1,4-Dihydroxybenzene Market Size (2024 – 2030)

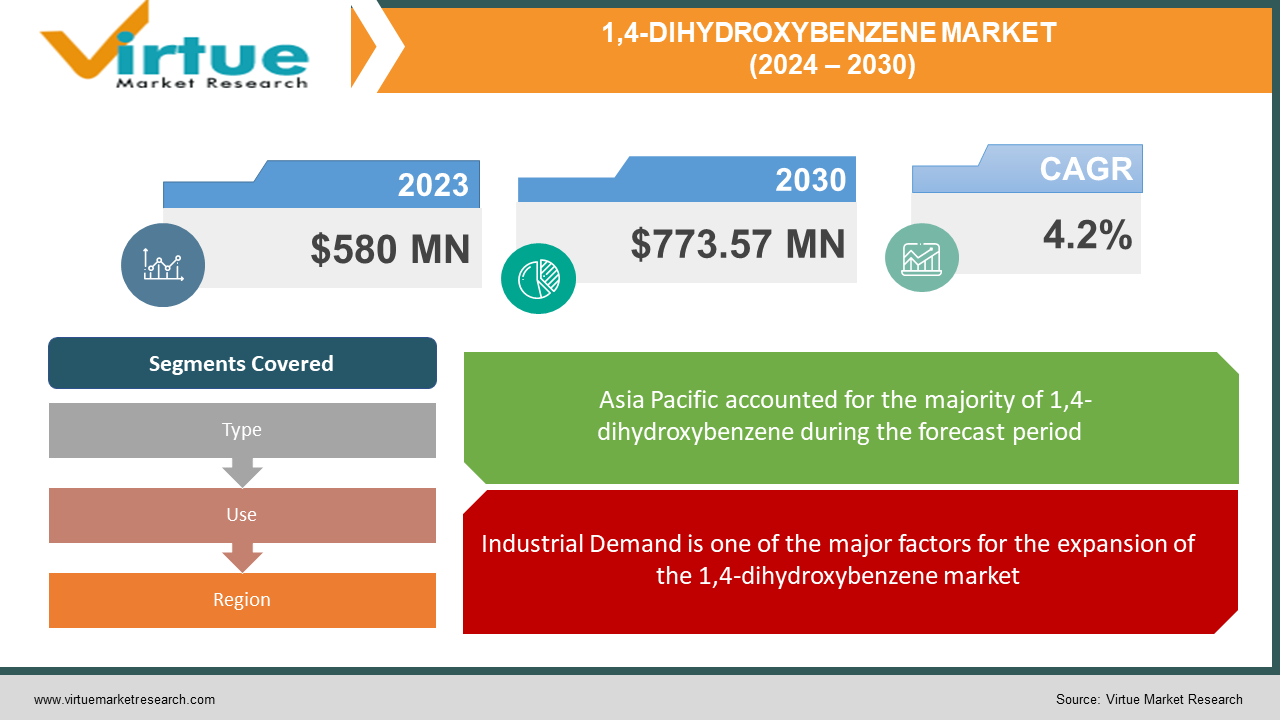

The global 1,4-dihydroxybenzene market was valued at approximately USD 580 million in 2023 and is projected to reach USD 773.57 million by 2030, growing at a CAGR of 4.2% during the forecast period of 2024-2030.

1,4-Dihydroxybenzene, also known as hydroquinone, this versatile compound fuels a global market exceeding half a billion dollars, and it's only growing. Its secret lies in its diverse applications: think rubber tires made supple by its antioxidant magic, photographic memories preserved with its developing touch, and even skin lightening creams benefitting from its brightening power. From agrochemicals protecting crops to electronics lighting up our lives, hydroquinone plays a silent but crucial role in countless industries. Asia Pacific leads the charge, but Europe and North America are close behind, and emerging regions are catching up fast. While a few major players dominate the market, bio-based alternatives are sprouting, driven by sustainability concerns. So, whether you're snapping a photo, driving on resilient tires, or simply enjoying a clearer complexion, remember, hydroquinone is quietly making your world a little better, one versatile molecule at a time.

Key Market Insights:

The Asia Pacific reigns supreme, holding over 50% of the market share. China and India led the charge, fuelled by rapid industrialization and booming demand. Europe and North America follow closely, with established chemical and pharmaceutical giants. Watch out for Latin America and the Middle East & Africa – their economies are expanding, and their demand for consumer goods (often containing hydroquinone) is rising fast. Hydroquinone's diverse applications are the key to success. It acts as an antioxidant in rubber, a developer in photography, a skin lightening agent in cosmetics, and even plays a role in agrochemicals, electronics, and pharmaceuticals. This versatility ensures its presence across various industries, driving market growth. The outlook is bright! Rising demand from emerging economies, increasing awareness of hydroquinone's applications, and a focus on sustainable alternatives are all set to propel the market forward. However, environmental regulations and fluctuating raw material prices could pose challenges.

1,4-dihydroxybenzene market Drivers:

Industrial Demand is one of the major factors for the expansion of the 1,4-dihydroxybenzene market

Hydroquinone shines as an antioxidant and polymerization inhibitor, ensuring the longevity and flexibility of rubber tires, hoses, and other products. With the global rubber market booming, hydroquinone's demand in this sector is also booming. Hydroquinone finds application in skin lightening creams and other pharmaceutical products. The Asia Pacific region, led by China and India, accounts for over 50% of the market share. Rapid industrialization and growing populations in these regions are fueling the demand for hydroquinone across various industries. With a projected CAGR of 12%, Latin America represents a promising market thanks to rising disposable incomes and increasing awareness of hydroquinone's benefits.

Innovation also ignited the market of 1,4-dihydroxybenzene

Environmental concerns are driving the development of bio-based alternatives to hydroquinone, a trend expected to gain traction in the coming years. Hydroquinone finds use in printed circuit boards and electronic displays as well.

1,4-dihydroxybenzene market challenges and restraints

Increasing awareness about the environment, resulting in regulation hindering the market

Hydroquinone is classified as a hazardous material by various regulatory bodies due to its potential health and environmental risks. Stringent regulations, particularly in developed regions, can increase production costs and limit market expansion. Improper disposal of hydroquinone waste poses environmental hazards, prompting stricter regulations and raising disposal costs for manufacturers.

Fluctuating Raw Material Prices impose restraint on the production of 1,4-dihydroxybenzene

The market for key raw materials used in hydroquinone production, such as benzene and phenol, is prone to fluctuations. This volatility can lead to unpredictable production costs and impact profit margins for manufacturers. Geopolitical events and economic instability can disrupt supply chains for raw materials, further exacerbating price fluctuations and hindering production stability.

Technological Advancements impacting 1,4-dihydroxybenzene overall market demand.

Advancements in photography and printing technologies could potentially reduce the reliance on hydroquinone in this sector. The development of new applications for hydroquinone and advancements in production processes require continuous investment and research, which can be challenging for smaller players in the market.

Public Perception and Consumer Concerns impacting 1,4-dihydroxybenzene overall market demand

Concerns regarding the potential health risks associated with hydroquinone, particularly in skin-lightening products, can negatively impact consumer perception and market demand. Consumers are increasingly demanding transparency and traceability in their products, which can be challenging for manufacturers using hydroquinone due to its potential environmental and health concerns. While still in their early stages, these alternatives have the potential to erode hydroquinone's market share in the long run. In cost-sensitive industries, such as rubber production, cheaper substitutes with similar properties may pose a competitive challenge to hydroquinone.

Market Opportunities

The 1,4-dihydroxybenzene, or hydroquinone, market is sizzling with potential, this fiery growth is fuelled by a perfect storm of factors: roaring industrial demand from diverse sectors like rubber, photography, and pharmaceuticals, where hydroquinone plays a vital role as an antioxidant, developer, and skin lightening agent respectively. The flames of growth are further stoked by the emerging economies of Asia Pacific, particularly China and India, where rapid industrialization and burgeoning populations create an insatiable appetite for hydroquinone. Innovation acts as the accelerant, constantly discovering new applications for this versatile compound, like bio-based plastics and electronic displays. Sustainability concerns inject a green hue into the market, pushing manufacturers towards eco-friendly alternatives like bio-based hydroquinone, reducing the industry's environmental footprint. However, storm clouds loom on the horizon in the form of environmental concerns: hydroquinone's hazardous nature could raise production costs due to stricter regulations. Volatile raw material prices pose another challenge, making cost prediction a tricky game for manufacturers. Competition heats up as substitutes emerge, putting downward pressure on prices. Despite these hurdles, the overall forecast for the hydroquinone market remains sunny. By proactively addressing the challenges, manufacturers can leverage the potent drivers of growth and capitalize on the sizzling opportunities this market presents, ensuring a bright future for hydroquinone.

1,4-DIHYDROXYBENZENE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.2% |

|

Segments Covered |

By Type, Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

LANXESS (Germany), Dow Chemical (United States), Solvay (Belgium), Tianjin Kerui Chemical Industry Co., Ltd, Jubilant Ingrevia Limited (India) |

1,4-dihydroxybenzene Market segmentation - By Type

-

Technical Grade Hydroquinone

-

USP Grade Hydroquinone

-

Photographic Grade Hydroquinone

-

Electronic Grade Hydroquinone

-

Bio-Based Hydroquinone

Technical grade, a workhorse in rubber and chemicals, struts with the fastest growth, fuelled by Asia's booming tire industry and diverse industrial applications. Growth has slowed down due to stricter regulations regarding its use in skin-lightening products. The rise of digital photography has impacted its demand, leading to limited growth. Its use in niche applications within the electronics industry results in modest and stable market growth.

1,4-dihydroxybenzene Market Segmentation - By Use

-

Rubber Industry

-

Photography

-

Pharmaceuticals

-

Agrochemicals

-

Electronics

Hydroquinone acts as an antioxidant and anti-tack agent in rubber, improving its durability and shelf life. The booming tire industry in Asia, particularly China, drives demand for hydroquinone in rubber applications, making it the fastest-growing sector. Hydroquinone also plays a crucial role in various chemical processes, including dye synthesis, photographic development, and polymer production. The growing demand for chemicals in various industries like construction, textiles, and electronics fuels this sector's growth. Hydroquinone has been used in topical skin-lightening creams, but its use has faced increasing scrutiny due to potential health risks and regulatory restrictions hence becoming the reason for slow growth in pharmaceuticals.

1,4-dihydroxybenzene Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific particularly China, is the dominant market for hydroquinone. The European market for hydroquinone is smaller than Asia-Pacific due to stricter regulations on its use in cosmetics. Similar to Europe, the North American market for hydroquinone is limited by regulatory restrictions, particularly in cosmetics. However, it remains important for pharmaceutical and industrial applications. South America is seeing growing demand for hydroquinone in various industries, including rubber, chemicals, and pharmaceuticals. The market in the Middle East and Africa region is relatively small but experiencing steady growth due to rising industrialization and increasing demand for skin-lightening products. Asia-Pacific is the fastest-growing market for hydroquinone.

COVID-19 Impact Analysis on 1,4-dihydroxybenzene market

The COVID-19 pandemic disrupted several key sectors that rely on 1,4-dihydroxybenzene (hydroquinone), casting a long shadow on the market. Lockdowns and supply chain disruptions impacted industries like rubber and automotive, leading to a decline in hydroquinone demand for tire production and other industrial applications. The shift to digital photography and reduced travel dampened demand for traditional film photography, another key user of hydroquinone. Pandemic-induced disruptions in supply chains and logistics led to fluctuations in the prices of key raw materials for hydroquinone production, impacting manufacturers' costs. However, the market also showed signs of resilience and adaptation. The rise of online shopping boosted demand for hydroquinone used in packaging and labeling materials, partially offsetting declines in other sectors. Increased awareness of hygiene during the pandemic fueled demand for hydroquinone in water treatment and disinfectant applications. While the pandemic initially posed challenges, the long-term impact is still unfolding. The market is expected to gradually recover and resume its growth trajectory as the global economy stabilizes.

Latest trends/Developments

The 1,4-dihydroxybenzene (hydroquinone) market buzzes with recent developments shaping its future. Sustainability reigns supreme, with bio-based alternatives like plant-derived hydroquinone gaining traction to reduce environmental impact. Innovation sizzles, with applications in 3D printing filaments and advanced batteries showcasing hydroquinone's versatility. The focus on health also simmers, with research exploring its potential in wound healing and targeted drug delivery. Regulatory ripples stir, with stricter environmental norms prompting cleaner production processes. E-commerce continues to surge, boosting demand for hydroquinone in packaging materials. As these trends converge, the hydroquinone market is poised for exciting transformations, promising sustainable, innovative, and health-focused solutions for the future.

Key Players:

-

LANXESS (Germany)

-

Dow Chemical (United States)

-

Solvay (Belgium)

-

Tianjin Kerui Chemical Industry Co., Ltd

-

Jubilant Ingrevia Limited (India)

Chapter 1. 1,4-Dihydroxy benzene Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. 1,4-Dihydroxy benzene Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. 1,4-Dihydroxy benzene Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. 1,4-Dihydroxy benzene Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. 1,4-Dihydroxy benzene Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. 1,4-Dihydroxy benzene Market – By type

6.1 Introduction/Key Findings

6.2 Technical Grade Hydroquinone

6.3 USP Grade Hydroquinone

6.4 Photographic Grade Hydroquinone

6.5 Electronic Grade Hydroquinone

6.6 Bio-Based Hydroquinone

6.7 Y-O-Y Growth trend Analysis By type

6.8 Absolute $ Opportunity Analysis By type, 2024-2030

Chapter 7. 1,4-Dihydroxy benzene Market – By Use

7.1 Introduction/Key Findings

7.2 Rubber Industry

7.3 Photography

7.4 Pharmaceuticals

7.5 Agrochemicals

7.6 Electronics

7.7 Y-O-Y Growth trend Analysis By Use

7.8 Absolute $ Opportunity Analysis By Use, 2024-2030

Chapter 8. 1,4-Dihydroxy benzene Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Use

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Use

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Use

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Use

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Use

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. 1,4-Dihydroxy benzene Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 LANXESS (Germany)

9.2 Dow Chemical (United States)

9.3 Solvay (Belgium)

9.4 Tianjin Kerui Chemical Industry Co., Ltd

9.5 Jubilant Ingrevia Limited (India)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global 1,4-dihydroxybenzene market was valued at approximately USD 580 million in 2023 and is projected to reach USD 773.57 million by 2030, growing at a CAGR of 4.2% during the forecast period of 2024-2030.

Industrial Demand, Fluctuating Raw Material Prices, and environmental concerns are some factors that are driving the market.

Technical Grade Hydroquinone, USP Grade Hydroquinone, Photographic Grade Hydroquinone, and Electronic Grade Hydroquinone are the segments by type.

Asia Pacific is the most dominant region for the 1,4 dihydroxy benzene Market

LANXESS (Germany), Dow Chemical (United States), Solvay (Belgium), Tianjin Kerui Chemical Industry Co., Ltd, Jubilant Ingrevia Limited (India)