: By Deployment Model

-

On-Premise

-

Cloud-Based

Cloud-based (SaaS) solutions are the largest and fastest-growing deployment mode. Greater scalability is provided by cloud-based solutions, which make it simple for businesses to expand and modify resources to meet their demands. They provide a more user-friendly experience with automatic updates and effortless scaling. This, coupled with a subscription-based model, makes them attractive for mid-market businesses and those seeking to avoid upfront IT infrastructure costs. The trade-off lies in some level of control being surrendered to the cloud vendor.

Global Account-Based Execution Software Market Segmentation: By Organization Size

-

Large-Scale Organization

-

Small and medium-scale organizations

Large-scale organizations hold the largest market share in 2023. They have the requisite funding and contingency. They are frequently distinguished by their vast operations, substantial personnel, and broad market reach. These companies usually have a lot of resources, such as money, technology, and human capital, which helps them to innovate, take on challenging initiatives, and adjust to changing market conditions. These organizations use account-based execution software to massively improve client interaction, automate sales procedures, and plan and execute customized marketing campaigns. The fastest-growing organizations are those that are small and medium-sized. These businesses work with bigger organizations by offering distinctive solutions. These firms are receiving assistance from the government in the form of grants, cash, and different initiatives.

Global Account-Based Execution Software Market Segmentation: By Industry Vertical

-

IT and Telecommunications

-

BFSI

-

Healthcare

-

Retail and E-commerce

-

Manufacturing

-

Media and Entertainment

-

Government and Public Sector

-

Others

The BFSI industry has the largest market share. This frequently involves intricate sales cycles with several stakeholders and decision-makers. BFSI organizations may more successfully target important accounts, personalize messages, and cultivate relationships throughout the sales process with the use of account-based execution software. High-value accounts held by BFSI organizations frequently call for individualized care and focused marketing initiatives. Account-based execution software makes it easier to prioritize accounts, which enables BFSI businesses to concentrate resources on high-potential clients and increase return on investment. The healthcare sector is the fastest-growing. Personalized patient engagement is becoming more and more important to healthcare practitioners to enhance patient happiness and health outcomes. Healthcare organizations may better connect patients and enhance their experiences by customizing outreach and communication efforts to specific patients or patient segments through the use of account-based execution software. Delivering high-quality, economically-effective treatment is the primary emphasis of healthcare organizations as they transition to value-based care models.

Global Account-Based Execution Software Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America reigns supreme with its established ABM practices, tech-savvy culture, and hefty marketing budgets. Europe follows closely, fueled by rising ABM adoption and government support for digital transformation. Asia-Pacific is the fastest-growing market. The fast-paced digital transformation of several industries, the rise in expenditures in marketing and sales technology, and the increased emphasis on customer-centric strategies in the region's emerging economies are some of the drivers driving this expansion. Latin America shows promise, especially for budget-conscious mid-sized businesses, while the Rest of the World offers pockets of opportunity in regions like the Middle East and Africa, though limited IT infrastructure and tighter marketing budgets present hurdles to overcome.

COVID-19 Impact Analysis on the Global Account-Based Execution Software Market

The COVID-19 pandemic caused a ripple effect on the Account-Based Execution (ABE) software market. Initial disruptions were felt as companies re-evaluated budgets and focused on immediate survival. However, the tide soon turned. The shift to remote work and increased focus on digital engagement strategies fueled the demand for tools that streamline ABM execution. ABE software emerged as a hero, enabling businesses to maintain personalized outreach to high-value accounts even amidst physical restrictions. Marketing and sales teams, now geographically dispersed, leveraged ABE platforms for coordinated outreach and data-driven decision-making. This newfound appreciation for the software's ability to navigate challenging market conditions is expected to propel its growth in the post-pandemic era. While the exact market size impact data might be limited, the qualitative shift towards data-driven ABM execution positions ABE software as a valuable asset in the new business landscape.

Latest trends/Developments

The global account-based execution (ABE) software market is undergoing a transformation fueled by cutting-edge features. AI is personalizing outreach like never before, recommending targeted content based on predicted buying behavior. Integrations are shattering data silos, creating a unified tech stack for a complete customer journey view. Marketers are demanding hard numbers, and ABE software is responding with advanced analytics that measure engagement across touchpoints and optimize campaigns for maximum ROI. Accessibility is also on the rise, with user-friendly solutions and subscriptions making these tools attractive not just to large enterprises but also to mid-market businesses. This wave of innovation, coupled with the growing embrace of ABM strategies, positions ABE software as a game-changer in B2B customer acquisition and retention for the digital era.

Key Players:

-

Terminus

-

Demandbase

-

Engagio

-

Sangram

-

RollWorks

-

Leadify.ai

-

6sense

-

SalesLoft

-

SiriusDecisions

-

Lattice Engines

Chapter 1. ACCOUNT-BASED EXECUTION SOFTWARE MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. ACCOUNT-BASED EXECUTION SOFTWARE MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. ACCOUNT-BASED EXECUTION SOFTWARE MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. ACCOUNT-BASED EXECUTION SOFTWARE MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. ACCOUNT-BASED EXECUTION SOFTWARE MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. ACCOUNT-BASED EXECUTION SOFTWARE MARKET – By Deployment Model

6.1 Introduction/Key Findings

6.2 On-Premise

6.3 Cloud-Based

6.4 Y-O-Y Growth trend Analysis By Deployment Model

6.5 Absolute $ Opportunity Analysis By Deployment Model, 2024-2030

Chapter 7. ACCOUNT-BASED EXECUTION SOFTWARE MARKET – By Organization Size

7.1 Introduction/Key Findings

7.2 Large-Scale Organization

7.3 Small and medium-scale organizations

7.4 Y-O-Y Growth trend Analysis By Organization Size

7.5 Absolute $ Opportunity Analysis By Organization Size, 2024-2030

Chapter 8. ACCOUNT-BASED EXECUTION SOFTWARE MARKET – By Industry Vertical

8.1 Introduction/Key Findings

8.2 IT and Telecommunications

8.3 BFSI

8.4 Healthcare

8.5 Retail and E-commerce

8.6 Manufacturing

8.7 Media and Entertainment

8.8 Government and Public Sector

8.9 Others

8.10 Y-O-Y Growth trend Analysis By Industry Vertical

8.11 Absolute $ Opportunity Analysis By Industry Vertical, 2024-2030

Chapter 9. ACCOUNT-BASED EXECUTION SOFTWARE MARKET , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Deployment Model

9.1.3 By Organization Size

9.1.4 By Industry Vertical

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Deployment Model

9.2.3 By Organization Size

9.2.4 By Industry Vertical

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Deployment Model

9.3.3 By Organization Size

9.3.4 By Industry Vertical

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Deployment Model

9.4.3 By Organization Size

9.4.4 By Industry Vertical

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Deployment Model

9.5.3 By Organization Size

9.5.4 By Industry Vertical

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. ACCOUNT-BASED EXECUTION SOFTWARE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Terminus

10.2 Demandbase

10.3 Engagio

10.4 Sangram

10.5 RollWorks

10.6 Leadify.ai

10.7 6sense

10.8 SalesLoft

10.9 SiriusDecisions

10.10 Lattice Engines

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global account-based execution software market was valued at USD 4 billion in 2023 and will grow at a CAGR of 10.8% from 2024 to 2030. The market is expected to reach USD 8.20 billion by 2030.

The rise of account-based marketing (ABM), improving sales & marketing alignment, and data-driven decision-making are the reasons that are driving the market.

Based on the deployment mode, the market is divided into two segments: on-premise and cloud-based.

North America is the most dominant region for the global account-based execution software market.

Terminus, Demandbase, Engagio, Sangram, and RollWorks are the leading players in this market.