Global Fluorotelomer Olefins Market Size (2024 – 2030)

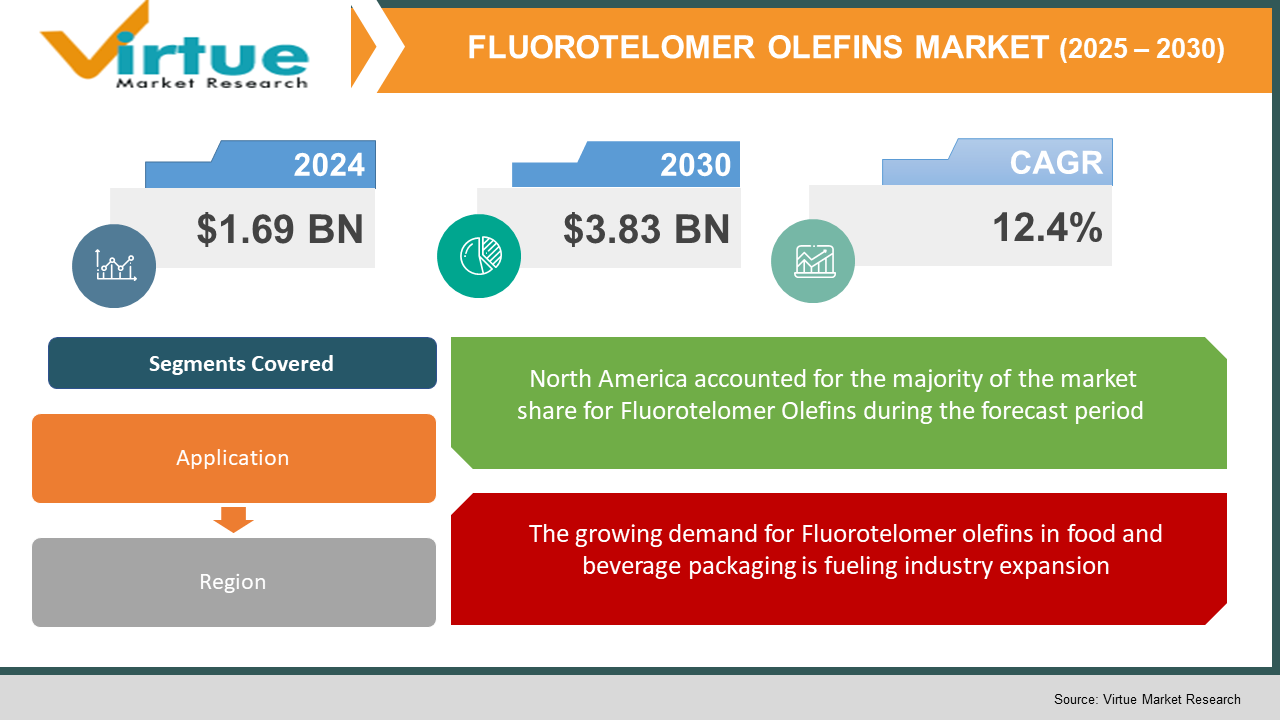

In 2023, the Fluorotelomer Olefins Market was valued at $1.69 billion, and is projected to reach a market size of $3.83 billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 12.4%. The market is being propelled by technical innovations as well as rising demand from specialized industries like surfactants, food & beverage packaging, and textiles.

Industry Overview:

The term "fluorotelomer olefin" describes a group of alkenes with the general formula F(CF2CF2)nCH=CH2. By polymerizing fluorocarbon-based telomers or oligomers, fluorotelomers are principally produced. Fluorotelomers and compounds based on them are the sources of many perfluorinated carboxylic acids, including PFOA and PFNA. For ecologically durable perfluorinated carboxylic acids, fluorotelomers and their derivatives are employed as raw materials. Applications for fluorotelomer olefins include stain-resistant surfactants, food packaging, and textiles. Food packaging, stain-resistant surfactants, and textiles are among the industries that use fluorotelomer olefins. Food contact papers are treated with fluorotelomers so they won't absorb oil from fried or greasy dishes. Microwave bags, fast food packaging, candy, and box packaging are all examples of products that contain fluorotelomer coatings. Olefin derivatives used in the production of premium packaging materials grew as a result of increased demand for packaging materials. As consumer goods consumption and demand rise, there will likely be a continued demand for more sophisticated packaging, which will cause sales of packaging materials in emerging nations to grow rapidly. With the enormous untapped potential to be unlocked, particularly in replacement applications for other fluorochemical compounds, the worldwide market for fluorotelomer olefins is still thought to be in its infancy. Fluorotelomers are increasingly being used in the textile and clothing sector, including in denim, leather jackets, knit shirts, and carpets as well as leather protectors. Additionally, recent advances in specialized industries like medicine, electronics, repellents, and surfactants are anticipated to create huge market prospects for the fluorotelomer olefins market.

COVID-19 pandemic impact on the Fluorotelomer Olefins Market

The global market for fluorotelomer olefins was negatively impacted by the COVID-19 epidemic. In 2020, the COVID-19 outbreak significantly impacted the food, beverage, and chemical industries. This can be ascribed to major disruptions in their supply chains and manufacturing processes brought on by multiple precautionary lockdowns. The lack of raw materials, workforce, and temporary stoppage of operations were all problems that business groups had to deal with. Additionally, consumer demand decreased as a result of people being more eager to cut non-essential costs from their budgets as the general economic situation of the majority of people has been badly impacted by this outbreak. However, this market has recovered throughout the latter half of 2020. The fluorotelomer olefin demand has remained steady in medicinal applications as the production of PPE kits, gloves, masks, equipment, and other items increased during the pandemic.

MARKET DRIVERS:

The growing demand for Fluorotelomer olefins in food and beverage packaging is fueling industry expansion:

Fluorotelomer olefins are used in packaging in the food and beverage sector. Food contact paper is coated with fluorotelomers in packaging applications to stop the paper from absorbing oil from food goods. In addition, fluorotelomers are employed as coating additives in popcorn bags, pizza box liners, and fast food wrappers. To meet the convenience, comfort, safety, and freshness requirements of packaged goods, a variety of packaging technologies have been developed. Fluorotelomers have been used more frequently in place of hazardous fluorocarbon due to the increase in demand for microwave bags, confectionery, and box packaging. The need for packaging applications is likely to increase due to the expanding food and beverage industry.

Technological advancements and rising demand for fluorotelomer olefins in specialized industries support market expansion:

The market for fluorotelomers may expand as a result of technological advancements made in specialized industries like pharmacology, liquid crystal additives, textiles, surfactants & repellents, and electronics. The function of these items is to treat textiles to increase stain resistance from chemicals, solvents, and dust. In addition to protecting patients and healthcare professionals from fluid-based viruses, telomers can provide protective surface finishes to textile products like surgical drapes and gowns. The need for fluorotelomers in the manufacture of PPE kits, masks, and other equipment is anticipated to increase globally as a result of growing government investments in the healthcare sector.

MARKET RESTRAINTS:

Volatility in the cost of the raw materials used to make olefins and the large associated investments can negatively impact the market growth

The market for fluorotelomer olefins is significantly impacted by fluctuating raw material prices. Olefin production costs climb in lockstep with the price of raw materials. This can spike the overall costs for the manufacturers. The market expansion for olefins can consequently be hampered by the varying pricing of the raw materials used in their production. The development of the global market for fluorotelomer olefins may be hampered by alternatives such as nanoparticle-based lubricants and tungsten disulfide.

The market expansion may be hampered by strict rules enforced regarding the use of raw materials

The growing environmental and health-related concerns among consumers could impede industry expansion. The business continues to face significant challenges due to stringent environmental rules governing the production and manufacture of crude oil byproducts. Due to their potential hazards, the manufacturing and use of certain important raw materials, including vinylidene fluoride, tetrafluoroethylene, chlorotrifluoroethylene, and hexafluoropropene, may be restricted. The price trend for fluorotelomers may be impacted by this as well as a possible short supply situation. For instance, under 64 FR 3865, the EPA and the United States have gradually stopped using refrigerant blends containing hexafluoropropene. The Department of Health and Human Services has classified tetrafluoroethylene as hazardous under the National Toxicology Program. Chlorotrifluoroethylene is a harmful substance for human health for its acute toxicity. These basic ingredients are all highly toxic and harmful to both human health and the environment.

GLOBAL FLUOROTELOMER OLEFINS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.4% |

|

Segments Covered |

By Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Wilshire Technologies, DuPont, TCI Chemicals, Fluorous Technologies, Fluoryx Inc., AGC Chemicals, Daikin America |

This research report on the global Fluorotelomer Olefins Market has been segmented based on application, and region.

Fluorotelomer Olefins Market – By Application

-

Fооd Расkаgіng

-

Fluorosurfactants & Coating Additives

-

Textiles

-

Others

Based on Application, the Fluorotolemer Market is bifurcated into Food Packaging, Fluorosurfactants & Coating Additives, Textiles, and Others. The use of food packaging is anticipated to expand during the forecasted period. Due to their grease resistance, these items are ideal for use as pizza box liners, microwave popcorn bags, candy wrappers, and fast food wrappers. In addition, changes in consumer food habits, food retail expansion, and the expanding use of chemical agents in the textile industry are driving the market growth. Fluorosurfactants are non-polymeric derivatives of fluorotelomer that are employed as coating additives and in aqueous film-forming foams (AFFF or fluorinated firefighting foams). Additionally, fluorotelomers are utilized in industrial, chemical, and military firefighting foams. The demand for firefighting foams is expanding as a result of the increased number of fire hazards and strict construction norms and regulations enacted in the emerging economies.

Fluorotelomer Olefins Market - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Rest of the World

Geographically, it is anticipated that the North American Fluorotelomer Olefins market would account for the highest share of the market during the forecast period. Europe is anticipated to have considerable market growth during the projected period due to the expansion of the textile sector in nations like Germany, Italy, and France. The Asia Pacific Fluorotolemer Olefins market is anticipated to expand at the highest growth rate during the forecast period. Fluorotelomer olefin demand is anticipated to be boosted by their expanding use in the food packaging industry. The development of a robust manufacturing infrastructure for textiles and surfactants is likely to support Asia Pacific's faster growth rate.

Major Key Players in the Market

- Wilshire Technologies

- DuPont

- TCI Chemicals

- Fluorous Technologies

- Fluoryx Inc.

- AGC Chemicals

- Daikin America

The leading businesses in the sector are spending on R&D to keep ahead of the competition. The top companies in the fluorotelomer olefins market are focusing on expanding their global reach through mergers and acquisitions and broadening their product portfolio to keep up with the fast-moving trends.

Notable happenings in the Global Fluorotelomer Olefins Market in the recent past:

- Acquisition- In January 2020, Evonik announced the acquisition of Wilshire Technologies Inc., a US-based manufacturer of phytochemicals and their derivatives to the global pharmaceutical and cosmetic sectors.

Chapter 1.Fluorotelomer Olefins Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.Fluorotelomer Olefins Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.Fluorotelomer Olefins Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.Fluorotelomer Olefins Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5.Fluorotelomer Olefins Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.Fluorotelomer Olefins Market – By Application

6.1. Fооd Расkаgіng

6.2. Fluorosurfactants & Coating Additives

6.3. Textiles

6.4. Others

Chapter 7.Fluorotelomer Olefins Market - By Region

7.1. North America

7.2. Europe

7.3. Asia-Pacific

7.4. Latin America

7.5. The Middle East

7.6. Africa

Chapter 8. Fluorotelomer Olefins Market – key players

8.1 Wilshire Technologies

8.2 DuPont

8.3 TCI Chemicals

8.4 Fluorous Technologies

8.5 Fluoryx Inc.

8.6 AGC Chemicals

8.7 Daikin America

Download Sample

Choose License Type

2500

4250

5250

6900