5G mmWave Chipset Market Size (2023 – 2030)

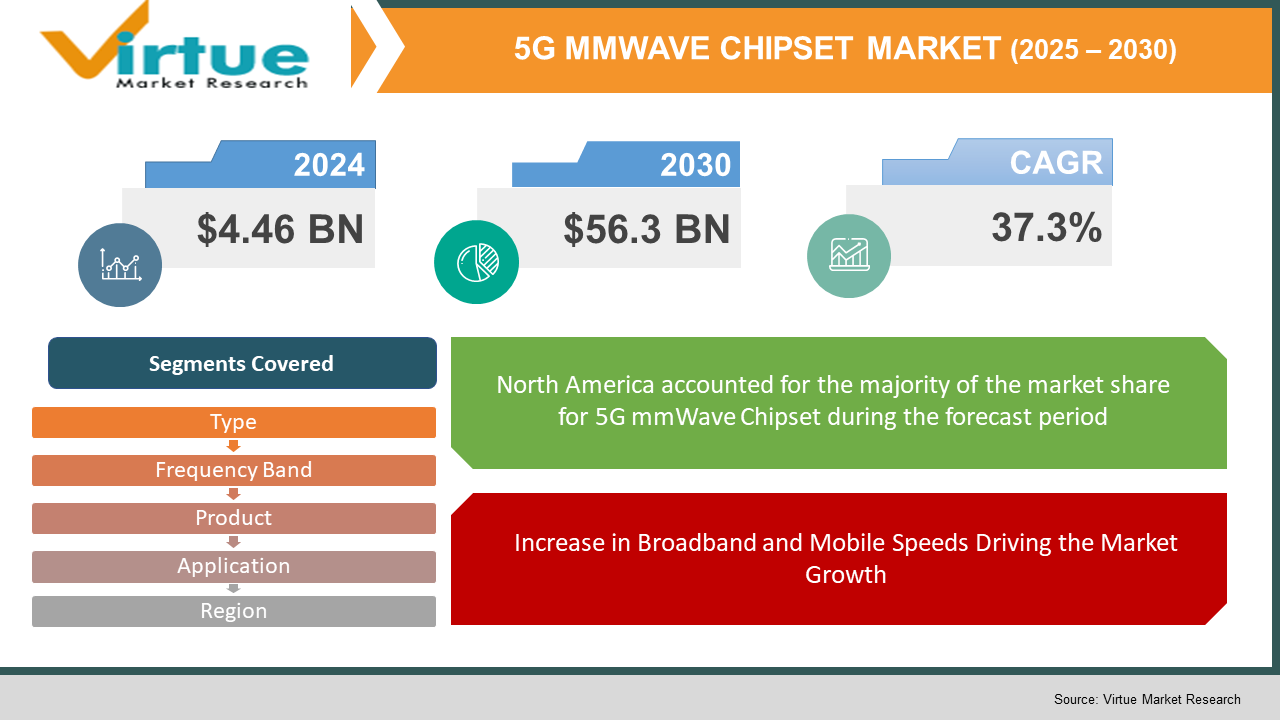

In 2022, the Global 5G mmWave Chipset Market was valued at USD 4.46 billion and is projected to reach a market size of USD 56.3 billion by 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 37.3%.

INDUSTRY OVERVIEW

Data-intensive applications like video streaming, video conferencing, online media sharing, and fast-paced online gaming are anticipated to increase the need for high bandwidth and drive adoption of the 5G mmWave chipset solution. Numerous industries, including communications, military & defence, security, automotive, and healthcare, employ 5G MMW technology significantly. Additionally, it is anticipated that the market will accelerate at a significant rate due to the growing demand that is coming from all of these industrial and commercial sectors.

The market is also developing as a result of the expanding infrastructure installations for quicker access to data, videos, voice, and services, as well as the rising demand for high-speed networks for accessing smart devices at the household and commercial levels. Demand is also anticipated to increase throughout the anticipated time due to the rising use of internet services, e-governance, and cloud computing. However, over the course of the projection period, the market expansion is anticipated to be constrained by technological range restrictions and propagation issues brought on by environmental or climatic factors. Additionally, as the technology is a form of line-of-sight communication, it could encounter a few additional challenges as it develops without problems. Around the world, intense R&D efforts are being made to remove the difficulties and other barriers preventing the market's expansion.

COVID-19 IMPACT ON THE 5G MMWAVE CHIPSET MARKET

Due to a major impact on key actors in the supply chain, the COVID-19 outbreak has had a severe influence on the expansion of chipset manufacturing in 2020. However, one of the key factors driving the market expansion during the COVID-19 pandemic is the increase in demand for three-dimensional print solutions across key industries. On the other hand, the COVID-19 pandemic had a significant negative impact on the market due to several challenges, including a shortage of competent labour and delays or cancellations of projects due to partial or total lockdowns throughout the world. Additionally, the market opportunity for 5G chipsets after COVID-19 is anticipated to be strengthened by the rise in the adoption of smart infrastructure solutions across the automotive, retail, healthcare, energy & utilities, and consumer electronics sectors. The 5G millimetre wave technology market saw a small contraction as a result of the COVID-19 epidemic. The production of the parts needed for the technology was halted as a result of the harsh lockdowns issued all across the world. The installations and growth plans of the market participants were unintentionally harmed by this. The pandemic had a significant influence on corporate revenues, which in turn had an impact on many firms' capital expenditures and capital expenditure estimates. Additionally, the worldwide pandemic's arrival caused a delay in the execution of some 5G projects. Due to the lockout, spectrum licencing and auctioning were suspended, which caused a delay in the rollout of 5G. The pandemic had a significant impact on other application areas, including electronics and the automobile and transportation industries, and as a result, these sectors' demand decreased. Because of its adaptable digital core, the telecom sector was relatively robust during the crisis. By the end of 2021, the target market had begun to recover, and by the beginning of 2021, it had significantly gained speed.

MARKET DRIVERS:

Increase in Broadband and Mobile Speeds Driving the Market Growth

An essential enabler of IP traffic is broadband speed. Increases in broadband speed lead to more people using applications and consuming high-bandwidth material. Between 2020 and 2025, the average broadband speed will double, from 62.5 Mbps to >130 Mbps. The deployment and uptake of fibre-to-the-home (FTTH), high-speed DSL and cable broadband adoption, as well as overall broadband penetration, all have an impact on the fixed broadband speed projection. Japan, South Korea, and Sweden are among the top nations for internet speed, in large part due to their extensive FTTH rollout. Standards for 5G technology are still being developed at this time. However, 5G has been implemented in a few industrialised countries, including pre-standard 5G technologies that use a millimetre wave spectrum for fixed wireless broadband networks with low latency and high capacity. Since very tiny beamwidth antennas may be used at millimetre wave frequencies, produced power can be swiftly and accurately focused where it is required. Since point-to-multipoint technology and near-line-of-sight wireless networks are made possible by millimetre waves, a single transmitter may support several transceivers dispersed across a wide area.

The need for high speed for running big applications is likely to fuel market expansion

Data-intensive applications like video streaming, video conferencing, online media sharing, and fast-paced online gaming are anticipated to increase the need for high bandwidth and drive adoption of the 5G mmWave chipset technology. Numerous industries, including communications, military & defence, security, automotive, and healthcare, employ MMW technology significantly. Additionally, it is anticipated that the market will accelerate at a significant rate due to the growing demand that is coming from all of these industrial and commercial sectors.

MARKET RESTRAINTS:

Low penetration power and adverse impact on the environment

Despite having several advantages over other radio frequencies, millimetre waves also have certain drawbacks. For instance, millimetre waves can't bounce off of real-world things. Tree branches and buildings can block the signal by interfering with the transmission and absorbing it. Additionally, compared to other widely utilised frequencies, millimetre waves are more costly. Because of this, the technology is almost out of reach for smaller businesses lacking the necessary funding. Currently, mobile network operators are concentrating on developing 5G infrastructure that is compatible with millimetre waves. This entails altering the structure of devices that will function on the 5G network as well as installing smaller base stations using millimetre wave technology in open space.

Challenges associated with the physical properties of millimetre waves may hamper the market growth

The spectrum is expanded by millimetre waves. However, until recently, only a small number of electronic parts could produce or receive millimetre waves, leaving the spectrum untapped. The travelling medium associated with these high frequencies presents a greater problem than the generation and reception of millimetre waves. Poor foliage penetration, air path loss, and free-space route loss are further significant difficulties. The same physical principles that control the remainder of the radio spectrum also apply to millimetre waves.

5 MMWAVE CHIPSET MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

37.3% |

|

Segments Covered |

By Product, Type, Frequency Band and By Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Qualcomm , Intel Corporation, Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., MediaTek Inc., Infineon Technologies AG, Unisoc Communications, Inc., Xilinx Inc., Qorvo, In |

This research report on the 5G mmWave Chipset Market has been segmented and sub-segmented based on Product, Type, Frequency Band and By Region.

5G MMWAVE CHIPSET MARKET– BY PRODUCT

- Telecommunication Equipment

- Imaging & Scanning Systems

- Radar & Satellite Communication Systems

Based on the product, the 5G mmWave chipset market is segmented into, Telecommunication Equipment, Imaging & Scanning Systems and Radar & Satellite Communication Systems. The telecom industry has transformed thanks to the adoption of 5G millimetre wave technology across all telecommunications equipment. The fifth generation (5G) of cellular communication is undergoing a revolution thanks to millimetre waves, which can transmit gigabits of data per second. Due to the expanded telecom industry, the communications equipment category had the biggest market share in 2021, exceeding 58.15 per cent.

The steadily expanding use of 5G MMW technology has improved the characteristics of imaging and scanning systems by bringing stability and dependability. Additionally, the use of technology in scanners improves the accuracy of security systems. Systems for radio and satellite communication are essential to a country's national security. Security systems have improved in effectiveness and dependability with the use of millimetre wave technology in radar and satellite communication, upgrading defensive strategies.

5G MMWAVE CHIPSET MARKET– BY TYPE

- Modem

- RFIC

- RF transceiver

- RF front end

Based on the type, the 5G mmWave chipset market is segmented into Modem and RFIC and Others. During the projected period, RFIC will have the biggest market share for 5G chipsets.

The industry with the highest CAGR is predicted to be RFIC, which encompasses the RF transceiver and RF FE segments. The RFIC market is anticipated to expand primarily due to the mobile devices and communications infrastructure sectors. The primary reason anticipated to propel the growth of the 5G chipset market for RFIC is the rise in the number of RF transceiver ICs in smartphones. The high bandwidth provided by mmWave technology and the use of mmWave ICs in 5G infrastructure equipment is anticipated to boost market expansion.

5G MMWAVE CHIPSET MARKET– BY FREQUENCY BAND

- V-Band

- E-Band

- Other Frequency Bands

Based on the frequency band, the 5G mmWave chipset market is segmented into V-Band, E-Band and Other Frequency Bands. The millimetre waves of the V-band frequencies, which span from 40 GHz to 70 GHz, are notably utilised in military and defence applications. Additionally, radar and satellite communications make substantial use of the V-band frequencies. Over the anticipated time frame, a significant shift in the market for E-band frequency applications is predicted. Applications for e-band frequencies may be found in many different types of telecommunications equipment. It is projected that the telecoms industry would continue to quickly consolidate its control over the whole market. The E-band frequency sector, in turn, is anticipated to expand rapidly throughout the projection period. In 2021, the E-band frequency band maintained a 62.07 per cent market share. During the projection period, the E-band segment, which is also the fastest-growing category, is anticipated to expand at a CAGR of 39.8 per cent. The second-largest market share was held by the V-band sector, which is predicted to expand considerably throughout the projected period. Millimetre wave technology is only permitted to operate commercially in a few frequency ranges.

5G MMWAVE CHIPSET MARKET- BY APPLICATION

- Telecommunications

- Military & Defense

- Automotive & Transport

- Healthcare

- Electronics & Semiconductor

- Security

Based on the application, the 5G mmWave chipset market is segmented into Telecommunications, Military & Defense, Automotive & Transport, Healthcare, Electronics & Semiconductor, Security and Others. Because of the growing need for high-speed data transmission and communication coming from the residential and commercial sectors, such as data centres and IT offices, the telecommunications category will hold the largest market share of over 49.18 per cent in 2021. Due to the introduction of 5G technology, telecommunications applications are anticipated to expand rapidly throughout the projection period.

5G MMWAVE CHIPSET MARKET- BY REGION

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East

- Africa

By region, the 5G mmWave Chipset Market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa. Due to the greater adoption of technology in the region, the North American region had the largest market in 2021. The U.S. and Canada are well-known for being early adopters of new and developing technology. As a result, the parameters are opening up new possibilities for 5G MMW technology in a variety of applications. During the projected period, the market in the Asia Pacific regions is anticipated to rise. With a CAGR of around 44.0 per cent throughout the projection period, the Asia Pacific is projected to grow at the greatest pace. The renovations and expansions being made to its communication infrastructures are responsible for the region's fast technological progress. Additionally, it is anticipated that the installation of new telecom equipment based on 5G millimetre wave chipset technology would significantly accelerate market growth throughout the area.

5G MMWAVE CHIPSET MARKET- BY COMPANIES

Some of the major players operating in the 5G mmWave Chipset Market include:

- Qualcomm

- Intel Corporation

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- MediaTek Inc.

- Infineon Technologies AG

- Unisoc Communications, Inc.

- Xilinx Inc.

- Qorvo, In

NOTABLE HAPPENING IN THE 5G MMWAVE CHIPSET MARKET

- COLLABORATION- To speed up the adoption of the IoT smart home, Keysight and VIOMI, the originator of IoT@Home, collaborated in March 2020. The radio frequency (RF) performance of the company's IoT devices for residential applications was validated by VIOMI using Keysight's 5G solutions.

- COLLABORATION- To speed up the rollout of 4G/5G open vRAN solutions, NEC and Altiostar, the industry leader in offering 5G-ready, open, virtualized RAN (vRAN) solutions, collaborated in January 2020. The integrated solution will assist service providers in raising spectral efficiency, enhancing user experience, and drastically lowering the total cost of ownership (TCO).

- PRODUCT LAUNCH- To maximise the usage of the 28 GHz band for the 5G millimetre-wave spectrum and enhance the channel quality for indoor 5G applications, NEC designed a millimetre-wave distributed antenna radio unit in January 2020.

- PRODUCT LAUNCH- In October 2019, Siklu and BATS Wireless, a pioneer in wireless stabilisation, optimization, and tracking systems, announced that their OnPoint 5G antenna stabilisation system had successfully been tested with Siklu's EtherHaul 8010FX, a high-throughput millimetre-wave wireless radio that is perfect for 5G backhaul applications. After a successful test, it was clear that OnPoint 5G may aid in achieving or exceeding the stability standards for a millimetre wave link with a large capacity.

Chapter 1.5G MMWAVE CHIPSET MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.5G MMWAVE CHIPSET MARKET– Executive Summary

2.1. Market Size & Forecast – (2022 – 2026) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-16 Impact Analysis

2.3.1. Impact during 2022 - 2026

2.3.2. Impact on Supply – Demand

Chapter 3.5G MMWAVE CHIPSET MARKET– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.5G MMWAVE CHIPSET MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. 5G MMWAVE CHIPSET MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.5G MMWAVE CHIPSET MARKET– By Product

6.1. Telecommunication Equipment

6.2. Imaging & Scanning Systems

6.3. Radar & Satellite Communication Systems

Chapter 7.5G MMWAVE CHIPSET MARKET– By Type

7.1. Modem

7.2. RFIC

7.2.1. RF transceiver

7.2.2. RF front end

Chapter 8.5G MMWAVE CHIPSET MARKET– By Frequency Band

8.1. V-Band

8.2. E-Band

8.3. Other Frequency Bands

Chapter 9.5G MMWAVE CHIPSET MARKET– By Application

9.1. Telecommunications

9.2. Military & Defense

9.3. Automotive & Transport

9.4. Healthcare

9.5. Electronics & Semiconductor

9.6. Security

Chapter 10.5G MMWAVE CHIPSET MARKET– By Region

10.1. North America

10.2. Europe

10.3. The Asia Pacific

10.4. Latin America

10.5. The Middle East

10.6. Africa

Chapter 11.5G MMWAVE CHIPSET MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

11.1. Qualcomm

11.2. Intel Corporation

11.3. Huawei Technologies Co., Ltd.

11.4. Samsung Electronics Co., Ltd.

11.5. MediaTek Inc.

11.6. Infineon Technologies AG

11.7. Unisoc Communications, Inc.

11.9. Xilinx Inc.

11.9. Qorvo, In

Download Sample

Choose License Type

2500

4250

5250

6900