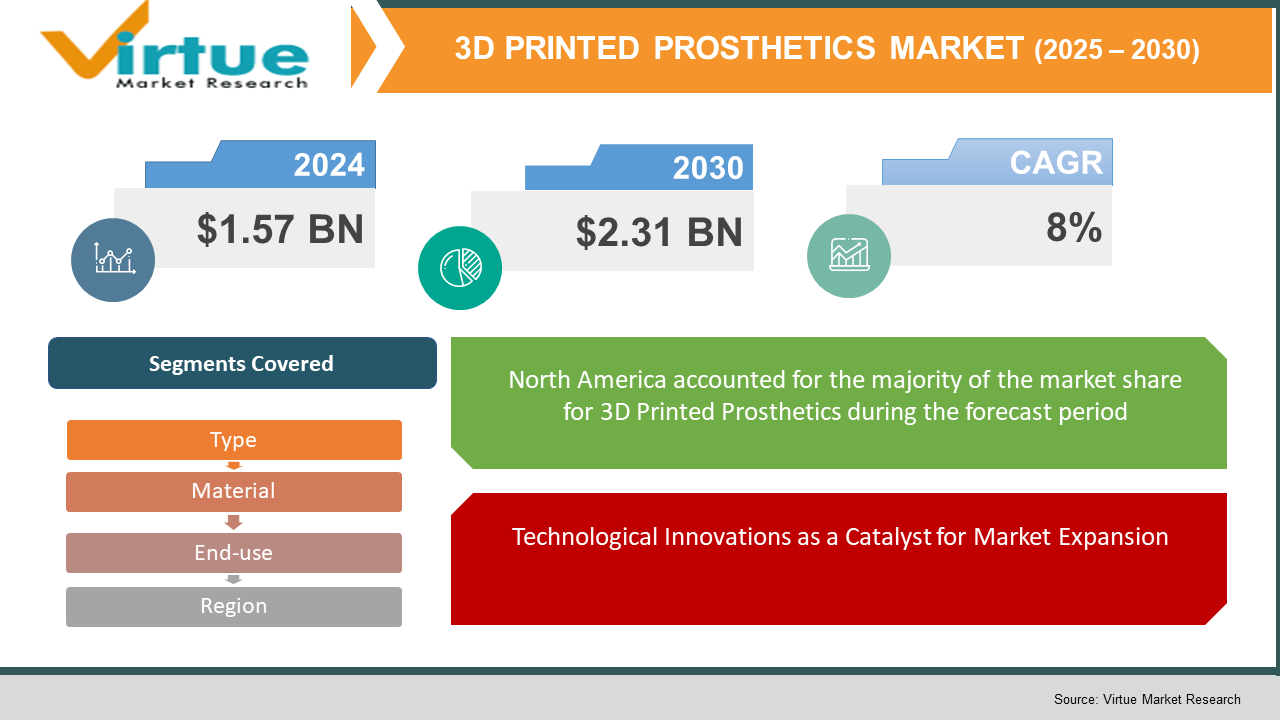

3D Printed Prosthetics Market Size (2025-2030)

The 3D Printed Prosthetics Market was valued at USD 1.57 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 2.31 billion by 2030, growing at a CAGR of 8%.

The market for 3D-printed prosthetics encompasses the segment focused on producing customized prosthetic devices through the use of 3D printing technology. These devices are tailored and fabricated according to the unique requirements and measurements of individual patients, offering a more accurate and personalized alternative to conventional prosthetic solutions.

Key Market Insights:

The 3D-printed prosthetics sector is reshaping the healthcare landscape by offering affordable, customizable, and cutting-edge solutions for individuals in need of artificial limbs and assistive devices. Utilizing additive manufacturing technologies, this market enables the production of prosthetics that are specifically designed to match a patient’s anatomical features, resulting in improved fit, functionality, and overall comfort when compared to traditional alternatives. Progress in both materials and 3D printing methodologies has facilitated the development of prosthetics that are not only lightweight and durable but also visually appealing, all while significantly reducing production costs relative to conventional methods.

A primary factor driving the growth of the 3D-printed prosthetics market is the rising demand for low-cost prosthetic options, especially in developing regions where traditional prosthetics remain inaccessible due to financial and logistical barriers. The adoption of this technology supports rapid prototyping and streamlined manufacturing processes, allowing for faster delivery of prosthetic solutions tailored to individual needs. Furthermore, advancements in 3D scanning and digital modelling have enhanced the design process, enabling healthcare providers and engineers to develop highly personalized prosthetics with greater ease and precision.

3D Printed Prosthetics Market Drivers:

Technological Innovations as a Catalyst for Market Expansion.

A key factor propelling the growth of the 3D-printed prosthetics market is the ongoing advancement of 3D printing technology. What was once considered a novel approach has evolved into a widely accepted manufacturing solution, particularly within the healthcare industry. This technology enables the production of prosthetic limbs that are specifically designed to meet the anatomical and functional needs of individual patients, resulting in enhanced comfort, improved usability, and greater overall user satisfaction.

Additive manufacturing supports the development of complex structures and intricate designs that are often unattainable through conventional production techniques. This capability proves especially advantageous in crafting prosthetic components with ergonomic contours and sophisticated features. Additionally, 3D printing offers a more cost-efficient alternative to traditional manufacturing methods, especially for customized or small-batch production. This affordability is particularly valuable in medical environments where financial limitations may otherwise restrict access to high-quality, personalized prosthetic solutions.

3D Printed Prosthetics Market Restraints and Challenges:

Regulatory Barriers and Compliance Issues as Constraints to Market Development.

The 3D-printed prosthetics market operates within a landscape of intricate regulatory frameworks and stringent compliance requirements, which present notable challenges for industry participants. Adherence to medical device regulations—such as ISO standards, U.S. FDA guidelines, and CE marking in the European Union—demands comprehensive testing, extensive documentation, and thorough validation procedures. Navigating these regulatory pathways and securing the necessary approvals often involves significant time and financial investment.

Entering international markets further compounds these challenges, as companies must address diverse regulatory systems, cultural nuances, and country-specific compliance obligations. While harmonizing global regulatory standards and simplifying market access processes could enhance international expansion, achieving such alignment remains a complex endeavor. As a result, regulatory and compliance demands underscore the need for a strategic focus on regulatory affairs, robust risk management, and consistent quality assurance. Within this environment, fostering collaboration, maintaining transparency, and committing to continuous improvement are essential for sustained success in the 3D-printed prosthetics sector.

3D Printed Prosthetics Market Opportunities:

Technological Progress Unlocks New Opportunities in the Market.

The ability to customize and personalize prosthetic devices through 3D printing technology presents substantial opportunities within the market. This level of customization enables prosthetists to design devices that align precisely with the anatomical, functional, and aesthetic needs of individual patients. Personalized prosthetics offer improved fit, enhanced comfort, and greater functionality, contributing to increased patient satisfaction and a better overall quality of life. Technological advancements in scanning systems, software development, and material innovation have made it possible to digitally model and fabricate prosthetic components with exceptional accuracy, accelerating the adoption of tailored prosthetic solutions.

Moreover, 3D printing facilitates the creation of innovative prosthetic designs that incorporate advanced functionalities not achievable through conventional manufacturing techniques. There is significant potential to develop prosthetic limbs featuring integrated sensors, smart materials, and biomechanical systems that replicate natural limb movement and deliver real-time feedback. These innovations enhance user interaction, encourage active lifestyles, and empower individuals to participate more confidently in daily and recreational activities.

3D PRINTED PROSTHETICS MARKET REPORT COVERAGE:

|

REPORT METRIC A |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8% |

|

Segments Covered |

By Type, material, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3D Systems Corporation, Stratasys Ltd. and EnvisionTEC. |

3D Printed Prosthetics Market Segmentation:

3D Printed Prosthetics Market Segmentation- By Type:

- Limbs

- Sockets

- Joints

- Others

The limbs segment has established itself as the dominant category within the global 3D-printed prosthetics market. This segment is expected to retain its leading position over the forecast period, supported by several critical drivers. These include the rising demand for 3D-printed prosthetic limbs, an increase in traumatic injuries resulting in limb loss, continuous advancements in 3D printing technologies for prosthetic applications, and a growing number of amputation cases globally.

Sockets, which serve as the interface between the prosthetic device and the user’s residual limb, play a vital role in ensuring both comfort and functional effectiveness. The application of 3D printing technology enables precise customization based on individual anatomical specifications, significantly improving user comfort and the overall performance of the prosthetic.

Additionally, prosthetic joints—such as those for knees, elbows, and fingers—benefit extensively from additive manufacturing. This technology supports the fabrication of intricate, articulated components designed to replicate natural joint movement, thereby enhancing mobility and overall quality of life for prosthetic users.

3D Printed Prosthetics Market Segmentation- By Material:

- Polypropylene

- Polyethylene

- Acrylics

- Polyurethane

The polypropylene segment has established itself as the dominant material category in the global 3D-printed prosthetics market. It is projected to witness substantial growth over the forecast period, driven by a combination of critical factors. These include increasing demand for polypropylene in prosthetic production, its cost-efficiency in manufacturing, the material’s inherent durability, heightened investment in research and development, and a growing global preference for polypropylene-based solutions.

Polypropylene offers several key advantages, including its lightweight composition, which contributes to overall prosthetic weight reduction compared to alternative materials. It is also capable of being sterilized without degradation, and it possesses excellent mechanical strength, making it a preferred material for 3D-printed prosthetics. These attributes collectively support the segment’s continued growth and adoption across the industry.

In addition to polypropylene, other materials play significant roles in the market. Polyethylene is widely utilized for its combination of lightweight characteristics and durability, particularly in prosthetic sockets where flexibility and strength are essential. Acrylic materials are increasingly applied in facial prosthetics and cosmetic enhancements due to their customizable aesthetic properties and natural appearance. Polyurethane, noted for its cushioning ability and resilience, is particularly well-suited for load-bearing prosthetic limbs, offering both impact resistance and user comfort.

3D Printed Prosthetics Market Segmentation- By End-use:

- Rehabilitation Centers

- Hospitals

- Prosthetic Clinics

Hospitals have emerged as the leading end-use segment within the global 3D-printed prosthetics market. This dominance can be attributed to several key factors, including a rapid increase in patient admissions, a rising number of accidents necessitating prosthetic solutions, and significant investments in 3D printing research and development initiatives.

The growing adoption of 3D-printed prosthetics by hospitals of all sizes, coupled with the overall expansion of healthcare facilities, particularly in developed regions, has further accelerated the market's growth.

The prosthetic clinics segment is expected to experience remarkable growth over the forecast period. This expansion is primarily driven by the continuous surge in demand for prosthetic devices, the increasing incidence of limb loss, and the growing need for cost-effective prosthetic solutions.

3D Printed Prosthetics Market Segmentation- by region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

North America holds a dominant position in the global 3D-printed prosthetics market, fueled by a strong healthcare infrastructure, widespread adoption of advanced technologies, and substantial investments in research and development. The healthcare systems in the United States and Canada are particularly focused on innovation and accessibility, making 3D printing an ideal solution to meet the increasing demand for customized prosthetic devices. Leading medical institutions and research centers across North America are actively exploring ways to enhance patient care through additive manufacturing, reinforcing the region's leadership in the market.

Emerging trends, such as the integration of smart sensors and Internet of Things (IoT) technology into 3D-printed prosthetics, are further enhancing the functionality and appeal of these devices in North America. These innovations enable real-time monitoring, improved mobility, and greater control over prosthetic limbs, addressing the growing demand for high-tech, adaptive solutions. With continuous innovation and a focus on improving patient outcomes, North America is expected to maintain its dominant position in the 3D-printed prosthetics market, driving ongoing growth.

The Asia Pacific region is projected to experience rapid growth during the forecast period. This growth is primarily driven by increased investments from major industry players in research and development activities within the region. Additionally, the rising number of accidents and the growing middle-income population have led to a heightened demand for affordable and innovative 3D-printed prosthetics. These factors have attracted significant interest from leading medical device companies, encouraging them to expand their operations and presence in the Asia Pacific market.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic significantly disrupted both the manufacturing operations and supply chain logistics related to raw materials used in 3D-printed prosthetics. During the pandemic lockdowns in various countries, supply chains were disrupted, leading to a decline in the sale of 3D-printed prosthetic products. However, following the pandemic, the market experienced a surge in sales as the demand for prosthetics increased, driven by greater consumer awareness of available prosthetic solutions.

In the post-pandemic period, the market saw substantial growth as many manufacturers reported that the importance of 3D printing had notably risen. This shift was due to the ability of 3D printing to produce parts on demand in a shorter time frame, reducing waste and inventory costs, which enhanced operational efficiency and supply chain resilience.

Latest Trends/ Developments:

February 2024: Open Bionics, a robotics company based in the UK, successfully fitted its 3D-printed finger device to a hand amputee in London for the first time. Referred to as the "Hero Gaunt," this advanced prosthetic device incorporates Open Bionics' state-of-the-art 3D scanning and additive manufacturing technologies. Engineered to meet the unique anatomical and functional needs of each individual, the Hero Gaunt empowers users with congenital or acquired partial hand limb differences to restore hand functionality.

June 2023: BASF and UltiMaker partnered with the Victoria Hand Project to supply 3D-printed prosthetic devices in Ukraine, aiming to improve accessibility to affordable and functional prosthetic solutions for individuals affected by limb loss. BASF highlights that its ULtrafuse PLA PRO1 material not only enhances the hand's functionality but is also optimized for quality, speed, strength, and reliability, thereby improving the prosthesis’s overall aesthetic appeal. UltiMaker emphasizes the importance of the user-friendly design of its machines, which is crucial for clinicians who may be new to utilizing this technology.

Key Players:

These are top 10 players in the 3D Printed Prosthetics Market :-

- 3D Systems Corporation

- Stratasys Ltd.

- EnvisionTEC

- YouBionic

- Bionicohand

- LimbForge, Inc.

- Create Prosthetics

- Prodways Group

- Bio3D Technologies

- Mecuris

Chapter 1. 3D Printed Prosthetics Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. 3D Printed Prosthetics Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. 3D Printed Prosthetics Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Packaging TypeScenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. 3D Printed Prosthetics Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. 3D Printed Prosthetics Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. 3D Printed Prosthetics Market – By Type

6.1 Introduction/Key Findings

6.2 Limbs

6.3 Sockets

6.4 Joints

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. 3D Printed Prosthetics Market – By Material

7.1 Introduction/Key Findings

7.2 Polypropylene

7.3 Polyethylene

7.4 Acrylics

7.5 Polyurethane

7.6 Y-O-Y Growth trend Analysis By Material

7.7 Absolute $ Opportunity Analysis By Material , 2025-2030

Chapter 8. 3D Printed Prosthetics Market – By End-use

8.1 Introduction/Key Findings

8.2 Rehabilitation Centers

8.3 Hospitals

8.4 Prosthetic Clinics

8.5 Y-O-Y Growth trend Analysis End-use

8.6 Absolute $ Opportunity Analysis End-use , 2025-2030

Chapter 9. 3D Printed Prosthetics Market , BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Material

9.1.3. By End-use

9.1.4. By Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Material

9.2.3. By End-use

9.2.4. By Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Material

9.3.3. By End-use

9.3.4. By Type

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By End-use

9.4.3. By Material

9.4.4. By Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By End-use

9.5.3. By Material

9.5.4. By Type

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. 3D Printed Prosthetics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 3D Systems Corporation

10.2 Stratasys Ltd.

10.3 EnvisionTEC

10.4 YouBionic

10.5 Bionicohand

10.6 LimbForge, Inc.

10.7 Create Prosthetics

10.8 Prodways Group

10.9 Bio3D Technologies

10.10 Mecuris

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The 3D-printed prosthetics sector is reshaping the healthcare landscape by offering affordable, customizable, and cutting-edge solutions for individuals in need of artificial limbs and assistive devices.

The top players operating in the 3D Printed Prosthetics Market are - 3D Systems Corporation, Stratasys Ltd. and EnvisionTEC.

The COVID-19 pandemic significantly disrupted both the manufacturing operations and supply chain logistics related to raw materials used in 3D-printed prosthetics.

February 2024: Open Bionics, a robotics company based in the UK, successfully fitted its 3D-printed finger device to a hand amputee in London for the first time.

. The Asia-Pacific is the fastest-growing region in the 3D Printed Prosthetics Market.