Global Embedded Payments Market Industry Size (2024 – 2030)

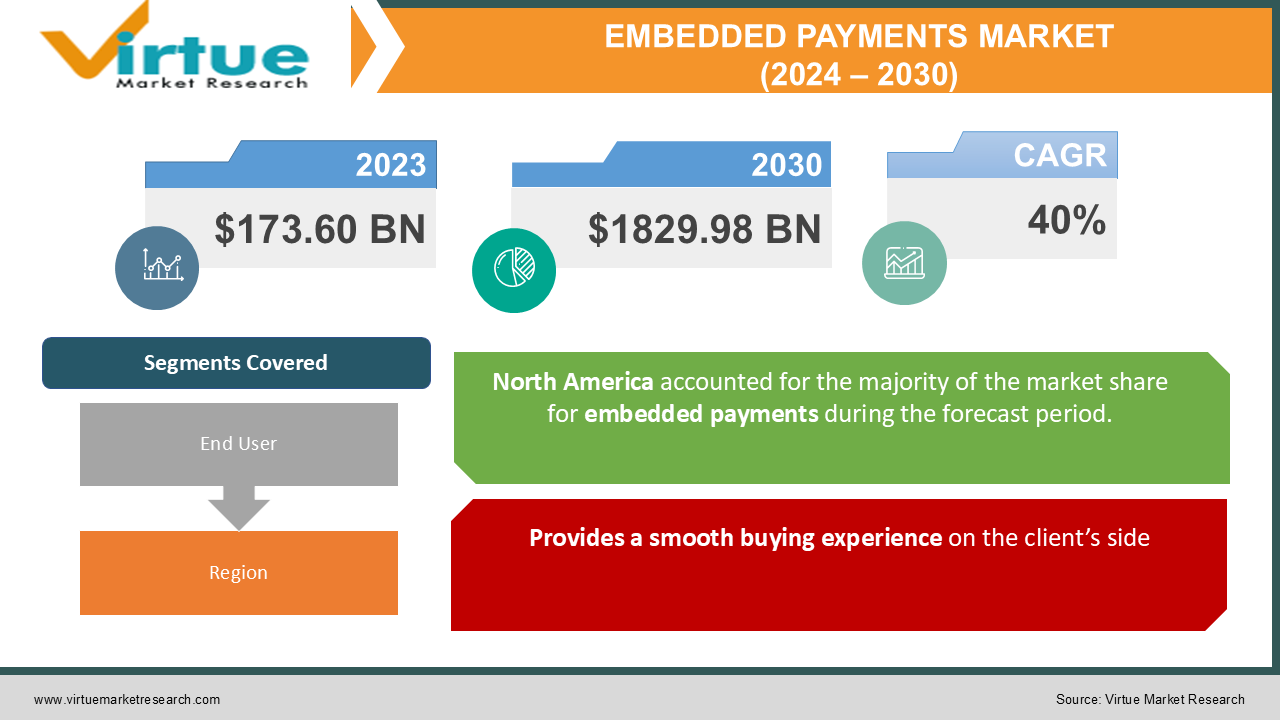

The Global Embedded Payments Market was valued at USD 173.60 billion in 2023 and is projected to reach a market size of USD 1829.98 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 40%.

Industry Overview

While digital B2C payment friction has decreased dramatically in recent decades, B2B payments have remained persistently high-friction due to legacy banking system processes and check-writing habits, as well as the lack of options to pay as a recipient chooses until recently. The epidemic has hastened digital change, expanding the market for modern payment providers like Plastiq, who are enabling new kinds of payment flexibility and bridging gaps in the legacy payment ecosystem. Through a set of bank-grade, secure Application Programming Interfaces, these new methods enable platforms to increase the B2B payment choices they offer to small and mid-sized customers (APIs). Businesses can now pay their suppliers using any payment method they want, while the supplier can get paid in the manner he or she wants.

Smarter solutions that minimize friction, eliminate guessing, and automate chores for business owners are critical for small and mid-sized enterprises. These smarter, automated features are best supplied through a small company owner's preferred commerce or financial platform, such as Shopify, QuickBooks, ADP, or others, rather than asking customers to access services directly through their bank's website. Smart payment solutions offered via easy and efficient APIs enable any provider (eCommerce, accounting, payroll, etc.) to seamlessly offer these payment capabilities to their SMB customers.

Impact of Covid-19 on the Industry

The COVID-19 pandemic has brought attention to the need for digital payments, and the sector is gearing up for a decade of massive expansion. Following the 2008 recession, the fintech business exploded, and numerous strong hitters emerged at the start of the decade, including Stripe, Square, Venmo, and others. Advances in radio-frequency identification (RFID), card chips, and mobile apps have propelled digital payments forward in the recent decade. Verticals that have been slow to embrace, such as construction, manufacturing, wholesalers, and education, are on the verge of a payment revolution.

The COVID-19 pandemic has highlighted the need for digital payments, and the industry is poised for a decade of rapid growth. Following the 2008 financial crisis, the fintech industry boomed, with a slew of big names like Stripe, Square, Venmo, and others launching at the start of the decade. In reality, advancements in radio-frequency identification (RFID), card chips, and mobile apps have accelerated the use of digital payments in the last decade. Construction, manufacturing, wholesaling, and education are among the industries that have been sluggish to adopt digital payments.

Market Drivers

Embedded Payments: Easing Customer Experience, Challenging Business Transformation

While embedded payments make processes easier for customers, they, like other new technologies, take time for organizations to learn and overcome. Despite the high cost of check payments ($22 per check, according to Goldman Sachs), 60 percent of businesses still use checks due to legacy processes. Other problems could include a lack of infrastructure and the necessity for partnerships, in addition to the challenges of going beyond these established processes.

Less hassle of compliance and operations

Platforms and marketplaces that adopt the technology will see benefits such as seamless integration of new payment options, reduced compliance and operations costs, the ability for SMBs to use existing cards on hand to extend working capital, and easy onboarding with the ability to set up the services in weeks. SMBs may simply pay their vendors, suppliers, and manufacturers by seamlessly syncing payment transactions with accounting systems, in addition to minimizing merchant costs. They can also free up money by paying suppliers with a credit card and deferring the payment of a bill.

Provides a smooth buying experience on the client’s side

Customers demand a pleasant purchase experience from e-commerce platforms. Embedded payment may be the answer to this ever-increasing client demand. This also allows businesses to give clients value-added perks and boost customer loyalty. As a result, the publisher anticipates rapid market expansion over the next four to eight quarters.

Market Restraints

The industry is still in its initial stages thus it is not getting the required attention

In most of the world's major economies, including Egypt and the United Arab Emirates, the embedded payments industry is still in its infancy. However, a surge in the number of start-ups in the embedded payment sector, fueled by the combined efforts of governments and other stakeholders, has improved payment systems in the last six to eight quarters.

EMBEDED PAYMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

40% |

|

Segments Covered |

By End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

|

This research report on the global Embedded Payments Market has been segmented and sub-segmented based on end-user, and region.

Global Embedded Payment Market- By End User

- Retail & Consumer Goods

- Digital Products & Services

- Utility Bill Payment

- Travel & Hospitality

- Leisure & Entertainment

- Health & Wellness

- Office Supplies & Equipment

- Other

Ride-sharing apps like Uber and Lyft are examples of programs with incorporated payments. You don't have to offer the driver cash or pull out a debit or credit card to pay when you take a ride with one of those businesses. Instead, after the ride, you finish the transaction via the app. Embedded payments are also available to Starbucks customers. People may order and pay from their phones using the app. It also gives them points that can be used to make future purchases.

Debit cards make it easier for businesses to pay contractors and staff. Companies can send payments to their own branded credit cards instead of cutting checks or making direct deposits. The corporation can agree to pay the card issuer all or part of the interchange charge in exchange for a white label debit card. PayPal is an example of a corporation that uses cards to simplify payments. The ability to link a PayPal account to a bank account is available to users. They can also apply for a cash card from the corporation, which provides them direct access to the PayPal account's balance.

Global Embedded Payment Market- By Geography & Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Embedded payments are still in their early phases of development in Latin America, but it has the potential to alter the financial industry by increasing collaboration between banks, FinTechs, and huge tech businesses. Embedded payments, along with other services, are becoming more popular in the region, and over the next four to eight quarters, the industry is projected to strive for strategic collaborations. Embedded lending, in particular, has already resulted in a cross-sector collaboration in Asia, Europe, and the United States. Latin America is now prepared to follow suit and create a banking system that can be accessed from anywhere and at any time. Over the next few quarters, the goal of providing products and services with a positive user experience and little friction is projected to lead to an increase in cross-sector strategic alliances in Latin America.

NOTABLE HAPPENINGS IN THE GLOBAL EMBEDDED PAYMENTS MARKET IN THE RECENT PAST:

- Business Partnership: - IN December 2021, Adyen, a payment platform provider located in the Netherlands, has teamed with Nonius, a hotel information technology service provider based in Portugal. Both companies seek to help businesses in the hospitality industry integrate guest technology with payment technologies as part of this agreement. Adyen intends to use Nonius's client base in the hospitality industry to expand its market share as part of this agreement.

- Business Investment: - In June 2021, A digital insurance start-up based in Germany. Target Global led a $650 million Series C fundraising deal for Wefox. Wefox is a digital insurer that focuses on personal insurance such as home, auto, and personal liability insurance. With the new round of funding, the company now has a total value of US$ 3 billion.

- Business Investments: - In June 2021, Bought by Many, a pet insurance firm located in London, earned US$ 350 million in Series D fundraising, valuing the company at more than US$ 2 billion.

Chapter 1.GLOBAL EMBEDDED PAYMENTS MARKET -– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.GLOBAL EMBEDDED PAYMENTS MARKET -– Executive Summary

2.1. Market Size & Forecast – (2022 – 2026) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-16 Impact Analysis

2.3.1. Impact during 2022 - 2026

2.3.2. Impact on Supply – Demand

Chapter 3.GLOBAL EMBEDDED PAYMENTS MARKET -– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.GLOBAL EMBEDDED PAYMENTS MARKET - - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL EMBEDDED PAYMENTS MARKET -- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.GLOBAL EMBEDDED PAYMENTS MARKET -– By End User

6.1. Retail & Consumer Goods

6.2. Digital Products & Services

6.3. Utility Bill Payment

6.4. Travel & Hospitality

6.5. Leisure & Entertainment

6.6. Health & Wellness

6.7. Office Supplies & Equipment

6.8. Other

Chapter 7.GLOBAL EMBEDDED PAYMENTS MARKET -– By Region

7.1. North America

7.2. Europe

7.3. The Asia Pacific

7.4. Latin America

7.5. The Middle East

7.6. Africa

Download Sample

Choose License Type

2500

4250

5250

6900