5G Enabled Remote Healthcare Monitoring Devices Market Size (2024 –2030)

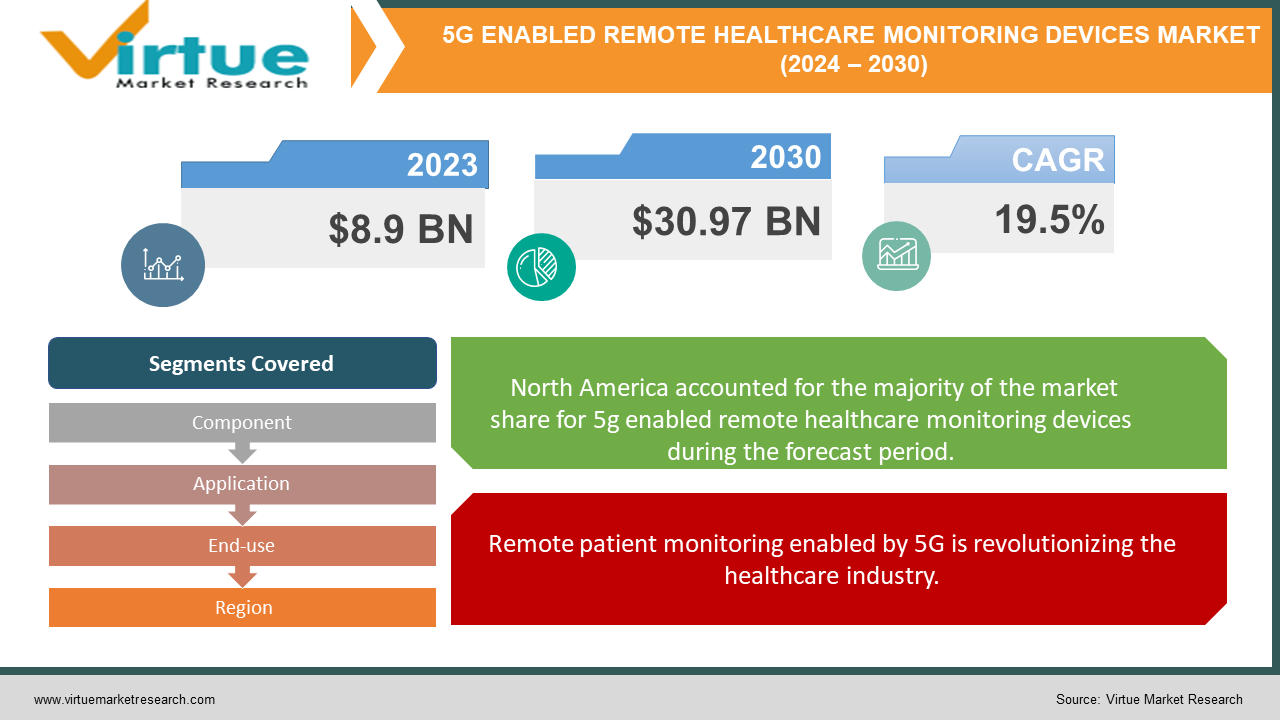

The Global 5G Enabled Remote Healthcare Monitoring Devices Market was valued at USD 8.9 billion in 2023 and is projected to reach a market size of USD 30.97 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 19.5% between 2024 and 2030.

The use of 5G-connected remote medical monitoring devices is rapidly expanding. This is a result of improved internet and phone technology, such as 5G, and the wearable gadgets that can connect to it. We can transmit a lot of health information rapidly with 5G. Not to mention inexpensive sensors are a help. Large corporations and governments are also investing more in 5G for healthcare. For instance, the Indian government supported 75 digital health and telemedicine businesses in 2021. 5G's ability to connect a large number of devices quickly, provide better service, and reduce latency makes it beneficial for the healthcare industry. This implies that 5G can be used for more healthcare-related tasks. The introduction of 5G will significantly expand the healthcare market. There will be a rise in the use of telemedicine, or online doctor consultations. More than thirty percent of the remote patient monitoring devices will be 5G enabled by 2025. This will speed up data collection and improve the management of chronic illnesses. Five-gigabit healthcare devices can reduce hospital visits by half, increase the use of remote monitoring by eighty percent, and improve patient health by seventy percent. However, some locations may find it difficult to afford the new 5G technology. Moreover, a lot of physicians are concerned about 5G's potential to compromise patient data security, which makes robust cybersecurity crucial.

Key Market Insights:

The global 5G-enabled remote healthcare monitoring devices market is estimated to be around $8.9 billion in value, driven by the increasing adoption of telehealth services and the need for real-time monitoring of patients' health conditions. North America accounts for nearly 40% of the global 5G-enabled remote healthcare monitoring devices market share, attributed to the advanced healthcare infrastructure, favorable reimbursement policies, and early adoption of cutting-edge technologies in the region. The wearable devices segment holds a market share of over 35% in the 5G-enabled remote healthcare monitoring devices market, owing to their convenience, portability, and ability to continuously track vital signs and health data. The cardiovascular disease monitoring segment contributes to around 25% of the overall 5G-enabled remote healthcare monitoring devices market, driven by the high prevalence of heart-related conditions and the need for continuous monitoring. The remote patient monitoring services segment is expected to grow at a rate of around 12% annually, driven by the increasing demand for cost-effective and accessible healthcare solutions, particularly in rural and underserved areas.

Global 5G Enabled Remote Healthcare Monitoring Devices Market Drivers:

Remote patient monitoring enabled by 5G is revolutionizing the healthcare industry.

The introduction of 5G technology is altering the way we care for patients, particularly when we are monitoring them remotely. Massive amounts of data can be sent almost instantly and quickly with 5G. This implies that we can view medical images instantly and monitor a patient's health in real-time. Thanks to 5G, doctors can use sensors and wearables more effectively. Long-term health issues will greatly benefit from 5G's ability to speed up response times. Additionally, by utilizing 5G, we can respond to medical emergencies promptly and spare patients from hospital stays. Thus, 5G isn't just about how we watch patients from a distance; it's also about enhancing patient-centered, proactive, and accessible healthcare, which benefits people everywhere.

Telemedicine is undergoing a revolution, due to 5G.

5G will transform the way we practice telemedicine or online doctor visits. With 5G, there is virtually no connection latency, so we can communicate with experts immediately from any location—even during operations. This implies improved access to healthcare for those living in rural areas. 5G will enable more people to use telemedicine, which will make it simpler to see a doctor when necessary. 5G enables doctors to monitor patients remotely as well, contributing to a more patient-centered and inclusive healthcare system. Therefore, everyone benefits from 5G's increased digitalization, accessibility, and connectivity in healthcare.

5G Enabled Remote Healthcare Monitoring Devices Market Challenges and Restraints:

Healthcare could benefit greatly from 5G use, but there are significant obstacles to be overcome. The expense of constructing and operating the required 5G network is a significant barrier, particularly for hospitals located in underdeveloped areas. Furthermore, we must ensure that the vast amounts of patient data we will be transmitting in real time are secure from hackers. We need clear guidelines to follow because the regulations surrounding the use of 5G in healthcare are still unclear. It's also challenging to ensure that 5G functions well with the existing computer systems in hospitals. Furthermore, not many medical devices are currently 5G capable, so more money needs to be spent on producing them. In general, in order to fully utilize 5G in healthcare, we must address these issues.

5G Enabled Remote Healthcare Monitoring Devices Market Opportunities:

The introduction of 5G technology will improve healthcare in numerous ways. Doctors can better understand their patient's health by using real-time data from wearables and other medical devices thanks to 5G. This enables them to identify issues early and develop individualized treatment programs. Additionally, using 5G during surgery can have a significant impact. Surgeons are able to view critical information during procedures, which improves surgical accuracy and lowers patient risk. In addition to assisting physicians, 5G can improve hospital operations. Through data analysis, hospitals can operate more cost-effectively and with less paperwork. In general, 5G is about more than just better healthcare; it's also about ensuring that patients receive the best care possible, streamlining healthcare systems, and saving time and money.

5G ENABLED REMOTE HEALTHCARE MONITORING DEVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

19.5% |

|

Segments Covered |

By Component, Application, End-use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AT&T, Verizon, China Mobile International Limited, Quectel, Telit, Telus, Huawei Technologies Co., Ltd., Cisco System Inc., Orange, NEC Corporation |

Global 5G Enabled Remote Healthcare Monitoring Devices Market Segmentation: By Component

-

Hardware

-

Services

The majority of the 5G healthcare device market last year was made up of physical goods like machinery and electronics. It is most likely to remain the largest for some time. More than 70% of the proceeds from the sale of these devices went to this section. It's because, in order to stay current with technology, people must constantly update or replace their devices. This segment is expanding as more consumers seek devices with high internet speeds, multiple connections, and near-instantaneous response times. Simultaneously, the portion of the market dedicated to services, such as ensuring that the devices are compatible, is expanding at a rapid pace. This is a result of the need for more internet-connected devices and consumer demand for fast and dependable data transmission. People also want faster connections and better internet on their phones, both of which are features of 5G services. Therefore, satisfying the demands of the digital age requires both developing better devices and enhancing services, particularly in industries where reliable internet access is essential.

Global 5G Enabled Remote Healthcare Monitoring Devices Market Segmentation: By Application

-

Remote Patient Monitoring

-

Connected Medical Devices

Remote patient monitoring, or the practice of tracking patients from a distance, accounted for the largest portion of the market for 5G healthcare devices last year. It is most likely to remain the largest for some time. More than 60% of the proceeds from the sale of these devices went to this component. It's critical for managing chronic health issues and ensuring that people receive the care they require without constantly visiting their physician. This portion is expanding as more elderly people require assistance with health management and as more people desire in-home checkups. The market for interconnected devices is expanding at a rate of roughly 36.2%, which is a very rapid pace. This is because more people prefer receiving healthcare at home, more doctors are scheduling appointments online, and more people want devices that can track their health on a daily basis. According to these trends, healthcare is becoming more connected and user-friendly, utilizing cutting-edge technology to support the well-being of a greater number of people.

Global 5G Enabled Remote Healthcare Monitoring Devices Market Segmentation: By End-use

-

Healthcare Providers

-

Healthcare Payers

Healthcare providers held the largest market share for 5G healthcare devices last year, and it's likely that they will continue to do so. They received more than 60% of the proceeds from the sale of these gadgets. This occurred as a result of the growing use of 5G wearable technology by clinics and hospitals to monitor patient health. Better medical solutions are also in greater demand, particularly as more people require healthcare. Healthcare payers (like insurance companies) and healthcare providers (like hospitals) make up the two main segments of the market. It is anticipated that the healthcare payers group will expand at the quickest rate, roughly 35.4%. This is a result of an increase in health insurance enrollment, particularly as a result of the COVID-19 pandemic. People's awareness of health risks and desire to obtain health insurance increased as a result of the pandemic. Therefore, ensuring that people receive the healthcare they require involves the contributions of both healthcare payers and providers.

Global 5G Enabled Remote Healthcare Monitoring Devices Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America dominated the market for 5G healthcare devices last year, and that situation is probably going to persist for some time. Over thirty-five percent of the proceeds from the sale of these devices went to the region. This occurred as a result of the government's aggressive push for improved healthcare through the use of 5G, particularly in rural areas. For instance, the Biden administration heavily invested in telehealth service improvements nationwide. Asia Pacific, on the other hand, is expanding at a growth rate of roughly 36.6% in this market. This is a result of the rapid adoption of new technology and improved internet access by the local population. Governments are also pushing the use of 5G in healthcare. For example, the Chinese government and a major Asian hospital group collaborated to introduce a WeChat program aimed at improving telehealth services. All of these developments demonstrate how healthcare is getting more advanced, more accessible, and more effective at keeping people healthy globally.

COVID-19 Impact on the Global 5G Enabled Remote Healthcare Monitoring Devices Market:

The COVID-19 pandemic had both positive and negative effects on the market for healthcare devices with 5G capabilities. It initially slowed down due to issues obtaining supplies and concentrating on COVID-19 testing. However, it also demonstrated how crucial it is to have remote patient monitoring. As a result, more people began using 5G-enabled gadgets to monitor their health at home. Even after the pandemic is over, it is anticipated that this trend will continue to rise as more people choose to take care of their health at home rather than visit the hospital. It's still unclear, though, how much money will be available for healthcare and how soon 5G will roll out in various locations.

Latest Trend/Development:

In the field of medicine, new devices are transforming the way we monitor our health. Superfast internet, or 5G, is one major development. These 5G gadgets are now even more intelligent. They analyze our health data in real time and provide recommendations to us using AI and machine learning. Additionally, these devices are becoming more compact and comfortable to wear, enabling us to continuously monitor our health. They help keep patients out of the hospital, which is especially beneficial for those with chronic health issues. However, with so much data floating around, it's critical to ensure that it is secure from hackers. For this reason, businesses are putting a lot of effort into ensuring that these gadgets protect our data. Moreover, these gadgets allow you to have online doctor consultations, which simplifies the process of obtaining healthcare. Businesses are working together to adhere to regulations and improve these devices even further. Thus, with all of these new advancements, maintaining good health is getting simpler and more advanced than it has ever been.

Key Players:

-

AT&T

-

Verizon

-

China Mobile International Limited

-

Quectel

-

Telit

-

Telus

-

Huawei Technologies Co., Ltd.

-

Cisco System Inc.

-

Orange

-

NEC Corporation

Market News:

-

A Montreal-based company called Accedian was acquired by Cisco in February 2022. Accedian contributes to improving 5G networks for medical purposes. This aids Cisco in further refining its 5G medical technology.

-

In October of 2022, AT&T acquired the San Diego-based company Aira. Aira uses 5G to create solutions for remote healthcare. This enables AT&T to provide improved 5G healthcare services.

-

Nokia acquired Vodafone's 5G and IoT division in February 2023. This enhances the 5G capabilities of Vodafone and strengthens Nokia's 5G technology.

-

In March 2023, Qualcomm acquired San Jose-based Xilinx. Xilinx is a manufacturer of 5G medical technology. This also improves the use of Qualcomm's 5G technology in the medical field.

-

Ericsson acquired Cisco's 5G and IoT division in May 2023. This enables Cisco's healthcare clients to use 5G to provide better patient care and helps Ericsson enhance its 5G technology.

Chapter 1. 5G Enabled Remote Healthcare Monitoring Devices Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. 5G Enabled Remote Healthcare Monitoring Devices Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. 5G Enabled Remote Healthcare Monitoring Devices Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. 5G Enabled Remote Healthcare Monitoring Devices Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. 5G Enabled Remote Healthcare Monitoring Devices Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. 5G Enabled Remote Healthcare Monitoring Devices Market – By Component

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Services

6.4 Y-O-Y Growth trend Analysis By Component

6.5 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. 5G Enabled Remote Healthcare Monitoring Devices Market – By Application

7.1 Introduction/Key Findings

7.2 Remote Patient Monitoring

7.3 Connected Medical Devices

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. 5G Enabled Remote Healthcare Monitoring Devices Market – By End-use

8.1 Introduction/Key Findings

8.2 Healthcare Providers

8.3 Healthcare Payers

8.4 Y-O-Y Growth trend Analysis By End-use

8.5 Absolute $ Opportunity Analysis By End-use, 2024-2030

Chapter 9. 5G Enabled Remote Healthcare Monitoring Devices Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Component

9.1.3 By Application

9.1.4 By End-use

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Component

9.2.3 By Application

9.2.4 By End-use

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Component

9.3.3 By Application

9.3.4 By End-use

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Component

9.4.3 By Application

9.4.4 By End-use

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Component

9.5.3 By Application

9.5.4 By End-use

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. 5G Enabled Remote Healthcare Monitoring Devices Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 AT&T

10.2 Verizon

10.3 China Mobile International Limited

10.4 Quectel

10.5 Telit

10.6 Telus

10.7 Huawei Technologies Co., Ltd.

10.8 Cisco System Inc.

10.9 Orange

10.10 NEC Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global 5G Enabled Remote Healthcare Monitoring Devices market is expected to be valued at US$ 8.9 billion.

Through 2030, the global 5G Enabled Remote Healthcare Monitoring Devices market is expected to grow at a CAGR of 19.5%.

By 2030, the global 5G Enabled Remote Healthcare Monitoring Devices is expected to grow to a value of US$ 30.97 billion.

North America is predicted to lead the market globally for 5G Enabled Remote Healthcare Monitoring Devices.

The global 5G Enabled Remote Healthcare Monitoring Devices market has segments like Component, Application, End-use, and Region.