Account-Based Analytics Software Market Size (2024 – 2030)

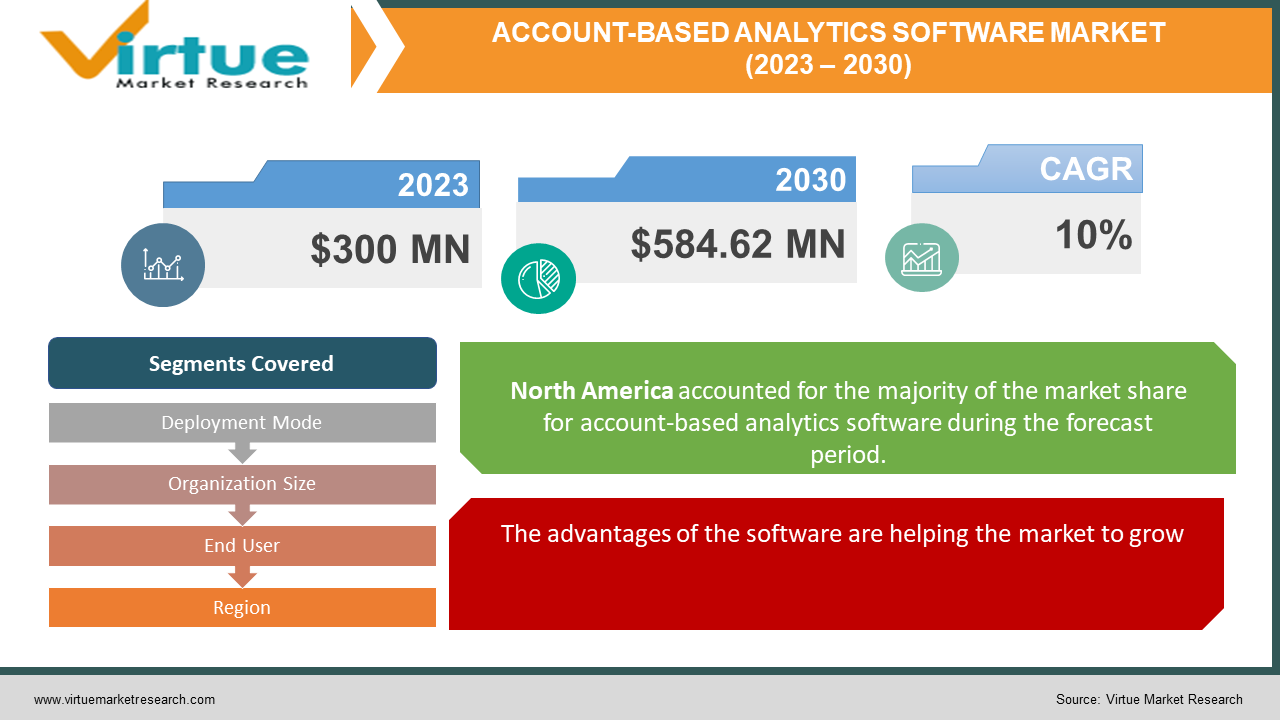

The global account-based analytics software market was valued at USD 300 million and is projected to reach a market size of USD 584.62 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 10%.

The market for account-based analytics started to gain significant prominence in the early 2000s. However, the tools were limited, along with knowledge. Presently, with training, awareness, and expertise, this market has shown a good growth rate. In the future, with ongoing technological advancements and increasing investments, this market will witness tremendous growth. During the forecast period, considerable development is anticipated.

Key Market Insights:

According to research conducted in late 2021, more than one in five business-to-business organizations globally felt that their account-based marketing programs achieved a great return on investment, while 38 percent of responding companies said they generated a reasonable return on investment.

Sixty-one percent of the organizations questioned in 2020 either had a pilot program underway or a complete ABM program in place. Almost a third (27%) considered beginning within the following six months.

According to 97% of marketers, ABM yields a better return on investment (ROI) than alternative marketing tactics.

The worldwide facilities management firm ABM Industries, with its headquarters in New York, declared total assets of over 4.44 billion dollars for the fiscal year 2021.

37% of marketers say it's difficult to secure enough funding for ABM initiatives. To address this measures like education of stakeholders, success stories, and resource reallocation are being implemented.

Account-Based Analytics Software Market Drivers:

The advantages of the software are helping the market to grow.

Account-based analytics software facilitates the analysis of a user's account-based marketing (ABM) strategy by offering account-based outcomes data, such as lead-to-account mapping and the percentage of target accounts achieved. Businesses may benefit from ABM techniques since they enable marketing teams to focus their resources on prospects with a high conversion probability. Marketing teams may assess the effectiveness of their ABM approach and make sure they are focusing on the right prospects by using the solutions this software offers. They utilize this software to help guide their future ABM tactics as well. Furthermore, it is used by marketing teams to gauge the caliber of leads produced by their ABM campaigns. This helps in emphasizing important tasks and making informed decisions.

The rising need for personalization is boosting development.

Personalized marketing and sales tactics are made possible by account-based analytics software, which offers comprehensive insights into individual accounts. As organizations attempt to target specific accounts, or even individual decision-makers inside those accounts, with their messages and strategies, the need for solutions that offer this degree of personalization is growing. The software facilitates the gathering, examination, and distribution of highly customized content and focused engagement strategies. As per Hotspot Blog, 56% of marketers customize material to prospects' unique wants and issues. Businesses may provide more relevant and customized interactions, increasing conversion rates and customer happiness, by getting to know the distinct requirements, preferences, and behaviors of each account.

Account-Based Analytics Software Market Restraints and Challenges:

Data quality, data privacy, associated costs, and lack of training are the main issues that are being experienced by the market.

The quality of data regarding accuracy and consistency can be a potential concern. Inaccurate data and information can cause huge losses for the company. Secondly, ensuring the safety of data is challenging. Leakage or misuse can cause damage and slow down the growth rate. Thirdly, the allocation of investments and other resources is a major barrier for smaller organizations, leading to demotivation. Moreover, integration, maintenance, and other upgrades further add up to the expenses. Furthermore, since this technology is emerging rapidly, proper education and awareness are vital. Staying updated and upskilling regularly can be difficult.

Account-Based Analytics Software Market Opportunities:

Technological advancements have been providing the market with an ample number of possibilities. With the integration of artificial intelligence, this market has achieved breakthroughs. Due to this, speed, accuracy, efficiency, and decision-making processes have been improved. Apart from the Internet of Things (IoT), machine learning and predictive analysis fields have been improving. Secondly, global outreach is helping with the expansion. Its applications are now being used in a wide range of industries, including healthcare, retail, and manufacturing. Furthermore, by focusing on specific accounts, companies can increase their return on investment (ROI). This is leading to an enormous amount of revenue generation. Apart from this, a lot of youngsters are interested in pursuing a research career. Several R&D projects are being undertaken in this regard to broaden human understanding.

ACCOUNT-BASED ANALYTICS SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023- 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10% |

|

Segments Covered |

By Deployment Mode, Organization Size, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Demandbase, Terminus, NextRoll Inc., 6sense, Engagio (Demandbase), InsideView, Madison Logic, True Influence, Albacross, LiveRamp |

Account-Based Analytics Software Market Segmentation: By Deployment Mode

-

Cloud-based

-

On-Premise

Based on the deployment method, the cloud-based industry is both the largest and fastest-growing category in the global account-based analytics software market, with a growth rate exceeding 65%. Features like affordability, scalability, flexibility, consistency, accessibility, automated updates, and user-friendliness all contribute to its flourishing. Additionally, a greater number of prestigious organizations offer cloud-based solutions, leading to greater success.

Account-Based Analytics Software Market Segmentation: By Organization Size

-

Small and Medium-Scale Enterprise

-

Large-Scale Enterprise

Large-scale enterprises are the largest segment of the market in terms of size, accounting for around 55%. This is because of reasons such as more employees, overseeing more complex processes, increasing production, international operations, funding, and other services. With a roughly 45% market share, small and medium-sized businesses are expanding at the fastest rate. The reasons for this include rising investments, improved infrastructure, more accessibility, creative solutions from entrepreneurs, government assistance, and facilities for global operations.

Account-Based Analytics Software Market Segmentation: By End User

-

BFSI

-

Healthcare

-

IT & Telecom

-

Retail

-

Advertising & Media

-

Automotive & Transportation

-

Manufacturing

-

Others

Based on end users, BFSI is the largest in the market. Client satisfaction is extremely important in this industry. These solutions are used for tailoring a specific approach, identifying patterns and behaviors, and making personalized plans. Secondly, BFSI often deals with high-profile accounts. Therefore, this software helps in the creation of strategies to increase sales and investments. Additionally, it helps with the complex decision-making process, offers various educational services, and strengthens the client relationship. With rising adoption and a trend towards digitalization, this market is expected to grow more during the forecast period. However, the healthcare sector is the fastest-growing. There have been significant improvements in this sector over the years. This software is utilized for maintaining and reaching out to healthcare organizations, pharmaceutical companies, hospitals, and other medical professionals. Besides, they need specific and customized approaches to deal with. Moreover, it aids in communication and engagement between patients and doctors. Furthermore, it assists in the creation of educational content about various healthcare applications that might contain information about drugs, treatments, diagnoses, etc.

Account-Based Analytics Software Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America has the largest region-wise sector, accounting for around 35% of the market. This is caused by several things, such as the existence of significant businesses, financial growth, accessibility, facilities, R&D initiatives, technological advancements, a wider labor pool, and the industry's explosive growth. The top two countries on the list are the United States and Canada. Asia-Pacific, with China, India, and Japan at the top, is the region seeing the fastest growth due to its developing economy, rising investments, expansion of developing enterprises, emerging organizations, worldwide operations, R&D activities, and trained workforce. Approximately 24% of the total is made up of this region. Europe is also among the top regions due to a growing AI ecosystem, financing, and research facilities. Countries like the United Kingdom, Germany, and Italy are the topmost.

COVID-19 Impact Analysis on the Global Account-Based Analytics Software Market:

The outbreak of the virus was advantageous to the market. Lockdowns, restricted movement, and social isolation became the new norm. This resulted in a change in favor of remote work and digitalization. To guarantee effective operation management, data security, and other services linked to strategic planning, the adoption of this service order was necessary. Marketing was done in virtual mode. This led to an increase in the usage of this software to customize plans. Besides, customer engagement was prioritized. Account-based analytics software played a crucial role in understanding the needs of customers and thereby maintaining good relationships with them. As per a webinarcare report, in 2020, 57% of marketers used ABM procedures with demand creation strategies, up from 57% in 2019. Post-pandemic, the market continued to grow with rising adoption and advancements.

Latest Trends/ Developments:

Companies in this industry are driven to increase their market share using a variety of tactics, including alliances, investments, and acquisitions. Along with maintaining competitive pricing, businesses are paying much to advance the existing technology as well as finding choices.

Emerging technologies like virtual reality (VR) and augmented reality (AR) are providing opportunities in the area of ABM. Businesses may develop immersive, interactive experiences using VR and AR that can help engage and convince target accounts. The production of virtual product demos is one way that ABM is utilizing VR and AR. This enables businesses to present their goods in an extremely engaging and realistic manner, piquing target customers' curiosity and fostering a sense of trust.

Key Players:

-

Demandbase

-

Terminus

-

NextRoll Inc.

-

6sense

-

Engagio (Demandbase)

-

InsideView

-

Madison Logic

-

True Influence

-

Albacross

-

LiveRamp

In March 2021, the top account engagement platform, 6sense, revealed that it had secured $125 million at a $2.1 billion value in Series D fundraising. Sapphire Ventures and Tiger Global participated in the round, which was headed by D1 Capital Partners. Insight Partners, an existing investor, took part as well. Sales and marketing teams may identify target accounts and connect with them on any channel at the appropriate moment with a relevant message because of this design.

In February 2021, the largest and fastest-growing sales engagement platform, Outreach, partnered with Terminus, a well-known and industry-leading account-based marketing platform, to offer product integration. Through this connectivity, the marketing and sales departments will be able to help the outbound and sales teams more effectively.

In June 2020, the top B2B account-based engagement platform, Engagio, was bought by Demandbase, the pioneer in account-based marketing (ABM). Demandbase's stronghold in the ABM industry is strengthened by the purchase, which also puts it in a position to overtake other B2B marketing platform providers. Additionally, Demandbase's revenue growth from $100 million to its next imminent milestone of $250 million would be accelerated thanks to the purchase.

Chapter 1. Account-Based Analytics Software – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Account-Based Analytics Software – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Account-Based Analytics Software – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Account-Based Analytics Software Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Account-Based Analytics Software – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Account-Based Analytics Software – By Deployment Mode

6.1 Introduction/Key Findings

6.2 Cloud-based

6.3 On-Premise

6.4 Y-O-Y Growth trend Analysis By Deployment Mode

6.5 Absolute $ Opportunity Analysis By Deployment Mode, 2024-2030

Chapter 7. Account-Based Analytics Software – By Organization Size

7.1 Introduction/Key Findings

7.2 Small and Medium-Scale Enterprise

7.3 Large-Scale Enterprise

7.4 Y-O-Y Growth trend Analysis By Organization Size

7.5 Absolute $ Opportunity Analysis By Organization Size, 2024-2030

Chapter 8. Account-Based Analytics Software – By End User

8.1 Introduction/Key Findings

8.2 BFSI

8.3 Healthcare

8.4 IT & Telecom

8.5 Retail

8.6 Advertising & Media

8.7 Automotive & Transportation

8.8 Manufacturing

8.9 Others

8.10 Y-O-Y Growth trend Analysis By End User

8.11 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 9. Account-Based Analytics Software , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Organization Size

9.1.3 By End User

9.1.4 By Deployment Mode

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Organization Size

9.2.3 By End User

9.2.4 By Deployment Mode

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Organization Size

9.3.3 By End User

9.3.4 By Deployment Mode

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Organization Size

9.4.3 By End User

9.4.4 By Deployment Mode

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Organization Size

9.5.3 By End User

9.5.4 By Deployment Mode

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Account-Based Analytics Software – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Demandbase

10.2 Terminus

10.3 NextRoll Inc.

10.4 6sense

10.5 Engagio (Demandbase)

10.6 InsideView

10.7 Madison Logic

10.8 True Influence

10.9 Albacross

10.10 LiveRamp

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Account-Based Analytics Software Market was valued at USD 300 million and is projected to reach a market size of USD 584.62 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10%.

The advantages of the software and the rising need for personalization are the main factors propelling the Global Account-Based Analytics Software Market.

Based on End Users, the Global Account-Based Analytics Software Market is segmented into BFSI, Healthcare, IT and telecom, Retail, Advertising and media, Automotive and transportation, Manufacturing, and Others.

North America is the most dominant region for the Global Account-Based Analytics Software Market.

Demandbase, Terminus, and NextRoll Inc. are the key players operating in the Global Account-Based Analytics Software Market.