4G LTE MIMO Market Size (2024 – 2030)

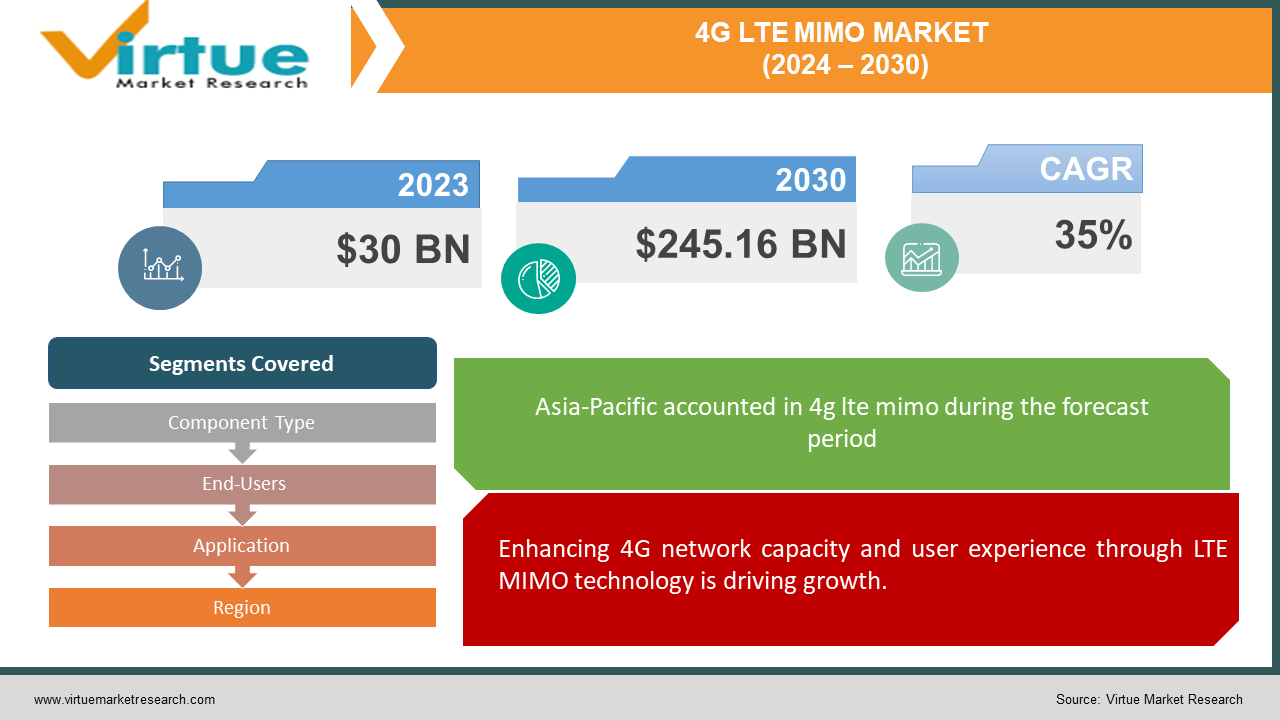

The global 4G LTE MIMO market was valued at USD 30 billion in 2023 and will grow at a CAGR of 35% from 2024 to 2030. The market is expected to reach USD 245.16 billion by 2030.

The 4G LTE MIMO market caters to the ever-growing demand for mobile data by providing technology that allows networks to transmit and receive more data simultaneously. This translates to faster speeds, improved network capacity in crowded areas, and a smoother user experience. While not a replacement for 5G, 4G LTE MIMO acts as a cost-effective bridge, offering network performance improvements until widespread 5G adoption arrives.

Key Market Insights:

Growth in the 4G LTE MIMO market is driven by rising mobile data demand, and MIMO technology improves 4G network capacity and user experience. The demand for improved network connectivity in urban areas drives growth and solves issues with network congestion. High infrastructure costs, restricted device compatibility, restricted spectrum availability, and regulatory obstacles are some of the difficulties.The largest growing end-user market is the information and telecommunications sector, which depends on quick connectivity to offer cloud computing, video conferencing, and data streaming services. Asia-Pacific is the market leader due to its large mobile user base, activities related to digital infrastructure, and robust demand for affordable solutions.

Global 4G LTE MIMO Market Drivers:

Enhancing 4G network capacity and user experience through LTE MIMO technology is driving growth.

The explosion of mobile data usage driven by video streaming, social media, and online gaming is creating a bottleneck for network capacity. 4G LTE MIMO technology stands as a powerful solution to address this challenge. By utilizing multiple antennas on both the cell tower and user devices, MIMO allows for the transmission and reception of multiple data streams simultaneously. This innovative approach acts like creating additional lanes on a highway, significantly increasing the overall data throughput. The result is a more efficient network that can handle the ever-growing demands of users. This results in enhanced user experience on 4G LTE networks with quicker upload and download speeds, smoother video streaming, lag-free online gaming, and seamless social media interaction.

The need for optimizing network connectivity in urban environments is facilitating the expansion.

Unlike traditional systems that blast signals in all directions, MIMO leverages multiple antennas at base stations. This targeted approach reduces signal interference, the crosstalk that occurs when too many devices try to communicate on the same frequency. With less interference, each user receives a clearer and stronger signal, leading to a significant improvement in network performance. This translates to fewer dropped calls, faster loading times, and a more stable connection for everyone in the crowd. In essence, MIMO acts like a traffic management system for data, ensuring a smoother flow of information even in densely populated areas.

Cost-effective network enhancement is boosting the market.

Upgrading existing 4G LTE infrastructure with MIMO presents a compelling solution due to its cost-effectiveness. Unlike a complete overhaul for 5G, which requires significant investment in new equipment and infrastructure, integrating MIMO into existing 4G towers is a more economical approach. This is akin to upgrading a car's engine instead of buying a whole new vehicle. The benefits are twofold: operators can improve network performance in the near term, addressing the immediate needs of users for faster speeds and better connectivity. This translates to happier customers and potentially increased revenue. Additionally, the cost savings from utilizing existing infrastructure allow them to strategically invest in 5G development in the future. MIMO acts as a bridge, ensuring a smooth transition and preventing a network performance gap before widespread 5G adoption. This measured approach allows operators to optimize their resources, deliver a better user experience today, and pave the way for a future-proofed network.

Global 4G LTE MIMO Market Challenges and Restraints:

The high cost of infrastructure is a significant hurdle.

Upgrading to MIMO technology can significantly improve network performance, but it comes at a cost. While it leverages existing 4G infrastructure, additional antennas are required for both base stations and user devices. These extra components can add up quickly, especially when considering large-scale deployments across entire cities or regions. Network operators must carefully weigh the potential gains in network capacity against the upfront investment needed. The cost is primarily driven by the increased number of antennas needed at base stations. Traditional cell towers might require significant modifications or even replacements to accommodate the additional antenna arrays. Furthermore, not all user equipment currently supports MIMO, and widespread adoption necessitates encouraging consumers to upgrade their devices. These factors can lead to a substantial initial investment for operators, posing a challenge for large-scale rollouts.

Limited device compatibility is throwing a curveball at the 4G LTE MIMO market.

One hurdle to the widespread adoption of 4G LTE MIMO is the current lack of universal device compatibility. MIMO's strength lies in its ability for both base stations and user devices to transmit and receive multiple data streams simultaneously. However, if a user's device doesn't have the necessary MIMO antennas, they won't be able to reap the full benefits of the upgraded network. This results in a two-tiered experience, with some users suffering from conventional constraints and MIMO-equipped customers enjoying noticeably quicker speeds and better connectivity. This disparity can be frustrating for users and limit the overall effectiveness of the network upgrade. The good news is that as technology advances, MIMO compatibility is becoming increasingly common in smartphones and other mobile devices. Chipset manufacturers are integrating MIMO capabilities into their latest offerings, and future generations of devices are expected to be universally compatible. This will unlock the full potential of MIMO technology and ensure a more equitable network experience for all users.

Spectrum availability and regulation are major barriers.

MIMO technology thrives on efficiently utilizing the available radio spectrum, the invisible bandwidth that carries our mobile data. However, this efficiency relies heavily on two factors that can hinder widespread MIMO deployment: spectrum availability and regulations. Spectrum allocation varies significantly by region, with some areas having limited resources available for mobile data. This scarcity can restrict the effectiveness of MIMO, as the technology requires a certain amount of dedicated spectrum to function optimally. Further complicating matters is the issue of regulations. Clear guidelines from governing bodies are crucial to ensuring how MIMO can operate on specific frequencies. Without proper regulations, deploying MIMO becomes a complex task, as operators might be hesitant to invest in infrastructure that may not be compatible with future regulations or could cause interference with existing services. Addressing both spectrum availability and establishing clear regulations are crucial steps to pave the way for smooth MIMO adoption.

Global 4G LTE MIMO Market Opportunities:

The skyrocketing data demands from video streaming, social media, and online gaming are pushing network capacity to the limit. 4G LTE MIMO emerges as a hero, offering a cost-effective solution by enabling simultaneous data transmission and reception. Faster speeds, more fluid streaming, and an improved user experience result from this, which benefits both operators by keeping consumers and users by giving them access to a responsive network. 4G LTE MIMO allows base stations to target individual devices, reducing interference and ensuring a stable connection for everyone. While 5G promises a bright future, widespread adoption takes time. 4G LTE MIMO acts as a bridge, allowing operators to leverage existing infrastructure for immediate improvements while they invest in future-proof 5G. The beauty of MIMO lies in its maturity and standardization, minimizing deployment risks and simplifying integration. As MIMO compatibility becomes increasingly common in devices, a broader ecosystem will unlock the technology's full potential, creating a more equitable network experience for all. In essence, the 4G LTE MIMO market offers a win-win for stakeholders, addressing the growing need for improved mobile network performance through a cost-effective solution, a bridge to 5G, and a path towards a future-proofed network.

4G LTE MIMO MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

35% |

|

Segments Covered |

By Component Type, End-Users, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nokia (Finland), Ericsson (Sweden), Huawei (China), ZTE (China), Samsung Electronics (South Korea), CommScope (USA), NEC (Japan), Fujitsu (Japan), Cisco Systems (USA), Airspan Networks (USA) |

4G LTE MIMO Market Segmentation: By Component Type

-

Antennas

-

Transceivers

-

Amplifiers

-

Processors

-

Others

Antennas are the largest growing type. In MIMO systems, antennas are crucial parts for sending and receiving wireless signals. Multiple-input multiple-output (MIMO) antennas and other advanced antenna technologies are in high demand due to the growing need for faster data transfer and improved network coverage. Antennas are among the most common component types on the market since they are essential for improving the effectiveness and performance of 4G LTE MIMO systems. Transceivers are the fastest-growing component. To transmit electrical impulses into radio waves and vice versa, transceivers are essential. Multiple transceivers are employed in MIMO systems to handle multiple data streams simultaneously, increasing spectral efficiency and data throughput. The market for transceivers in 4G LTE MIMO systems is growing significantly, along with the desire for more dependable and faster wireless connectivity.

4G LTE MIMO Market Segmentation: By End-Users

-

IT & Telecommunication

-

Healthcare

-

Transportation

-

Manufacturing

-

Retail

-

Energy & Utilities

-

Financial Services

-

Government

The IT & telecommunications industry is the largest growing end-user. Leading data consumers include IT and telecom firms, which depend on dependable, fast connectivity to provide cloud computing, video conferencing, and data streaming services. To support their operations, these industries mostly rely on a strong network infrastructure. By switching to 4G LTE MIMO technology, they may improve network speed and capacity to satisfy their users' growing demands. The healthcare sector is the fastest-growing. Category. Telemedicine and remote patient monitoring are being used by the healthcare sector more and more, which necessitates dependable and fast internet access. Healthcare professionals may now transfer medical data, conduct real-time video consultations, and remotely monitor patients due to 4G LTE MIMO technology without sacrificing service quality. A vast quantity of data is produced by the spread of IoT devices and wearables in the healthcare industry, including smart medical equipment, fitness trackers, and wearable monitors. This data must be sent safely and effectively. With the capacity and dependability that 4G LTE MIMO technology offers to enable these devices, medical practitioners can efficiently gather and evaluate patient data.

4G LTE MIMO Market Segmentation: By Application

-

Mobile Devices (Smartphones, Tablets)

-

Laptops and Notebooks

-

Industrial Automation

-

Surveillance and Security

-

Smart Grids

-

Others

Mobile devices are the largest and fastest-growing applications. There are billions of users of smartphones worldwide, making them a ubiquitous device. For the great majority of people, they serve as their main method of getting online and consuming digital material. Consequently, there is a constant need for 4G LTE MIMO technology to enable quicker and more dependable mobile connectivity. Consumer preferences and technological improvements fuel regular cycles of smartphone upgrades. To improve the user experience and stay competitive in the market, manufacturers are always integrating new features and enhancements, such as support for network technologies like 4G LTE and MIMO, into their products.

4G LTE MIMO Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific (APAC) is the largest and fastest-growing market. This dominance is driven by a confluence of factors: a booming mobile user base with high data consumption, government initiatives promoting digital infrastructure, and the presence of major network operators and telecom equipment manufacturers within the region. This combination creates a strong demand for cost-effective solutions like 4G LTE MIMO to improve network capacity and the user experience.

COVID-19 Impact Analysis on the Global 4G LTE MIMO Market:

The COVID-19 pandemic caused a temporary disruption to the 4G LTE MIMO market. Initial impacts included supply chain disruptions leading to shortages of equipment and decreased operator spending due to economic uncertainty. However, the pandemic also accelerated long-term trends that favor MIMO adoption. The surge in remote work, online learning, and video conferencing significantly increased reliance on mobile data. This highlighted network capacity limitations, making 4G LTE MIMO a more attractive solution for operators seeking to improve network performance without a complete 5G overhaul. Additionally, government stimulus packages in many regions prioritized investments in digital infrastructure, creating opportunities for MIMO deployments. Looking ahead, the 4G LTE MIMO market is expected to recover and maintain its growth trajectory as the focus on improving network capacity and user experience remains a top priority for mobile operators in the post-pandemic era.

Latest trends/Developments

The 4G LTE MIMO market is in a state of exciting evolution, fueled by the ever-increasing need for data and cost-effective network upgrades. A shift towards higher-order MIMO systems with more antennas (think 8x8 or even 16x16) for significantly boosted capacity is being observed. Beamforming technology is getting smarter, allowing for precise targeting of individual devices and reducing interference, especially in crowded cities. Cloud-based RAN (Radio Access Network) is gaining traction, enabling centralized MIMO management and real-time network optimization. Open RAN, where different vendors' components can work together, is picking up steam, potentially leading to cost reductions and faster deployments. Finally, the focus is on creating MIMO systems that can seamlessly work with not only 4G LTE but also future 5G technologies, ensuring a smooth transition path and future-proofing network infrastructure. These trends paint a picture of a dynamic 4G LTE MIMO market actively bridging the gap between current limitations and the exciting potential of 5G.

Key Players:

-

Nokia (Finland)

-

Ericsson (Sweden)

-

Huawei (China)

-

ZTE (China)

-

Samsung Electronics (South Korea)

-

CommScope (USA)

-

NEC (Japan)

-

Fujitsu (Japan)

-

Cisco Systems (USA)

-

Airspan Networks (USA)

Chapter 1. 4G LTE MIMO Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. 4G LTE MIMO Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. 4G LTE MIMO Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. 4G LTE MIMO Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. 4G LTE MIMO Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. 4G LTE MIMO Market – By Component Type

6.1 Introduction/Key Findings

6.2 Antennas

6.3 Transceivers

6.4 Amplifiers

6.5 Processors

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Component Type

6.8 Absolute $ Opportunity Analysis By Component Type, 2024-2030

Chapter 7. 4G LTE MIMO Market – By Application

7.1 Introduction/Key Findings

7.2 Mobile Devices (Smartphones, Tablets)

7.3 Laptops and Notebooks

7.4 Industrial Automation

7.5 Surveillance and Security

7.6 Smart Grids

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. 4G LTE MIMO Market – By End-User

8.1 Introduction/Key Findings

8.2 IT & Telecommunication

8.3 Healthcare

8.4 Transportation

8.5 Manufacturing

8.6 Retail

8.7 Energy & Utilities

8.8 Financial Services

8.9 Government

8.10 Y-O-Y Growth trend Analysis By End-User

8.11 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. 4G LTE MIMO Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Component Type

9.1.3 By Application

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Component Type

9.2.3 By Application

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Component Type

9.3.3 By Application

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Component Type

9.4.3 By Application

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Component Type

9.5.3 By Application

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. 4G LTE MIMO Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Nokia (Finland)

10.2 Ericsson (Sweden)

10.3 Huawei (China)

10.4 ZTE (China)

10.5 Samsung Electronics (South Korea)

10.6 CommScope (USA)

10.7 NEC (Japan)

10.8 Fujitsu (Japan)

10.9 Cisco Systems (USA)

10.10 Airspan Networks (USA)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global 4G LTE MIMO market was valued at USD 30 billion in 2023 and will grow at a CAGR of 35% from 2024 to 2030. The market is expected to reach USD 245.16 billion by 2030.

Enhancing 4G network capacity and user experience, optimizing network connectivity, and cost-effective network enhancement are the reasons that are driving the market.

Based on component type, the market is divided into antennas, transceivers, amplifiers, processors, and others.

Asia-Pacific is the most dominant region for the global 4G LTE MIMO market.

Nokia, Ericsson, Huawei, ZTE, and Samsung Electronics are the major players in the global 4G LTE MIMO market.