Europe Industrial Lubricants Market Size (2024-2030)

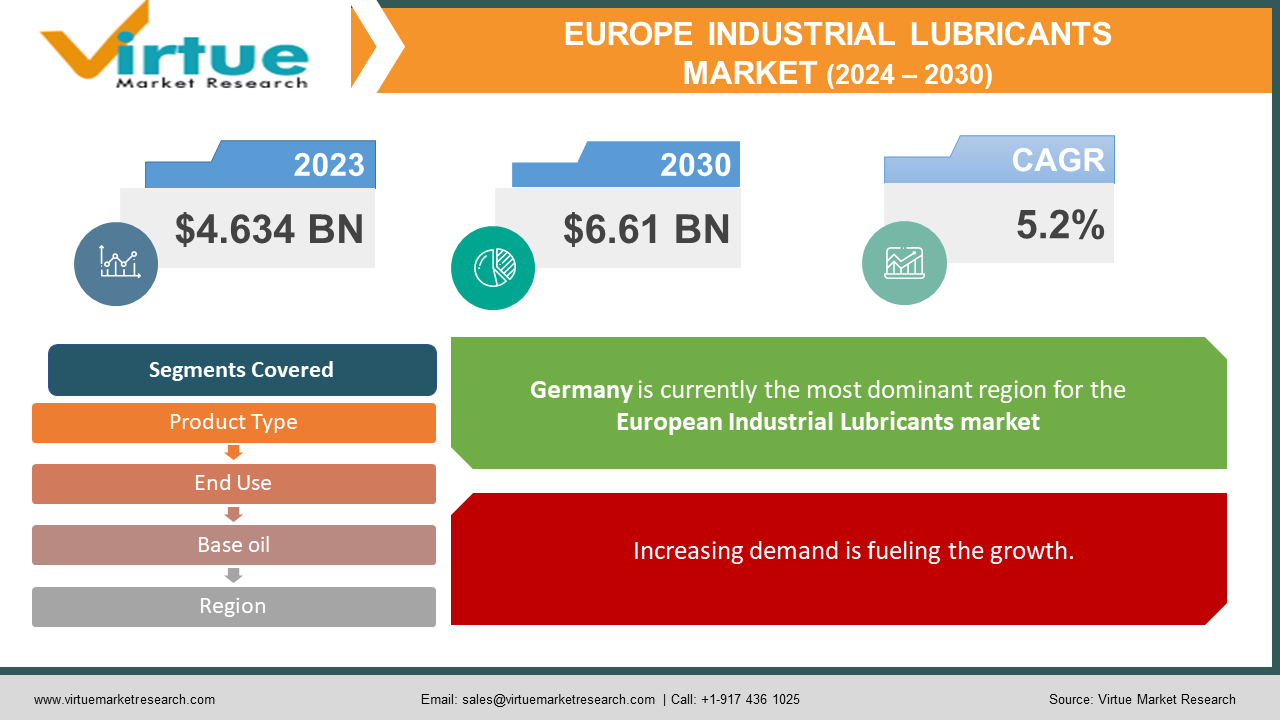

The European industrial lubricants market was valued at USD 4.634 billion and is projected to reach a market size of USD 6.61 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 5.2% between 2024 and 2030.

Oily or greasy materials called industrial lubricants are used on the moving elements of machinery to lessen wear and friction. They serve as a layer of border between two surfaces, facilitating quick and fluid movement. This market has had a significant presence in the past. This was used in many industries like automotive, marine, manufacturing, aerospace, etc. Presently, this market has seen considerable growth owing to economic growth. Besides, high-performance lubricants are being commercialized in the market, accelerating the growth rate. In the future, with a growing focus on sustainability, electric vehicles, and artificial intelligence, this market is set to see tremendous expansion.

Key Market Insights:

The market for lubricants is expected to increase significantly due to several important factors. Sales growth is expected to be significantly accelerated by the growing demand for specialty lubricants due to the increasing popularity of electric and hybrid vehicles. Furthermore, it is anticipated that the combination of automation and Industry 4.0 will increase demand for lubricants in high-tech robotics and machinery. Additionally, the rapidly growing food processing and packaging industries, which depend on lubricants for effective machinery and conveyor systems, are probably going to boost sales even more. Demand is also expected to be driven by the growth of the renewable energy industry, particularly in wind and solar power, which need lubricants for equipment upkeep and operation. Last but not least, the growing expenditures on building and infrastructure throughout Europe are expected to give the lubricants market a big boost, indicating a bright future for the sector's growth trajectory.

Europe Industrial Lubricants Market Drivers:

Increasing demand is fueling the growth.

Business lubricants play a crucial role in the food processing industry. These are necessary to keep equipment operating at peak efficiency, reduce energy use, and lengthen the equipment's lifespan. Food processing industries need lubricants that are non-toxic, safe for human consumption, and meet strict requirements. To minimize production downtime and wear and tear, as well as the risk of failure, these lubricants must continue to be effective. The food processing industry in Europe is a major driver of economic growth and holds a substantial share of the market for industrial lubricants. The need for high-performance lubricants that can withstand the demanding operating conditions of food processing equipment is growing as the food industry develops. Improved machinery and equipment efficiency may lead to fewer emissions and energy consumption when using high-quality lubricants. Manufacturing and transportation are two industries that rely significantly on machinery and equipment. This efficiency boost may be advantageous for them. The improvement of worker health and safety through the use of premium lubricants is another important factor. Toxic substances found in some lubricants can be harmful to people's health. Businesses may lessen these hazards and put employee welfare first by switching to environmentally friendly lubricants. The use of premium, environmentally friendly lubricants is being pushed by laws. Soon, businesses would be compelled by strict rules to reduce emissions, improve efficiency, and safeguard the health and safety of their employees. They would also strengthen their standing as organizations that care about the environment.

The automotive industry is facilitating the expansion.

The need for lubricants, which are essential to the production and upkeep of automobiles, is directly impacted by the rising demand for automobiles. These are necessary to stop corrosion, lessen wear and friction between moving parts, and improve performance. Industrial lubricants are needed at several points in the automotive manufacturing process, from the creation of engine components to the assembly of finished cars. A select handful are essential for keeping cars in good working order and for repairs. Performance and durability standards are strict in the automotive industry. Modern cars have sophisticated engines, gearboxes, and mechanical systems, which means that lubricants need to be able to endure high loads, pressures, and temperatures. Specific demands in the automotive industry have led to the development of specialized industrial lubricants. One of the main factors driving the industry is the rising demand for cars. It is anticipated that this need will keep rising as the automobile industry expands and experiences new developments.

European Industrial Lubricants Market Restraints and Challenges:

The common source of lubricants is crude oil and its byproducts. The cost of producing lubricants goes up in response to rising crude oil prices, which could lead to higher market prices. Increased costs may cause a slowdown in the market and a decline in the demand for lubricants. The fluctuations in oil prices have wider economic ramifications that affect the general state of the area economy and, in turn, consumer demand. Businesses may experience higher operational costs during high oil price periods, which may result in lower investment in equipment and maintenance. Consequently, companies may decide to postpone maintenance or reduce usage to save money, which could reduce the need for industrial lubricants. Excessive oil costs can exacerbate inflationary pressures by reducing enterprises' and consumers' spending power and reducing the market for industrial lubricants.

European Industrial Lubricants Market Opportunities:

Manufacturers are aiming to cater to the automotive sector by offering specialized lubricants for different vehicle types, such as passenger cars, commercial vehicles, and off-road vehicles, in response to the increasing demand for automobiles in Europe. The increasing industrial operations in various sectors of the European economy are causing a surge in demand for industrial lubricants. The expanding manufacturing sector and the expanding economy highlight how important lubricants are to the smooth running of machinery and other equipment. The increased emphasis on energy efficiency and sustainability in Europe has increased the significance of industrial lubricants. These lubricants are essential in cutting down on waste and energy use, which is consistent with the area's dedication to environmentally friendly policies and sustainable practices. Environmentally friendly lubricants are in high demand in Europe due to strict laws and an increasing focus on sustainable practices. The rising demand for industrial lubricants in Europe has been further spurred by the adoption of new technologies and creative lubricant compositions. To maximize equipment performance, lower maintenance costs, and minimize operational disruptions, businesses are investing more and more in premium lubricants.

EUROPE INDUSTRIAL LUBRICANTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By Product Type, End Use, Base oil, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profiled |

TotalEnergies SE, Eni SpA, Fuchs Petrolub SE, Repsol SA, JSC Lukoil, Carl Bechem Lubricants, PJSC Gazprom, PJSC Rosneft Oil, Valvoline, Inc., Motul S.A. |

Europe Industrial Lubricants Market Segmentation:

Europe Industrial Lubricants Market Segmentation: By Base Oil:

- Mineral Oil

- Synthetic Oil

- Bio-based Oil

Mineral oil has the largest market share in 2023. Mineral oil-based lubricants are adaptable and may be tailored to satisfy a variety of industrial lubrication requirements. They are employed in a variety of applications, including manufacturing, automotive, mining, construction, and transportation. Mineral oil-based lubricants are versatile and suited for a wide range of machinery and equipment, resulting in sustained demand. The widespread availability of mineral oil permits the production of enormous volumes of lubricants to meet demand from a variety of industries. Mineral oil-based lubricants are becoming increasingly popular and widely used due to their ease of availability. Synthetic oil is the fastest-growing category. Their low-temperature flow characteristics, oxidation resistance, and thermal stability are all improved. As a result, machinery and equipment may function less worn out and more efficiently.

Europe Industrial Lubricants Market Segmentation: By Product Type:

- Hydraulic Fluids

- Metal-working fluids

- Gear Oil

- Compressor Oil

- Grease

- Turbine Oil

- Transformer Oil

- Refrigeration Oil

- Textile Machinery Lubricants

Hydraulic fluids are both the largest and fastest-growing category. The ability of these fluids to convey power in hydraulic systems is expected to drive up demand. These are projected to be sought by European makers of heavy machinery, automobile brakes, and aircraft systems. Hydraulic fluids are used because they have particular qualities that make them suitable for various applications. Their capacity to transport energy, lubricate moving parts, and prevent corrosion would help boost sales. It is expected to be a major fluid used in manufacturing processes throughout Europe. Its application may result in the development of high-performance lubricants capable of operating in severe environments, such as high temperatures and pressures. Demand for sophisticated hydraulic fluids, including synthetic and high-performance fluids, is also predicted to increase. The growing industrial and infrastructural sectors in the region are expected to provide lucrative growth possibilities for hydraulic fluid makers.

Europe Industrial Lubricants Market Segmentation: By End Use:

- Construction

- Metal and Mining

- Cement Production

- Power Generation

- Automotive

- Chemical Production

- Oil and Gas

- Textile Manufacturing

- Food Processing

- Agriculture

- Pulp and Paper

- Marine Applications

Automotive is the largest category, accounting for over 49% of total consumption in 2023. In recent years, lubricant usage in the automotive sector has steadily increased by about 3.5%. Industrial lubricants are widely used in the automobile industry for a variety of components, including brake systems, gearboxes, engines, metalworking fluid, and high-speed bearings. This is because lubricants have better qualities than other substances, such as binding, greater performance, and longer machinery life. The power generation industry is the fastest-growing end-user category, with a compound annual growth rate (CAGR) of 2.54% throughout the forecast period. This development trajectory is related to the expansion of power generation capacity, notably in renewables, which is increasing demand for lubricants in Europe's power industry.

Europe Industrial Lubricants Market Segmentation: By Region:

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

Germany is one of Europe's leading markets for industrial lubricants. The country is predicted to grow over the projection period. Germany is noted for its export-oriented economy, with a sizable amount of its industrial production shipped internationally. To remain competitive in the worldwide market, German industries prioritize high-quality lubricants to assure product dependability and performance. The export-oriented character of the economy has contributed to increased demand for industrial lubricants in Germany. Germany is likewise strongly committed to sustainability and environmental protection. The country has adopted tough laws and standards to reduce emissions and promote environmentally friendly practices. The United Kingdom is the fastest-growing market. Strong demand from a variety of important industries has an impact on the region's industrial lubricant market. The better qualities of industrial lubricants, such as higher performance, binding, protection against damage, and extended machinery life, are primarily responsible for the demand in the automobile industry.

COVID-19 Impact Analysis on the European Industrial Lubricants Market:

The COVID-19 epidemic has significantly disrupted the lubricant business, which was previously positioned for flat growth due to technological shifts. With Europe in crisis, firms suffered widespread closures, resulting in enormous financial losses and compelling many to demonstrate strong liquidity to escape bankruptcy. The pandemic-induced shift in consumer perceptions of lubrication as non-essential may further reduce demand, compounding business issues. As a result, the previously slow growth trajectory has deteriorated, leaving the lubricant industry uncertain. Navigating through these challenging times will necessitate adaptation to changing market dynamics and customer tastes, posing substantial challenges for the business in a post-pandemic context. Strong demand from a variety of important industries has an impact on the region's industrial lubricant market. The better qualities of industrial lubricants, such as higher performance, binding, protection against damage, and extended machinery life, are primarily responsible for the demand in the automobile industry.

Latest Trends/ Developments:

In January 2022, the French oil manufacturer Motul announced the launch of its heavy-duty diesel engine lubricant brand, called TEKMA. Motul TEKMA engine oils are made to meet the most demanding circumstances without sacrificing performance. They are intended to provide increased power and fuel economy, optimal engine protection, and longer drain intervals.

Key Players:

- TotalEnergies SE

- Eni SpA

- Fuchs Petrolub SE

- Repsol SA

- JSC Lukoil

- Carl Bechem Lubricants

- PJSC Gazprom

- PJSC Rosneft Oil

- Valvoline, Inc.

- Motul S.A.

Chapter 1. Europe industrial lubricant Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe industrial lubricant Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe industrial lubricant Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe industrial lubricant Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe industrial lubricant Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe industrial lubricant Market– By Base Oil

6.1. Introduction/Key Findings

6.2. Mineral Oil

6.3. Synthetic Oil

6.4. Bio-based Oil

6.5. Y-O-Y Growth trend Analysis By Base Oil

6.6. Absolute $ Opportunity Analysis By Base Oil , 2024-2030

Chapter 7. Europe industrial lubricant Market– By Product Type

7.1. Introduction/Key Findings

7.2 Hydraulic Fluids

7.3. Metal-working fluids

7.4. Gear Oil

7.5. Compressor Oil

7.6. Grease

7.7. Turbine Oil

7.8. Transformer Oil

7.9. Refrigeration Oil

7.10. Textile Machinery Lubricants

7.11. Y-O-Y Growth trend Analysis By Product Type

7.12. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 8. Europe industrial lubricant Market– By End Use

8.1. Introduction/Key Findings

8.2. Construction

8.3. Metal and Mining

8.4. Cement Production

8.5. Power Generation

8.6. Automotive

8.7. Chemical Production

8.8. Oil and Gas

8.9. Textile Manufacturing

8.10. Food Processing

8.11. Agriculture

8.12. Pulp and Paper

8.13. Marine Applications

8.14. Y-O-Y Growth trend Analysis End Use

8.15. Absolute $ Opportunity Analysis End Use , 2024-2030

Chapter 9. Europe industrial lubricant market Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.2.1. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Base Oil

9.1.3. By Product Type

9.1.4. By End Use

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe industrial lubricant market Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 TotalEnergies SE

10.2. Eni SpA

10.3. Fuchs Petrolub SE

10.4. Repsol SA

10.5. JSC Lukoil

10.6. Carl Bechem Lubricants

10.7. PJSC Gazprom

10.8. PJSC Rosneft Oil

10.9. Valvoline, Inc.

10.10. Motul S.A

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The European industrial lubricants market was valued at USD 4.634 billion and is projected to reach a market size of USD 6.61 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 5.2% between 2024 and 2030.

The market is expected to reach USD 6.61 billion by 2030

The automotive sector drives the market

By 2023, the market is expected to be valued at USD 4.634 billion.

Germany dominates the European industrial lubricant market.