2-Decanol Market Size (2024-2030)

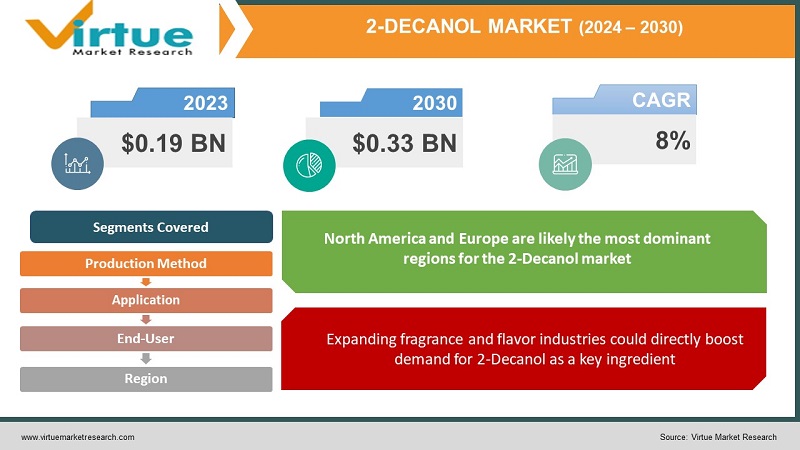

The 2-Decanol Market was valued at USD 0.19 billion in 2023 and is projected to reach a market size of USD 0.33 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 8%.

2-Decanol is a niche fatty alcohol, meaning it's produced in smaller quantities than some of its more common counterparts. While there isn't a dedicated market for 2-Decanol, it likely finds its place within the broader fatty alcohol or even decanol market research. This colorless liquid has a mild fatty alcohol odor and sees applications in various industries including fragrance and flavoring, pharmaceuticals, and even as a plasticizer or lubricant.

Key Market Insights:

2-Decanol, a type of fatty alcohol, occupies a niche space in the chemical market. Unlike its more common counterparts, 2-Decanol is produced in smaller quantities.

Despite its niche status, 2-Decanol finds applications in various industries. This colorless liquid with a mild fatty alcohol odor is used in fragrance and flavoring agents, pharmaceuticals, and even as a plasticizer or lubricant. Its versatility across diverse sectors hints at the potential for future growth within the specialty chemicals market. If you're interested in learning more about 2-Decanol's specific market dynamics, consider exploring research on the broader fatty alcohol or decanol market, or contacting chemical suppliers and relevant industry associations for further insights.

The 2-Decanol Market Drivers:

Expanding fragrance and flavor industries could directly boost demand for 2-Decanol as a key ingredient.

The fragrance and flavor industries are major consumers of 2-Decanol due to its unique properties. These industries are expected to experience steady growth driven by factors like increasing disposable income, rising demand for premium personal care products, and a growing global population. If this growth trajectory continues, it could directly translate into a corresponding rise in demand for 2-Decanol as a key ingredient.

Consumer preference for eco-friendly options creates an opportunity for 2-Decanol as a potential sustainable alternative.

Consumers are increasingly prioritizing natural and eco-friendly ingredients in the products they purchase. This trend presents an opportunity for 2-Decanol if it can be effectively positioned as a viable sustainable alternative within specific applications. Manufacturers in the fragrance, flavor, and pharmaceutical industries could potentially switch to 2-Decanol if it aligns with their sustainability goals and meets consumer preferences.

The development of bio-based production methods could make 2-Decanol a more attractive and sustainable choice.

Traditionally, fatty alcohols like 2-Decanol have been produced from petroleum-derived sources. However, advancements in bio-based production methods using renewable feedstocks like plant oils are gaining traction. This shift towards bio-based production could make 2-Decanol a more attractive option for manufacturers seeking sustainable solutions. As bio-based production becomes more cost-effective and widely adopted, it could lead to increased production volumes and wider adoption of 2-Decanol.

2-Decanol's safety and environmental profile could lead to increased demand if it meets or exceeds stricter regulations.

Regulatory bodies are constantly reviewing and updating regulations governing the safety and environmental impact of chemicals. If 2-Decanol demonstrates a safety profile or environmental footprint that meets or exceeds evolving regulations compared to substitutes, it could experience increased demand. This could be particularly relevant if stricter regulations are imposed on currently used alternatives, forcing manufacturers to seek safer or more environmentally friendly options.

The 2-Decanol Market Restraints and Challenges:

While there are potential drivers for the 2-Decanol market, its niche status presents significant challenges. Limited production capacity compared to more common fatty alcohols restricts its availability and adoption. Established alternatives in various applications pose a threat, as they might benefit from economies of scale, lower costs, and wider industry acceptance. Price sensitivity is another hurdle. If 2-Decanol remains expensive to produce or lacks a significant cost advantage over alternatives, manufacturers might be reluctant to switch. Additionally, lower market awareness compared to other fatty alcohols could hinder potential users from considering it as an option.

Beyond these core challenges, further research and development are needed to explore new applications or optimize production processes for better cost-effectiveness. Finally, evolving regulations could create uncertainty if 2-Decanol needs to meet stricter safety or environmental standards compared to existing alternatives. Addressing these restraints will be crucial for 2-Decanol to carve out a more prominent space within the specialty chemicals market.

The 2-Decanol Market Opportunities:

While the niche nature of 2-Decanol presents challenges, it also offers exciting opportunities. The growing demand for sustainable ingredients creates a chance to position 2-Decanol as an eco-friendly alternative in fragrances, Flavors, and pharmaceuticals. Developing bio-based production methods can further solidify its sustainability credentials. Beyond current applications, there's potential for discovering entirely new uses in various industries. Research and development efforts focused on its unique properties could lead to breakthroughs and market expansion. Additionally, 2-Decanol might possess performance advantages over existing alternatives. Highlighting these benefits through targeted marketing and technical data could attract new users. Collaboration with manufacturers in relevant industries could open doors for wider adoption. Partnerships could involve jointly developing new applications or exploring more efficient production methods. Finally, staying ahead of evolving regulations and ensuring 2-Decanol meets or exceeds safety and environmental standards could position it favourably as a compliant and responsible alternative. By capitalizing on these opportunities and addressing existing challenges, 2-Decanol has the potential to carve out a more prominent niche within the specialty chemicals market, becoming an attractive option for manufacturers seeking innovative and sustainable solutions.

2-DECANOL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8 % |

|

Segments Covered |

By Production method, application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF, Kao Corporation, Wilmar International, Kuala Lumpur Kepong, Sasol, Emery Oleochemicals, Royal Dutch Shell, ExxonMobil |

The 2-Decanol Market Segmentation:

The 2-Decanol Market Segmentation: By Production Method:

- Conventional (Petroleum-derived)

- Bio-based

Currently, the conventional (petroleum-derived) production method is likely the most dominant segment due to established infrastructure and lower production costs. However, the bio-based segment has the potential to be the fastest-growing segment if advancements in bio-based production methods make it more cost-competitive and environmentally friendly.

The 2-Decanol Market Segmentation: By Application:

- Base note

- Modifier

- Carrier

Due to limited data on 2-Decanol, definitive dominance is difficult to pinpoint. However, fragrances & Flavors are likely the most prominent application sector based on 2-Decanol's properties. The fastest-growing segment is potentially unexplored applications. While current uses are known, there's potential for discovering entirely new applications in various industries. This segment could see significant growth if R&D efforts are successful.

The 2-Decanol Market Segmentation: By End-User:

- Fragrance and Flavourings

- Pharmaceuticals

- Plasticizers and Lubricants

- Other Industries

Among End-User sectors, Fragrances and Flavors likely represent the most dominant segment for 2-Decanol due to its applications as a fragrance component or flavouring agent. The fastest-growing segment is uncertain due to limited data on 2-Decanol. However, the pharmaceuticals sector has the potential for high growth, especially if 2-Decanol proves valuable in drug development or manufacturing.

The 2-Decanol Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

North America has a well-developed fragrance and flavour industry, which could be a significant driver for 2-Decanol consumption. Additionally, a growing focus on sustainable ingredients might create opportunities if bio-based production methods become established. Stringent regulatory environments could also play a role, potentially favouring 2-Decanol if it meets or exceeds safety and environmental standards compared to alternatives.

COVID-19 Impact Analysis on the 2-Decanol Market:

Due to the niche nature of the 2-Decanol market, definitively assessing the impact of COVID-19 on its overall performance is challenging. However, by examining the potential effects on its major end-use industries, we can make some educated guesses.

On the one hand, the pandemic might have negatively impacted the 2-Decanol market. Global lockdowns and travel restrictions could have disrupted supply chains, leading to temporary shortages or price fluctuations for 2-Decanol itself or the raw materials needed for its production. Additionally, the fragrance and flavor industries, which are significant consumers of 2-Decanol, might have experienced a decline in demand during lockdowns. As people stayed home and curtailed discretionary spending, the demand for products containing fragrances and flavors – and consequently, the demand for 2-Decanol – could have fallen.

However, there could also be some positive aspects to consider. The pandemic's emphasis on hygiene might have led to a temporary rise in demand for 2-Decanol if it's used in certain pharmaceutical applications like hand sanitizers or disinfectants. Additionally, the significant growth of e-commerce during the pandemic could have benefited online sales of products containing 2-Decanol, such as fragrances or flavors.

Latest Trends/ Developments:

Despite the limited data specifically on 2-Decanol, the broader fatty alcohol and decanol markets offer intriguing insights into potential future developments. A major trend is the growing emphasis on sustainability, driving the development of bio-based production methods for various chemicals. This could be a game-changer for 2-Decanol. If bio-based production becomes more cost-effective and widely adopted, it could transform 2-Decanol into a much more attractive option for manufacturers seeking eco-friendly solutions. Furthermore, research and development efforts within the decanol market are uncovering new applications for various decanol types, including potentially 2-Decanol. These advancements could lead to entirely new uses for 2-Decanol in different industries, significantly expanding its market reach beyond its traditional applications.

Staying informed about the evolving regulatory landscape is also crucial. Regulatory bodies are constantly updating regulations governing the safety and environmental impact of chemicals. If 2-Decanol demonstrates a safety profile or environmental footprint that meets or exceeds stricter standards compared to substitutes, it could experience a surge in demand due to its safer or more environmentally friendly characteristics. Additionally, there's a growing trend in various industries to seek high-performance alternatives to existing materials. If 2-Decanol possesses unique performance properties that make it superior for specific applications compared to current options, highlighting these advantages through targeted marketing and technical data could attract a new wave of users and drive significant market growth. Finally, strategic partnerships between manufacturers of 2-Decanol and companies in the fragrance, flavor, or pharmaceutical industries could be a key development. These collaborations could involve jointly developing new applications for 2-Decanol or exploring more efficient and sustainable production methods. By capitalizing on these broader trends and developments in the decanol market, companies involved with 2-Decanol can position themselves to identify and leverage potential opportunities, ultimately propelling 2-Decanol's growth trajectory within the specialty chemicals landscape.

Key Players:

- BASF

- Kao Corporation

- Wilmar International

- Kuala Lumpur Kepong

- Sasol

- Emery Oleochemicals

- Royal Dutch Shell

- ExxonMobil

Chapter 1. GLOBAL 2-DECANOL MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL 2-DECANOL MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL 2-DECANOL MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL 2-DECANOL MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL 2-DECANOL MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL 2-DECANOL MARKET– BY PRODUCTION METHOD

6.1. Introduction/Key Findings

6.2. Conventional (Petroleum-derived)

6.3. Bio-based

6.4. Y-O-Y Growth trend Analysis By Production Method

6.5. Absolute $ Opportunity Analysis By Production Method , 2024-2030

Chapter 7. GLOBAL 2-DECANOL MARKET– BY APPLICATION

7.1. Introduction/Key Findings

7.2. Base note

7.3. Modifier

7.4. Carrier

7.5. Y-O-Y Growth trend Analysis By APPLICATION

7.6. Absolute $ Opportunity Analysis By APPLICATION , 2024-2030

Chapter 8. GLOBAL 2-DECANOL MARKET– BY End-Use

8.1. Introduction/Key Findings

8.2. Fragrance and Flavourings

8.3. Pharmaceuticals

8.4. Plasticizers and Lubricants

8.5. Other Industries

8.6. Y-O-Y Growth trend Analysis End-Use

8.7. Absolute $ Opportunity Analysis End-Use , 2024-2030

Chapter 9. GLOBAL 2-DECANOL MARKET, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Application

9.1.3. By Production Method

9.1.4. By End-Use

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By APPLICATION

9.2.3. By End-Use

9.2.4. By Production Method

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By APPLICATION

9.3.3. By Production Method

9.3.4. By End-Use

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By APPLICATION

9.4.3. By Production Method

9.4.4. By End-Use

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By APPLICATION

9.5.3. By Production Method

9.5.4. By End-Use

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL 2-DECANOL MARKET– COMPANY PROFILES – (OVERVIEW, PRODUCT PORTFOLIO, FINANCIALS, STRATEGIES & DEVELOPMENTS)

10.1 BASF

10.2. Kao Corporation

10.3. Wilmar International

10.4. Kuala Lumpur Kepong

10.5. Sasol

10.6. Emery Oleochemicals

10.7. Royal Dutch Shell

10.8. ExxonMobil

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The 2-Decanol Market was valued at USD 0.19 billion in 2023 and is projected to reach a market size of USD 0.33 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 8%.

Growth in Fragrance & Flavor Industries, Shift Towards Sustainable Ingredients, Advancements in Bio-based Production, Evolving Regulatory Landscape

Base note, Modifier, Carrier.

North America and Europe are likely the most dominant regions for the 2-Decanol market.

BASF, Kao Corporation, Wilmar International, Kuala Lumpur Kepong, Sasol, Emery Oleochemicals, Royal Dutch Shell, ExxonMobil.