5G Voice over New Radio (VoNR) Market Size (2023 – 2030)

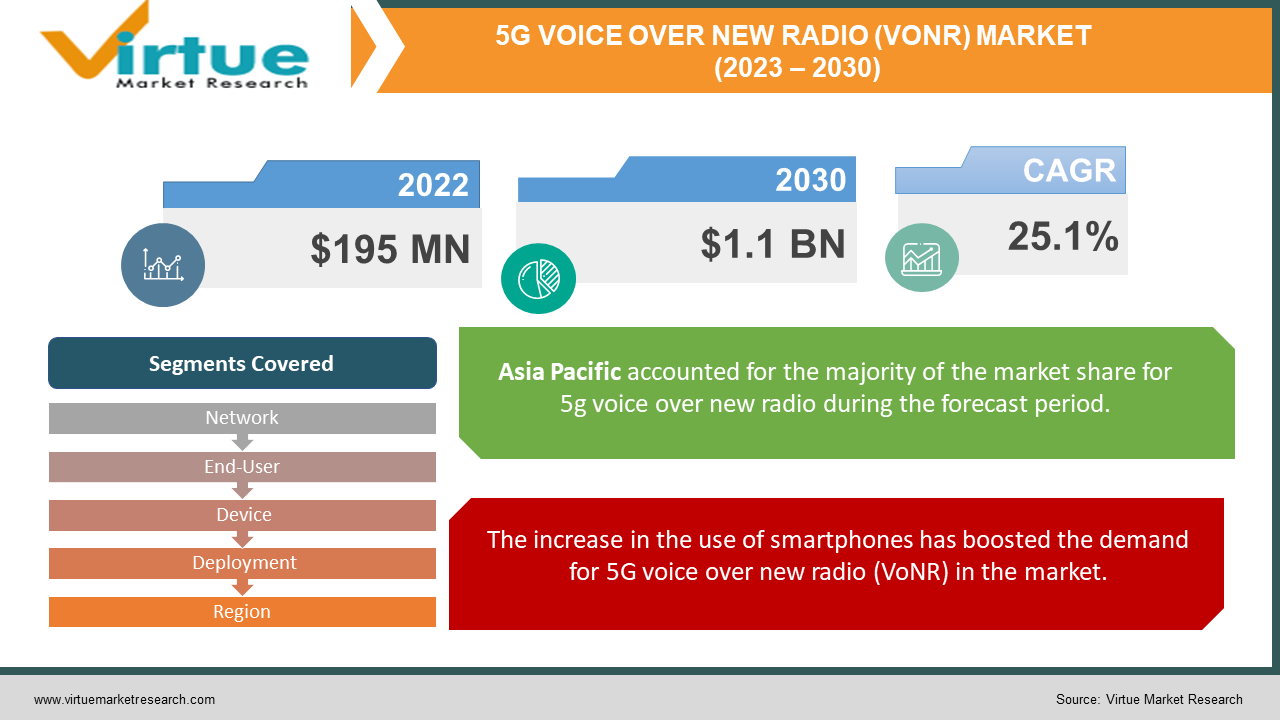

The 5G Voice over New Radio (VoNR) Market was valued at USD 195 Million and is projected to reach a market size of USD 1.1 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 25.1%.

In the past, there was a minimum demand for faster networks, as there was less pressure on data connectivity and communication. These needs were easily fulfilled by 4G and 3G networks. However, with the passage of time and increased use of the internet and smartphones, 5G technology gained momentum in the telecommunication market, witnessing increased applicability in various sectors, which require faster communication and connectivity services. These sectors include the financial sector, healthcare sector, and others. Moreover, 5G technology provided a reduction in call delays and enhanced the mobile experience with its faster connectivity, leading to a further increase in consumer demand for 5G VoNR subscriptions. The future for 5G voice over new radio holds positive with further technological developments in voice communication and increasing consumer demand for smart home experiences.

Key Market Insights:

As per the Ericsson Mobility Report, the 5G mid-band population has reached 30% globally.

As per Economic Times Telecom, 30% - 50% of smartphones shipped in India are 5G enabled.

According to GSMA, 1.33 billion people will subscribe to mobile services in China by the year 2030.

According to an announcement by the Hong Kong Stock Exchange in 2022, the total number of 5G mobile users increased to 401.27 in January.

5G Voice over New Radio (VoNR) Market Drivers:

The increase in the use of smartphones has boosted the demand for 5G voice over new radio (VoNR) in the market.

There is a rising demand for smartphones, especially due to the increase in digitization post-pandemic. Moreover, smartphones have become the most important part of today’s consumers, as they use them to perform various daily tasks. This has also increased the demand for high-speed internet, giving a boost to the development of 5G smartphones that offer seamless mobile experiences to consumers. Furthermore, the proliferation of 5G smartphones has increased the demand for 5G VoNR that offers quality voice-over services to consumers. These services include fast and high-quality voice calls, faster connectivity, uninterrupted video conferencing, and others. Furthermore, telecom operators are offering additional services along with the 5G voice-over new radio services that would help them attract more consumers and expand their market base. These include services such as high-speed online gaming, HD streaming, smart app integrations, and others.

The rapid adoption of the 5G network has boosted the demand for 5G voice-over new radio (VoNR) in the market.

The ever-evolving demand for faster connectivity and efficiency has led to the development of a 5G network that can cater to increased consumer demand for faster connectivity. Moreover, the rapid adoption of the 5G network, especially in developing countries has enhanced the network infrastructure in many ways. These include less buffering while browsing information or streaming videos, high-quality video conferencing, a high-speed gaming experience, and faster data connectivity. Moreover, 5G has made operations in various industries easy, such as increased efficiency in education & training by integration with AR and VR technology, for example in use of AR in aviation training, medical training, and others, telemedicine and teleconsultations, it provided increased security to large enterprises dealing with confidential information by deploying private 5G network that helped these enterprises to have complete control over their data, and others.

5G Voice over New Radio (VoNR) Market Restraints and Challenges:

Device compatibility issues can decrease the demand for 5G voice-over new radios in the market. Some devices or operating system versions such as smartphones may not support 5G VoNR, which can decline its demand in the market.

Furthermore, even though 5G VoNR offers faster communication and connectivity levels, it can lose signals in rural or remote regions, leading to reduced market demand.

5G Voice over New Radio (VoNR) Market Opportunities:

The 5G Voice over New Radio (VoNR) Market is anticipated to deliver lucrative opportunities for businesses, which include acquisitions, partnerships, collaborations, product launches, and agreements during the forecasted period. Furthermore, increasing adoption of 5G technology for faster communication and connectivity is predicted to develop the market for the 5G voice over new radio (VoNR) and enhance its future growth opportunities.

5G VOICE OVER NEW RADIO (VONR) MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

25.1% |

|

Segments Covered |

By Network, End-User, Device, Deployment, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nokia, Vodafone, Qualcomm, Jio, Ericsson, T-Mobile, Du Demos, STC Bahrain, TIM Brasil, EE UK |

5G Voice over New Radio (VoNR) Market Segmentation: By Network

-

Standalone

-

Non-Standalone

In 2022, based on market segmentation by network, standalone occupied the highest share of about 27% in the market. Standalone 5G VoNR services primarily operate on a 5G network and do not rely on another network. Moreover, they offer increased performance, low latency, and more flexibility in deployment. Moreover, customers can experience faster call times, high-speed connectivity, and energy efficiency in terms of battery usage, as standalone 5G VoNR eliminates the need to switch over other networks and hence conserves smartphone batteries.

5G Voice over New Radio (VoNR) Market Segmentation: By End-User

-

Healthcare

-

Automotive

-

Agriculture

-

Telecommunication

-

Public Safety

-

Retail & Consumer

-

Industrial

-

Others

In 2022, based on market segmentation by end-user telecommunication occupied the highest share of about 35% in the market. 5G VoNR is increasingly used in the telecommunication sector by telecom operators and service providers that want customers to subscribe to their 5G services. These operators and service providers offer VoNR as their core service with various add-ons that can cater to a wide range of customers. The services include unlimited or subscription-based voice calls and video calls, roaming services, and multi-device support, which is compatible with 5G networks with various devices such as smartphones, tablets, IoT devices, and others.

Healthcare is the fastest-growing segment during the forecast period. Growing demand for telehealth and teleconsultation has propelled the growth of 5G VoNR in the healthcare industry. 5G VoNR is increasingly used in healthcare facilities for offering telehealth services to at-home patients, which include audio or virtual communication. Moreover, with the help of 5G VoNR doctors can remotely monitor their patients from anywhere via integration with smart devices that are connected via VoNR technology. These include wearables and sensors attached to a patient’s body in the hospital. Additionally, 5G VoNR technology helps healthcare professionals integrate IoT devices for tracking hospital inventories such as vaccines, medical equipment and devices, and others.

5G Voice over New Radio (VoNR) Market Segmentation: By Device

-

Smartphones

-

IoT Devices

In 2022, based on market segmentation by device, smartphones occupied the highest share of about 56% in the market. The increased usage of smartphones has developed the market for 5G VoNR services. Consumers are demanding faster and quality 5G services that cater to their various needs such as voice calls, sending and receiving multimedia messages, unlimited data pack and voice calls services, and others. Moreover, with the help of 5G VoNR services, it has become possible to connect VoNR services with smartphone applications and avail the services, which include quality and faster voice calls, integration to social media apps, unlimited messages, and others. In addition, the emergence of new 5 G-enabled smartphones is further expanding the market base of 5G VoNR services.

IoT devices are the fastest-growing segment during the forecast period. 5G VoNR offers integration capabilities with IoT devices that are used to communicate, transfer, and receive data in various industries such as healthcare, construction, agriculture, and others. In addition, it offers additional features when integrated with IoT devices, which include remote monitoring of crops in agriculture, patient monitoring in the healthcare sector, and others, further, with the help of 5G VoNR, IoT cameras, and advanced sensors can send and receive visual data and signals at a faster rate to security personnel. In addition, a standalone 5G VoNR network increases the battery life of IoT devices, as they often operate on low battery levels.

5G Voice over New Radio (VoNR) Market Segmentation: By Deployment

-

Cloud-Based VoNR

-

On-Premises VoNR

In 2022, based on market segmentation by deployment, cloud-based VoNR occupied the highest share of about 27% in the market. Cloud-based VoNR offers increased scalability, flexibility over multiple devices, and cost-effectiveness, as they are hosted on the cloud infrastructure by third-party service providers or telecom operators. Moreover, the increasing demand for 5G VoNR services by large enterprises, businesses, and retail and consumer-oriented industries for maintenance of VoNR infrastructure, has increased the demand for cloud-based 5G VoNR in the market. In addition, it enables customers to remotely monitor, manage, and access the services without the need for deploying or maintaining any device or data center.

On-premise VoNR occupies a sizeable share of the market. The growth is attributed to increased demand for direct control over data privacy & security in industries dealing with confidential information such as financial, healthcare, public security, and others. Moreover, the organization has direct control over the VoNR infrastructure because the VoNR service is deployed on their local data centers or other devices, eliminating exposure to cyber threats.

5G Voice over New Radio (VoNR) Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle-East & Africa

In 2022, based on market segmentation by region, Asia-Pacific occupied the highest share of about 36% in the market. The rapid adoption of 5G network infrastructure in both rural and urban areas, and increased penetration of 5G smartphones have contributed to the demand for 5G voice over new radio in the region.

North America is the fastest-growing region during the forecast period. Continuous technological advancements in communication and IoT technology, and rising demand for faster and quality emergency communication services, especially for the elderly, have contributed to the demand for 5G voice over new radio in the region

COVID-19 Impact Analysis on the 5G Voice over New Radio (VoNR) Market

The pandemic had a positive impact on the 5G VoNR market. Increased digitization trends during the pandemic, increased the demand for 5G voice-over new radio services by consumers. This growth was attributed to the rising demand for faster communication and connectivity services for remote working and learning purposes. Moreover, the healthcare sector was one of the major consumers of 5G VoNR services, as increased demand by patients for telemedicine and teleconsultation induced healthcare professionals to subscribe to 5G VoNR services.

Latest Developments:

- In May 2023, Du Demos in collaboration with Huawei and Nokia launched 5G voice-over radio capabilities in the UAE market. The service provides 5G standalone network infrastructure for a faster calling experience with other innovative features such as 3D audio and holographic calls that can provide an immersive communication experience to its customers.

- In May 2023, Dish Network announced it to expand its 5G voice over new radio in the latter phase of this year. The service will run on a 5G standalone network and aims to expand its network coverage throughout the USA.

Key Players:

-

Nokia

-

Vodafone

-

Qualcomm

-

Jio

-

Ericsson

-

T-Mobile

-

Du Demos

-

STC Bahrain

-

TIM Brasil

-

EE UK

Chapter 1. 5G Voice over New Radio (VoNR) Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. 5G Voice over New Radio (VoNR) Market – Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. 5G Voice over New Radio (VoNR) Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. 5G Voice over New Radio (VoNR) Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. 5G Voice over New Radio (VoNR) Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. 5G Voice over New Radio (VoNR) Market – By Network

6.1 Introduction/Key Findings

6.2 Standalone

6.3 Non-Standalone

6.4 Y-O-Y Growth trend Analysis By Network

6.5 Absolute $ Opportunity Analysis By Network, 2023-2030

Chapter 7. 5G Voice over New Radio (VoNR) Market – By End-User

7.1 Introduction/Key Findings

7.2 Healthcare

7.3 Automotive

7.4 Agriculture

7.5 Telecommunication

7.6 Public Safety

7.7 Retail & Consumer

7.8 Industrial

7.9 Others

7.10 Y-O-Y Growth trend Analysis By End-User

7.11 Absolute $ Opportunity Analysis By End-User, 2023-2030

Chapter 8. 5G Voice over New Radio (VoNR) Market – By Device

8.1 Introduction/Key Findings

8.2 Smartphones

8.3 IoT Devices

8.4 Y-O-Y Growth trend Analysis By Device

8.5 Absolute $ Opportunity Analysis By Device, 2023-2030

Chapter 9. 5G Voice over New Radio (VoNR) Market – By Deployment

9.1 Introduction/Key Findings

9.2 Cloud-Based VoNR

9.3 On-Premises VoNR

9.4 Y-O-Y Growth trend Analysis By Deployment

9.5 Absolute $ Opportunity Analysis By Deployment, 2023-2030

Chapter 10. 5G Voice over New Radio (VoNR) Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Network

10.1.2.1 By Deployment

10.1.3 By By Device

10.2 By End-User

10.2.1 Countries & Segments - Market Attractiveness Analysis

10.3 Europe

10.3.1 By Country

10.3.1.1 U.K

10.3.1.2 Germany

10.3.1.3 France

10.3.1.4 Italy

10.3.1.5 Spain

10.3.1.6 Rest of Europe

10.3.2 By Network

10.3.3 By End-User

10.3.4 By By Device

10.3.5 By Deployment

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 Asia Pacific

10.4.1 By Country

10.4.1.1 China

10.4.1.2 Japan

10.4.1.3 South Korea

10.4.1.4 India

10.4.1.5 Australia & New Zealand

10.4.1.6 Rest of Asia-Pacific

10.4.2 By Network

10.4.3 By End-User

10.4.4 By By Device

10.4.5 By Deployment

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 South America

10.5.1 By Country

10.5.1.1 Brazil

10.5.1.2 Argentina

10.5.1.3 Colombia

10.5.1.4 Chile

10.5.1.5 Rest of South America

10.5.2 By Network

10.5.3 By End-User

10.5.4 By By Device

10.5.5 By Deployment

10.5.6 Countries & Segments - Market Attractiveness Analysis

10.6 Middle East & Africa

10.6.1 By Country

10.6.1.1 United Arab Emirates (UAE)

10.6.1.2 Saudi Arabia

10.6.1.3 Qatar

10.6.1.4 Israel

10.6.1.5 South Africa

10.6.1.6 Nigeria

10.6.1.7 Kenya

10.6.1.8 Egypt

10.6.1.9 Rest of MEA

10.6.2 By Network

10.6.3 By End-User

10.6.4 By By Device

10.6.5 By Deployment

10.6.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. 5G Voice over New Radio (VoNR) Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Nokia

11.2 Vodafone

11.3 Qualcomm

11.4 Jio

11.5 Ericsson

11.6 T-Mobile

11.7 Du Demos

11.8 STC Bahrain

11.9 TIM Brasil

11.10 EE UK

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The 5G Voice over New Radio (VoNR) Market was valued at USD 195 Million and is projected to reach a market size of USD 1.1 billion by the end of 2030.

The increase in the use of smartphones and the Rapid adoption of the 5G network are the market drivers of the 5G Voice over New Radio (VoNR) market.

Healthcare, Automotive, Agriculture, Telecommunication, Public Safety, Retail, consumer, Industrial, and Others, are the segments under the 5G Voice over New Radio (VoNR) Market by end-user.

Asia-Pacific is the most dominant region for the 5G Voice over New Radio (VoNR) Market.

North America is the fastest-growing region in the 5G Voice over New Radio (VoNR) Market.