Ancient Grains Market Size (2024-2030)

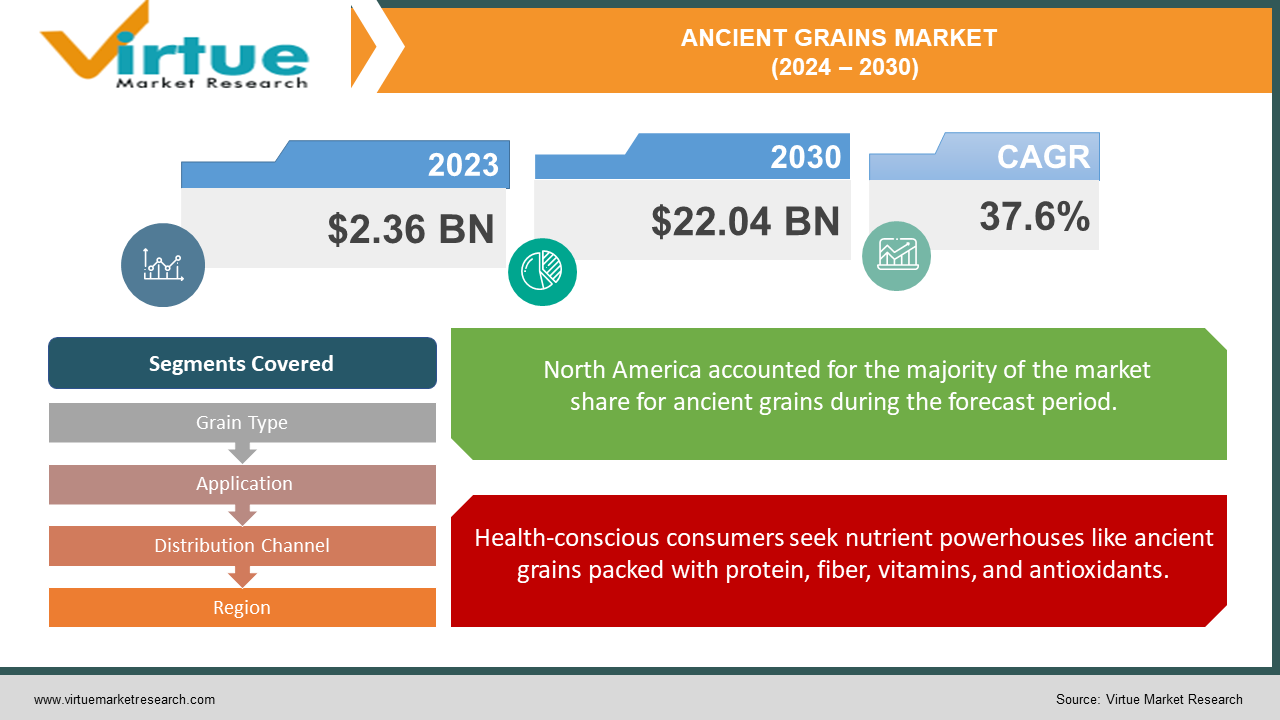

The Ancient Grains Market was valued at USD 2.36 billion in 2023 and is projected to reach a market size of USD 22.04 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 37.6%.

Consumer interest in healthy and nutritious foods has fueled a surge in popularity for these grains, which have been cultivated for centuries but are experiencing a modern comeback.

Key Market Insights:

With over a third of the population following gluten-free diets or having gluten sensitivity, naturally gluten-free options like quinoa and amaranth are a welcome addition to the table. Additionally, the fast-paced modern lifestyle demands convenient healthy options. Ancient grains are incredibly versatile, easily incorporated into various dishes, or even ground into flour for baking, making them a time-saving nutritional powerhouse.

The environmental impact of food choices is becoming increasingly important. Many ancient grains are drought-resistant and require fewer resources to grow, making them a more sustainable option compared to traditional grains. This focus on eco-friendly practices, coupled with the health and convenience benefits, positions the ancient grains market for continued expansion in the coming years.

Ancient Grains Market Drivers:

Health-conscious consumers seek nutrient powerhouses like ancient grains packed with protein, fiber, vitamins, and antioxidants.

Today's consumers are increasingly health-conscious, actively seeking out nutrient-rich foods to fuel their bodies. Ancient grains perfectly align with this trend. They boast a remarkable nutritional profile, containing high levels of protein, essential for building and repairing tissues. Additionally, their rich fiber content promotes healthy digestion and gut health. Furthermore, ancient grains are loaded with vitamins, minerals, and antioxidants, which play a crucial role in maintaining overall health and potentially preventing chronic diseases. This emphasis on holistic well-being is a significant driver propelling the ancient grains market forward.

The rise of gluten-free diets, particularly for those with celiac disease or gluten sensitivity, fuels demand for naturally gluten-free ancient grains.

The rise of gluten-free diets has created a substantial market demand for alternative grains that are naturally gluten-free. This dietary trend is often driven by individuals with celiac disease or gluten sensitivity, who experience adverse reactions to gluten consumption. Ancient grains like quinoa and amaranth offer a welcome solution, providing delicious and nutritious options that cater to this growing segment of the population. This ability to fulfill a specific dietary need is a key driver of the ancient grains market's expansion.

Easy to prepare and incorporate into meals, ancient grains cater to fast-paced lifestyles by offering versatility for cooking or baking.

Busy schedules often leave little time for elaborate meal preparation. Consumers are seeking healthy options that are easy to incorporate into their daily routines. Ancient grains are a perfect fit for this need due to their remarkable versatility. They can be cooked on their own as a side dish, or effortlessly added to soups, stews, salads, and baked goods for a quick and nutritious boost. Additionally, some ancient grains can even be ground into flour for baking purposes, offering further convenience and culinary exploration.

Drought-resistant and requiring fewer resources, ancient grains resonate with environmentally conscious consumers.

Environmental consciousness is on the rise, with consumers increasingly making choices that align with sustainable practices. Ancient grains hold a significant advantage in this regard due to their eco-friendly nature. Many ancient grain varieties are drought-resistant, requiring less water for cultivation compared to traditional grains. Additionally, they often require fewer pesticides and fertilizers, minimizing their environmental impact. This focus on sustainability resonates with eco-conscious consumers, acting as a key driver for the ancient grains market.

Ancient Grains Market Restraints and Challenges:

The burgeoning ancient grains market isn't without its hurdles. One key challenge is overcoming limited consumer awareness. While interest is growing, there's still a segment of the population unfamiliar with these ancient grains. This is particularly true in certain regions, potentially hindering market expansion in those areas.

Another hurdle lies in taste and texture. Some ancient grains possess a distinct flavor or a different mouthfeel compared to the commonly consumed grains people are accustomed to. This can be a barrier for some, requiring recipe adjustments or techniques to mask unfamiliar flavors and textures.

Furthermore, price can be a sticking point. Ancient grains can sometimes carry a higher price tag compared to traditional grains like wheat or rice. This price difference can be a significant concern for budget-conscious consumers, potentially pushing them towards more affordable options.

Finally, limited availability and distribution can also act as a roadblock. Ancient grains may not be readily stocked on shelves in all grocery stores, particularly in smaller chains or rural areas. This lack of accessibility can make it difficult for some consumers to find and purchase these grains, hindering their potential to become a dietary staple.

Ancient Grains Market Opportunities:

The ancient grains market presents fertile ground for innovation and expansion. A key opportunity lies in developing new products that cater to a broader audience. This could involve pre-cooked ancient grain options with exciting flavor profiles, ready-to-eat ancient grain snacks for on-the-go convenience, or ancient grain blends specifically designed for baking or quick meals. By addressing potential taste and convenience concerns, these innovative products can attract new consumers and propel market growth.

Furthermore, strategic partnerships across the supply chain hold immense potential. Collaboration between farmers, distributors, and retailers can ensure consistent product availability and wider distribution of ancient grains. This would address the challenge of limited accessibility, making them a more readily available option for consumers across various regions. This increased accessibility, coupled with innovative product development, can significantly contribute to the continued success of the ancient grains market.

ANCIENT GRAINS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

37.6% |

|

Segments Covered |

By Grain Type, Application, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer-Daniels-Midland Company (ADM), Cargill, Inc., Ardent Mills, LLC, Bob's Red Mill Natural Foods, Inc., Ancient Golden Mill (India), Glanbia plc, The Hain Celestial Group, Inc., Ingredion Incorporated, Ebro Foods, S.A., Conagra Brands, Inc. |

Ancient Grains Market Segmentation: By Grain Type

-

Quinoa

-

Oats

-

Rye

-

Barley

-

Spelt

-

Sorghum

-

Millet

-

Others

Among grain types, quinoa is currently the most dominant segment of the ancient grains market due to its high protein content and gluten-free nature. However, the "Others" segment, which includes amaranth, teff, and fonio, is expected to be the fastest-growing category. This is because these lesser-known grains are gaining traction due to their unique flavors and potential health benefits, attracting adventurous consumers and health-conscious individuals seeking alternatives.

Ancient Grains Market Segmentation: By Application

-

Bakery Products

-

Breakfast Cereals

-

Soups & Salads

-

Side Dishes

-

Snacks

-

Beverages

Within the ancient grains market, the application sector with the dominant market share is Bakery Products (bread, cookies, pasta). This is likely due to the versatility of ancient grains in baking and their ability to cater to dietary needs with gluten-free options. However, the fastest-growing segment is Snacks. The convenience and health benefits of ancient grains make them ideal for on-the-go snacking, driving innovation in pre-cooked and flavored ancient grain snack options.

Ancient Grains Market Segmentation: By Distribution Channel

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Health Food Stores

-

Online Retailers

-

Direct from Farmers

Supermarket & Hypermarkets are the dominant channel for ancient grains distribution, offering a wide selection and one-stop shopping convenience. However, online retailers are expected to be the fastest-growing segment. The ease of ordering, home delivery options, and access to niche or specialty ancient grains are driving online sales growth.

Ancient Grains Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America currently holds the largest market share for ancient grains, driven by factors like high health consciousness, a growing gluten-free population, and established distribution networks. Consumers readily embrace new and healthy food options, making this a mature market with consistent demand for ancient grains across various applications.

Asia-Pacific is expected to witness the fastest growth in the ancient grains market. Rising disposable incomes, increasing urbanization, and growing awareness of healthy eating habits are key drivers. Additionally, ancient grains like quinoa and amaranth are gaining popularity due to their unique flavors and versatility. However, limited infrastructure and consumer familiarity with certain ancient grains in some parts of the region require strategic marketing and distribution efforts.

COVID-19 Impact Analysis on the Ancient Grains Market:

The COVID-19 pandemic's impact on the ancient grains market was a mixed bag. On the positive side, the heightened focus on health and immunity during the pandemic played to the advantage of ancient grains. Perceived as a natural source of nutrients and antioxidants that could potentially boost immunity, ancient grains saw a surge in demand from health-conscious consumers. Additionally, the rise of e-commerce due to stockpiling and limited grocery store visits benefitted the market. Online retailers offered wider access to these grains compared to some physical stores, making them a convenient option for consumers.

However, the pandemic also presented challenges. Global lockdowns and travel restrictions disrupted supply chains for ancient grains, leading to temporary shortages and price fluctuations in some regions. Furthermore, the closure of restaurants and cafes significantly impacted the demand for ancient grains used in foodservice applications.

Despite these initial hurdles, the ancient grains market exhibited resilience. The positive impacts, particularly the focus on health and the rise of e-commerce, largely outweighed the temporary disruptions. In the long term, the pandemic might have even accelerated the growth of the ancient grains market by highlighting their health benefits to a wider audience.

Latest Trends/ Developments:

The ancient grains market is a hive of innovation, constantly buzzing with new trends to meet evolving consumer preferences. Functionality is a rising star, with research exploring the potential of specific ancient grains, like teff, to promote gut health. This could pave the way for the development of exciting new products targeting digestive well-being. Convenience remains king, and pre-mixed ancient grain blends are gaining popularity. These blends offer a versatile and user-friendly option, combining different grains with complementary flavors and textures for easy incorporation into various dishes. The gluten-free movement continues to fuel innovation, with ancient grain flours like sorghum and millet finding their way into alternative pastas and baking mixes. This caters to those seeking delicious and nutritious options that fit their dietary needs, whether due to celiac disease, gluten sensitivity, or simply a desire for culinary variety. The snacking scene is also getting a makeover with the rise of innovative ancient grain snack options. Think bars, puffs, and trail mixes made with these nutritious powerhouses, offering a delicious and satisfying way to curb hunger pangs on the go. Finally, sustainability is taking center stage. Consumers are increasingly concerned about the environmental impact of their food choices, and the market is responding with a focus on sourcing ancient grains grown using sustainable practices. Additionally, the naturally drought-resistant nature of many ancient grains is being highlighted as a key benefit, resonating with environmentally conscious consumers. These trends showcase the dynamic and ever-evolving nature of the ancient grains market, well-positioned for continued growth and exciting innovations in the years to come.

Key Players:

-

Archer-Daniels-Midland Company (ADM)

-

Cargill, Inc.

-

Ardent Mills, LLC

-

Bob's Red Mill Natural Foods, Inc.

-

Ancient Golden Mill (India)

-

Glanbia plc

-

The Hain Celestial Group, Inc.

-

Ingredion Incorporated

-

Ebro Foods, S.A.

-

Conagra Brands, Inc.

Chapter 1. Ancient Grains Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Ancient Grains Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Ancient Grains Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Ancient Grains Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Ancient Grains Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Ancient Grains Market – By Application

6.1 Introduction/Key Findings

6.2 Bakery Products

6.3 Breakfast Cereals

6.4 Soups & Salads

6.5 Side Dishes

6.6 Snacks

6.7 Beverages

6.8 Y-O-Y Growth trend Analysis By Application

6.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Ancient Grains Market – By Grain Type

7.1 Introduction/Key Findings

7.2 Quinoa

7.3 Oats

7.4 Rye

7.5 Barley

7.6 Spelt

7.7 Sorghum

7.8 Millet

7.9 Others

7.10 Y-O-Y Growth trend Analysis By Grain Type

7.11 Absolute $ Opportunity Analysis By Grain Type, 2024-2030

Chapter 8. Ancient Grains Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Supermarkets & Hypermarkets

8.3 Convenience Stores

8.4 Health Food Stores

8.5 Online Retailers

8.6 Direct from Farmers

8.7 Y-O-Y Growth trend Analysis By Distribution Channel

8.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Ancient Grains Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By Grain Type

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By Grain Type

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By Grain Type

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By Grain Type

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By Grain Type

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Ancient Grains Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Archer-Daniels-Midland Company (ADM)

10.2 Cargill, Inc.

10.3 Ardent Mills, LLC

10.4 Bob's Red Mill Natural Foods, Inc.

10.5 Ancient Golden Mill (India)

10.6 Glanbia plc

10.7 The Hain Celestial Group, Inc.

10.8 Ingredion Incorporated

10.9 Ebro Foods, S.A.

10.10 Conagra Brands, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Ancient Grains Market was valued at USD 2.36 billion in 2023 and is projected to reach a market size of USD 22.04 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 37.6%.

Surging Focus on Health and Wellness, The Gluten-Free Boom Caters to a Large Population Segment, Convenience Reigns Supreme in Fast-Paced Lifestyles, Sustainability Concerns Drive Eco-Conscious Choices.

Supermarkets & Hypermarkets, Convenience Stores, Health Food Stores, Online Retailers, Direct from Farmers.

North America holds the dominant position in the Ancient Grains Market, driven by high health consciousness and established distribution networks.

Archer-Daniels-Midland Company (ADM), Cargill, Inc., Ardent Mills, LLC, Bob's Red Mill Natural Foods, Inc., Ancient Golden Mill (India), Glanbia plc, The Hain Celestial Group, Inc., Ingredion Incorporated, Ebro Foods, S.A., Conagra Brands, Inc..