Bio-Pesticides for Food Crops Market Size (2024 – 2030)

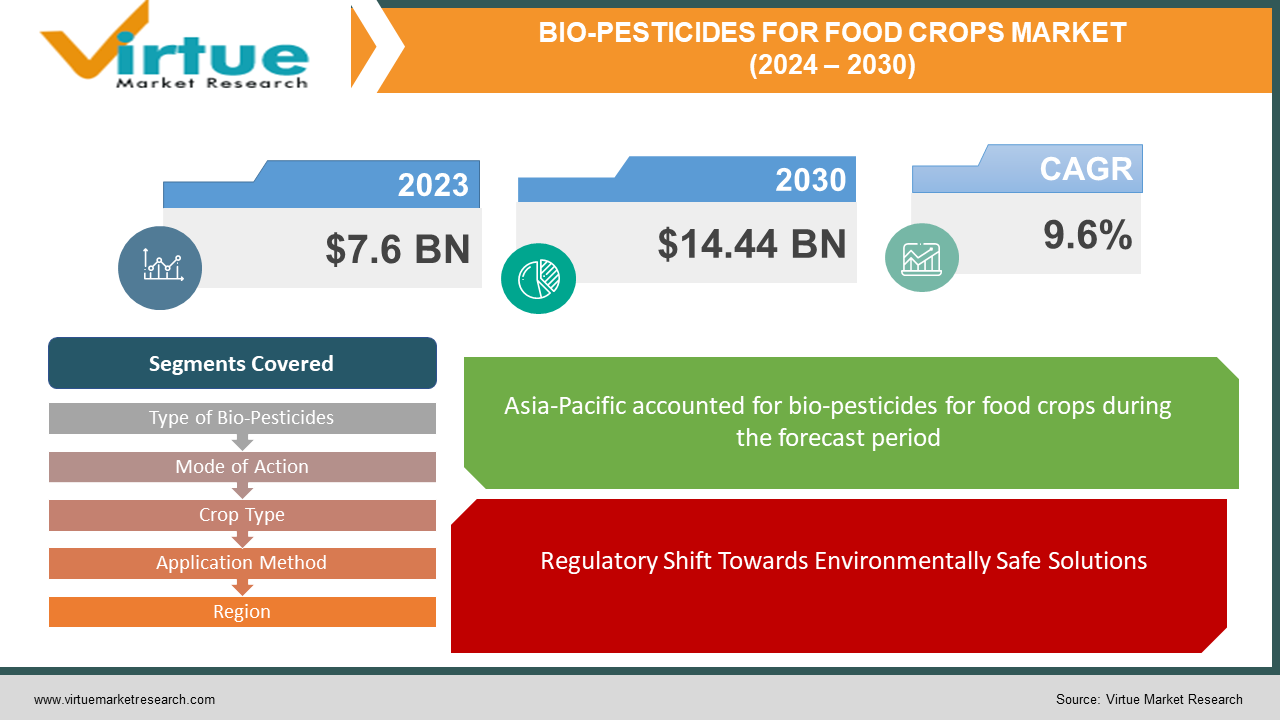

The Global Bio-Pesticides for Food Crops Market was valued at USD 7.6 billion in 2024 and is projected to reach a market size of USD 14.44 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.6%.

The bio-pesticides market for food crops is seeing healthy growth globally, driven by increasing consumer demand for organic produce and stringent regulations on synthetic pesticides. Advancements in bio-pesticide technology have enhanced their efficacy and shelf-life, further boosting market adoption. With a rising awareness of sustainable agricultural practices and the growth of combined pest organization strategies, bio-pesticides are becoming essential components of pest control in food crop production. The market is predicted to continue its skyward course, maintained by the increasing importance of environmentally friendly farming methods and the chase of healthier food options.

Key Market Insights:

Key insights into the bio-pesticides market for food crops specify a significant shift towards supportable and environmentally friendly pest management practices. Factors such as growing consumer preference for organic food, stringent regulations governing synthetic pesticides, and advancements in bio-pesticide technology are lashing market growth. Integrated pest management strategies are gaining adhesion, supplementary fueling demand for bio-pesticides as part of holistic pest control approaches. Furthermore, rising awareness among farmers about the long-term benefits of bio-pesticides and their role in promoting soil health is contributing to market expansion. Regional disparities in regulatory frameworks and crop preferences influence market dynamics, with emerging economies witnessing rapid adoption of biopesticides. Overall, the bio-pesticides market for food crops is poised for continued growth, supported by the ongoing transition towards sustainable agriculture and the cumulative importance of food safety and environmental stewardship.

Bio-Pesticides for Food Crops Market Drivers:

Regulatory Shift Towards Environmentally Safe Solutions:

Governments worldwide have magnificent stricter rules on the use of synthetic pesticides due to their contrary effects on human health and the environment. This controlling pressure is a significant driver for the bio-pesticides market. Bio-pesticides, derived from natural sources such as plants, microbes, and minerals, bid a safer alternative with negligible environmental impact. Regulatory bodies are incentivizing the acceptance of bio-pesticides through subsidies, grants, and promising policies, encouraging farmers to transition towards eco-friendly pest management practices.

Increasing Consumer Demand for Organic Products:

Consumer mindfulness regarding the health and environmental impacts of conventional farming is fueling the demand for organic food products. Bio-pesticides play a crucial role in organic farming as they are allowable under organic certification values. Consumers are eager to pay first-class prices for organic produce grown without synthetic pesticides, driving the implementation of bio-pesticides among farmers. This demand twitch from consumers is a significant driver for the growth of the bio-pesticides market for food crops.

Advancements in Biotechnology and Research:

Continuous research and development pains in biotechnology have led to significant advancements in bio-pesticide designs and efficacy. Scientists are continually discovering new strains of beneficial microbes and refining extraction methods for botanical extracts, enhancing the potency and specificity of bio-pesticides. Furthermore, innovations in formulation technologies progress the stability, shelf-life, and distribution instruments of bio-pesticides, making them more practical and operative for farmers. These progressions not only increase the adoption of bio-pesticides but also drive further venture and innovation in the sector, making an optimistic feedback loop for market growth.

Bio-Pesticides for Food Crops Market Restraints and Challenges

Despite its growth, the bio-pesticides market for food crops faces several restraints and challenges. One major trial is the inferior efficacy of bio-pesticides associated with synthetic alternatives, which may boundary their efficiency in governing certain pests or diseases. Furthermore, bio-pesticides often have a shorter shelf life and may require more frequent applications, growing operational costs for farmers. Regulatory barriers, such as lengthy approval processes and inconsistent standards across provinces, also pose trials for market expansion. Furthermore, restricted awareness and understanding among farmers about the proper use and benefits of bio-pesticides hinder adoption rates. Addressing these challenges will be crucial for solving the full potential of bio-pesticides in supportable agriculture.

Bio-Pesticides for Food Crops Market Opportunities:

The bio-pesticides market for food crops presents several talented opportunities for growth and innovation. One key opportunity lies in the growing demand for sustainable agricultural practices driven by consumer liking for organic and environmentally friendly food products. This demand generates a fertile ground for the expansion of bio-pesticides, which are perceived as safer and more environmentally sound replacements for synthetic pesticides. Furthermore, advancements in biotechnology and preparation technologies suggest opportunities to improve the effectiveness, specificity, and constancy of bio-pesticides, making them more competitive with synthetic counterparts. Moreover, the development of integrated pest management (IPM) strategies, which combine numerous pest control methods including bio-pesticides, presents opportunities for market penetration and expansion. Leveraging these opportunities can not only drive growth in the bio-pesticides market but also contribute to sustainable and resilient food production systems.

BIO-PESTICIDES FOR FOOD CROPS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.6% |

|

Segments Covered |

By Type of Bio-Pesticides, Mode of Action, Crop Type, Application Method, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bayer Crop Science AG, BASF SE, Syngenta AG, Marrone Bio Innovations, Inc., Certis USA LLC,. Valent BioSciences Corporation, Koppert Biological Systems, Isagro S.p.A., Stockton Group, Novozymes A/S |

Bio-Pesticides for Food Crops Market Segmentation: Type of Bio-Pesticides

-

Microbial Bio-Pesticides

-

Plant-Incorporated Bio-Pesticides (PIPs)

-

Biochemical Bio-Pesticides

Microbial Bio-Pesticides stands as the largest subsegment within this group, esteemed for their broad-spectrum efficacy and eco-friendly landscape, pleasing to a wide range of farmers and agricultural practitioners. In the meantime, Plant-Incorporated Bio-Pesticides (PIPs) appear as the fastest-growing segment, determined by advances in biotechnology, genetic engineering, and the demand for targeted pest management solutions amidst escalating environmental concerns

Bio-Pesticides for Food CropsMarket Segmentation: Mode of Action

-

Insecticides

-

Fungicides

-

Herbicides

Insecticides reign as the largest subsegment, reflecting the persistent global challenge of insect pest management and the significant demand for effective control measures. Simultaneously, Fungicides emerge as the fastest-growing category, driven by rising apprehensions concerning fungal diseases jeopardizing crop yields, combined with a burgeoning implementation of cohesive pest management strategies.

Bio-Pesticides for Food Crops Market Segmentation: Crop Type

-

-

-

Grains and Cereals

-

Fruits and Vegetables

-

Oilseeds and Pulses

-

Other Crop Types

-

-

Grains and Cereals assert dominance as the largest subsegment, reinforced by their ubiquitous cultivation and vital role in global food security. On the other hand, Fruits and Vegetables emerge as the fastest-growing category, buoyed by surging consumer preferences for fresh produce and the imperative for supportable pest control practices within horticulture to meet sprouting market demands.

Bio-Pesticides For Food Crops Market Segmentation: By Application Method

-

-

Foliar Spray

-

Soil Drench

-

Seed Treatment

-

Trunk Injection

-

Foliar Spray arises as the largest subsegment, owing to its widespread utilization and efficacy in delivering bio-pesticides to target crops effectively. Meanwhile, Seed Treatment emerges as the fastest-growing segment, fueled by progressions in seed coating technologies and the imperious for early-stage pest protection, aligning with the industry's shift towards preventive and sustainable agricultural practices.

Bio-Pesticides for Food Crops Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The largest region in the bio-pesticides for food crops market is typically influenced by factors such as agricultural infrastructure, market demand, and regulatory frameworks, making it difficult to definitively identify without specific data. However, regions with established agricultural sectors and strong commitments to sustainable farming practices, such as North America, often command significant market shares. As for the fastest-growing region, it tends to be characterized by dynamic agricultural development, rising adoption of bio-pesticides, and helpful government policies. Developing economies in Asia-Pacific or regions experiencing a surge in organic farming practices may exhibit notable growth rates in the bio-pesticides market, fueled by increasing consciousness of environmental concerns and the need for harmless pest management resolutions.

COVID-19 Impact Analysis on the Global Bio-Pesticides For Food Crops Market:

The COVID-19 pandemic has had varied properties on the global bio-pesticides market for food crops. While the amplified focus on food security and safety has driven demand for sustainable agricultural practices, including bio-pesticides, disturbances in supply chains and labor shortages have posed challenges for market growth. Lockdown measures and limitations on movement have delayed the circulation and availability of bio-pesticides, impacting their adoption by farmers. Moreover, commercial qualms and financial constraints faced by growers have led to budgetary restrictions, potentially limiting investments in bio-pesticide solutions. However, heightened consciousness of health and environmental anxieties during the pandemic has accelerated the shift towards organic and sustainable farming practices, offering opportunities for the long-term growth of the bio-pesticides market post-pandemic.

Latest Trends/ Developments:

Some of the latest trends and developments in the bio-pesticides market for food crops include the increasing adoption of biotechnology and nanotechnology for the expansion of novel bio-pesticide preparations with improved usefulness and target specificity. Furthermore, there is a growing emphasis on the incorporation of digital technologies such as precision agriculture, IoT, and AI-driven analytics into bio-pesticide application methods to optimize pest management strategies and diminish environmental impact. Furthermore, collaborations between research institutions, agricultural companies, and government bodies are developing innovation and fast-tracking the commercialization of bio-pesticide products. Moreover, the appearance of bio-based seed treatments and biostimulants is increasing the scope of bio-pesticides elsewhere in pest control to include plant health and productivity enhancement, driving further growth and diversification in the market.

Key Players:

-

Bayer Crop Science AG

-

BASF SE

-

Syngenta AG

-

Marrone Bio Innovations, Inc.

-

Certis USA LLC

-

Valent BioSciences Corporation

-

Koppert Biological Systems

-

Isagro S.p.A.

-

Stockton Group

-

Novozymes A/S

Chapter 1. Bio-Pesticides for Food Crops Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Bio-Pesticides for Food Crops Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Bio-Pesticides for Food Crops Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Bio-Pesticides for Food Crops Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Bio-Pesticides for Food Crops Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Bio-Pesticides for Food Crops Market – Type of Bio-Pesticides

6.1 Introduction/Key Findings

6.2 Microbial Bio-Pesticides

6.3 Plant-Incorporated Bio-Pesticides (PIPs)

6.4 Biochemical Bio-Pesticides

6.5 Y-O-Y Growth trend Analysis Type of Bio-Pesticides

6.6 Absolute $ Opportunity Analysis Type of Bio-Pesticides, 2024-2030

Chapter 7. Bio-Pesticides for Food Crops Market – By Application

7.1 Introduction/Key Findings

7.2 Foliar Spray

7.3 Soil Drench

7.4 Seed Treatment

7.5 Trunk Injection

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Bio-Pesticides for Food Crops Market – Mode of Action

8.1 Introduction/Key Findings

8.2 Insecticides

8.3 Fungicides

8.4 Herbicides

8.5 Y-O-Y Growth trend Analysis Mode of Action

8.6 Absolute $ Opportunity Analysis Mode of Action, 2024-2030

Chapter 9. Bio-Pesticides for Food Crops Market – Crop Type

9.1 Introduction/Key Findings

9.2 Grains and Cereals

9.3 Fruits and Vegetables

9.4 Oilseeds and Pulses

9.5 Other Crop Types

9.6 Y-O-Y Growth trend Analysis Crop Type

9.7 Absolute $ Opportunity Analysis Crop Type, 2024-2030

Chapter 10. Bio-Pesticides for Food Crops Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 Type of Bio-Pesticides

10.1.3 Crop Type

10.1.4 Mode of Action

10.1.5 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 Type of Bio-Pesticides

10.2.3 By Application

10.2.4 Mode of Action

10.2.5 Crop Type

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 Type of Bio-Pesticides

10.3.3 By Application

10.3.4 Mode of Action

10.3.5 Crop Type

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 Type of Bio-Pesticides

10.4.3 By Application

10.4.4 Mode of Action

10.4.5 Crop Type

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 Type of Bio-Pesticides

10.5.3 By Application

10.5.4 Mode of Action

10.5.5 Crop Type

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Bio-Pesticides for Food Crops Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Bayer Crop Science AG

11.2 BASF SE

11.3 Syngenta AG

11.4 Marrone Bio Innovations, Inc.

11.5 Certis USA LLC

11.6 Valent BioSciences Corporation

11.7 Koppert Biological Systems

11.8 Isagro S.p.A.

11.9 Stockton Group

11.10 Novozymes A/S

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Bio-Pesticides For Food Crops Market was valued at USD 7.6 billion and is projected to reach a market size of USD 14.44 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.6%.

The Global Bio-Pesticides For Food CropsMarket encompasses the sales and demand for vacuum devices designed to remove blackheads, utilizing silicon-based technology for effective and non-invasive skincare solutions.

The segments under the Global Bio-Pesticides For Food CropsMarket include product type (handheld devices, pore cleansers), skin type suitability (normal, oily, sensitive), distribution channels (retail, online, specialty stores), price range (budget-friendly to premium), geography (regions), demographics (age, gender, income), and usage (personal or professional).

North America emerges as the most dominant region for the Global Bio-Pesticides For Food Crops Market due to high consumer awareness and technological adoption.

Key players in the Global Bio-Pesticides For Food market include Panasonic Corporation, Philips (Koninklijke Philips N.V.), L'Oréal Group, Neutrogena (Johnson & Johnson), and Clarisonic (L'Oréal Group), among others.