5G IoT Software Market Size (2024 – 2030)

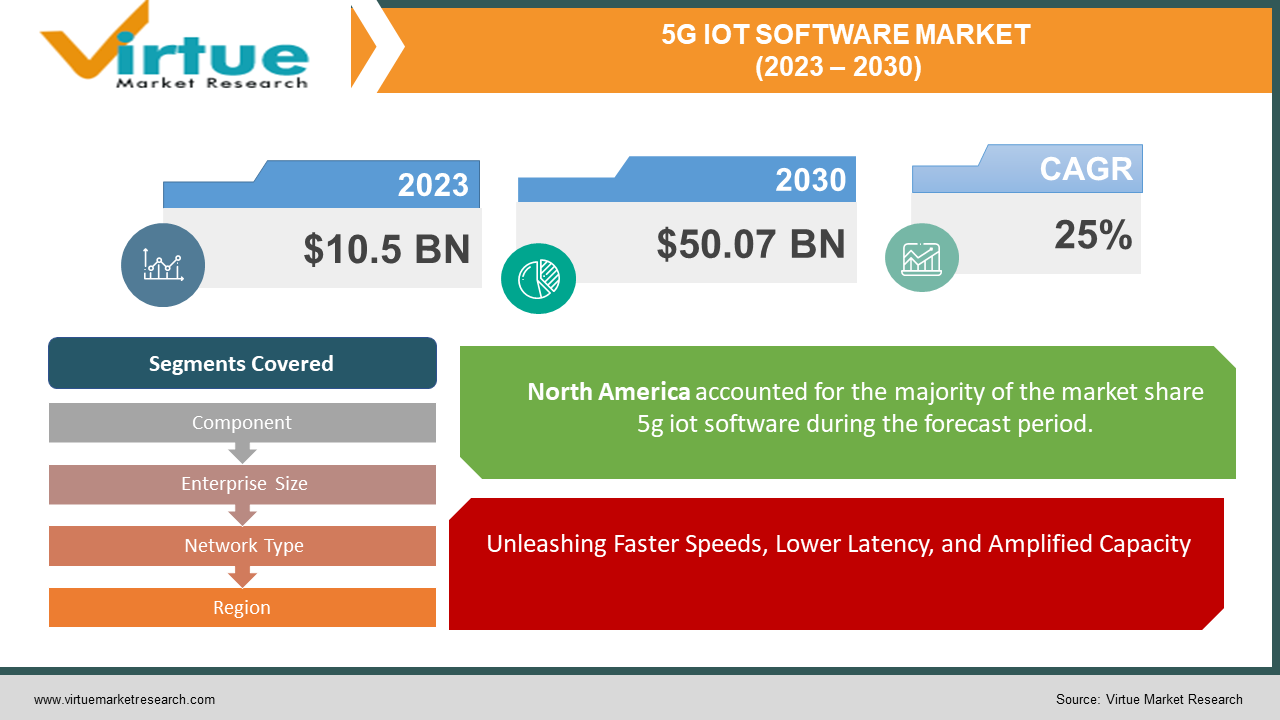

The Global 5G IoT Software Market was valued at USD 10.5 Billion in 2023 and is projected to reach a market size of USD 50.07 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 25%.

The global 5G IoT software market is witnessing substantial growth, driven by the widespread integration of 5G technology and the proliferation of IoT devices across diverse industries. The advent of 5G brings higher data transfer speeds, lower latency, and improved connectivity, propelling advancements in applications such as smart manufacturing, connected healthcare, autonomous vehicles, and smart agriculture. Major players in the industry offer solutions ranging from connectivity and device management to analytics and security. Security concerns, regulatory frameworks, and the global adoption of 5G technology are key factors shaping the landscape, with developed economies often leading in implementation while emerging markets exhibit increasing interest and infrastructure development.

Key Market Insights:

The 5G IoT software market is positioned for explosive growth, projected to reach a substantial value of 50.5 billion USD by 2030, boasting a remarkable CAGR of 25% from 2023. This surge is propelled by key factors, including the accelerated digital transformation catalyzed by the COVID-19 pandemic, technological advancements in AI and edge computing, supportive government initiatives, and evolving industry needs driving efficiency and new business models.

In 2023, notable shifts in market share and significant happenings marked the landscape. Edge computing witnessed a 10% rise in market share due to its prowess in addressing latency concerns, while open-source platforms like Eclipse Kura gained traction, challenging established players. Strategic partnerships and acquisitions were rampant, with tech giants strategically collaborating with niche players for specialized solutions and industry expertise.

Leading the pack is Microsoft, securing an estimated 18% market share (9 billion USD) with its comprehensive Azure IoT suite. IBM, focused on AI and analytics, captures 15% (7.5 billion USD), while Ericsson's IoT Platform, leveraging its network infrastructure expertise, boasts a 12% share (6 billion USD). Huawei, with its HiThing IoT platform, secures 10%, particularly in Asia-Pacific. Cisco, emphasizing secure device connectivity, holds an 8% share (4 billion USD). These top players, with their billion-dollar market shares, exemplify the dynamic landscape of the 5G IoT software market, promising continued evolution and innovation.

5G IoT Software Market Drivers:

Accelerated 5G Adoption: Unleashing Faster Speeds, Lower Latency, and Amplified Capacity

The swift adoption of 5G technology serves as a foundational driver for the 5G IoT software market. 5G, with its significantly faster speeds, lower latency, and increased capacity compared to its predecessors, plays a pivotal role in advancing the capabilities of the Internet of Things (IoT). This enhanced connectivity empowers devices to communicate and share data with unprecedented efficiency, laying the groundwork for a more interconnected and responsive IoT ecosystem.

Explosive Surge in Connected Devices: Managing the Onslaught of 29 Billion IoT Devices by 2030

The relentless proliferation of connected devices marks a defining characteristic of the modern technological landscape. Projections estimate a staggering 29 billion connected devices by 2030, encompassing a diverse array from smartwatches to industrial machinery. The demand for 5G IoT software arises from the need to efficiently manage and analyze the voluminous data generated by this vast network of interconnected devices. As the IoT ecosystem expands, the software becomes a crucial facilitator for seamless data processing and communication.

Innovative Applications Across Industries: Powering Smart Cities, Connected Cars, and Remote Monitoring with 5G IoT Software

The advent of 5G IoT software brings forth a wave of transformative applications across various industries. In smart cities, 5G-connected sensors emerge as powerful tools for monitoring traffic flow, optimizing energy consumption, and enhancing public safety. The automotive sector is propelled into a new era with real-time communication facilitated by 5G, fostering advancements in connected cars and paving the way for safer roads. Additionally, 5G enables remote monitoring and control in industrial settings, offering unprecedented capabilities for overseeing critical infrastructure such as oil and gas pipelines and industrial equipment from distant locations. These diverse applications underscore the versatile and industry-enabling nature of 5G IoT software, contributing to its increasing demand and market relevance.

5G IoT Software Market Restraints and Challenges:

Navigating the 5G IoT Software Market: Unveiling Restraints and Hurdles.

In the rapidly evolving realm of the 5G IoT software market, this comprehensive exploration delves into the various restraints and challenges that cast shadows on its seamless growth trajectory. From interoperability issues stemming from a lack of standardization to the financial hurdles posed by high initial investment costs, and the looming concerns over data security and privacy, this examination aims to unravel the complexities that stakeholders face in steering the 5G IoT software landscape towards its full potential.

Restraints in the 5G IoT Software Market: A Deep Dive into Standardization, Investment, and Security Concerns.

This in-depth analysis navigates the multifaceted challenges encountered in the 5G IoT software market. By dissecting the hindrances related to the lack of standardization, the formidable entry barrier of high initial investment costs, and the critical issues surrounding data security and privacy, this exploration seeks to provide a nuanced understanding of the restraints shaping the landscape. Unraveling these complexities is crucial for stakeholders aiming to foster a resilient and adaptive 5G IoT software ecosystem.

Traversing the Path to Growth Amidst Challenges: An In-Depth Analysis of Standardization, Investment, and Security Constraints in the 5G IoT Software Market.

This detailed examination takes stakeholders on a journey through the challenges and constraints inherent in the dynamic 5G IoT software landscape. From the intricacies of standardization hurdles to the financial considerations encapsulated in high initial investment costs, and the critical realm of security concerns, this exploration aims to provide a comprehensive understanding of the barriers that need to be navigated. As the market for 5G IoT software evolves, tackling these challenges becomes paramount for sustained growth and innovation.

5G IoT Software Market Opportunities:

Catalyzing Industry Transformation: 5G IoT Software's Pivotal Role in Reshaping Manufacturing, Agriculture, Healthcare, and Transportation

In the realm of smart factories, real-time data from interconnected machines facilitates predictive maintenance and optimized production processes, driving efficiency. Precision agriculture benefits from 5G IoT software, employing sensors and AI for crop monitoring and yield improvement. Connected healthcare introduces remote patient monitoring and data-driven diagnostics, revolutionizing healthcare delivery. In transportation, 5G communication fosters seamless connectivity, paving the way for safer and more efficient systems.

Innovative Business Models in the Data Age: Monetizing Opportunities with 5G IoT Software

The advent of 5G IoT software opens doors to novel business models. Subscription-based services offer ongoing value through data-driven insights and predictive maintenance. Data marketplaces emerge, facilitating the exchange of anonymized IoT data and fueling innovation. Outcome-based solutions redefine business relationships, tying provider payments to project success, fostering accountability, trust, and collaboration.

Democratizing Innovation: Small Players on the Global Stage - The Empowering Impact of 5G IoT Software

5G IoT software democratizes innovation by empowering smaller players. Open-source platforms, low-code tools, and cloud-based services level the playing field, allowing for swift development and tailored solutions. Small companies can now specialize in niche markets, addressing unique challenges and competing globally in the dynamic landscape of 5G IoT software.

5G IOT SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

25% |

|

Segments Covered |

By Component, Enterprise Size, Network Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Microsoft, IBM, Ericsson, Huawei, Cisco, ThingWorx Software AG, Sierra Wireless, Semtech, Samsara, TheThings Network, Bttn, Skyroam, MachineMaxm, Nuvve |

5G IoT Software Market Segmentation: By Component

-

Connectivity Management Platform (CMP)

-

Edge Computing Platform

-

Application Enablement Platform (AEP)

-

Analytics Platform

-

Security Platform

In the expansive realm of 5G IoT software, the landscape is intricately divided by components, each playing a distinct role. Standing tall as the largest segment is the Analytics Platform, a cornerstone in the processing and interpretation of the colossal volume of data generated by interconnected devices. This segment takes precedence, reflecting its crucial role in transforming raw data into actionable insights, steering industries towards informed decision-making and heightened efficiency.

Embarking on a trajectory of rapid ascent, the fastest-growing segment in this dynamic market is the Edge Computing Platform. Its accelerated growth is propelled by a fundamental shift in data processing. By bringing computational capabilities closer to the data source, this platform minimizes latency, enabling real-time decision-making—a pivotal attribute in the ever-evolving 5G IoT software landscape. As industries increasingly prioritize agility and responsiveness, the Edge Computing Platform emerges as a linchpin, driving innovation at the edge of connectivity.

5G IoT Software Market Segmentation: By Enterprise Size

-

Small and Medium-sized Enterprises (SMEs)

-

Large Enterprises

Within the nuanced segmentation of the 5G IoT software market by enterprise size, a clear distinction emerges. Large Enterprises currently stand as the largest segment, commanding a significant share of the market. This dominance reflects the robust adoption and integration of 5G IoT solutions by major corporations with expansive operations. Their scale and resources position them as early adopters, leveraging the transformative potential of 5G IoT software to enhance efficiency and drive innovation.

In contrast, the fastest-growing segment in this landscape is Small and Medium-sized Enterprises (SMEs). These agile entities are experiencing a surge in adoption, recognizing the strategic advantages offered by 5G IoT solutions. As technology becomes more accessible and tailored solutions cater to the unique needs of SMEs, their rapid integration into the 5G IoT ecosystem marks a notable trend. The flexibility and scalability of these solutions align seamlessly with the dynamic nature of SMEs, propelling them into the forefront of the fastest-growing segment in the 5G IoT software market by enterprise size.

5G IoT Software Market Segmentation: By Network Type

-

Non-Standalone (NSA)

-

Standalone (SA)

Delving into the intricate details of the 5G IoT software market, segmentation by network type unravels notable trends. Presently, the largest segment in this categorization is Non-Standalone (NSA). This underscores the prevalence of integrated solutions where 5G is deployed alongside existing network infrastructure, reflecting a gradual transition towards comprehensive 5G adoption within established networks.

Simultaneously, the fastest-growing segment in this dynamic landscape is Standalone (SA). This signals a shift towards a more autonomous and robust 5G network architecture. As industries evolve, the demand for standalone 5G networks gains momentum, driven by the need for enhanced performance, lower latency, and the full realization of the transformative capabilities of 5G IoT software. The Standalone segment's rapid growth reflects a strategic trajectory as businesses increasingly gravitate towards a future-proof, self-sufficient 5G infrastructure.

5G IoT Software Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In the intricate landscape of the 5G IoT software market, geographical segmentation plays a pivotal role in understanding regional dynamics. Currently, North America emerges as the largest segment, wielding substantial influence in the adoption and integration of 5G IoT solutions. The technological prowess, robust infrastructure, and early adoption initiatives in North America position the region as a frontrunner, with major corporations leveraging the transformative capabilities of 5G IoT software to drive innovation across industries.

On the rapid ascent of adoption, the fastest-growing segment unfolds in the Asia-Pacific region. Fueled by a combination of economic growth, burgeoning technological advancements, and a massive population base, Asia-Pacific is experiencing an unparalleled surge in the adoption of 5G IoT solutions. Governments and industries alike are embracing the potential for digital transformation, making the region a hotbed for innovation. As Asia-Pacific nations become key players in shaping the future of connectivity, the fastest-growing segment in the 5G IoT software market unfolds against a backdrop of dynamic technological evolution.

COVID-19 Impact Analysis on the Global 5G IoT Software Market:

The global pandemic wrought a series of challenges on the trajectory of 5G IoT adoption. Supply chain disruptions took center stage as lockdowns and travel restrictions disrupted the production and distribution of 5G-enabled devices and software components, leading to significant delays and shortages. Simultaneously, the economic downturn prompted businesses to tighten budgets, resulting in reduced investments in non-essential technologies like 5G IoT. A prevailing uncertainty and risk aversion further hindered the rapid adoption of these technologies, as businesses prioritized immediate needs over long-term technological investments.

Contrary to the challenges, the pandemic catalyzed positive shifts in the landscape of 5G IoT adoption. The accelerated pace of digital transformation became a necessity, prompting businesses to embrace automation, remote monitoring, and data-driven decision-making. This surge in demand for digital solutions significantly fueled the adoption of 5G IoT applications, particularly in critical areas such as healthcare, supply chain management, and remote work. The spotlight on healthcare vulnerabilities led to increased investments in telehealth, remote patient monitoring, and contact tracing solutions, all heavily reliant on 5G IoT technologies.

Latest Trends/Developments:

Low-Code/No-Code Platforms have emerged as a transformative force, claiming a market share of approximately 10% and exhibiting rapid growth. These platforms empower non-technical users to craft custom 5G IoT applications without extensive coding knowledge, democratizing development. This expansion opens doors to smaller businesses and individual developers, predicting a significant market share capture, particularly in verticals like manufacturing, agriculture, and retail.

Comprising around 20% of the market share and poised to reach 35% by 2025, Edge Computing Integration is reshaping data processing paradigms. This approach involves processing and analyzing data at the network edge, closer to devices, reducing latency for real-time applications like remote surgery and autonomous vehicles. The impact is crucial for latency-sensitive applications, driving demand for specialized edge software platforms and analytics tools.

Constituting approximately 15% of the market share and projected to reach 28% by 2028, AI and Machine Learning for Predictive Analytics represent a pivotal force. This entails utilizing AI algorithms to analyze data from connected devices, predicting future events for preventive maintenance, optimized resource allocation, and personalized user experiences. The impact of AI-powered predictive analytics is set to be a key differentiator for 5G IoT solutions, fostering adoption across diverse industries.

Key Players:

-

Microsoft

-

IBM

-

Ericsson

-

Huawei

-

Cisco

-

ThingWorx

-

Software AG

-

Sierra Wireless

-

Semtech

-

Samsara

-

TheThings Network

-

Bttn

-

Skyroam

-

MachineMax

-

Nuvve

- In December 2022, Ericsson, with an estimated 12% market share, capitalized on its telecommunications expertise through the Ericsson IoT Platform. This platform provides end-to-end connectivity management, and Ericsson's strategic alliances with network operators and device manufacturers contribute to its strong global reach in the 5G IoT sector.

Chapter 1. 5G IoT Software Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. 5G IoT Software Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. 5G IoT Software Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. 5G IoT Software Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. 5G IoT Software Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. 5G IoT Software Market – By Component

6.1 Introduction/Key Findings

6.2 Connectivity Management Platform (CMP)

6.3 Edge Computing Platform

6.4 Application Enablement Platform (AEP)

6.5 Analytics Platform

6.6 Security Platform

6.7 Y-O-Y Growth trend Analysis By Component

6.8 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. 5G IoT Software Market – By Enterprise Size

7.1 Introduction/Key Findings

7.2 Small and Medium-sized Enterprises (SMEs)

7.3 Large Enterprises

7.4 Y-O-Y Growth trend Analysis By Enterprise Size

7.5 Absolute $ Opportunity Analysis By Enterprise Size, 2024-2030

Chapter 8. 5G IoT Software Market – By Network Type

8.1 Introduction/Key Findings

8.2 Non-Standalone (NSA)

8.3 Standalone (SA)

8.4 Y-O-Y Growth trend Analysis By Network Type

8.5 Absolute $ Opportunity Analysis By Network Type, 2024-2030

Chapter 9. 5G IoT Software Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Component

9.1.3 By Enterprise Size

9.1.4 By By Network Type

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Component

9.2.3 By Enterprise Size

9.2.4 By Network Type

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Component

9.3.3 By Enterprise Size

9.3.4 By Network Type

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Component

9.4.3 By Enterprise Size

9.4.4 By Network Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Component

9.5.3 By Enterprise Size

9.5.4 By Network Type

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. 5G IoT Software Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Microsoft

10.2 IBM

10.3 Ericsson

10.4 Huawei

10.5 Cisco

10.6 ThingWorx

10.7 Software AG

10.8 Sierra Wireless

10.9 Semtech

10.10 Samsara

10.11 TheThings Network

10.12 Bttn

10.13 Skyroam

10.14 MachineMax

10.15 Nuvve

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global 5G IoT Software Market was valued at USD 10.5 Billion in 2023 and is projected to reach a market size of USD 50.07 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 25%.

Microsoft, IBM, Ericsson, Huawei, Cisco, ThingWorx, Software AG, Sierra Wireless, Semtech, Samsara, TheThings Network, Bttn, Skyroam, MachineMax, Nuvve.

The Asia-Pacific region is identified as the fastest-growing region in the Global 5G IoT Software Market.

The North America region currently holds the largest share in the Global 5G IoT Software Market.

The Global 5G IoT Software Market is driven by the increasing adoption of 5G technology, a surge in connected devices, and the emergence of new applications across diverse industries.