5G Services Market Size (2024 – 2030)

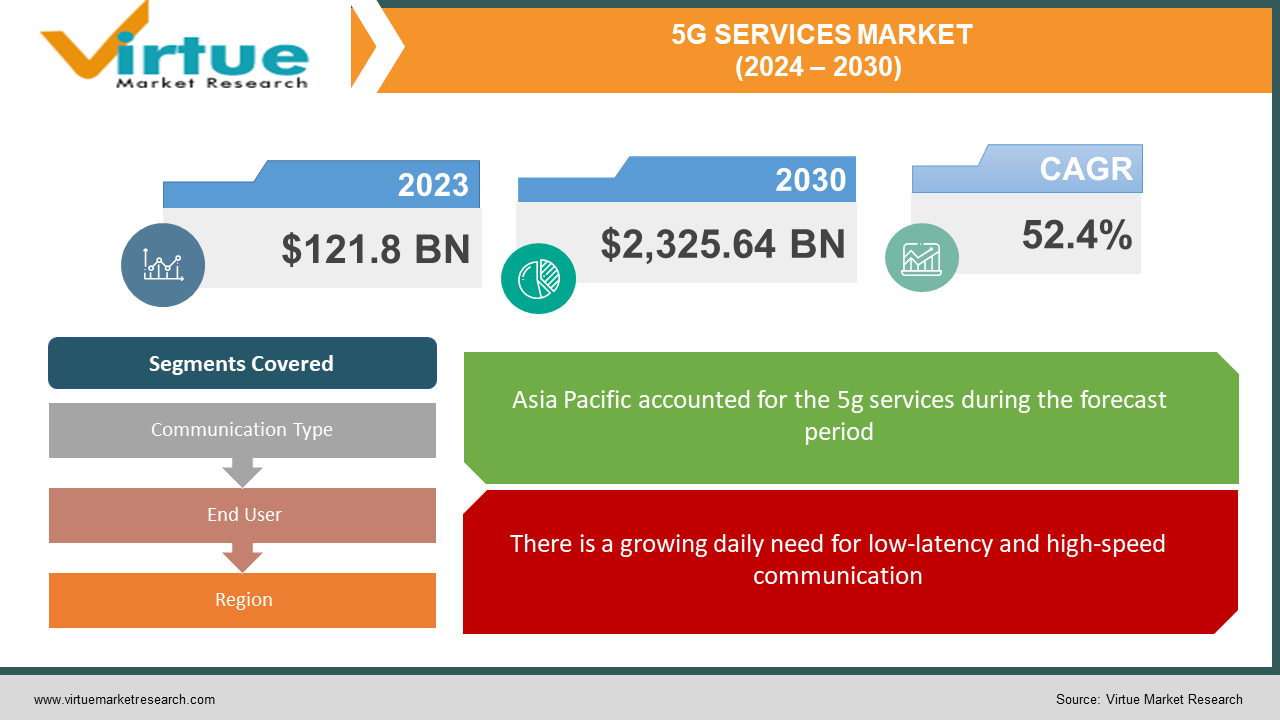

By the end of 2030, the global market for 5G services is expected to have grown from its 2023 valuation of USD 121.8 billion to USD 2,325.64 billion. The market is anticipated to expand at a compound annual growth rate (CAGR) of 52.4 percent between 2024 and 2030.

5G isn't just a faster download bar; it's a tidal wave of connectivity poised to reshape every corner of our lives by 2028. Its market value is expected to break the trillion-dollar barrier, propelled by a 52% annual growth rate driven by a thirst for data-hungry applications. The catalyst for this meteoric rise lies in the escalating demand for 5G's unparalleled connectivity, driven by the relentless proliferation of data-intensive applications such as high-definition video streaming, virtual reality (VR), and augmented reality (AR). Industries at the forefront of technological innovation, such as smart manufacturing, autonomous vehicles, and remote healthcare, are not merely exploring but actively deploying 5G. The common denominator for these sectors is their imperative need for high-speed, low-latency connectivity, a hallmark attribute of 5G. As the world ushers in an era of smart cities, the multifaceted applications of 5G, ranging from smart infrastructure to public safety and traffic management, are slated to fuel an exponential demand for 5G services. This connectivity revolution isn't confined to factories and highways. Cities transformed into living, breathing ecosystems where traffic lights adapt to real-time congestion and waste management is optimized by a network of 5G-powered sensors. Public safety leaps to the next level with connected devices and real-time data analysis, ensuring a safer future for all. Riding this 5G wave requires investment. Network infrastructure providers and telecom giants are pouring billions into building the digital highways of tomorrow. Governments, recognizing the transformative potential, are actively supporting 5G development with policies and initiatives. Affordability remains a hurdle, potentially leaving some communities behind in the digital divide. Cybersecurity threats loom large in this hyper-connected world, demanding robust safeguards to protect our data and privacy. And the infrastructure itself needs careful planning and deployment to ensure seamless coverage across urban and rural landscapes.

Key Market Insights:

5G can link billions of devices concurrently, opening the door for smart cities and the Internet of Things (IoT). The global market for 5G services has been expanding significantly due to the increasing need for high-speed, low-latency connectivity. The industry has grown because of the rollout of 5G networks in numerous nations and areas. Massive MIMO (Multiple Input, Multiple Output) systems, millimeter-wave spectrum, and network slicing are some of the cutting-edge technologies that underpin 5G services. These developments in technology allow for increased network capacity, quicker data rates, and support for many connected devices at once. Applications for 5G services can be found in several business verticals, such as smart cities, telecommunications, healthcare, and automobiles. Businesses are utilizing 5G to improve their operational efficiency and facilitate connections to the Internet of Things, and the adoption of 5G services varies across regions, with some countries leading in terms of deployment and coverage. The adoption rate of 5G may be impacted by obstacles including spectrum availability, infrastructure deployment costs, and regulatory issues, even with its rapid expansion. As the 5G ecosystem grows, security and privacy issues also need to be addressed.

Global 5G Services Market Drivers:

There is a growing daily need for low-latency and high-speed communication.

5G technology addresses the need for greater data capacity and better data speeds as the demand for high-speed internet and data-intensive applications rises. The seamless movement of massive volumes of data is made possible by 5G networks' increased capacity, which supports applications like streaming, virtual reality, augmented reality, and Internet of Things devices. An important factor propelling the expansion of the global market for 5G services is the growing need for fast and low-latency connectivity. Faster and more dependable communication networks are becoming increasingly necessary as technology develops, particularly with the growth of data-intensive services and applications like the Internet of Things (IoT), augmented reality (AR), virtual reality (VR), and driverless cars. The data transfer rates of 5G technology are noticeably higher than those of 4G LTE and other earlier technologies. For applications that need real-time communication, 5G offers a smooth and immersive user experience with the ability to deliver gigabit-per-second speeds and decreased latency. The adoption of 5G services across a variety of industries, such as healthcare, manufacturing, entertainment, and smart cities, is fueled by their improved speed and responsiveness.

The ongoing creation and uptake of new applications and technology is another important factor propelling the global market for 5G services.

5G technology has a big impact on emerging technologies like edge computing, AI, and ML. 5G's lower latency features improve the performance of applications that need quick answers by enabling real-time processing and decision-making. 5G and emerging technologies work together to create new opportunities for applications that require high bandwidth, low latency, and quick data delivery. Real-time AI and ML applications that depend on speedy data processing and analysis fall under this category. The lower latency of 5G is especially helpful for apps that need to process and decide in real time. 5G's capabilities are advantageous to industries and sectors like autonomous systems that need to make decisions instantly. Autonomous vehicles, industrial automation, and other time-sensitive applications are affected by this. By improving connectivity through the use of 5G in IoT applications, companies may deploy more sophisticated and effective IoT solutions. This is seen in the use of IoT for automation, data analysis, and increased productivity in industries like healthcare, manufacturing, smart cities, and transportation. The Internet of Things is growing thanks to 5G's mMTC features, which make it easier for many devices with different bandwidth needs to communicate with one another.

New standards for 5G technologies are being set by network evolution and technological advancements.

The worldwide market for 5G services is significantly fueled by the ongoing creation and uptake of new applications and technologies. The continuous progress in technology generates a need for sophisticated connectivity solutions. Industry adoption of digital transformation has led to a greater demand for 5G services' reliable and creative connectivity. The market for 5G services is anticipated to develop because of this demand. Thanks to its ability to facilitate automation, real-time data analysis, and remote control, 5G is essential to the Industry 4.0 revolution. 5G connectivity helps businesses including manufacturing, healthcare, transportation, and logistics integrate smart technologies more easily and operate more efficiently. Industry 4.0's implementation of 5G allows for quicker and more dependable machine-to-machine connectivity. This is essential for successful application deployment, which demands low latency, high data speeds, and dependable connectivity, as well as real-time monitoring and control. The mass deployment of 5G technologies depends on standardization. It guarantees that 5G networks and devices from many suppliers may function flawlessly together, promoting a unified and interoperable global 5G ecosystem. The dynamic panorama of technical advancement, Industry 4.0's integration of smart technologies, standardization activities, R&D investments, and cooperative industry initiatives all play a part in the market's robust expansion for 5G services globally.

Global 5G Services Market Restraints and Challenges:

Expenses of infrastructure and difficulties in deployment.

A primary impediment to the worldwide market for 5G services is the substantial expense linked to constructing the requisite infrastructure. A dense network of base stations and tiny cells is needed for 5G deployment to provide a high-speed, low-latency connection. Telecom operators and other stakeholders will need to make large capital expenditures to implement this vast network. One constraining element may be the cost, particularly for operators hoping to roll out nationwide 5G coverage. Telecom companies and other important players must make large capital investments to develop 5G networks. An important part of developing and growing 5G infrastructure is telecom operators. Operators may find their financial resources strained by the significant outlays necessary for the deployment of small cells, base stations, and associated equipment. This financial obstacle might slow down the deployment of 5G networks, which would limit consumer access to 5G services. Obtaining regulatory authorization is a crucial phase in the implementation of 5G infrastructure. Navigating through diverse regulatory regimes in numerous nations and areas is a challenging procedure. Permit delays can impede the deployment process and prevent 5G services from being widely and promptly available to end customers.

Technological immaturity and spectrum availability.

5G adoption is likely to be uneven across different regions and populations. Developed economies with higher disposable incomes and stronger infrastructure are likely to adopt it faster than developing nations. The need for new devices could exacerbate the digital divide, leaving low-income individuals and communities without access to 5G technology and its potential benefits. The increased connectivity and complexity of 5G networks introduce new cybersecurity challenges that need to be addressed. Building and maintaining 5G infrastructure can be expensive and time-consuming, particularly in rural or remote areas.

Concerns about security, a larger attack surface, network vulnerabilities, risks to privacy, and risks related to data protection.

5G's intricate architecture, with edge computing at its heart, throws traditional security measures into disarray. Securing such a labyrinthine network becomes a formidable puzzle, requiring dexterous maneuvers to plug in every vulnerability. Throw in virtualization and SDN, and the security landscape becomes a dizzying maze. Managing and securing this virtualized environment demands constant vigilance and agility from even the most seasoned cybersecurity warriors. As 5G devices spew a torrent of data, from location pings to health records, concerns about user privacy rise like a tidal wave. Safeguarding this personal tsunami requires robust data protection measures to prevent unauthorized access and ensure user consent. A single breach in this data dam could unleash a deluge of identity theft and cybercrime. Consumers become vulnerable when their digital footprints are exposed, like flotsam on a stormy sea. While tech enthusiasts revel in 5G's potential, many consumers remain adrift in a sea of confusion. Lack of awareness about its benefits and a perceived lack of urgency can dampen adoption, leaving the security fortress vulnerable in some corners. Manufacturers must prioritize robust security features in every connected device, making them fortresses against cyberattacks. Building detailed network maps and implementing comprehensive security protocols are crucial for navigating the complexities of 5G's distributed architecture. Effective communication campaigns are needed to educate users about the benefits and potential risks of 5G, empowering them to make informed choices.

Global 5G Services Market Opportunities:

5G isn't just about faster downloads; it's about precision-level communication. Its low latency makes it ideal for real-time data exchange between machines, enabling advanced robotics, automation, and remote control of machinery. This paves the way for Industry 4.0, where factories become interconnected ecosystems of intelligent machines, optimizing production and boosting efficiency.5G isn't just about streaming; it has the potential to revolutionize healthcare. Imagine doctors remotely monitoring patients in real-time or surgeons performing complex procedures using robots controlled from miles away. With its high speeds and reliability, 5G enables telemedicine, remote patient monitoring, and the efficient transmission of large medical data files, bringing essential healthcare to even the most remote areas. Businesses can deploy private 5G networks to cater to their specific security and connectivity needs, while the entertainment industry can experiment with high-quality streaming services, AR/VR experiences, and cloud-based gaming. Think of it as a canvas for innovation, where every brushstroke brings a new possibility to life. Service providers can partner with various industries to co-create innovative solutions, like joint ventures for smart city applications or research partnerships for developing new 5G-enabled healthcare solutions. This collaborative spirit paves the way for a thriving ecosystem where 5G's potential can be fully realized.5G isn't just about faster downloads; it's a catalyst for groundbreaking innovations across industries. It's the fuel that will power smarter cities, revolutionize healthcare, and unlock a world of immersive entertainment experiences. With its potential to connect billions of devices and enable real-time data exchange, 5G is more than just a technological marvel; it's a glimpse into a future where connectivity becomes the lifeblood of a more efficient, safer, and more connected world.

5G SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

52.4% |

|

Segments Covered |

By Communication Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AT&T, British Telecommunications, Deutsche Telekom AG, SK Telecom Co., Ltd, Verizon Communications, Inc, NTT DOCOMO, T-Mobile USA, Inc, Rakuten Mobile, Swisscom, Telenor |

Global 5G Services Market Segmentation: By Communication Type

-

Enhanced Mobile Broadband (eMBB)

-

Massive Machine-Type Communication (mMTC)

-

Ultra-Reliable Low-Latency Communication (uRLLC)

-

Fixed Wireless Access (FWA)

With around 43% of the market, eMBB currently has the biggest share and provides incredibly fast data speeds, perfect for virtual reality, augmented reality, and high-definition video streaming, all of which improve the user experience. It is anticipated that it will soon continue to rule because of the strong customer desire for cutting-edge multimedia applications.

With a substantial market share of about 35%, mMTC is expected to grow at the highest rate. It links the Internet of Things (IoT) ecosystem's millions of low-power, low-data devices, such as wearables, smart meters, and sensors. Explosive growth fueled by projects for industrial automation, connected homes, and smart cities. Although it currently only has a 15% stake, uRLLC is expected to develop significantly in the coming years. Low latency and ultra-reliable communications are essential for applications such as industrial control systems, driverless vehicles, and remote surgery. It is anticipated to become increasingly popular as more sectors embrace real-time data exchange and latency-sensitive applications. FWA provides an alternative to conventional fixed broadband lines, although with a smaller market share of about 7%. It offers 5G networks with high-speed internet connectivity, especially in underdeveloped areas with inadequate fiber-optic infrastructure. It is anticipated to expand gradually as it closes the digital gap and provides remote areas with an inexpensive broadband option.

Global 5G Services Market Segmentation: By End User

-

Consumers

-

Enterprises

The enterprise segment is likely to hold the largest market share, despite currently having a smaller share than consumers. The potential for increased efficiency, automation, and innovation in various industries through 5G is driving significant investments, leading to faster growth in this segment. The standards and capabilities for advanced enterprise services are being actively developed. This early-stage investment and development suggests real-world applications like factories, autonomous vehicles, and robotics. The execution phase has already begun for some of these transformative technologies. This includes the standardization of network slicing, edge computing, and other key technologies. Applications like robotics and autonomous driving, requiring low latency and fast response times, will particularly benefit from the combined power of edge computing and 5G network slicing. This combination will enable real-time data processing and decision-making at the network edge, which is crucial for these latency-sensitive applications.

Global 5G Services Market Segmentation: Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Asia Pacific has the largest market share, exceeding 40% in 2023. Key drivers include aggressive infrastructure investments in China, Japan, and South Korea, coupled with a tech-savvy population and high demand for mobile data. It is projected to maintain its lead with a CAGR of around 55%, fueled by ongoing infrastructure expansion, government initiatives, and the adoption of 5G in diverse industries like manufacturing, healthcare, and entertainment.

North America is a significant player, with a market share of about 30%. Established telecom operators like Verizon and AT&T have led the initial rollout, focusing on enhanced mobile broadband for consumers and early enterprise adoption. It is expected to experience steady growth at a CAGR of roughly 45%. Continued infrastructure development, a focus on advanced applications like autonomous vehicles, and growing investments in private 5G networks will fuel this growth.

The Middle East and Africa (MEA) take the lead with a blazing CAGR of 75%. Rapid infrastructure development, government digitization efforts, and a largely untapped market propel its meteoric rise.

Impact Analysis of COVID-19 on the Global Market for 5G Services.

The pandemic's initial shockwaves disrupted the production and supply of 5G hardware, putting a brake on network expansion and deployment. With factories grinding to a halt, the rollout schedule hit a wall. Economic uncertainty fueled by lockdowns casts a shadow on 5G investments, particularly for consumer-oriented applications. Investors, skittish and unpredictable, hit the pause button on many projects. With travel restrictions and social distancing dampening activities like tourism and entertainment, the demand for 5G-enabled services took a tumble. 5G's fancy footwork went largely unnoticed in a socially distant world. Governments, forced to waltz with healthcare emergencies and economic recovery, had to temporarily reallocate funds away from 5G development. 5G, though promising, wasn't the partner when basic needs were at stake. The pandemic laid bare the fragility of existing infrastructure, highlighting the urgency for better digital connectivity. 5G, once seen as a futuristic fad, has transformed into a critical infrastructure project, propelling governments and businesses to prioritize its development. As the need for contactless solutions and operational efficiency soared, industries like manufacturing and logistics pivoted towards 5G-powered automation. Robots and machines, controlled by the 5G beat, stepped in to fill the gaps left by human limitations. COVID-19 may have temporarily slowed down the 5G groove, but its long-term impact has been a dance toward increased adoption. By revealing 5G's crucial role in communication, resilience, and efficiency, the pandemic has ultimately pushed the technology toward a brighter future.

Latest Trends/ Developments:

The 5G services market is in a constant state of evolution, with exciting new trends and developments emerging all the time. The emphasis is shifting from consumer-driven 5G adoption to enterprise-centric solutions. 5G's ability to connect machines and enable automation and real-time data processing is opening revolutionary possibilities for industries like manufacturing, healthcare, and transportation. Factories are implementing 5G-powered robots, predictive maintenance, and smart logistics solutions for enhanced efficiency and productivity. Remote surgery, real-time patient monitoring, and AI-powered diagnostics are just some of the transformative applications of 5G in healthcare. 5G enables autonomous vehicles, smart traffic management systems, and connected logistics for safer and more efficient transportation networks. Network slicing and edge computing are crucial for supporting the diverse needs of different 5G applications. Network slicing allows for customized, virtual networks with varying characteristics tailored for specific use cases. As 5G connects critical infrastructure and devices, security becomes paramount. Implementing robust cybersecurity measures and addressing privacy concerns will be essential for building trust and widespread adoption of 5G-powered solutions. Government policies and regulations play a significant role in shaping the pace and trajectory of the 5G rollout.

Key Players:

-

AT&T

-

British Telecommunications

-

Deutsche Telekom AG

-

SK Telecom Co., Ltd

-

Verizon Communications, Inc

-

NTT DOCOMO

-

T-Mobile USA, Inc

-

Rakuten Mobile

-

Swisscom

-

Telenor

Chapter 1. 5G services Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. 5G services Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. 5G services Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. 5G services Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. 5G services Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. 5G services Market – By Communication Type

6.1 Introduction/Key Findings

6.2 Enhanced Mobile Broadband (eMBB)

6.3 Massive Machine-Type Communication (mMTC)

6.4 Ultra-Reliable Low-Latency Communication (uRLLC)

6.5 Fixed Wireless Access (FWA)

6.6 Y-O-Y Growth trend Analysis By Communication Type

6.7 Absolute $ Opportunity Analysis By Communication Type, 2024-2030

Chapter 7. 5G services Market – By End User

7.1 Introduction/Key Findings

7.2 Consumers

7.3 Enterprises

7.4 Y-O-Y Growth trend Analysis By End User

7.5 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. 5G services Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By By Communication Type

8.1.3 By End User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By By Communication Type

8.2.3 By End User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By By Communication Type

8.3.3 By End User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By By Communication Type

8.4.3 By End User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By End User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. 5G services Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 AT&T

9.2 British Telecommunications

9.3 Deutsche Telekom AG

9.4 SK Telecom Co., Ltd

9.5 Verizon Communications, Inc

9.6 NTT DOCOMO

9.7 T-Mobile USA, Inc

9.8 Rakuten Mobile

9.9 Swisscom

9.10 Telenor

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The size of the world market was projected to be USD 121.8 billion in 2023 and is projected to grow to USD 2,325.64 billion by 2030.

Enterprise transformation, government initiatives, consumer demand, technological advancements, and ecosystem evolution.

The market for 5G services is dominated by the Asia-Pacific area.

With a 75 percent compound annual growth rate, the Middle East and Africa are the regions with the quickest rate of growth.

Network slicing and edge computing, cybersecurity concerns, tech-driven advancements, artificial intelligence, and machine learning.