240Hz Monitor Market Size (2024-2030)

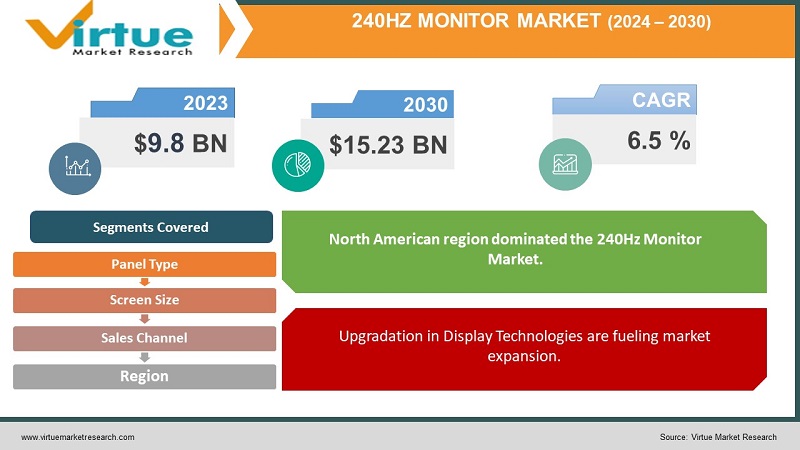

The 240Hz Monitor Market was valued at USD 9.8 billion in 2023 and is projected to reach a market size of USD 15.23 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.5%.

The global sports monitoring market is a booming segment within the broader sports industry. As gaming enthusiasts around the world are looking for more and more attractive and responsive displays, this market has seen great growth and innovation. Gaming monitors are designed to deliver a unique viewing experience, reducing load times and improving image quality. Many factors contribute to the growth of this market. High refresh rate: Gamers are familiar with the refresh rate, usually 144 Hz, 240 Hz or even 360 Hz. These refresh rates reduce motion blur and make games run smoother, meeting the needs of competitive players.

Key Market Insights:

The 240Hz monitor market is like a beautiful sports car tearing up the screen, fueled by a strong cocktail of gamers' desires and technological advancements. Competitive gamers and content creators demand a smooth, responsive experience, and the 240Hz frequency banishes lag and blur into oblivion. Imagine a buttery movie so sweet it's like the world of the game melts into your fingers.

But it's not just about speed. The technology experts weave their magic by creating new TN and IPS panels with fast flash response times, ensuring that even the most frenetic events remain sharp. Let's not forget the visual pleasure: the combination of HDR makes the movie more intense and dynamic, making every pixel stand out. This technological playground is not cheap, however. Think high-end graphics cards and prices that can make your wallet win. But trust us, for celebrities and content creators looking for the best, it's worth every penny. And the future? Buckle up, because 240 Hz is just the beginning. Think of a niche market like esports and simulation, where every center is profitable, and you have a blueprint for continued growth.

240Hz Monitor Market Drivers:

There has been a rise in the popularity of competitive gaming.

The explosive growth of eSports and competitive gaming has been a major driver of viewership eSports has grown from a niche competition to a global event with millions of participants and spectators. Professional gamers, as well as enthusiasts, need high-performance equipment, and gaming monitors are an important part of that setup.

These players are looking for features like fast refresh rates, low input lag, and high resolution to gain a competitive advantage. As eSports continues to gain recognition and investment, the demand for gaming monitors with advanced features will remain robust.

Upgradation in Display Technologies are fueling market expansion.

The sports monitoring market is growing due to rapid advancements in display technology. Recent innovations in panel technology, such as in-plane switching (IPS), organic light-emitting diodes (OLED), and small LEDs, have resulted in displays with higher resolutions, faster refresh rates, and more accurate colors. These technological advancements result in a visually appealing gaming experience.

High refresh rates (such as 144Hz, 240Hz and even 360Hz) are now standard on most gaming monitors, providing smoother and more responsive gaming. Getting 4K and even 8K resolution gives players a better and more detailed image. High dynamic range (HDR) technology improves contrast and color gamut, making games more realistic. As display technology continues to advance, gamers are encouraged to upgrade their monitors to take advantage of the latest gaming titles and hardware.

240Hz Monitor Market Restraints and Challenges:

The gaming monitor market is highly competitive, with many manufacturers competing for market share. This competition has led to a price war, as companies try to attract cheaper players. While this benefits consumers in the short term by providing them with cheaper options, it poses challenges for manufacturers, especially smaller ones. To maintain profitability. As prices continue to fall, it becomes important for businesses to differentiate themselves through innovation and unique features. In order to overcome this challenge, the producers have to adjust the amount of money and premium features, understanding that the players have different budgets and interests.

Gaming monitor technology is rapidly changing, with improvements in display quality, refresh rates and response times. While these advancements are exciting for players, they pose challenges for developers. Keeping up with the latest technology trends requires significant investment in R&D. Staying competitive means repeatedly developing new models to incorporate these technologies, which can disrupt a company's production and distribution capabilities. Manufacturers must focus on product planning and long-term research to anticipate and adapt to emerging technologies. They can also explore collaborations with technology providers to gain faster access and maintain a competitive advantage.

240Hz Monitor Market Opportunities:

The 240Hz monitor market is a playground, filling the space for every gamer. For producers, it is a race to innovate, pushing the rate of innovation even faster and creating niche markets with unique characteristics. Retailers can increase sales by targeting esports and offering adrenaline-pumping in-store displays. Content creators? Get on the fashion train! Previews, tutorials, and sponsored deals await, all backed up by seamless smoothness that leaves viewers breathless. As technology advances, this market has promising potential, promising a future where every image screams short and sweet. So, hold on tight, grab your fans, and get ready to experience the game in a whole new way.

240Hz MONITOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Panel Type, screen size, sales channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Samsung Electronics Co., Ltd., LG Electronics, Dell Inc., ASUSTeK Computer Inc., GIGA-BYTE Technology Co., Ltd., AOC Global, Acer Inc., Micro-Star INT'L CO., LTD., CORSAIR, BenQ Corporation |

240Hz Monitor Market Segmentation:

240Hz Monitor Market Segmentation: By Panel Type

- IPS Panel

- TN Panel

- VA Panel

In 2023, based on the panel type, the TN Panel segment accounted for the largest revenue share. Twisted Nematic (TN) panel technology has become a prominent player in the global 240Hz monitor market, driving both its growth and impact. TN panels are known for their fast response times, making them ideal for high refresh rate displays such as 240Hz monitors. The growing demand for an immersive gaming experience and the rise of competitive gaming have fueled the adoption of this high refresh rate, as TN panels excel in producing beautiful and responsive images. Additionally, TN panels are relatively inexpensive compared to other display technologies, contributing to their widespread adoption. However, the impact on the global 240 Hz monitor market is not without its challenges. Although TN panels offer fast response times, they often compromise color accuracy and viewing angles. As consumer preferences shift toward better image quality, this trade-off may affect market dynamics. Nevertheless, TN panels continue to play an important role in changing the competitive landscape of the 240Hz monitor market, with their performance and ability to carry both demand and innovation.

IPS panel are the fastest growing segment. In high-end displays, In-Plane Switching (IPS) panels have become an important factor shaping the global 240Hz monitor market. IPS panels are also known for their high color reproduction and wide viewing angle, meeting the limits of TN (Twisted). Nematic) panel. The demand for immersive gaming and content creation experiences, where color accuracy is critical, has contributed greatly to the growing adoption of IPS technology in 240Hz monitors. While discerning customers are increasingly appreciative of not only the bright refresh rate, but also the stunning and realistic display offered by the IPS panel. This change in interest is in line with the changing needs of users looking for a balance between speed and image quality. As a result, IPS panels have played a revolutionary role in influencing the dynamics of the 240Hz monitor market, contributing to their importance in a landscape that requires both performance and visual fidelity.

240Hz Monitor Market Segmentation: By Screen Size

- Less than 27 Inch

- 27-32 Inch

- More Than 32 Inch

27-32-inch screen size is the leading segment. The 27–32-inch screen size category has been the source and evolution of the global 240Hz monitor market, with significant growth affecting consumer choice. One of the main factors driving the increase in monitors of this size is the desire for a more engaging viewing experience, especially in sports and content consumption. The large screen area provides the best balance, giving users an expanded display without compromising their work space. As content creators and gamers increasingly prefer larger screens for better visibility and productivity, the 27–32-inch screen has seen a resurgence in popularity. This trend is in line with the demand for 240Hz monitors, where the large screen supports advanced refresh technology, providing a smooth and responsive vision. Therefore, the screen size of 27 to 32 inches has not only defined user expectations but also played an important role in the evolution of the global 240 Hz monitor market.

The sub-27-inch display category has been a significant driver in the evolution of the global 240Hz monitor market. As technological advances continue to improve display capabilities, compact monitors are growing in popularity due to their space-saving nature. This trend is influenced by the growing demand for a richer gaming experience and the rise of compact industrial designs. Consumers are increasingly appreciative of innovative high-end monitors that provide a smooth and responsive viewing experience. The impact on the 240Hz monitor market is critical as manufacturers struggle to meet a wide range of consumer preferences. The compact model not only fits into modern lifestyle choices, but also supports professional applications where space optimization is critical. Therefore, the sub-27-inch screen type plays an important role in market changes, reflecting the needs and preferences of many users.

240Hz Monitor Market Segmentation: By Sales Channel

- Online Stores

- Offline Stores

The global 240Hz monitor market is experiencing a change due to the rise of online retailers. The increasing popularity of e-commerce platforms has been a key driver of change in the market, reshaping the way consumer’s access and purchase high-quality products. Online retailers offer quality and great deals, offering a wide variety of 240Hz monitors to a global audience. The effect is evident in the increase of these monitors, giving consumers the opportunity to choose information from detailed product descriptions and user reviews. Competitive prices and exclusive deals often found online drive market growth, attracting a wide range of consumers. In addition, the ease of comparison shopping and the convenience of home delivery contribute to the growing interest for online channels. As a result, online retailers have helped expand the global 240Hz monitor market, providing a convenient and consumer-friendly option for enthusiasts and consumers.

Offline retailers continue to play an important role in the global 240Hz monitor market, despite the growing importance of online channels. The intuitive experience and human advice provided by physical stores are still important factors influencing customer choice. Consumers often want to be exposed directly to the display technology, such as color beauty and smooth motion, which are key features for 240Hz monitors. Also, offline retail spaces promote personalized interactions that help consumers make informed decisions based on their needs. As online business grows, especially for convenience, the impact of offline retailers on the 240Hz monitor market remains constant. Their presence contributes to brand visibility, customer confidence and faster purchase options. As the market develops, the relationship between online and offline businesses can continue, giving consumers more opportunities to explore and invest in advanced display technology.

240Hz Monitor Market Segmentation: Regional Analysis

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In 2023, the North American region dominated the 240Hz Monitor Market. North America is at the forefront of influencing the global 240 Hz monitor market with a growing mix of factors. The local tech market, driven by the strong gaming community's strong demand for high-end technology, is one of the reasons for the rise in adoption of 240Hz monitors. The changing work-from-home culture, along with the growing interest in e-sports and competitive gaming, has led to a demand for renewable energy rate analysts in the region. In addition, continuous innovations and product launches from major players in North America are contributing significantly to market growth, introducing advanced features and technologies. Although the region is still the source of technological advancements and early adopters of the technology, its impact on the global 240Hz monitor market is very visible, setting trends and shaping interests affecting the international market. . The growth of the North American market and its preference for display technology continues to make it a key player in the changing global 240Hz climate. However, the Asia-Pacific region is anticipated to grow at the fastest CAGR of about 15.87% during the forecast period. Asian countries are seen as the top choice for 240Hz Monitor Market and travel owing to the low cost of treatments. India is considered to be the world’s tenth most popular tourist place for 240Hz Monitor Market, as per the 240Hz Monitor Market Index. As a result, it is boosting the growth of the market in the Asia-Pacific region. Thailand is one of the most prevalent destinations for 240Hz Monitor Market. Its popularity is augmenting its market growth. Thailand currently has almost 400 private hospitals, a number that is likely to rise substantially in the forthcoming years.

COVID-19 Impact Analysis on the 240Hz Monitor Market:

The COVID-19 pandemic has left an undeniable mark on various industries, including the electronics and technology sectors, affecting the 240 Hz monitor market in many ways. The sudden shift to remote work and the reliance on digital platforms for entertainment during lockdown has fueled the rise for high-end monitors, including those with 240Hz refresh rates. As the home office expands, professionals are looking for better, more immersive displays for work and play.

However, the pandemic has also disrupted supply chains, leading to production delays and shortages of some electronics. These challenges have affected the availability of 240 Hz monitors in the market and, in some cases, led to price changes.

On the consumer side, economic uncertainty has spurred positive investment, affecting purchasing decisions. Even if demand for renewable energy rate monitors is still strong, some consumers may postpone unnecessary purchases, affecting overall market growth.

Despite the challenges, the 240Hz monitor market has shown resilience, recognizing the need for high-quality displays for professional and entertainment purposes. As the global situation develops, the market is expected to change, incorporating lessons learned during the pandemic into future plans.

Latest Trends/ Developments:

Rise of Gaming Monitors: The demand for refresh rate monitors, including 240Hz monitors, is fueled by the growing popularity of competitive gaming. Gamers are looking for glasses with fast refresh rates for smooth and responsive gaming. Technological Advancement: Manufacturers have focused on improving panel technology, such as IPS (In-Plane Switching) and TN (Twisted Nematic), to strike a balance between fast response time and high color reproduction. Innovations to reduce mobility issues and entry barriers are also common. Adoption of Ada Sync Technology: The integration of technologies such as NVIDIA G-Sync and AMD FreeSync to reduce screen tearing and stuttering during games is popular. These technologies synchronize the monitor's refresh rate with the graphics card's output for a smoother gaming experience. Increasing screen resolution: Although a high refresh rate is important, there is also a trend towards higher screen resolutions, such as QHD (2560 x 1440) and 4K (3840 x 2160), to provide sharper, more detailed images.

Key Players:

- Samsung Electronics Co., Ltd.

- LG Electronics

- Dell Inc.

- ASUSTeK Computer Inc.

- GIGA-BYTE Technology Co., Ltd.

- AOC Global

- Acer Inc.

- Micro-Star INT'L CO., LTD.

- CORSAIR

- BenQ Corporation

- On February 14, 2023, Samsung launched the Odyssey Gaming monitor for Indian customers. Samsung says the new gaming monitors aim to offer faster refresh rates, better gaming experience and display, and increased pixel density, all in a compact aluminum form factor. The Odyssey OLED G8, Odyssey G7, and G7 Neo are the latest additions to the Odyssey Monitor lineup. These gaming monitors have features like Neo Quantum processor, HDR True black 400, smart entertainment, and AMD FreeSync Premium Pro.

- On January 7, 2023, Sony released the Sony Inzone M3 Sports Display. The monitor is a cheaper version of the Inzone M9, released a few months ago. While the previous gaming monitor cost $900, the new Sony Inzone M3 costs $529. It has a full HD resolution rather than the 4K resolution of the Sony Inzone M9. The new Sony Inzone M3 has a 27-inch screen with up to 400 nits of brightness. The Sony Inzone M3 has a 16:9 aspect ratio, 1000:1 contrast ratio, 99% sRGB color gamut coverage, and 1.07 billion color options.

Chapter 1. GLOBAL 240HZ MONITOR MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL 240HZ MONITOR MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL 240HZ MONITOR MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL 240HZ MONITOR MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL 240HZ MONITOR MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL 240HZ MONITOR MARKET– BY PANEL TYPE

6.1. Introduction/Key Findings

6.2. IPS Panel

6.3. TN Panel

6.4. VA Panel

6.5. Y-O-Y Growth trend Analysis By Panel Type

6.6. Absolute $ Opportunity Analysis By Panel Type , 2024-2030

Chapter 7. GLOBAL 240HZ MONITOR MARKET– BY SCREEN SIZE

7.1. Introduction/Key Findings

7.3. 27-32 Inch

7.4. More Than 32 Inch

7.5. Y-O-Y Growth trend Analysis By SCREEN SIZE

7.6. Absolute $ Opportunity Analysis By SCREEN SIZE , 2024-2030

Chapter 8. GLOBAL 240HZ MONITOR MARKET– BY SALES CHANNEL

8.1. Introduction/Key Findings

8.2 Online Stores

8.3. Offline Stores

8.4. Y-O-Y Growth trend Analysis Sales Channel

8.5. Absolute $ Opportunity Analysis Sales Channel , 2024-2030

Chapter 9. GLOBAL 240HZ MONITOR MARKET, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By SCREEN SIZE

9.1.3. By Panel Type

9.1.4. By Sales Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By SCREEN SIZE

9.2.3. By Panel Type

9.2.4. By Sales Channel

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By SCREEN SIZE

9.3.3. By Panel Type

9.3.4. By Sales Channel

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By SCREEN SIZE

9.4.3. By Panel Type

9.4.4. By Sales Channel

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By SCREEN SIZE

9.5.3. By Panel Type

9.5.4. By Sales Channel

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL 240HZ MONITOR MARKET– COMPANY PROFILES – (OVERVIEW, PRODUCT PORTFOLIO, FINANCIALS, STRATEGIES & DEVELOPMENTS)

10.1 Samsung Electronics Co., Ltd.

10.2. LG Electronics

10.3. Dell Inc.

10.4. ASUSTeK Computer Inc.

10.5. GIGA-BYTE Technology Co., Ltd.

10.6. AOC Global

10.7. Acer Inc.

10.8. Micro-Star INT'L CO., LTD.

10.9. CORSAIR

10.10. BenQ Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The 240Hz Monitor Market was valued at USD 9.8 billion in 2023 and is projected to reach a market size of USD 15.23 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.5%.

Rise of Gaming Monitors, increase in esports and games, advancements in technology.

Based on Screen Size, the 240Hz Monitor Market is segmented into Less than 27-inch, 27-32 inch, more than 32 inch

North America is the most dominant region for the 240Hz Monitor Market.

Alienware 27 Gaming Monitor (AW2723DF), Dell S2522HG, Acer Predator XB323U, Samsung Odyssey G7 (32-inch), Samsung Odyssey Neo G8, Samsung Odyssey Neo G9, Acer XB253Q GWbmiiprzx, Asus ROG Swift PG259QN are the key players operating in the 240Hz Monitor Market.