3D Printing Construction Market Size (2025 – 2030)

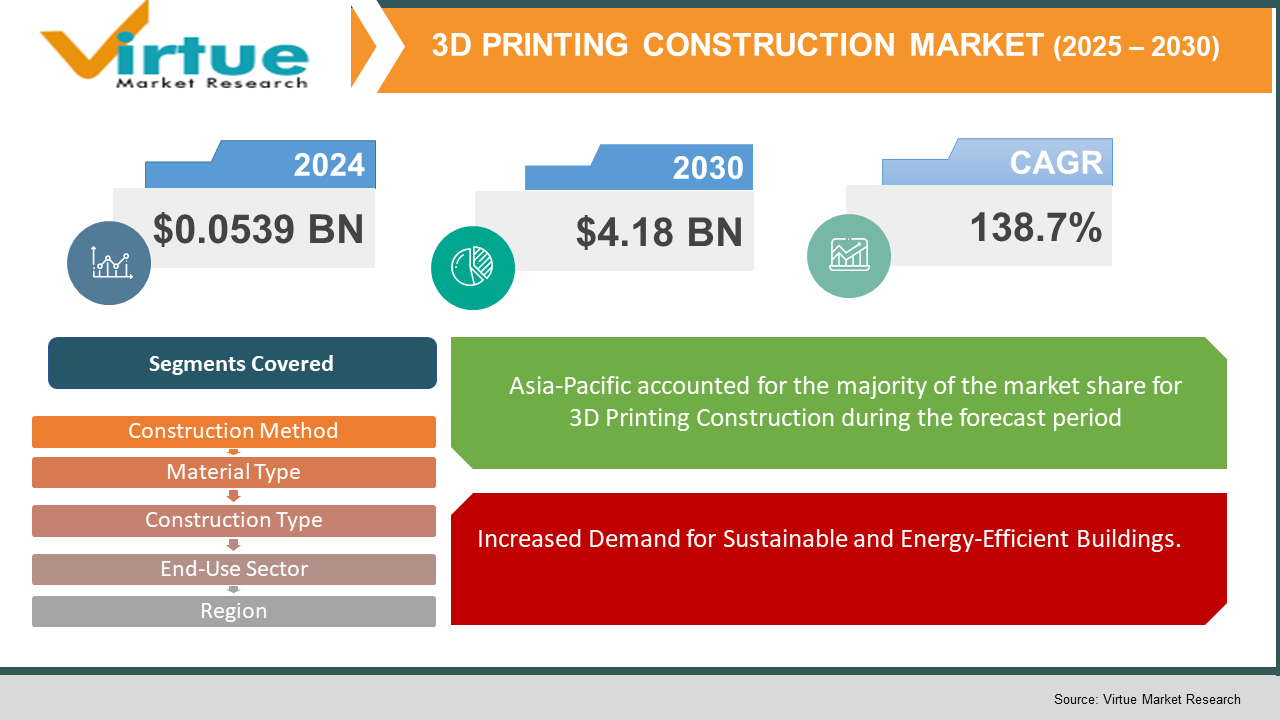

The 3D Printing Construction Market was valued at $0.0539 billion and is projected to reach a market size of $4.18 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 138.7%.

3D printing construction is transforming the sector by making it possible to develop smart infrastructure quickly, such as modular buildings, sophisticated utility systems, and public spaces that can be adjusted. Using this technology, one can build customized structures with IoT devices integrated into them, green roofs optimized for energy efficiency, and energy-efficient materials—all the hallmarks of smart cities today. Using a layer-by-layer printing technology with materials like concrete, polymers, clay, and metal, 3D construction printing reduces construction time, labor expenses, and material loss considerably. The most popular technique is through a robotic arm extruding concrete, but other methods like powder binding and additive welding are employed as well. One of the benefits of 3D printing is its design versatility, making it possible for architects to bring out intricate and new designs that would be impossible or expensive to create using conventional practices. Not only does the flexibility promote architectural innovation but also offers improved project visualization, where contractors and clients can render and correct 3D models until satisfaction is obtained. The use of high-speed, automated equipment has significantly cut down production time and eliminated most human mistakes, further optimizing the construction process. Notably, 3D printing reduces material waste through accurate usage, with robotic arms using only the required amount of material—often with recycled inputs—improving environmental sustainability. Beyond sustainability and cost-effectiveness, 3D printing offers innovative solutions to construction challenges through simplified logistics, minimized dependency on labor, and scalable solutions for both off-site and on-site construction. Overall, 3D printed construction is not just changing the way structures are constructed but also reshaping the future of intelligent, sustainable urban planning.

Key Market Insights:

- The overview study of the 3D printing construction market includes 20 countries. The study comprises a segment analysis of every country based on value ($Billion) for the forecast years 2023-2032.

- Over 1, 500 product literature, industry releases, annual reports, and other similar documents of key 3D printing construction system industry players, as well as genuine industry journals, trade associations' releases, and government websites, have been scanned for producing high-value industry analyses.

- The research incorporated quality data, expert views and analysis, and objective independent viewpoints. The research methodology is designed to give an even-handed perception of international markets and to help stakeholders make informed choices in an attempt to meet their most ambitious growth targets.

- November 2020: PERI GmbH constructs a 3D-printed commercial apartment building, with 5 apartments and 3 floors in Wallenhausen, Germany. The around 380 square meters of building space built with 10.12. COBOD International A/S's patented 3D construction printer.

3D Printing Construction Market Key Drivers:

3D Printing in Construction: Cutting Costs, Building Faster, Going Green

Speeded-up Construction and Cost Effectiveness.

3D printing technology dramatically shortens construction schedules and labor expenses through the automation of building processes. This automation lessens human errors and material loss, resulting in huge cost reductions. For example, 3D printing supports accurate material deposition, which assures that only the material needed is consumed, thus conserving material and related costs. This efficiency especially favors large-sized projects and where there are labor shortages.

Increased Demand for Sustainable and Energy-Efficient Buildings.

With growing environmental consciousness, there is an increased need for sustainable construction. 3D printing construction meets this by allowing the incorporation of green materials and minimizing waste during construction. The technology also makes it possible to include recycled materials, like geopolymers and clay, in construction. This not only reduces the footprint on the environment but also complies with global sustainability efforts.

Technological Innovation and Advancements.

Ongoing improvements in 3D printing technology, such as the creation of new construction-ready materials and printers, are opening new avenues for 3D printing capabilities in construction. New technologies such as robotic 3D printers for construction and eco-friendly materials such as 'SIMPLICRETE' are allowing for the construction of complex structures with improved speed and accuracy. These technologies are making 3D printing increasingly viable and desirable for use in different construction applications.

3D Printing Construction Market Restraints and Challenges:

Regulatory Gaps, High Costs, and Technical Limitations.

Although 3D printing possesses revolutionary power for the construction industry, several critical challenges stand in its way of adoption. Primarily among these is the lack of uniform building codes and regulatory guidelines specific to 3D-printed buildings. This regulatory ambiguity hinders approvals for projects and scares off investment, with developers needing to work through unclear compliance requirements. Financial obstacles also remain an enormous obstacle. The up-front capital needed to purchase large-scale 3D printing machinery, as well as the expense of specialized materials, can be exorbitant, especially for small- and medium-sized businesses. In addition, the technology requires a labor force familiar with digital design and printer use—a resource presently in short supply in the construction industry. Technical limitations also limit the scalability of 3D printing in construction. Challenges like maintaining structural integrity, controlling material properties, and providing consistent quality control are common. Moreover, the technology's existing capabilities are more appropriate for low-rise buildings, with high-rise construction still being a complicated task owing to equipment and material limitations.

3D Printing Construction Market Opportunities:

The market for 3D printing construction is set to undergo revolutionary growth, with huge opportunities to meet world challenges including affordable housing deficits, sustainable urban growth, and the need for new construction techniques. Perhaps the most interesting opportunity is using 3D printing to build affordable housing quickly, especially in countries with severe housing crises. For example, in the United States, new construction techniques such as 3D printing are being considered to address the shortage of housing, providing quicker and cheaper solutions than conventional construction methods. 3D printing technology also fits well with the mission of smart city projects, making it possible to produce personalized, energy-efficient buildings that incorporate state-of-the-art technologies such as IoT devices and green materials. This convergence aids in the establishment of robust and responsive urban infrastructures that suit the changing requirements of contemporary cities. There are huge opportunities in emerging markets, especially within the Asia-Pacific region, for the implementation of 3D printing in buildings. Nations such as China and India are making investments in this technology to cope with the pressures of rapid urbanization and infrastructure growth, aware of its capability to transform the construction sector through increased efficiency and lower environmental footprints. In addition, the use of sustainable materials within 3D printing techniques provides a route towards environmentally friendly building practices. By using recycled and biodegradable materials, 3D printing can greatly minimize construction waste and carbon emissions and support global sustainability efforts.

3D PRINTING CONSTRUCTION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

138.7% |

|

Segments Covered |

By constructin method, end use sector, material type, construction type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

COBOD International A/S, D-Shape, Apis Cor, WASP S.r.l., Contour Crafting Corporation, CyBe Construction, ICON Technology, Inc., MX3D, Skanska AB, Peri Group |

3D Printing Construction Market Segmentation:

3D Printing Construction Market Segmentation: By Construction Method

- Extrusion

- Powder Bonding

- Other Methods

Extrusion is the quickest and most common building technique used in the 3D printing sector. Extrusion entails laying down materials such as concrete or mortar in a layer-by-layer fashion via a nozzle on a robotic arm, gantry system, or crane, allowing for quick construction of large-scale buildings. Its effectiveness is seen in ventures like Luyten 3D's build of a two-story house in Australia in merely 32 hours using their Platypus X12 printer. The compatibility of the method with traditional building materials and its potential to create complex geometries place it in high demand for use on-site, leading to its market dominance. Extrusion dominated 85.8% of the world's 3D printing construction market share in 2023, reflecting its popularity and efficiency in expediting building activities.

Extrusion excels in terms of speed and market share while powder bonding gains popularity for precision and versatility. This technique entails bonding powdered materials, including sand or recycled glass, together with a binding agent or through heat, to enable the formation of very detailed and complex architectural features. Powder bonding is specifically ideal for making personalized components and ornamental features, which conforms to the increasing need for tailored construction solutions. Its capacity for using environmentally friendly and recycled materials also conforms to green building standards. Despite having a smaller share of the market at present, powder bonding is expected to grow substantially on the back of its use in intricate design schemes and the move towards environmentally friendly building practices within the industry.

3D Printing Construction Market Segmentation: By Material Type

- Concrete

- Metal

- Composite

- Others

Concrete is still the backbone of 3D printing in construction, with the highest market share because of its natural strength, durability, and affordability. In 2023, concrete dominated the market for 3D printing in construction, with a market share of more than 65%. Its extensive application is because it is versatile and can be used for large-scale structural purposes, such as walls, floors, and foundations. Advances in concrete mixes, including low-carbon and high-strength versions, have contributed to its popularity further, in line with international sustainability imperatives and minimizing the environmental footprint of construction work. The flexibility of concrete to most 3D printing methods, especially extrusion-based ones, has cemented its position as the go-to material for 3D-printed construction work.

Polymers are becoming the quickest-growing material within the 3D printing construction industry due to their light properties, versatility, and ability for sustainable use. The polymers segment is expected to account for the highest compound annual growth rate (CAGR) during the forecast period because of their ability to be used in modular and decorative features as well as temporary structures. Polymers are frequently employed in conjunction with composites to create durable, insulated, and lightweight parts, of interest to energy-efficient and sustainable design projects. With 3D printing allowing the use of sophisticated polymer formulations with excellent thermal resistance and flexibility, the building industry increasingly employs polymers for uses such as interior partitions, facades, and insulation, especially in residential and modular construction.

3D Printing Construction Market Segmentation: By Construction Type

- Modular

- Full Building

Modular 3D printing is quickly becoming the fastest-growing sector in the construction business. Modular design entails prefabricating parts off-site with 3D printing technology that are then moved and installed on-site. Modular construction reduces construction time and labor expenses greatly by allowing site preparation and component manufacturing to be processed in parallel. Also, it facilitates more accuracy and quality control, as parts are manufactured in a controlled factory environment. This is especially useful in meeting housing deficits and urban development requirements, where speed and cost savings are the top priority. The use of modular 3D printing will continue to grow at an increasing rate as demand for fast and affordable building solutions increases.

Whole building 3D printing, which means building whole structures layer by layer on-site, is the leading 3D printing construction technique today. This process is especially beneficial for developing intricate architectural designs and tailored structures that conventional building techniques would find too difficult or expensive. Printing whole buildings directly on-site means less wastage of materials and transportation costs, making construction more environmentally friendly. Further, full building 3D printing is highly customizable in design, making it easy to produce one-of-a-kind and innovative buildings that can be specially designed to meet requirements and tastes. As technology continues to progress and policies are adapted, full-building 3D printing will play an invaluable role in the construction industry's future by providing scalable options for residential and commercial buildings.

3D Printing Construction Market Segmentation: By End-Use Sector

- Building

- Infrastructure

The construction industry is the dominant sector in the 3D printing construction market, accounting for over 73% of the global revenue share in 2024. This is because of the increasing demand for residential, commercial, and industrial buildings that require rapid construction, affordability, and flexibility in terms of structure. The technology of 3D printing has the potential to create complex architectural designs and personalized buildings, which are hard to achieve using traditional construction methods. Additionally, the potential to use green materials and reduce material waste aligns with the growing emphasis on green construction practices. Strategic collaborations between 3D printer firms and construction firms have also increased the adoption of this technology in the construction sector, leading to its continued dominance in the sector.

The infrastructure sector is growing at a fast pace in the field of 3D printing construction, with a substantial increase in market share expected between 2024 and 2034. The growth is being driven by demand for smart cities, transportation networks, and utility networks with efficient construction solutions. 3D printing allows for the swift construction of complex projects like tunnels and bridges with enhanced precision and lower labor costs. The use of sustainable, long-lasting materials in 3D printing is in line with the industry's focus on sustainability and resilience. Growing urbanization is likely to drive the use of 3D printing in infrastructure, making it the fastest-growing segment.

3D Printing Construction Market Segmentation: By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

The worldwide 3D printing construction market is witnessing differential growth by region, with unique leaders and new entrants defining its profile. In 2024, the Asia-Pacific region dominated the market with about 42% of the global revenue share. This is driven by fast urbanization, rising demand for affordable housing, and high investments in construction technology in nations such as China, India, and Japan. The region's robust manufacturing sector and emphasis on sustainable building solutions further strengthen its position. North America was closely following, with around 36% of the market share, with major investments, technological innovations, and increasing importance given to sustainable building methods. The United States, specifically, has been a leader in the adoption of 3D printing technologies for housing and infrastructure development. Europe contributed a significant 15% share, and nations such as the Netherlands, Germany, and the UK excelled in environmentally friendly and economical housing schemes. The Middle East & Africa (MEA) and Latin America (LATAM) regions, although presently with smaller market shares of 5 and 3%, respectively, are expected to see immense growth because of growing urbanization and infrastructure demands.

COVID-19 Impact Analysis on the 3D Printing Construction Market:

The COVID-19 pandemic heavily impacted the 3D printing construction industry, and it experienced a steep decline in 2020. Lockdowns worldwide suspended construction operations, resulting in a 35.76% decrease in market size from $0.004 billion in 2019 to $0.002 billion in 2020. Disruptions in supply chains, such as the delay in the importation of construction materials and the closure of manufacturing plants, further added to the impact. For example, the U.S. saw a 20% drop in cargo volumes in the first quarter of 2020 as a result of border closures and port congestion. Moreover, the pandemic resulted in a decline in new home sales, with U.S. Census Bureau statistics showing a fall from 717,000 in February 2020 to 623,000 in April 2020. Even with these difficulties, the market showed resilience and is expected to bounce back and grow substantially. The market will grow to $0.12 billion by 2023, at a compound annual growth rate (CAGR) of 147.79%. This recovery is due to the enhanced adoption of 3D printing technology, which allows for cost-effective, time-saving, and eco-friendly construction solutions. For instance, 3D printing reduces labor costs by 50%-80%, production time by 50%-70%, and construction waste by 30%-60%. In addition, the pandemic brought to the fore the possibility of 3D printing as a solution for immediate housing needs, as illustrated by efforts such as China's use of 3D-printed isolation wards in Hubei province.

Trends/Developments:

In July 2024, Institute for Advanced Architecture of Catalonia (IAAC) researchers employed a Crane WASP 3D printer to develop a 100 m² model of a low-carbon emission building for the 3D Printed Earth Forest Campus (TOVA) within Collserola Natural Park, Barcelona. The building employed natural materials and earth from the immediate region, displaying a sustainable building method.

Züblin, which is part of Putzmeister and Strabag, constructed in May 2024 a first-in-the-world load-bearing warehouse with concrete walls with one single 3D print. Stuttgart in Germany hosts the building that also functions as a testing platform for Züblin's pioneering 3D printing.

In March 2024, ICON Technology, Inc. introduced a set of cutting-edge construction technologies, such as a robotic printer used to build multi-story buildings, a digital catalog that contains more than sixty sets of ready-to-construct home designs, a low-carbon material, and an AI Architect to aid in the design. ICON's vision is to automate building, making the process more efficient and sustainable while facilitating the global distribution of affordable housing.

In January 2024, AJAX Engineering launched a 3D concrete printing machine that has easy integration with CAD designs to produce physical structures from digital models.

In October 2023, Tvasta Construction, based in Chennai, completed a 3D-printed building at Thiruvananthapuram as part of its AMAZE-28 demonstration project.

In August 2023, L&T Construction revealed a 3D-printed post office constructed by utilizing COBOD's BOD2 3D construction printer.

In June 2023, XtreeE launched three networked 3D printing units globally in Switzerland, the United States, and Japan. This increases the number of their deployed units to 12, with intentions to reach 50 units by 2025, increasing customized structural component production.

Key Players:

- COBOD International A/S

- D-Shape

- Apis Cor

- WASP S.r.l.

- Contour Crafting Corporation

- CyBe Construction

- ICON Technology, Inc.

- MX3D

- Skanska AB

- Peri Group

Chapter 1. 3D PRINTING CONSTRUCTION MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. 3D PRINTING CONSTRUCTION MARKET– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. 3D PRINTING CONSTRUCTION MARKET– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. 3D PRINTING CONSTRUCTION MARKET- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. 3D PRINTING CONSTRUCTION MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. 3D PRINTING CONSTRUCTION MARKET– By Construction Method

6.1 Introduction/Key Findings

6.2 Extrusion

6.3 Powder Bonding

6.4 Other Methods

6.5 Y-O-Y Growth trend Analysis By Construction Method

6.6 Absolute $ Opportunity Analysis By Construction Method , 2025-2030

Chapter 7. 3D PRINTING CONSTRUCTION MARKET– By Material Type

7.1 Introduction/Key Findings

7.2 Hardware

7.3 Software

7.4 Services

7.5 Y-O-Y Growth trend Analysis By Material Type

7.6 Absolute $ Opportunity Analysis By Material Type , 2025-2030

Chapter 8. 3D PRINTING CONSTRUCTION MARKET– By Construction Type

8.1 Introduction/Key Findings

8.2 Modular

8.3 Full Building

8.4 Y-O-Y Growth trend Analysis Construction Type

8.5 Absolute $ Opportunity Analysis Construction Type , 2025-2030

Chapter 9. 3D PRINTING CONSTRUCTION Market– By End-Use Sector

9.1 Introduction/Key Findings

9.2 Building

9.3 Infrastructure

9.4 Y-O-Y Growth trend Analysis End-Use Sector

9.5 Absolute $ Opportunity Analysis End-Use Sector , 2025-2030

Chapter 10. 3D PRINTING CONSTRUCTION MARKET, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Construction Method

10.1.3. By Construction Type

10.1.4. By Material Type

10.1.5. End-Use Sector

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Construction Method

10.2.3. By Construction Type

10.2.4. By Material Type

10.2.5. End-Use Sector

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Construction Method

10.3.3. By End-Use Sector

10.3.4. By Material Type

10.3.5. Construction Type

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By End-Use Sector

10.4.3. By Material Type

10.4.4. By Construction Method

10.4.5. Construction Type

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Construction Type

10.5.3. By End-Use Sector

10.5.4. By Material Type

10.5.5. Construction Method

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. 3D PRINTING CONSTRUCTION MARKET– Company Profiles – (Overview, Service End-Use Sector Product Construction Method Portfolio, Financials, Strategies & Developments)

11.1 COBOD International A/S

11.2 D-Shape

11.3 Apis Cor

11.4 WASP S.r.l.

11.5 Contour Crafting Corporation

11.6 CyBe Construction

11.7 ICON Technology, Inc.

11.8 MX3D

11.9 Skanska AB

11.10 Peri Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Asia-Pacific, particularly China and India, is experiencing rapid growth due to urbanization and infrastructure development. Europe is also a major hub, with a strong focus on sustainability and innovation. Countries like Denmark and the Netherlands are leading the way with companies such as COBOD International and CyBe Construction.

Challenges include high upfront costs, limited availability of skilled labor, regulatory hurdles, and material constraints. Additionally, the need for standardization and quality assurance in 3D-printed structures poses significant obstacles

3D printing enables rapid construction, reduces material waste, and allows for complex architectural designs. It facilitates the use of sustainable materials and can significantly lower labor costs, making construction more efficient and eco-friendly

The market is projected to grow substantially, with estimates reaching USD 11.4 billion by 2030. Advancements in technology, increasing demand for sustainable housing, and supportive government policies are expected to drive this growth.