5G CPE Market Size (2024 – 2030)

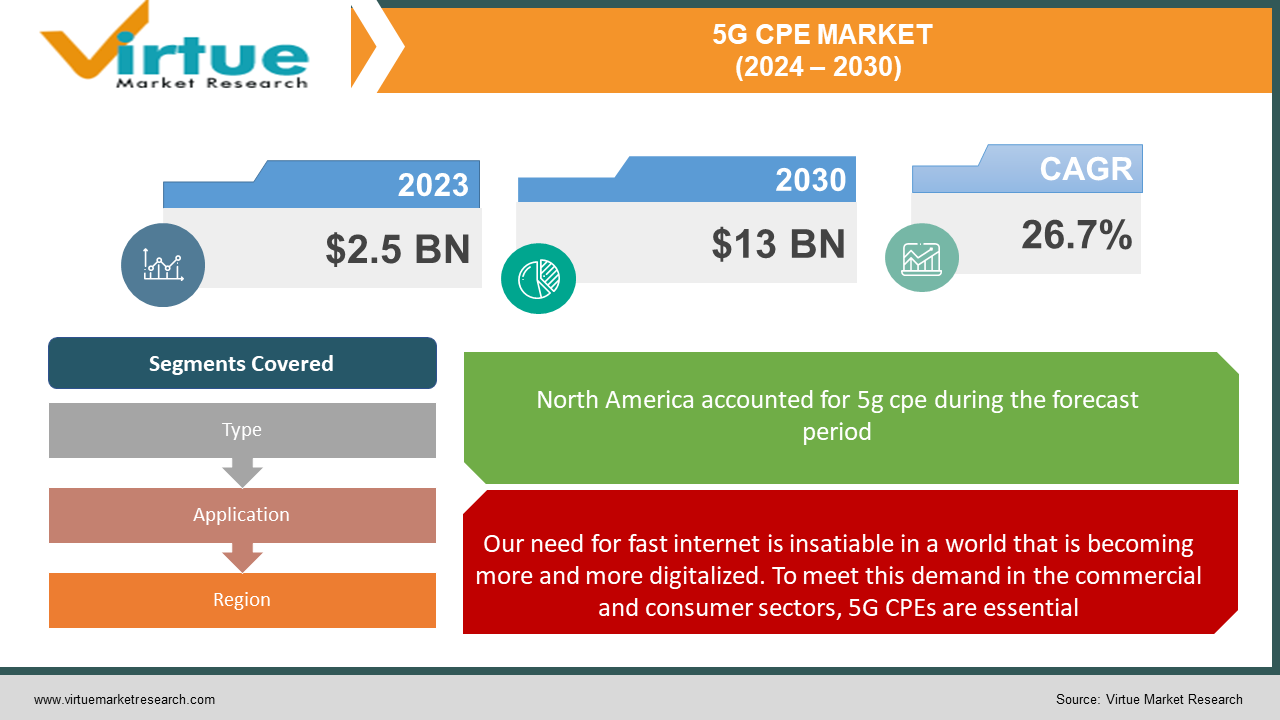

The 5G CPE market was valued at USD 2.5 Billion in 2023 and is projected to reach a market size of USD 13 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 26.7%.

The 5G CPE (Customer Premises Equipment) market refers to 5G-enabled fixed wireless access devices used to connect end users and provide network services in homes, offices, and enterprises. It comprises indoor and outdoor 5G router units, 5G gateways, and modems that enable ultra-high-speed, low-latency data connectivity harnessing next-generation cellular network advancements. The growth of this nascent market is driven by the ongoing 5G infrastructure development and the rising need for efficient broadband connectivity. 5G FWA CPE devices allow service providers to offer fiber-like speeds wirelessly to user premises as an alternative to fixed-line connectivity. They enable smooth streaming, gaming, smart device networking, and other bandwidth-intensive applications for consumers and businesses alike. Unlike earlier generations, 5G technology uses higher frequency mmWave spectrums facilitating extreme data speeds of over Gigabits per second coupled with much lower latency of under 5 milliseconds.

Key Market Insights:

The foremost driver steering growth of the 5G CPE ecosystem involves rising end-user demand for seamless, ultra-high-speed connectivity suited to bandwidth-intensive applications, without geographical constraints of fiber availability. As living experiences grow increasingly dependent on cloud-linked functionalities across media consumption, smart products, telemedicine, and remote work ecosystems, the need for future-proof wireless connectivity hardware is rising from consumer segments alongside businesses. With economies of scale lowering equipment costs as Chinese majors expand affordable product portfolios, 5G CPE units are expected to turn progressively economical, averaging below $200. Compared to expenditures associated with laying physical last-mile fiber, wireless self-installation CPE routers offer better value. Such price parity with LTE predecessors will promote deployments by regional ISPs besides tech-savvy households' willingness to pay premiums to gain an edge with next-generation capabilities. The gradual maturation of 5G networks as pioneering tier-1 carriers already flush with recent spectrum acquisitions are joined by smaller providers seeking differentiated service offerings is laying fertile ground for CPE uptake. With roll-out momentum set to spread globally, secondary markets now upgrading networks to keep pace promise greater addressable space soon that equipment vendors seek to tap into.

5G CPE Market Drivers:

Our need for fast internet is insatiable in a world that is becoming more and more digitalized. To meet this demand in the commercial and consumer sectors, 5G CPEs are essential.

The bar for 'good internet' keeps rising. Today it's not merely web browsing, but a household full of video calls, 4K/8K streaming, cloud gaming, and perhaps even VR/AR experiences in the future. Traditional broadband often struggles to keep up, with hiccups and buffering ruining the experience. 5G CPEs promise to break through these bottlenecks, especially in underserved areas where fiber upgrades remain slow. Hybrid and remote work aren't going away. This requires reliable, often high-bandwidth connectivity outside traditional offices. 5G CPEs present themselves as solutions for quick setup, strong security, and a dedicated business internet line even within employees' homes, without costly wired installations. As more connected devices enter our homes (from cameras to smart appliances), managing network congestion becomes important. A powerful 5G CPE acts as a powerful backbone, supporting dozens of devices simultaneously without hiccups. Live streaming, cloud gaming, and immersive content formats require both exceptional download speeds and ultra-low latency. 5G CPEs shine in this domain, making the latest forms of entertainment possible even outside densely populated areas. 5G CPEs allow network operators to quickly expand their offerings to new markets. It eliminates the time, logistical hurdles, and customer permission needed for physical cable installations, enabling faster service expansion.

The immediate driver steering 5G CPE uptake involves growing end-user need for future-proof residential connectivity solutions allowing immersive digital experiences.

While the immense technological leap 5G represents captures the public imagination, its pervasive adoption at scale depends considerably on affordable access endpoints finally lowering ownership barriers that restricted previous wireless generations as niche solutions. Within the home broadband networking context, price parity with existing mainstream Wi-Fi equipment remains imperative for large-scale 5G CPE subscriber uptake. Encouragingly, continuous economies of scale refinements by Chinese original design manufacturers catering to global operators have brought down integrated CPE hardware costs considerably. Contemporary 5G indoor routers and gateways are expected to turn progressively economical, averaging below $200 over the next few years compared to first-generation sticker prices exceeding $700. Such cost savings lend advantage over expenditures associated with laying physical fiber drops to each premises in metros and suburbs which can average thousands of dollars when factoring right-of-way permits, labour fees, and installation charges. Even compared to mid-range LTE equipment that sells for $100-$150 apiece currently in retail, the narrowing price gap makes premium 5G upgrades an easy buying justification. Market watchers hence predict the number of households shifting to 5G as their primary broadband platform to rise exponentially as ownership cost parity is achieved with legacy Wi-Fi alternatives, especially when bundled with carrier service plans. Even mainstream consumers not entirely technology savvy stand more chances of finding appeal once the sheer velocity promise of 5G connectivity becomes available without prohibitive price barriers.

5G CPE Market Restraints and Challenges:

The complex limitations associated with enabling unhindered propagation for 5G’s mmWave signals indoors pose significant infrastructure headaches.

The promising ultra-wideband spectrum characteristics within high-frequency millimeter wave domains that 5G networks harness introduce associated complex limitations regarding unhindered signal propagation – especially across interior spaces. Generally dissipating rapidly beyond a few hundred meters or failing to penetrate glass/concrete barriers due to inherent attributes at such frequencies, ensuring reliable delivery of mmWave signals from outdoor towers to end-user devices situated deep indoors poses immense infrastructure and equipment design challenges. Blunt signal drops and intermittent connectivity associated make uninterrupted coverage a pivotal pain point. Overcoming such reliability concerns through technological intervention alone compulsively relies on CPE devices shouldering sophisticated signal conditioning capabilities by themselves to negate external barriers. This includes integrating advanced amplifier arrays or multi-lobe transceiver systems within modem hardware to actively strengthen signals through beamforming and spatial angle diversity.

The continuous wireless technology evolutions witnessed roughly every 3 years risk quickly rendering CPE terminals outdated or incompatible.

The breakneck iterative pace associated with generational technology refinements poses significant challenges for telecom gear longevity, especially impacting sophisticated Customer Premises Equipment (CPE) elements that represent substantial capex for carriers. In case of cellular connectivity platforms like 3G, LTE, and now 5G, refinements via new radio specifications and spectrum augmentations occur roughly every 8-10 years in pursuit of harnessing higher data capacities. Qualcomm recently demonstrated prototype radios already crossing 10 Gbps peaks that could seed the next ‘6G’ wave by 2030. However, unlike user handsets that routinely refresh every 2-3 years or computational hardware embracing planned obsolescence, network access Points require reliably functioning for prolonged periods to redeem rollout costs. Outdoor base stations may last 10-15 years but residential fixed wireless gear also necessitate 5–7-year lifespans or more when factoring subscriber business model realities.

5G CPE Market Opportunities:

The emerging 5G CPE (customer premise equipment) market presents exciting opportunities for telecom companies, hardware manufacturers, and other players as 5G networks continue rolling out globally. 5G CPEs will enable telecom operators to generate revenue beyond just connectivity services. Operators can monetize value-added services like cloud gaming, AR/VR, and enterprise applications through 5G CPEs. This creates new revenue streams beyond connectivity. 5G CPEs target both consumers and enterprises, allowing operators to grow their customer base. Operators can offer 5G routers, gateways, and other devices for homes and businesses to access 5G connectivity. The ultra-high speeds and low latency of 5G make it attractive for enterprises. Operators can upsell existing 4G customers to new 5G CPE devices and plan to enjoy faster speeds. This allows monetizing existing subscribers. 5G CPEs can enable innovative use cases like cloud VR/AR gaming, connected vehicles, smart factories, and other industrial automation. These new applications present significant opportunities for hardware makers and software providers.

5G CPE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

26.7% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Huawei, ZTE, Nokia, Ericsson, NetgearNetgear Inseego, D-Link, TP-Link, Arcadyan, Samsung, Sercomm |

5G CPE Market Segmentation: By Type

-

Indoor CPE

-

Outdoor CPE

-

Industrial-grade CPE

Indoor CPE includes residential gateways, fixed wireless access points and routers used indoors. Accounts for the largest share of around 70% of the total 5G CPE market. It is dominant due to the demand for in-home high-speed internet. Outdoor CPE consists of outdoor routers and gateways installed on building exteriors. It holds around 20% of the market share. It is growing due to enterprise demand. Industrial-grade CPE is utilized by manufacturing facilities, energy companies, and other similar establishments for their equipment. At the moment, it only has a meager 10% stake. The adoption of private 5G and Industry 4.0 has caused it to grow at the highest rate. Indoor CPE is the most dominant type, owing to the huge demand from homes and small offices looking to upgrade to 5G connectivity. With remote work and learning boosting home internet usage, indoor CPE sales are surging. However, the industrial-grade CPE segment is forecast to grow at the fastest rate of over 40% CAGR. This is attributable to the rapid adoption of 5G across manufacturing, oil and gas, utilities, and other industries for smart factories, real-time automation, and private 5G networks. Demand for outdoor CPE will also rise steadily, driven by enterprises setting up outdoor 5G small cells and gateways. But growth will trail indoor CPE and industrial CPE. Overall, indoor 5G routers and gateways will lead the market, but industrial 5G CPE will see the fastest acceleration in demand.

5G CPE Market Segmentation: By Application/End User

-

Residential

-

Enterprises

-

Industrial

-

Government

The residential sector Holds the largest share. This sector includes 5G routers, gateways, and Wi-Fi mesh systems for homes. It is the Dominant sector due to rising consumer demand for ultra-high-speed broadband. Enterprises account for 30% market share. This sector includes Indoor and outdoor 5G CPEs for offices, retail, hospitals, etc. It is Growing rapidly due to the need for enhanced enterprise connectivity. The industrial segment holds Around 20% of the market share. It includes Rugged 5G devices for factories, utilities, ports, etc. It is the fastest-growing segment owing to Industry 4.0, automation, and private 5G networks. The government sector holds a Small 10% share presently. It includes 5G CPEs for smart city infrastructure, traffic management, etc. This sector shows high growth potential with smart city projects. The residential segment currently dominates 5G CPE sales, driven by consumers hungry for fiber-like 5G speeds to power smart homes, 4K video streaming, online gaming, and multiple connected devices. However the industrial enterprise segment is forecast to grow at 50%+ CAGR, becoming the fastest-growing market. Manufacturing, energy companies, warehouses, and other industries are deploying private 5G networks and Industrial IoT solutions necessitating robust, secure 5G CPEs.

5G CPE Market Segmentation: Regional Analysis

-

Europe

-

North America

-

Asia Pacific

-

South America

-

Middle East and Africa

At 35% currently, North America has the largest stake. Its dominance stems from early 5G network rollouts and high technological adoption. The Asia Pacific region holds a thirty percent market share. Driven by major markets such as China, Japan, and South Korea, this area is expanding at the quickest rate. At the moment, Europe accounts for 25% of the market share. It is gradually increasing as 5G services become more widely available. Currently holding a meagre 5% market share, the Middle East and Africa have significant growth potential as 5G deployments rise. At the moment, Latin America accounts for about 5% of the market. Although there are only a few 5G networks, there is great potential for growth.

COVID-19 Impact Analysis on the 5G CPE Market.

The COVID-19 epidemic has complicatedly affected the 5G CPE market, posing development potential as well as obstacles. Lockdowns and supply chain interruptions have on the one hand, hampered the global rollout and uptake of 5G CPEs. However, the epidemic has also made digital transformation faster and more pressing, emphasizing the necessity for reliable connectivity options like 5G CPEs. The availability of 5G CPE devices has been limited by restrictions on manufacturing and transportation activities, particularly in China, a significant hub for production. Component shortages, such as chipset and antenna shortages, made things more difficult. The introduction of 5G CPE has been slowed back by this limited availability. Telecom companies' deployment of 5G networks has been hampered by manpower shortages and social distancing regulations. The adoption and deployment of 5G CPE products have slowed considerably since many nations do not yet have fully functional 5G infrastructure. Many businesses have decided against investing capital funds in new technology, such as 5G CPEs, for their offices and facilities due to cost concerns and economic uncertainty.

Latest Trends/ Developments:

New 5G CPE devices are integrating the latest Wi-Fi 6 standard for faster multi-device connections and reduced network congestion at home. Wi-Fi 6 capabilities like OFDMA and MU-MIMO allow CPEs to efficiently handle many connected devices simultaneously. CPEs supporting mmWave frequencies are being launched to take advantage of ultra-high speed 5G networks being built using mmWave. mmWave 5G has bandwidth up to 10 Gbps enabling new applications. Qualcomm, Ericsson and others are releasing mmWave CPEs. Enterprise-grade indoor and outdoor 5G routers are being developed as businesses move to 5G. These routers promise speeds up to 3 Gbps, low-latency, enhanced security and plug-and-play simplicity for offices. Industrial-grade ruggedized 5G CPEs are coming to market for factories, warehouses, utilities and other industrial settings. These devices can withstand harsh environments and provide reliable connectivity.

Key Players:

-

Huawei

-

ZTE

-

Nokia

-

Ericsson

-

NetgearNetgear

-

Inseego

-

D-Link

-

TP-Link

-

Arcadyan

-

Samsung

-

Sercomm

Chapter 1. 5G CPE Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. 5G CPE Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. 5G CPE Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. 5G CPE Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. 5G CPE Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. 5G CPE Market – By Application/End User

6.1 Introduction/Key Findings

6.2 Residential

6.3 Enterprises

6.4 Industrial

6.5 Government

6.6 Y-O-Y Growth trend Analysis By Application/End User

6.7 Absolute $ Opportunity Analysis By Application/End User , 2024-2030

Chapter 7. 5G CPE Market – By Type

7.1 Introduction/Key Findings

7.2 Indoor CPE

7.3 Outdoor CPE

7.4 Industrial-grade CPE

7.5 Y-O-Y Growth trend Analysis By Type

7.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. 5G CPE Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application/End User

8.1.3 By Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application/End User

8.2.3 By Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application/End User

8.3.3 By Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application/End User

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application/End User

8.5.3 By Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. 5G CPE Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Huawei

9.2 ZTE

9.3 Nokia

9.4 Ericsson

9.5 NetgearNetgear

9.6 Inseego

9.7 D-Link

9.8 TP-Link

9.9 Arcadyan

9.10 Samsung

9.11 Sercomm

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The transformative speed, low latency, and capacity expansion 5G brings makes possible new connectivity services and enables a wave of data-hungry applications. CPEs are the bridge to harness this power at homes, businesses, and within IoT frameworks.

The promise of blazing fast mmWave CPEs is limited by line-of-sight hurdles and a short signal range. Until supporting infrastructure is extensive, such CPEs remain niche solutions.

Huawei, ZTE, Nokia, Ericsson, NetgearNetgear, Inseego, D-Link.

North America holding currently holds the largest market share, estimated around 35%.

Asia Pacific exhibits the fastest growth, driven by its increasing population, and expanding economy.