5G Infrastructure in Healthcare Market Size (2025 – 2030)

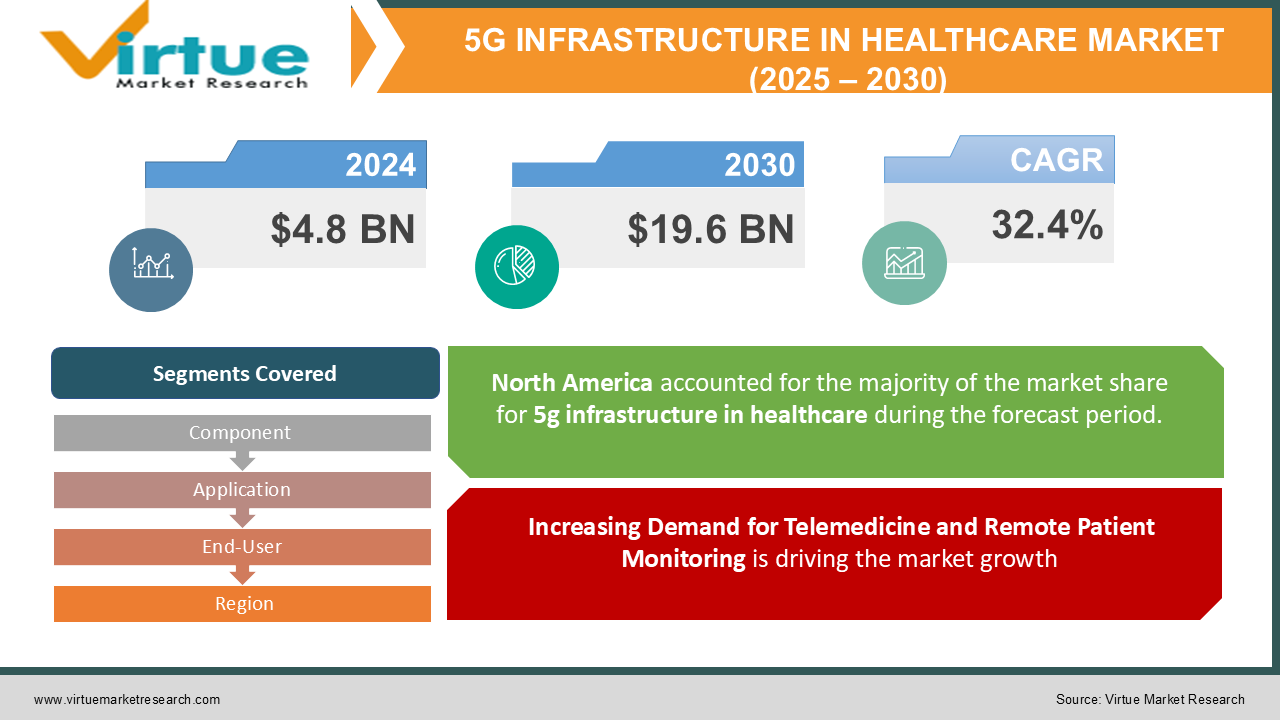

The Global 5G Infrastructure in Healthcare Market was valued at USD 4.8 billion in 2024 and is projected to reach USD 19.6 billion by 2030, growing at a CAGR of 32.4% during the forecast period.

The adoption of 5G technology in healthcare is revolutionizing the industry by enabling high-speed data transmission, real-time remote monitoring, telemedicine advancements, and enhanced AI-driven diagnostics. With increasing reliance on connected medical devices, robotic surgeries, and augmented reality (AR)/virtual reality (VR) applications, the demand for 5G infrastructure in healthcare is surging.

Key Market Insights

-

Remote patient monitoring holds the largest share, accounting for 35% of market revenue, driven by the need for real-time data transfer and patient management.

-

Hospitals and large healthcare institutions dominate the end-user segment, holding a 50% market share, due to their extensive investments in 5G technology.

-

North America leads the market with a 40% share, fueled by rapid adoption of 5G-enabled medical technologies and government investments in digital healthcare.

-

Telemedicine applications are growing at the fastest rate, with a CAGR of 28%, as 5G reduces latency and improves virtual consultations.

-

Software solutions for 5G healthcare applications are experiencing strong demand, particularly for AI-powered diagnostics, cloud-based medical data processing, and real-time analytics.

-

The integration of AI and 5G is driving market growth, with AI-driven applications enhancing predictive healthcare and robotic-assisted surgeries.

-

Regulatory challenges and cybersecurity risks remain key concerns in implementing 5G infrastructure in healthcare systems.

Global 5G Infrastructure in Healthcare Market Drivers

1. Increasing Demand for Telemedicine and Remote Patient Monitoring is driving the market growth

The rise of telehealth services and remote patient monitoring (RPM) is a major driver for 5G adoption in healthcare. 5G networks provide ultra-low latency, allowing healthcare professionals to conduct real-time video consultations, monitor patient vitals remotely, and deliver emergency care virtually.

Moreover, 5G-enabled wearable medical devices enhance real-time tracking of patient health metrics such as heart rate, blood pressure, and glucose levels, enabling proactive healthcare interventions.

2. Growing Adoption of AI, IoT, and AR/VR in Healthcare is driving the market growth

The integration of 5G with artificial intelligence (AI), the Internet of Things (IoT), and AR/VR is transforming healthcare services. AI-powered diagnostics, predictive analytics, and personalized treatment plans benefit from 5G's fast data transfer capabilities.

Additionally, AR/VR applications are improving medical training and robotic-assisted surgeries by providing high-definition imaging and real-time data sharing, enhancing precision and reducing surgical risks.

3. Government Investments and Regulatory Support is driving the market growth

Governments worldwide are investing heavily in 5G-enabled healthcare infrastructure. Initiatives such as the FCC’s Connected Care Pilot Program in the U.S. and the EU’s 5G Action Plan are promoting the deployment of 5G networks in healthcare. These investments are accelerating the adoption of digital healthcare technologies, making 5G a crucial enabler for future healthcare solutions.

Global 5G Infrastructure in Healthcare Market Challenges and Restraints

1. High Initial Investment and Deployment Costs is restricting the market growth

Implementing 5G infrastructure in healthcare requires significant capital investments in network deployment, medical device upgrades, and cybersecurity measures. Smaller healthcare providers and rural hospitals may face challenges in adopting 5G due to budget constraints and technical limitations.

2. Data Security and Privacy Concerns is restricting the market growth

With 5G enabling real-time data exchange across multiple devices, cybersecurity risks such as data breaches, unauthorized access, and hacking increase. Ensuring compliance with HIPAA, GDPR, and other data protection regulations is critical for securing patient data in 5G-powered healthcare systems.

Market Opportunities

The global 5G infrastructure in healthcare market is ripe with lucrative opportunities, poised to transform healthcare delivery and patient care. One significant area of potential lies in the expansion of Smart Hospitals. The increasing demand for connected healthcare systems, AI-driven diagnostics, and cloud-based patient data management creates a strong impetus for the development of 5G-enabled smart hospitals. These facilities can leverage 5G's high bandwidth and low latency to seamlessly integrate various technologies, improving operational efficiency, enhancing patient experiences, and optimizing resource allocation. Advancements in Telerobotic Surgeries represent another exciting opportunity. 5G technology enables the low-latency communication required for robotic-assisted surgeries, allowing expert surgeons to perform complex procedures remotely with enhanced precision and dexterity. This capability can bridge geographical barriers, providing access to specialized surgical expertise in remote or underserved areas. Furthermore, 5G is revolutionizing Emergency Response Systems. 5G-powered ambulances and emergency healthcare units can transmit real-time patient data, including vital signs and medical images, to hospitals en route. This allows medical professionals to prepare for the patient's arrival, improving emergency response efficiency and potentially saving lives. Finally, the increased adoption of 5G in emerging markets presents significant growth potential. Countries in Asia-Pacific, Latin America, and the Middle East are rapidly investing in 5G healthcare infrastructure, driven by increasing smartphone penetration, rising healthcare expenditure, and a growing focus on digital health initiatives. These regions offer substantial opportunities for market players to deploy 5G-enabled healthcare solutions and contribute to the development of more advanced and accessible healthcare systems.

5G INFRASTRUCTURE IN HEALTHCARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

32.4% |

|

Segments Covered |

By Component, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Qualcomm Inc., Ericsson AB, Huawei Technologies Co., Ltd., AT&T Inc., Verizon Communications Inc., Nokia Corporation, Cisco Systems, Inc., Samsung Electronics Co., Ltd., T-Mobile USA, Inc., Telstra Corporation Limited |

5G Infrastructure in Healthcare Market Segmentation - By Component

-

Hardware

-

Software

-

Services

The hardware component currently holds the dominant share. This segment encompasses the physical infrastructure necessary for 5G networks, including base stations, antennas, servers, and other network equipment. The substantial investments required for deploying and upgrading 5G networks in healthcare facilities contribute significantly to the hardware segment's leading position. While software and services are crucial for enabling and supporting 5G applications in healthcare, the foundational hardware infrastructure remains the primary driver of market revenue at this stage.

5G Infrastructure in Healthcare Market Segmentation - By Application

-

Remote Patient Monitoring

-

Telemedicine

-

Augmented Reality (AR) & Virtual Reality (VR) in Healthcare

-

Connected Medical Devices

Remote Patient Monitoring (RPM) currently holds a dominant position. The increasing prevalence of chronic diseases, coupled with the growing emphasis on proactive healthcare management and cost containment, has fueled the demand for RPM solutions. 5G's high bandwidth and low latency enable the seamless transmission of patient data from connected devices to healthcare providers, facilitating timely interventions and personalized care. While telemedicine has also seen significant growth, particularly accelerated by the COVID-19 pandemic, RPM's continuous monitoring capabilities and focus on chronic disease management give it a leading edge. Augmented Reality (AR) and Virtual Reality (VR) in healthcare, while promising, are still in relatively early stages of adoption, although 5G is expected to play a crucial role in their future development. Connected medical devices also contribute significantly to the market, but their integration with RPM systems further strengthens the latter's dominance. Therefore, while all these applications benefit from 5G, RPM currently stands out as the most prominent segment due to its widespread applicability and established market presence.

5G Infrastructure in Healthcare Market Segmentation - By End-User

-

Hospitals

-

Clinics

-

Ambulatory Surgical Centers

Hospitals currently represent the largest end-user segment, holding a substantial 50% market share. Hospitals are complex healthcare environments that require seamless connectivity for a wide range of applications, from patient monitoring and telehealth to remote surgery and data management. The increasing adoption of advanced technologies like AI-driven diagnostics, robotic surgery, and connected medical devices within hospitals necessitates robust 5G infrastructure, contributing significantly to this segment's dominance. While clinics and ambulatory surgical centers also benefit from 5G technology, their scale of operations and infrastructure requirements are generally smaller compared to hospitals. Therefore, while these segments are growing and represent important parts of the market, the complex needs and large-scale deployments within hospitals make them the primary driver of the 5G infrastructure in healthcare market.

5G Infrastructure in Healthcare Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

The 5G in healthcare market exhibits significant regional variations. North America currently dominates, holding the largest market share (40%), driven by high adoption rates of 5G-powered healthcare technologies, supportive government initiatives like the FCC’s 5G Health Pilot Programs, and the presence of key industry players like Qualcomm, AT&T, and Verizon. Europe is also experiencing substantial growth, fueled by government funding for 5G deployment in healthcare and the increasing adoption of 5G-enabled robotic surgeries and AI-driven diagnostics. However, the Asia-Pacific region is projected to be the fastest-growing, with a remarkable CAGR of 29%, thanks to high smartphone penetration, increasing investments in digital health, and the rapid expansion of 5G networks in countries like China, Japan, and South Korea. Finally, emerging markets in Latin America, the Middle East, and Africa are gradually embracing 5G in healthcare, with government-backed pilot projects and growing investments in telehealth infrastructure laying the foundation for future growth.

COVID-19 Impact Analysis

The COVID-19 pandemic served as a catalyst for the rapid adoption and development of 5G-enabled healthcare solutions. The unprecedented crisis underscored the urgent need for innovative approaches to patient care, particularly in minimizing physical contact and maximizing remote capabilities. This led to a surge in the implementation of telemedicine and remote patient monitoring systems, leveraging 5G's high bandwidth and low latency to facilitate virtual consultations, remote vital sign monitoring, and timely interventions, thereby reducing the strain on hospitals and minimizing the risk of infection. The pandemic also accelerated the development and deployment of AI-driven diagnostics, with 5G enabling the rapid processing and analysis of medical images and patient data for faster and more accurate COVID-19 detection. Furthermore, the need to limit human interaction in operating rooms spurred interest in 5G-powered robotic surgeries, allowing surgeons to perform procedures remotely with enhanced precision and minimizing the risk of transmission. Beyond these specific applications, the pandemic significantly boosted government funding for 5G healthcare initiatives, recognizing the critical role of this technology in strengthening healthcare infrastructure and improving pandemic preparedness. This increased investment further fueled market growth and fostered innovation in the 5G healthcare sector, paving the way for a more resilient and technologically advanced healthcare ecosystem.

Latest Trends/Developments

The convergence of 5G technology and Artificial Intelligence (AI) is revolutionizing healthcare, leading to significant advancements in diagnostics, treatment, and patient care. AI-powered healthcare applications are being enhanced with 5G-enabled data processing, enabling predictive analytics and diagnostics with unprecedented speed and accuracy. 5G Smart Ambulances, already being deployed in countries like the UK and Japan, facilitate real-time patient data transmission to hospitals, enabling doctors to prepare for patient arrival and potentially provide remote guidance to paramedics. Edge computing, integrated with 5G in hospitals, allows for healthcare data processing closer to the source, improving efficiency and reducing latency. 5G's high-speed connectivity also plays a crucial role in medical imaging, enabling high-resolution images to be transmitted and analyzed in real-time, fostering collaboration among radiologists and improving diagnostic accuracy. These advancements, powered by the synergy of 5G and AI, are transforming healthcare delivery, making it more efficient, accessible, and personalized.

Key Players

-

Qualcomm Inc.

-

Ericsson AB

-

Huawei Technologies Co., Ltd.

-

AT&T Inc.

-

Verizon Communications Inc.

-

Nokia Corporation

-

Cisco Systems, Inc.

-

Samsung Electronics Co., Ltd.

-

T-Mobile USA, Inc.

-

Telstra Corporation Limited

Chapter 1. 5G Infrastructure in Healthcare Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. 5G Infrastructure in Healthcare Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. 5G Infrastructure in Healthcare Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. 5G Infrastructure in Healthcare Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. 5G Infrastructure in Healthcare Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. 5G Infrastructure in Healthcare Market – By Component

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Software

6.4 Services

6.5 Y-O-Y Growth trend Analysis By Component

6.6 Absolute $ Opportunity Analysis By Component , 2025-2030

Chapter 7. 5G Infrastructure in Healthcare Market – By Application

7.1 Introduction/Key Findings

7.2 Remote Patient Monitoring

7.3 Telemedicine

7.4 Augmented Reality (AR) & Virtual Reality (VR) in Healthcare

7.5 Connected Medical Devices

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. 5G Infrastructure in Healthcare Market – By End-User

8.1 Introduction/Key Findings

8.2 Hospitals

8.3 Clinics

8.4 Ambulatory Surgical Centers

8.5 Y-O-Y Growth trend Analysis By End-User

8.6 Absolute $ Opportunity Analysis By End-User, 2025-2030

Chapter 9. 5G Infrastructure in Healthcare Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Component

9.1.3 By Application

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Component

9.2.3 By Application

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Component

9.3.3 By Application

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Component

9.4.3 By Application

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Component

9.5.3 By Application

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. 5G Infrastructure in Healthcare Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Qualcomm Inc.

10.2 Ericsson AB

10.3 Huawei Technologies Co., Ltd.

10.4 AT&T Inc.

10.5 Verizon Communications Inc.

10.6 Nokia Corporation

10.7 Cisco Systems, Inc.

10.8 Samsung Electronics Co., Ltd.

10.9 T-Mobile USA, Inc.

10.10 Telstra Corporation Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The market was valued at USD 4.8 billion in 2024 and is projected to reach USD 19.6 billion by 2030, growing at a CAGR of 32.4%.

Key drivers include the rise of telemedicine, AI-powered diagnostics, and government investments in 5G healthcare infrastructure.

North America, with a 40% market share.

Remote patient monitoring, telemedicine, AR/VR applications, and connected medical devices.

Leading players include Qualcomm, Ericsson, Huawei, AT&T, and Verizon.