A2 Milk Market Size (2024 – 2030)

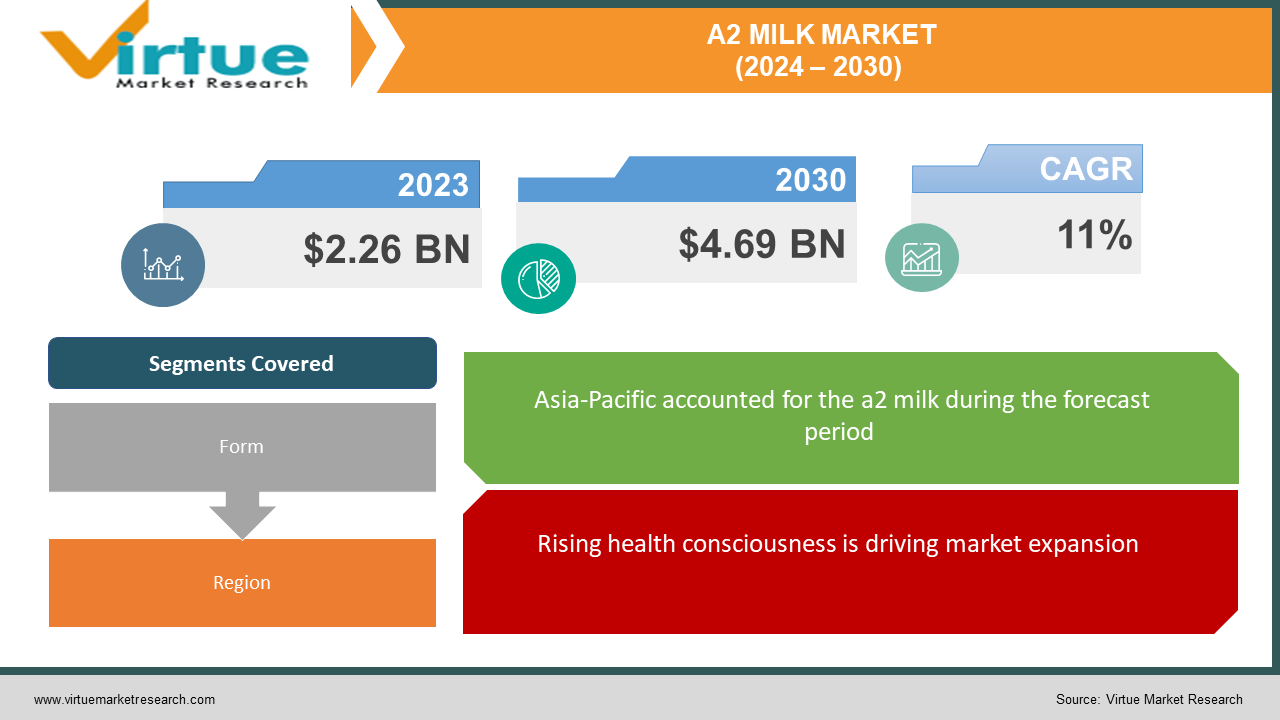

The global A2 milk market was valued at $2.26 billion in 2023 and is projected to be $4.69 billion by 2030, exhibiting a CAGR of 11% during 2024–2030.

A2 milk is a variety of cow's milk that primarily contains the A2 beta-casein protein instead of the more common A1 beta-casein. Some people who experience discomfort after consuming regular milk report better digestion with A2 milk. This is because A1 beta-casein breaks down into a peptide fragment called BCM-7, which some research suggests may trigger digestive issues in sensitive individuals. While research is ongoing, some studies suggest potential health benefits of A2 milk, such as reduced risk of type 1 diabetes, heart disease, and autism spectrum disorder. However, more research is needed to confirm these findings.

Key Market Insights:

The A2 milk market has immense potential. It is estimated to reach $4.69 billion by 2030. It is driven by health-conscious consumers and lactose-intolerant individuals seeking easier digestion. Asia Pacific leads the charge, while diversification into cheese, yogurt, and formula fuels the fire. But there are a lot of challenges as well. Higher prices and production limitations require innovative solutions like sustainable practices and alternative A2 protein sources. With increased competition and personalized nutrition being the top priority, this market is anticipated to reach new heights during the forecast period.

A2 Milk Market Drivers:

Rising health consciousness is driving market expansion.

Consumers are increasingly looking for healthier food and beverage options, and A2 milk is perceived as a more natural and digestible alternative to regular milk. Some studies suggest that A2 milk may be easier to digest for people with lactose intolerance and may also offer other health benefits, such as reduced inflammation and improved gut health. Compared to other milk varieties, A2 milk has 12% more protein, 25% more vitamin A, 15% more calcium, 33% more vitamin D, and 30% more healthy fat. It is frequently used in baby formula as well.

Increasing Lactose intolerance cases are driving the market

Lactose intolerance is a common condition in which people have difficulty digesting lactose, the sugar found in milk. A2 milk contains a different type of beta-casein protein than regular milk, which some people find easier to digest. This has led to a growing demand for A2 milk from people with lactose intolerance.

Product diversification is contributing to market success.

The A2 milk market is exploding with innovative products, transforming it from a niche to a diverse haven for health-conscious foodies. Consumers can enjoy enjoying guilt-free scoops of A2 ice cream, tart A2 yogurt parfaits filled with berries, or creamy A2 cheese on their pizza. All these are made with the readily digested A2 protein. This promotes the idea of inclusiveness. Parents looking for milder choices for their infants can trust A2 infant formula, and those who are lactose intolerant can enjoy A2 cheese spreads on breakfasts like toast.

Consumers are increasingly concerned about the environmental impact of their food choices.

Concerns about how their dietary choices may affect the environment are growing among consumers. Dairy farming can be a major source of greenhouse gas emissions. However, some A2 milk producers are adopting more sustainable practices, such as using grass-fed cows and renewable energy sources. This is helping to make A2 milk a more attractive option for environmentally conscious consumers.

A2 Milk Market Challenges and Restraints:

A2 milk is typically more expensive than regular milk

One of the major barriers to A2 milk is its price tag. Regular milk flows freely from well-established breeds like Holsteins, churning out gallons with each moo. A2 milk, on the other hand, demands specific cow breeds like Gir and Sahiwals, whose yields are a mere fraction. Additionally, rigorous testing to ensure A2 purity, involving DNA analysis and beta-casein protein checks, is involved. This adds more charges when compared to the routine sampling of regular milk. This price premium can affect the market, especially in regions where budgets are tight. Cracking this affordability nut is crucial for A2 Milk to reach a wider audience. Innovating breeding practices, streamlining testing protocols, and exploring alternative A2 protein sources are the potential strategies that the companies in this market can implement to brew a more accessible future for this promising milk.

Limited Supply of A2 Milk

Unlike the ubiquitous Holstein, A2-producing breeds like Guernseys and Jerseys are precious rarities. This scarcity creates a delicate balance between supply and demand. This can affect the accessibility and availability of distribution channels like supermarkets, hypermarkets, and online retail. Regions with lower A2 cow populations, like Southeast Asia, face this milk drought especially acutely. This can significantly affect the potential damage. To tackle this, investing in breeding programs that nurture A2 cow populations is a crucial step. Vast meadows could be teemed with contented A2 bovines to provide their unique milk. Additionally, exploring alternative A2 protein sources, like plant-based options, could be another ideal alternative.

Many consumers are still unaware of its advantages, which hinder growth.

Due to insufficient awareness and lack of knowledge, the health benefits of this milk are not popular. Pros like easier digestion for lactose-sensitive folks and reduced inflammation are possible because of this. Besides, a lower percentage of the population might be skeptical about the use of this milk due to assumptions and prejudice. This can create hurdles while marketing the products. Education is extremely vital to eradicating this. Building brand awareness and highlighting the benefits is necessary. Furthermore, scientific evidence, presented clearly and concisely, can be another major milestone. Highlighting the research behind A2's potential can unlock many possibilities for the industry.

Market Opportunities:

The A2 milk market has an ample number of opportunities. With an elevation in health consciousness and a lactose-intolerant population, consumers are on the lookout for other options that have a rich nutritional profile. Diversification beyond plain milk can help with the augmentation. This can include frothy lattes, creamy cheeses, and guilt-free ice cream, which can broaden its appeal. Sustainable practices can win over eco-conscious consumers, while technological advancements in testing and breeding could unlock a more affordable future. Building brand awareness and demystifying the A2 difference with clear education will bridge the knowledge gap. Apart from this, cost-effective products, nurturing A2 cow populations, and conducting research and developmental activities about alternative protein sources can be a boon for market growth.

A2 MILK MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11% |

|

Segments Covered |

By Form, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Fonterra, The a2 Milk Company, Nestlé, Amul, Ripley Farms , China Mengniu Dairy Company Limitedm Yili Group, Synlait Milk Limited, Freedom Foods Group Limited, Dairy Farmers of America, Inc. |

A2 Milk Market Segmentation: By Form

-

Liquid milk

-

Powdered milk

-

Cheese, yogurt, and ice cream

-

Infant formula

Liquid milk is the largest category based on form in this market. The primary reason for this is its easy availability. Most of the distribution channels have this product, making accessibility simpler. Additionally, this product has a lot of flavors. This diversity attracts more customers, resulting in better profits. Powdered milk, a shelf-life champion, caters to regions with limited chill, while playful flavored milk and creamy yogurt, cheese, and even A2 ice cream tempt taste buds and attract a broader audience. However, infant formula is the fastest-growing segment. A2 infant formula is a popular alternative for lactose-sensitive babies, and with an increasing number of infants suffering from this issue, the demand for this category is rising tremendously. During the forecast period, this segment is predicted to expand. Meanwhile, in the slowest lane, buttermilk with a tangy charm is being appreciated. Marketing strategies are being given prominence for the growth of this segment.

A2 Milk Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Based on region, Asia-Pacific has the largest market, with a share of around 45%. This is because of the area's vast population. This calls for the need for bulk manufacturing and a variety of options. Secondly, urbanization has been another major factor. With a rising middle class and an increasing disposable income, people can afford better options. This region is fueling a 15% CAGR, with liquid milk leading the charge due to its familiarity and affordability. Furthermore, this area has prominent key players. These companies have a global presence, and therefore better profits are achieved. A few of them are The a2 Milk Company Limited, Nestlé S.A., Fonterra Co-operative Group Limited, China Mengniu Dairy Company Limited, Yili Group, and Synlait Milk Limited. China, with its lactose-intolerant population, particularly loves A2 yogurt and infant formula. This country is growing at a CAGR of 20%. Apart from China, countries like India, Japan, and South Korea are at the top. North America is the fastest-growing region, growing at a rate of 7%, with flavored A2 milk being at the top, appealing to health-conscious millennials. The main reason for this is the increasing number of people with lactose intolerance. This has increased the demand for A2 milk, helping with the expansion. Secondly, this region has good economic stability. This helps with better investments and funds for innovations and other diversifications. A lot of R&D activities are being conducted to gain more scientific evidence, alternatives, and other health benefits. Europe is growing at a steady CAGR of 8%, favoring premium cheese and milk powder for their long shelf life, perfect for remote regions. Africa shows a promising 5% CAGR, with powdered milk dominating due to limited refrigeration access. South America is developing slowly, growing at a CAGR of 4%, favoring liquid milk but showing potential for infant formula. While each region has its growth, liquid milk remains the most popular category, followed by the rise of diverse A2 products reflecting local preferences and addressing specific needs.

COVID-19 Impact Analysis on the A2 Milk Market

Panic buying and restaurant closures initially hit A2 milk sales, particularly in liquid milk, which relies heavily on on-the-go consumption. However, the overall impact was milder than expected. Powdered A2 milk, with its long shelf life and convenience, saw a surge in demand, especially in regions with limited refrigeration access. This highlights the market's adaptability and ability to cater to changing consumer needs. As health concerns heightened, A2 milk's perceived digestive benefits and potential immune-boosting properties resonated with consumers, leading to increased demand for products like yogurt and infant formula.

Latest trends/Developments

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Companies are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

The A2 milk market is churning with exciting trends! Beyond the classic carton, A2 is infiltrating every corner of the dairy aisle, with plant-based A2 alternatives emerging for lactose-sensitive and environmentally-conscious consumers. Sustainable practices are being emphasized, with A2 farms embracing grass-fed cows and renewable energy. Technological innovations are accelerating the growth rate, with AI-powered breeding programs optimizing A2 cow populations and blockchain tracing ensuring milk purity. And personalized nutrition is raising the bar, with A2 milk customized to individual gut microbiomes for targeted health benefits.

Key Players:

-

Fonterra

-

The a2 Milk Company

-

Nestlé

-

Amul

-

Ripley Farms

-

China Mengniu Dairy Company Limited

-

Yili Group

-

Synlait Milk Limited

-

Freedom Foods Group Limited

-

Dairy Farmers of America, Inc.

Chapter 1. A2 Milk Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. A2 Milk Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. A2 Milk Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. A2 Milk Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. A2 Milk Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. A2 Milk Market – By Form

6.1 Introduction/Key Findings

6.2 Liquid milk

6.3 Powdered milk

6.4 Cheese, yogurt, and ice cream

6.5 Infant formula

6.6 Y-O-Y Growth trend Analysis By Form

6.7 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 7. A2 Milk Market, By Geography – Market Size, Forecast, Trends & Insights

7.1 North America

7.1.1 By Country

7.1.1.1 U.S.A.

7.1.1.2 Canada

7.1.1.3 Mexico

7.1.2 By Form

7.1.3 Countries & Segments - Market Attractiveness Analysis

7.2 Europe

7.2.1 By Country

7.2.1.1 U.K

7.2.1.2 Germany

7.2.1.3 France

7.2.1.4 Italy

7.2.1.5 Spain

7.2.1.6 Rest of Europe

7.2.2 By Form

7.2.3 Countries & Segments - Market Attractiveness Analysis

7.3 Asia Pacific

7.3.1 By Country

7.3.1.1 China

7.3.1.2 Japan

7.3.1.3 South Korea

7.3.1.4 India

7.3.1.5 Australia & New Zealand

7.3.1.6 Rest of Asia-Pacific

7.3.2 By Form

7.3.3 Countries & Segments - Market Attractiveness Analysis

7.4 South America

7.4.1 By Country

7.4.1.1 Brazil

7.4.1.2 Argentina

7.4.1.3 Colombia

7.4.1.4 Chile

7.4.1.5 Rest of South America

7.4.2 By Form

7.4.3 Countries & Segments - Market Attractiveness Analysis

7.5 Middle East & Africa

7.5.1 By Country

7.5.1.1 United Arab Emirates (UAE)

7.5.1.2 Saudi Arabia

7.5.1.3 Qatar

7.5.1.4 Israel

7.5.1.5 South Africa

7.5.1.6 Nigeria

7.5.1.7 Kenya

7.5.1.8 Egypt

7.5.1.9 Rest of MEA

7.5.2 By Form

7.5.3 Countries & Segments - Market Attractiveness Analysis

Chapter 8. A2 Milk Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 Fonterra

8.2 The a2 Milk Company

8.3 Nestlé

8.4 Amul

8.5 Ripley Farms

8.6 China Mengniu Dairy Company Limited

8.7 Yili Group

8.8 Synlait Milk Limited

8.9 Freedom Foods Group Limited

8.10 Dairy Farmers of America, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global A2 milk market was valued at $2.26 billion in 2023 and is projected to be $4.69 billion by 2030, exhibiting a CAGR of 11% during 2024–2030.

Rising health consciousness, product diversification, increasing lactose intolerance, and sustainability concerns are the reasons that are driving the market.

Based on form, the A2 milk market is divided into four segments: liquid milk, powdered milk, yogurt and cheese ice cream, and infant formula.

Asia-Pacific is the most dominant region for the luxury vehicle market.

The a2 Milk Company, Fonterra, Nestlé, Amul, and Ripley Farms are the prominent players in this market.