3D Printing in Healthcare Market Size (2024 – 2030)

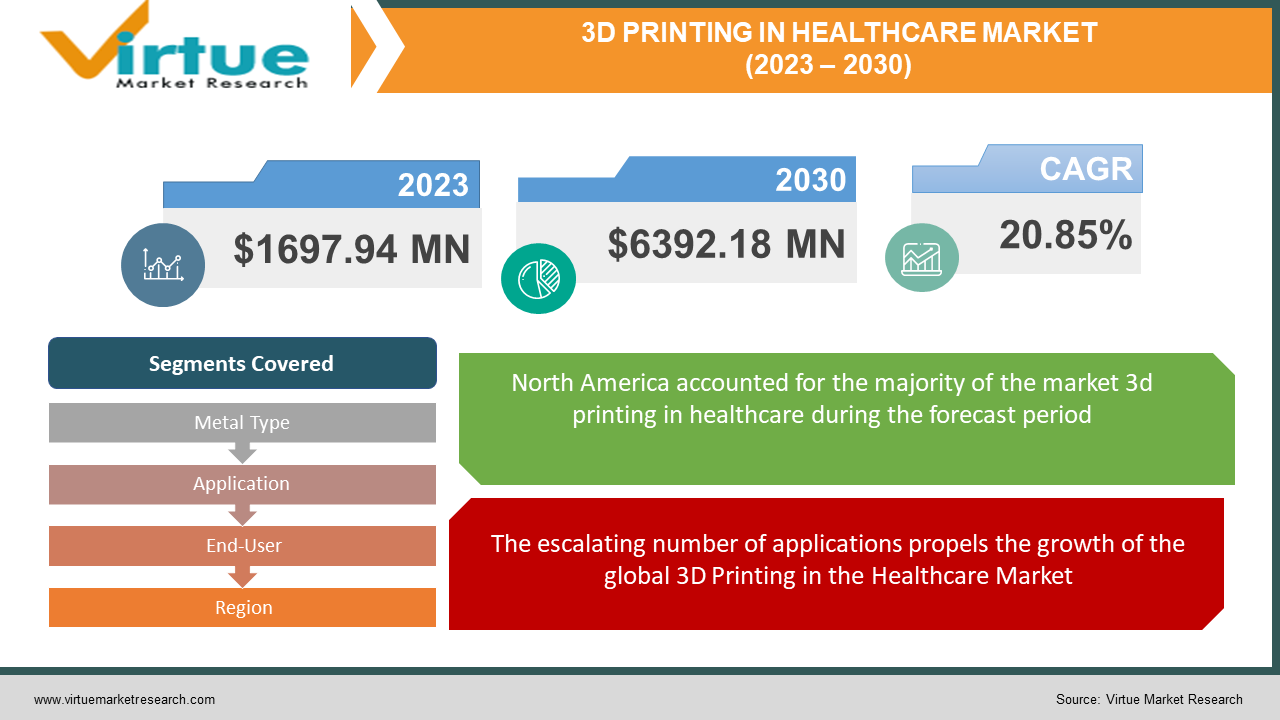

In 2023, the Global 3D Printing in Healthcare Market achieved a valuation of USD 1697.94 million and anticipates attaining a market size of USD 6392.18 million by 2030. The market is poised for a growth trajectory at a Compound Annual Growth Rate (CAGR) of 20.85% during the forecast period spanning 2024-2030. Key drivers propelling this growth encompass technological advancements in 3D printing, customization and personalization trends, augmented Research and Development (R&D) investments, the presence of a substantial patient pool, and an upswing in biomedical applications.

Key Market Insights:

The field of 3D printing undergoes rapid evolution, facilitating medical manufacturers to craft tailor-made medical devices and products. Also referred to as additive manufacturing, this technology employs layer-by-layer techniques to construct tangible objects from 3D digital files. Addressing the escalating demand for personalized medicine, 3D printing technology delivers customized medical devices tailored to individual requirements.

Moreover, it offers several advantages over traditional reconstructive surgery by mitigating surgical risks in complex procedures, reducing susceptibility to infections, and minimizing the duration of anesthesia exposure. Consequently, patients experience quicker recovery times and reduced hospital stays. Additionally, 3D printing technology empowers surgeons to enhance the success rates of intricate procedures. Furthermore, it has revolutionized preclinical drug testing, enabling experimentation on 3D-printed organs as opposed to traditional animal testing. Recent breakthroughs in 3D printing on tablets have opened new vistas for the pharmaceutical industry, leveraging 3D printing technology in both rapid prototyping and layered modeling. The versatility of object shapes or geometries is achieved using digital model data from a 3D model or another electronic data source. The burgeoning adoption of 3D printing technology in healthcare has significantly propelled market growth, owing to its diverse applications.

Impact of COVID-19 on the 3D Printing in Healthcare Market:

The COVID-19 pandemic has wrought multifaceted disruptions across various countries, straining healthcare systems globally. The surge in patient numbers, coupled with supply chain disruptions, led to shortages of medical equipment and personal protective gear. A community specializing in layered modeling emerged in response to the scarcity of medical devices during the COVID-19 pandemic, as highlighted in a December 2020 article titled "The Role of 3D Printing during the COVID-19 Pandemic: Review." Diverse designs were manufactured and are now in use in hospitals by both patients and healthcare professionals. The utilization of 3D printing devices, including face shields, face masks, valves, and nasopharyngeal swabs, has witnessed a notable uptick, contributing to market growth.

According to an article published in April 2021, titled "3D Printing and the Future of Agile, Personalized Healthcare," companies specializing in 3D printing services supported relief efforts against COVID-19. They adapted technology and design to facilitate mass production of medical products, an essential response to pandemic challenges. Another article from November 2021, titled "3D Printing in the Battle of COVID-19," emphasized that 3D printing played a crucial role in overcoming the scarcity of available devices. The adaptability of 3D printing technology in producing essential equipment showcased its positive impact on market growth during the COVID-19 pandemic.

MARKET DRIVERS:

The escalating number of applications propels the growth of the global 3D Printing in the Healthcare Market.

A fundamental catalyst within the global 3D Printing in the Healthcare Market is the increasing utilization of this technology across diverse applications such as transplantation, drug delivery, 3D-printed organs, and various others within the healthcare sector. The growing demand for customized implants during surgical procedures, coupled with a surge in research and development investments, is a driving force behind the global expansion of 3D Printing in the healthcare market. The adoption is on the rise due to the broad spectrum of 3D printing applications in healthcare. The increasing array of applications, combined with the diminishing costs of 3D Printing and printers, will stimulate the growth of the 3D Printing market.

The Adoption of 3D Printing in Healthcare Driven by New Technological Advancements is also Contributing to Market Growth.

Technological advancements focus on creating novel 3D-printed products, elevating the demand for 3D printing in the healthcare industry and contributing to market growth. Additionally, intensified research and development efforts lead to the development of new treatments for various diseases, fostering growth in the 3D Printed Medical Devices Market. Engineers at Pohang University of Science and Technology, South Korea, have successfully engineered "bio-blood vessels" using a 3D printer, utilizing material extracted from the human body as a template. These bio-blood vessels can also serve as drug carriers, releasing the drug into the inserted environment, thereby enhancing the likelihood of a successful implant.

MARKET RESTRAINTS:

The High Cost Associated with 3D Printing Hinders Market Growth.

A significant obstacle in the global 3D Printing in the Healthcare Market is the exorbitant cost of 3D printers. Technologies such as stereolithography, laser beam, electron beam, photopolymerization, and droplet deposition methods are excessively expensive. Business and Industrial printers commonly used in the healthcare sector are priced around $10,000, presenting a major barrier for facilities to adopt. While 3D Printed products have the potential to significantly reduce the cost of final products and enhance efficiency, the high cost of 3D Printers remains a primary impediment to widespread adoption.

3D PRINTING IN HEALTHCARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

20.85% |

|

Segments Covered |

By Metal Type, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3d systems Corporation, Exone Company, Formlabs Inc., General electric, Materialize NV, Oxford Performance Materials, Inc., Organavo holdings, Inc., Proto Labs, SLM Solutions Group AG, Stratasys Ltd |

3D Printing in Healthcare Market – By Metal Type

-

Metal and alloys

-

Polymer

-

Other materials

The dominance of the market revenue is exhibited by Polymer, emerging as the leading segment, underscoring the potential of 3D printing in manufacturing intricate and customizable medical devices. The versatility inherent in polymer-based 3D printing fosters a diverse range of medical applications, solidifying its supremacy in the market.

Experiencing notable growth within Metal Type is the Metal and alloys segment. This growth is attributed to advancements in additive manufacturing techniques, propelling metal 3D printing's popularity in creating high-strength and durable medical components. The capability to fashion intricate designs and tailored solutions for surgical implants and medical instruments positions Metal and alloys as the swiftest-growing segment within the 3D Printing in Healthcare market.

3D Printing in Healthcare Market - By Application

-

Prosthetics

-

Surgical Implants

-

Hearing Aids

-

Dental Implants

-

Tissue Engineering

-

Drug Screening

-

Surgical Guides

-

Medical Components

-

Others.

The prominence of Prosthetics is evident as it stands out with the highest market revenue, asserting its dominance among other segments. Enabled by 3D printing's capacity to craft customized and comfortable prosthetic devices, the appeal of Prosthetics in the market is driven by its ability to address individual patients' needs and preferences.

The rapidly advancing segment in Application is Surgical Implants. Its potential to fabricate patient-specific implants through 3D printing technology enhances surgical precision and improves patient outcomes. Surgeons can now create implants tailored to a patient's unique anatomy, thereby reducing the risk of complications and enhancing postoperative recovery. These factors position the segment of surgical implants as a significant contributor to the market revenue share during the forecast period.

The utilization of 3D printing technology in healthcare witnesses a trend marked by increased collaboration between medical professionals and 3D printing experts. The creation of accurate anatomical models using patient-specific data aids surgeons in preoperative planning and augments medical education. These tangible models empower medical teams to comprehend complex procedures, ultimately enhancing patient care and surgical outcomes. This collaborative trend facilitates innovative solutions that bridge the gap between technology and healthcare expertise.

3D Printing in Healthcare Market - By End-User

-

Medical & Surgical Centers

-

Pharmaceutical & Biotechnology Companies

-

Academic Institutions

Maintaining its dominance within the segment, Medical & Surgical Centers lead with the highest market revenue. In these centers, 3D printing technology revolutionizes the production of medical devices and patient-specific solutions, playing a pivotal role in enhancing patient care and surgical procedures.

Conversely, the fastest-growing segment within End-User is Pharmaceutical & Biotechnology Companies. Recognizing the value of 3D printing in drug development, these companies leverage the technology to create intricate pharmaceutical formulations and precise dosage forms. As 3D printing technology offers opportunities for innovation in drug delivery and personalized medicine, Pharmaceutical & Biotechnology Companies rapidly adopt these solutions to expedite research and development efforts.

3D Printing in Healthcare Market - By Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East and Africa

North America, propelled by robust healthcare infrastructure and technological advancement, emerges as the largest market for 3D Printing in Healthcare, commanding the highest market revenue share. The region's penchant for innovation and substantial investments in healthcare technology fosters widespread adoption of 3D printing, positioning North America at the forefront of the industry.

Simultaneously, the Asia-Pacific region showcases exceptional growth potential, serving as the fastest-growing market during the forecast period. The expanding healthcare sector in this region, driven by increasing healthcare expenditure and a burgeoning population, aligns with the adoption of 3D printing technology in healthcare. This resonance with the need for efficient and patient-centered solutions propels rapid growth in the Asia-Pacific region.

The convergence of technology and healthcare is evident in a trend where 3D printing facilitates collaboration between diverse entities. Medical professionals, researchers, and technology experts unite to develop groundbreaking solutions that address healthcare challenges. This trend underscores the pivotal role of interdisciplinary collaboration in harnessing the true potential of 3D printing in healthcare.

3D Printing in Healthcare Market Share by company

-

3d systems Corporation

-

Exone Company

-

Formlabs Inc.

-

General electric

-

Materialize NV

-

Oxford Performance Materials, Inc.

-

Organavo holdings, Inc.

-

Proto Labs

-

SLM Solutions Group AG

-

Stratasys Ltd

Recent Notable Developments in the 3D Printing in Healthcare Market:

-

A recent noteworthy development is the establishment of a center of excellence for 3D bioprinting by Johnson & Johnson. This collaborative initiative, formed in partnership with the medical and pharmaceutical giant AMBER (Advanced Bioengineering and Materials Research), has been operational since July 2019. The facility is dedicated to conducting various orthopedic research projects, signaling Johnson & Johnson's commitment to advancing 3D printing applications in healthcare. Furthermore, engineers from Pohang University of Science and Technology in South Korea have achieved a significant milestone by successfully creating a "biological circuit" using a 3D printer. This innovative process utilizes materials extracted from the human body as a model, with the resulting bio-blood vessels capable of acting as drug transporters, releasing drugs into their insertion medium and thereby enhancing the likelihood of successful implantation.

-

Product Launch - In February 2022, DeGen Medical, Inc., a spinal implant manufacturer specializing in Augmented Reality and Patient-Specific Solutions, commercially launched Impulse AM. This 3D-printed porous titanium implant is designed for posterior interbody fusion, showcasing the company's commitment to advancing innovative solutions in spinal healthcare.

-

Agreement - Also in February 2022, 3D Systems entered into an agreement to acquire Kumovis, a healthcare-focused additive manufacturing technology startup based in Munich. This strategic move aims to enhance 3D Systems' polymer 3D printing portfolio by incorporating Kumovis' unique extrusion technology. The acquisition positions 3D Systems to further expand its offerings in the personalized healthcare market, with the transaction expected to be completed in April 2022. This agreement reflects the industry's continuous efforts to integrate cutting-edge technologies and broaden its capabilities in addressing healthcare challenges through 3D printing.

Chapter 1. 3D Printing in Healthcare Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. 3D Printing in Healthcare Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. 3D Printing in Healthcare Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. 3D Printing in Healthcare Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. 3D Printing in Healthcare Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. 3D Printing in Healthcare Market – By Metal Type

6.1. Metal and alloys

6.2. Polymer

6.3. Other materials

Chapter 7. 3D Printing in Healthcare Market – By Application

7.1. Prosthetics

7.2. Surgical Implants

7.3. Hearing Aids

7.4. Dental Implants

7.5. Tissue Engineering

7.6. Drug Screening

7.7. Surgical Guides

7.8. Medical Components

7.9. Others.

Chapter 8. 3D Printing in Healthcare Market – By End-User

8.1. Medical & Surgical Centers

8.2. Pharmaceutical & Biotechnology Companies

8.3. Academic Institutions

Chapter 9. 3D Printing in Healthcare Market- By Region

9.1 North America

9.2 Asia-Pacific

9.3 Europe

9.4 South America

9.5 Middle East and Africa

Chapter 10. 3D Printing in Healthcare Market – Key Companies

10.1. 3d systems Corporation

10.2. Exone Company

10.3. Formlabs Inc.

10.4. General electric

10.5. Materialize NV

10.6. Oxford Performance Materials, Inc.

10.7. Organavo holdings, Inc.

10.8. Proto Labs

10.9. SLM Solutions Group AG

10.10. Stratasys Ltd

Download Sample

Choose License Type

2500

4250

5250

6900