Digital Therapeutics and Self Help tools Market Size (2023 – 2030)

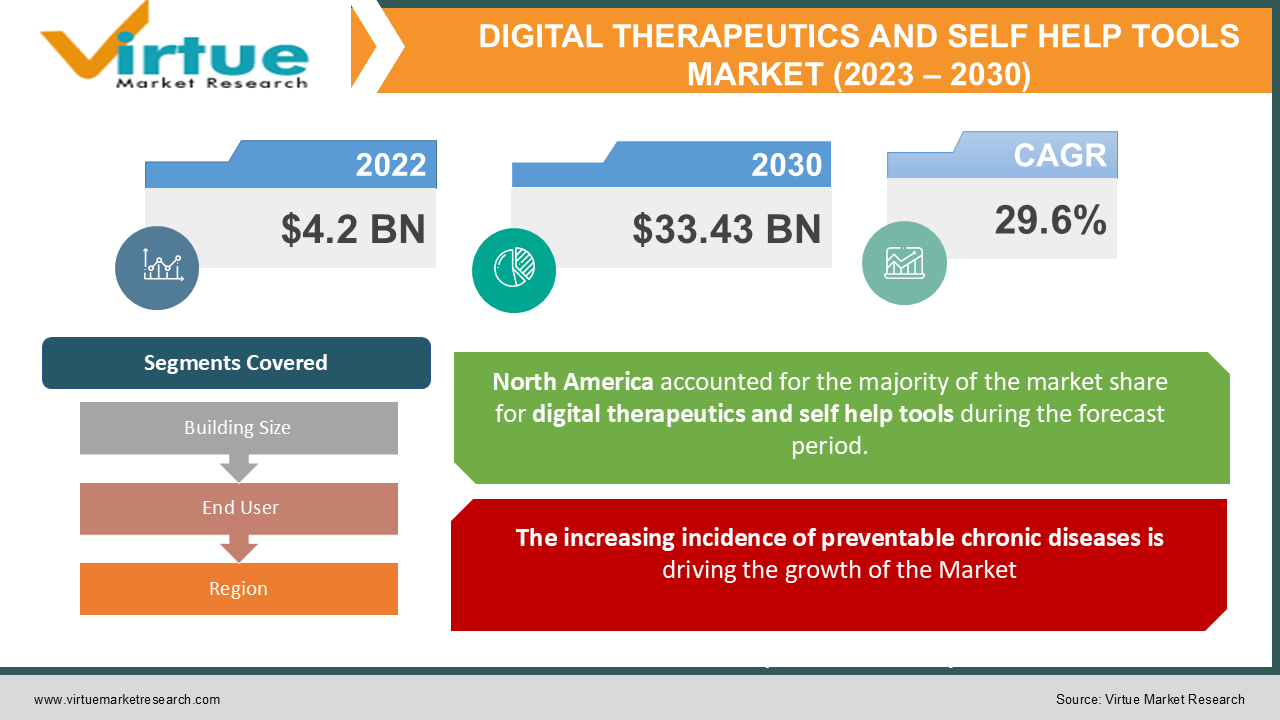

As per our research report, the Digital Therapeutics and Self Help tools Market size was USD 4.2 billion in 2022 and is estimated to grow to USD 33.43 billion by 2030. This market is witnessing a healthy CAGR of 29.6% from 2023 - 2030. The increasing incidence of preventable chronic diseases, the need to control healthcare costs, rising focus on preventive healthcare, and rising investments in digital therapeutics are majorly driving the growth of the industry.

Industry Overview:

Digital Therapeutics (DTx) is a high-quality software system that helps patients manage a variety of illnesses and illnesses through health-related tips, behavioral recommendations, exercise plans, medication warnings, and more. Like medicines, DTx products provide clinically proven results that affect the condition. This sets DTx apart from many other wellness apps and medication reminders. There are a variety of disorders and illnesses covered by DTx products, including obesity, ADHD (Attention Deficit Hyperactivity Disorder), type 2 diabetes, anxiety, depression, and congestive heart failure. According to Kepios, as of April 2021, there are 4.27 billion Internet users worldwide, which is more than 60% of the world's population. As the numbers grow, we expect to see better awareness of smart health tracking. In addition, the COVID 19 pandemic, supportive regulatory initiatives, early signs of reimbursement, and increased prevalence of chronic diseases are expected to drive market growth.

For example, the Software PreCert Pilot Program is part of the FDA's Digital Health Innovation Action Plan, aimed at more efficient regulatory oversight of manufacturer-developed software-based medical devices (SaMDs). This program aims to develop efficient regulatory oversight to evaluate an organization in order to build confidence that the organization can develop high-quality SaMD products. According to the CDC's National Centers for Disease Control and Prevention, 6 out of 10 adults in the United States have some form of chronic illness, and 4 out of 10 adults have two or more chronic illnesses. Cardiovascular disease, cancer, diabetes, chronic kidney disease, chronic lung disease, and Alzheimer's disease have been identified as the leading causes of death and disorders in the country. Poor diet, tobacco use, alcoholism, and lack of exercise further increase the risk of chronic illness. Medical costs are affected exponentially because most chronic illnesses do not occur alone and patients often suffer from comorbidity. As global interconnectivity improves, smartphone ownership is becoming an economic and social imperative. The spread of smartphones is an important factor related to market growth.

COVID-19 impact on Digital Therapeutics and Self Help tools Market

The impact of the corona pandemic and the subsequent establishment of a national blockade can be seen in various industries. Especially in countries with high rates of COVID19, such as India, China, Brazil, the United States, and some European countries (including Russia, Italy, and Spain), the overall growth of the various sectors will be seriously impacted. Sales are declining significantly in industries such as oil, oil, aerospace, and mining, but the healthcare, biotechnology, and pharmaceutical industries are optimizing this situation to serve the largest number of patients and healthcare professionals. It offers.

As of June 28, 2021, there were 179,686071 confirmed COVID 19 cases worldwide and 3,899,172 deaths (WHO). As the pandemic continues to grow, medical professionals are overwhelmed by their outbreak efforts, but more and more cases are causing serious complications. As a result, patients are increasingly turning to digital therapies for disease assessment and treatment. With the outbreak of COVID19, healthcare providers have begun to seek alternatives to standard procedures. With the outbreak of COVID19, healthcare providers are looking for alternatives to standard systems and processes. As a result, both providers and consumers are increasingly turning to digital therapies.

MARKET DRIVERS:

The increasing incidence of preventable chronic diseases is driving the growth of the Market

Chronic diseases are increasing the burden on healthcare systems around the world. The high prevalence and incidence of chronic diseases are a major concern for healthcare systems around the world. Treatment of patients with chronic illness is a major challenge, as psychosomatic or biopsychiatric factors often affect these patients. Chronic illness is often associated with high levels of uncertainty, so patients need to change their behavior as part of a new self-care lifestyle. In addition, many chronic disorders and conditions are progressive and their incidence increases with age. Therefore, with the significant increase in the aging population around the world, chronic diseases are expected to continue to increase over the next few years.

Effective Healthcare services in remote areas and the Launch of Software applications are also driving the growth of the Market

Digital Therapy has been the best part for people living in rural areas. Through these healthcare services, people who live in remote areas can get diagnosed with the latest technology and get the best treatment with high-quality medicines. This improves patients' convenience, as there will be no need to wait in the waiting rooms. There are many smartphone applications that we can use by logging on at the scheduled time with the physician or doctor.

MARKET RESTRAINTS:

Lack of Knowledge and Cases of Patients Data leak is restraining the growth of the Market

Some people found that going to the hospital will ensure proper diagnosis and treatment procedures, which is slightly degrading the market demand. In many countries, various medical apps have been denied approval, raising concerns about product and data quality, treatment decision reliability, patient privacy, security, and responsible use of data. Digital treatment providers have access to patient information and must not share it with anyone who is not involved in the care of that patient. However, when using digital tools to consolidate data, there is a risk that medical professionals who are not connected to the patient's treatment program may have access to the patient data.

DIGITAL THERAPEUTICS AND SELF HELP TOOLS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

3.77% |

|

Segments Covered |

By Building size, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Omada Health, Inc., Welldoc, Inc., 2Morrow, Inc., Livongo Health, Inc., Propeller Health, Fitbit inc., Canary Health, Mango Health, Noom, Inc., Pear Therapeutics, |

This research report on the Digital Therapeutics and Self Help tools Market has been segmented and sub-segmented based on application, end-user, and region.

Digital Therapeutics and Self Help tools Market - By Application:

- Diabetes

- Obesity

- CVD

- Respiratory Diseases

- Smoking Cessation

- CNS Diseases

- Others

Based on the application The Diabetes Applications segment accounted for the largest share of global sales in 2021 with more than 28.5%. Factors driving segment growth include an increased prevalence of diabetes and other chronic illnesses. Digital treatment helps healthcare providers assess the lives of patients and improve treatment strategies based on their individual treatment needs. According to the CDC, about 34.2 people will have diabetes in 2020, with 10.5% of their population living in the United States. The obesity application segment took the second-largest share in 2021 due to the growing obese population around the world. Digital therapies provide cost-effective solutions for the treatment of many chronic diseases and should boost the market in the near future. Cardiovascular disease and smoking cessation are expected to show significant growth rates with obesity over the predicted period. The increasing adoption of digital therapeutic products to treat respiratory disorders is driving market growth. These products include Hailie from Adherium, Respiro from Amiko, Propeller from Propeller Health, Breathe Smart from Cohero Health, and CareTRx from Teva. Digital therapies can change the course of treatment for COPD and asthma. This is because poor medication adherence is a major issue in the management of respiratory illness. Digital treatment solutions can help solve this problem efficiently.

Digital Therapeutics and Self Help tools Market - By End-User:

- Patients

- Providers

- Payers

- Employers

- Others

Based on End-User, the global market is further divided into patients, providers, payers, employers, and more. The patient end-user segment accounted for the largest share of global revenue in 2021 with more than 33.0%. This growth was primarily due to increased patient acceptance of digital treatment solutions. Patients are major users of therapeutic health applications and programs. As the number of patients suffering from chronic illness increases, so does the demand for digital therapies. Meanwhile, the growth of the provider's end-user segment has led to providers using digital therapies to provide and support clinically proven therapies outside the care environment, in addition to providing reliable patient involvement. This is due to the increase. Payers are also increasingly interested in covering digital therapies, and this segment shows significant growth potential. Payers are encouraged to take the initiative through a business model that promotes compliance and improves effectiveness while reducing costs.

Digital Therapeutics and Self Help tools Market - By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East

- Africa

Geographically, North America had the largest share of global sales in 2021 with more than 41%. This is due to a variety of factors, including. Increased use of digital health products and favorable reimbursement scenarios focused on improving quality of life through improved tracking and diagnosis. The prevalence of chronic diseases and the growing population of the elderly in the region are expected to drive the market. Major players in the region include Proteus Digital Health, Inc., Omada Health, Inc., WellDoc, Inc., and Livongo Health, Inc.

Most of these companies are based in the United States, further strengthening their local advantage. The Asia Pacific region is expected to grow at the fastest growth rate during the forecast period. This high growth is due to the growing demand for effective healthcare, the proliferation of smart phones and improved access to the Internet. Market growth is also expected to accelerate as demand for personal care devices and related services increases as a result of increased government health care costs.

Digital Therapeutics and Self Help tools Market Share by company

- Omada Health, Inc.

- Welldoc, Inc.

- 2Morrow, Inc.

- Livongo Health, Inc.

- Propeller Health

- Fitbit inc.

- Canary Health

- Mango Health

- Noom, Inc.

- Pear Therapeutics

and others are playing a pivotal role in the market.

the industry is characterized by the presence of entrepreneurs of all sizes. The market is highly competitive and is dominated by major companies focused on increasing profits by implementing innovative strategies such as mergers and acquisitions, market penetration, partnerships, and distribution transactions. For example, in December 2021, Teladoc expanded its partnership with the National Labor Alliance to offer all kinds of virtual grooming products and services. These products and services included specialty, general care, specialty services, mental health, virtual primary care programs, and chronic illness management.

Suppliers invest in research and development to develop technologically advanced systems that give them a competitive advantage over other providers and provide an economic benefit to the industry. The industry is expected to see several mergers and acquisitions over the next few years. Companies are taking proactive steps to gain market share and provide a diversified product portfolio.

NOTABLE HAPPENINGS IN THE DIGITAL THERAPEUTICS AND SELF HELP TOOLS MARKET IN THE RECENT PAST:

- Collaboration - In April 2021, Welldoc(US) partnered with Dexcom (US). This partnership helped provide BlueStar with Dexcom G6 CGM as a single platform for people with Type 2 diabetes for improved health.

- Collaboration - In April 2020, Crossroads Treatment Centers (US) collaborated with Pear Therapeutics (US) to implement the company’s digital platform reSET-O to help patients with opioid abuse and addiction.

- Collaboration - In March 2021, Pear Therapeutics (US) partnered with Spectrum Health Systems (US). Tufts Health Plan and Spectrum Health Systems announced collaboration with Pear Therapeutics to test FDA-approved digital therapeutics to help people with substance use disorders and improve their recovery journeys by delivering solutions for improved treatment access and care innovation journeys by delivering solutions for improved treatment access and care innovation

Chapter 1.DIGITAL THERAPEUTICS AND SELF HELP TOOLS MARKET-– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.DIGITAL THERAPEUTICS AND SELF HELP TOOLS MARKET-– Executive Summary

2.1. Market Size & Forecast – (2022 – 2026) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-16 Impact Analysis

2.3.1. Impact during 2022 - 2026

2.3.2. Impact on Supply – Demand

Chapter 3.DIGITAL THERAPEUTICS AND SELF HELP TOOLS MARKET-– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.DIGITAL THERAPEUTICS AND SELF HELP TOOLS MARKET- - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. DIGITAL THERAPEUTICS AND SELF HELP TOOLS MARKET-- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.DIGITAL THERAPEUTICS AND SELF HELP TOOLS MARKET-– By Application

6.1. Diabetes

6.2. Obesity

6.3. CVD

6.4. Respiratory Diseases

6.5. Smoking Cessation

6.6. CNS Diseases

6.7. Others

Chapter 7.DIGITAL THERAPEUTICS AND SELF HELP TOOLS MARKET-– By End-User:

7.1. Patients

7.2. Providers

7.3. Payers

7.4. Employers

7.5. Others

Chapter 8.DIGITAL THERAPEUTICS AND SELF HELP TOOLS MARKET-– By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9.DIGITAL THERAPEUTICS AND SELF HELP TOOLS MARKET-– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Omada Health, Inc

9.2. Welldoc, Inc

9.3. 2Morrow, Inc

9.4. Livongo Health

9.5. Inc.

9.6. Propeller Health

9.7. Fitbit inc

9.8.Canary Health

9.9. Mango Health

9.10. Noom, Inc

9.11. Pear Therapeutics

Download Sample

Choose License Type

2500

4250

5250

6900