Global Abrasive Tapes Market Size (2024 – 2030)

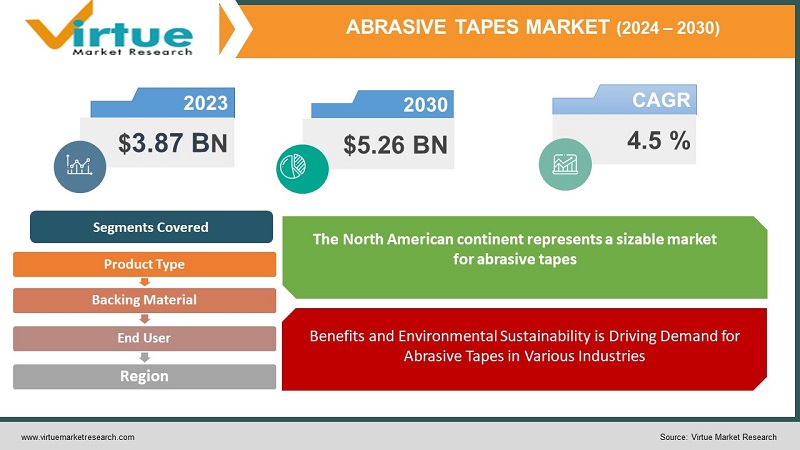

The Global Abrasive Tapes Market was valued at USD 3.87 Billion and is projected to reach a market size of USD 5.26 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.5%.

The market for tapes coated with abrasive substances including Aluminum oxide, silicon carbide, and diamond, among others, is referred to as the abrasive tapes market. In a variety of industries, including the automotive, building, electronics, and woodworking, among others, these tapes are typically utilized for grinding, sanding, and polishing applications. Abrasive tapes are employed in a variety of tasks, including surface preparation, deburring, and finishing. They come in a variety of forms, including film-backed tapes, cloth-backed tapes, and PSA (pressure-sensitive adhesive) tapes, among others. Abrasive tapes are chosen over conventional abrasive procedures because they are more efficient, easier to handle, and less expensive.

The market for new abrasive tapes is being driven by an increase in demand for advanced abrasive tapes with improved features and qualities. These brand-new abrasive tapes have been created to specifically full-fill the demands of end-use sectors like automotive, aerospace, building, and electronics. The creation of ecologically friendly abrasive tapes is one of the key developments in the market for new abrasive tapes. These tapes are made with environmentally friendly ingredients and manufacturing techniques that reduce the effects of both production and disposal on the environment.

Global Abrasive Tapes Market Drivers:

End-Use Industry Demand and Technological Advancements Propel Growth of Abrasive Tapes Market:

- In a wide range of final-use industries, including automotive, construction, electronics, and aerospace, among others, abrasive tapes are frequently utilized. The market for abrasive tapes is expanding as a result of the escalating demand from these sectors. Modern abrasive tapes have improved qualities and features as a result of technological improvements. The market is expanding as a result of these tapes' improved performance, enhanced efficiency, and lower production costs.

Benefits and Environmental Sustainability is Driving Demand for Abrasive Tapes in Various Industries:

- Abrasive tapes have a number of advantages, including better finishing quality, increased output, and faster processing. The demand for abrasive tapes in numerous industries is being driven by the increased knowledge of these advantages. Demand for ecologically friendly abrasive tapes that are produced using sustainable materials and methods is rising as environmental consciousness grows.

Global Abrasive Tapes Market Challenges:

Price fluctuations may impact the cost of the raw materials needed to make abrasive tapes, including abrasives, adhesives, and backing materials. The market's growth may be constrained by this volatility, which may also have an impact on manufacturers' profitability. The market for abrasive tapes is extremely competitive, with both long-standing manufacturers and recent newcomers. The market’s expansion and manufacturing profitability may be constrained by this rivalry. Abrasive tapes' effectiveness and performance depend greatly on their quality. The inconsistent performance brought on by poor quality control might result in unhappy customers and a decline in market share. The market for abrasive tapes is governed by a number of laws and norms, including those pertaining to public safety and the environment. Sandpapers, grinding wheels, and polishing pads are some of the substitute items that compete with abrasive tapes. These alternatives may restrict the market for abrasive tapes from expanding.

Global Abrasive Tapes Market Opportunities:

The market for abrasive tapes is experiencing significant growth potential because of the industrialization and infrastructure development in developing nations like China, India, and Brazil. The market is expanding as a result of the rising demand from these economies. New growth opportunities are being produced by the abrasive tape industry's ongoing technological advancements. The use of abrasive tapes is growing across a range of end-use sectors due to the development of more modern versions with improved features and qualities.

COVID-19 Impact on the Global Abrasive Tapes Market:

Due to trade restrictions, logistics, and transportation problems, and the closure of manufacturing facilities, the worldwide supply chains for abrasive tapes have been disrupted. The disruption has caused delays in the delivery of both finished goods and raw materials, which has an impact on firms' output and financial success. Reduced demand from end-use industries including automotive, construction, and electronics are just a few examples of how the pandemic has affected these sectors. Government-imposed lockdowns and restrictions have resulted in the closure of production facilities and decreased consumer spending, which has decreased the market for abrasive tapes.

Global Abrasive Tapes Market Recent Developments:

- In October 2022, Saint-Gobain launched a new range of Norton BlazeX F970 fiber discs and flap discs for grinding and finishing operations. The new products are designed for use in the automotive and aerospace industries and provide improved performance and productivity.

• In January 2021, Avery Dennison Corporation introduced a new range of 3M Diamond Grade DG³ Reflective sheeting, which is designed for use in road signs and traffic control devices. The new product features improved retro-reflectivity and durability.

• In August 2022, Tesa SE introduced a new range of tesa 64958 ultra-thin adhesive tapes for electronic applications. The new products are designed for use in smartphones, tablets, and other electronic devices and provide improved bonding strength and durability.

ABRASIVE TAPES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Product Type, Backing Material, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Elantas GmbH (Germany), Axalta Coating Systems (the U.S.), Von Roll Holdings AG (Switzerland), Hitachi Chemicals Company Ltd. (Japan), 3M Company (the U.S.), and Kyocera Corporation (Japan) |

Global Abrasive Tapes Market Segmentation:

Global Abrasive Tapes Market Segmentation: By Product Type

• Aluminum oxide

• Silicon Carbide

• Zirconia Alumina

• Ceramic Alumina

• Others

Due to their adaptability and affordability, Aluminum oxide abrasive tapes are the most popular segment of abrasive tapes and have many different uses, including in the metalworking, woodworking, and automotive sectors. For applications that call for a more robust abrasive, silicon carbide abrasive tapes are employed. They are frequently employed in the grinding and polishing of tough metals in the aerospace and automotive industries. High-performance abrasive tapes made of zirconia and alumina have better durability and a longer lifespan than other varieties of abrasive tape. They are frequently employed in demanding fields like aerospace and metal manufacturing.

Global Abrasive Tapes Market Segmentation: By Backing Materials

- Cloth

- Paper

- Film

- Foam

The flexible and long-lasting fabric used to make cloth-backed abrasive tapes offer exceptional excellence and flexibility for usage on curved surfaces. These tapes are often employed in heavy-duty applications such as metalworking, woodworking, and other tasks which require exceptional strength and longevity. The lightweight, flexible paper used to make paper-backed abrasive tapes offers good conformability for use on both flat and curved surfaces. These tapes are frequently largely employed for sanding and finishing tasks on surfaces such as wood, paint, and others. Also, the thin, flexible film used to create film-backed abrasive tapes offers great strength and flexibility for use on both flat and curved finished surfaces. These tapes are frequently used on metal, plastic, and other surfaces for delicate sanding and finishing tasks.

Global Abrasive Tapes Market Segmentation: By End-User

• Automotive

• Construction

• Aerospace

• Electronics

• Metalworking

• Woodworking

• Others

One of the biggest end-users of abrasive tapes is the automotive industry, which uses them for a variety of tasks such as surface preparation, paint removal, and polishing. The need for abrasive tapes in the automotive sector is anticipated to rise as a result of rising vehicle production and the use of lightweight components like Aluminum and carbon fibre composites. Abrasive tapes are used in the construction sector for a variety of tasks such as surface preparation, cleaning, and finishing. In the upcoming years, it is anticipated that the demand for abrasive tapes would be driven by the expanding construction sector in developing nations like China and India. Abrasive tapes are used in the aerospace sector for a variety of tasks such as surface preparation, cleaning, and finishing.

Global Abrasive Tapes Market Segmentation: By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Latin America

Due to the prevalence of numerous industries like the automobile, aerospace, and electronics, the North American continent represents a sizable market for abrasive tapes. The established economy of the area and improvements in technology fuel the market for abrasive tapes. Due to the prevalence of numerous industries like automotive, construction, and metallurgy, the European region is also a sizable market for abrasive tapes. The market for eco-friendly abrasive tapes is anticipated to increase as a result of the region's focus on sustainable development and rising public awareness of the advantages of abrasive tapes. The market for abrasive tapes is expanding at the quickest rate in the Asia-Pacific region as a result of the rapid industrialization and urbanization of nations like China, India, and Japan.

Global Abrasive Tapes Market Key Players:

- 3M Company

- Saint-Gobain

- Avery Dennison Corporation

- Scapa Group PLC

- Nitto Denko Corporation

- tesa SE

- Lohmann GmbH & Co. KG

- Shurtape Technologies LLC

- Henkel AG & Co. KGaA

- Adhesives Research Inc.

Chapter 1. ABRASIVE TAPES MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. ABRASIVE TAPES MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. ABRASIVE TAPES MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. ABRASIVE TAPES MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. ABRASIVE TAPES MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. ABRASIVE TAPES MARKET – By Product Type

6.1. Aluminum oxide

6.2. Silicon Carbide

6.3. Zirconia Alumina

6.4. Ceramic Alumina

6.5. Others

Chapter 7. ABRASIVE TAPES MARKET – By Backing Materials

7.1 Cloth

7.2. Paper

7.3. Film

7.4. Foam

Chapter 8. ABRASIVE TAPES MARKET – By End User

8.1. Automotive

8.2. Construction

8.3. Aerospace

8.4. Electronics

8.5. Metalworking

8.6. Woodworking

8.7. Others

Chapter 9. ABRASIVE TAPES MARKET – By Region

9.1. North America

9.2. Europe

9.3.The Asia Pacific

9.4.Latin America

9.5. Middle-East and Africa

Chapter 10. ABRASIVE TAPES MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. 3M Company

10.2. Saint-Gobain

10.3. Avery Dennison Corporation

10.4. Scapa Group PLC

10.5. Nitto Denko Corporation

10.6. tesa SE

10.7. Lohmann GmbH & Co. KG

10.8. Shurtape Technologies LLC

10.9. Henkel AG & Co. KGaA

10.10. Adhesives Research Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Abrasive Tapes Market was valued at USD 3.87 Billion and is projected to reach a market size of USD 5.26 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.5%.

The Global Abrasive Tapes Market is majorly driven by the growing demand from various end-use industries, Technological advancements, and Growing awareness regarding the benefits of abrasive tapes.

The Segments under the Global Abrasive Tapes Market by the Backing Materials are Cloth, Paper, Film, and Foam.

China, Japan, South Korea, Singapore, and India are the most dominating countries in the Asia Pacific region for the Global Abrasive Tapes Market.

3M Company, Saint-Gobain and Avery Dennison Corporation are the three major leading players in the Global Abrasive Tapes Market.