Drone Services Market Size (2024 – 2030)

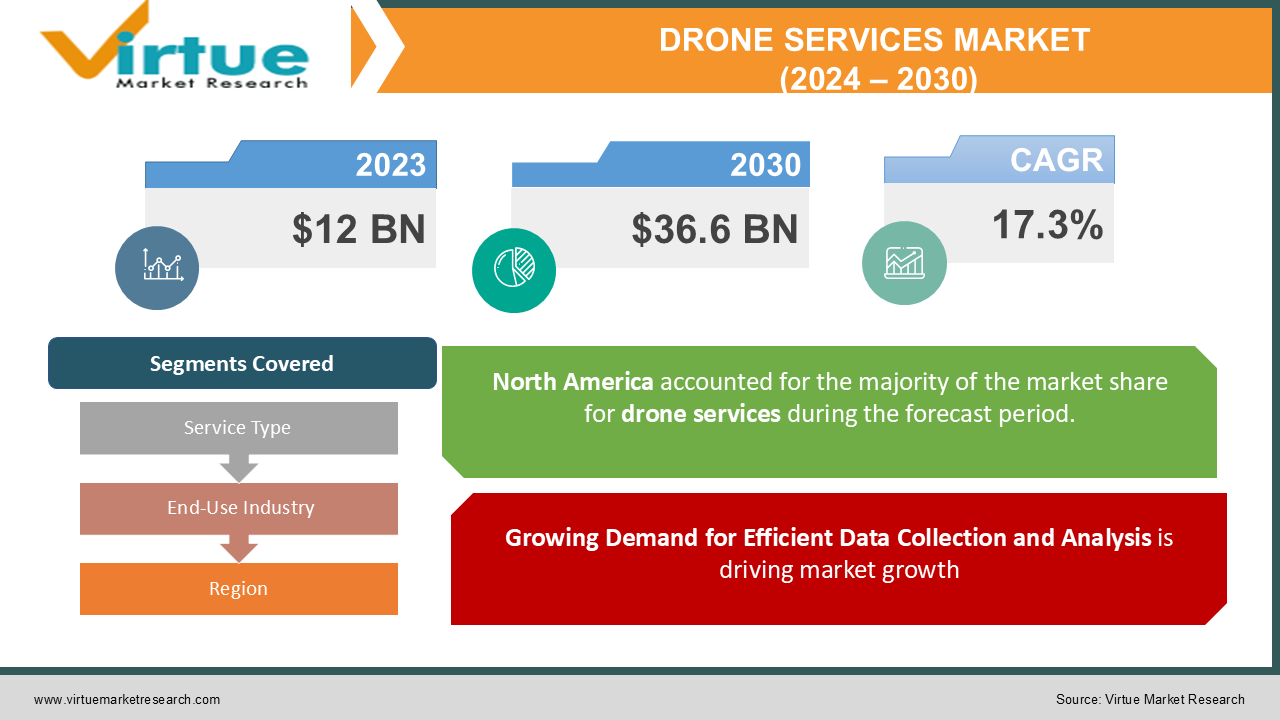

The Global Drone Services Market was valued at USD 12 billion in 2023 and is projected to grow at a robust CAGR of 17.3% from 2024 to 2030. By 2030, the market is expected to reach USD 36.6 billion.

Drone services encompass a wide range of applications such as aerial photography, surveying and mapping, inspection and monitoring, delivery services, and precision agriculture. The market's growth is fueled by the increasing adoption of drones across diverse industries for enhanced data collection, reduced operational costs, and improved efficiency. Technological advancements, such as AI and machine learning integration into drones, have further enhanced their utility, making them essential tools in modern business and government operations.

Key Market Insights:

The commercial segment is the largest contributor to the drone services market, accounting for more than 60% of total revenue in 2023, driven by the increasing use of drones in real estate, construction, media, and agriculture.

North America leads the market with a substantial share, driven by strong investments in drone technology and supportive regulatory frameworks that facilitate commercial and governmental drone use.

The use of drones in inspection and monitoring services, especially in the energy and utilities sector, is experiencing notable growth, with a CAGR of 19% projected from 2024 to 2030.

Challenges such as stringent regulations, safety concerns, and limited battery life continue to affect the market's expansion, but improvements in battery technology and regulatory adaptations are mitigating these challenges.

Global Drone Services Market Drivers:

Growing Demand for Efficient Data Collection and Analysis is driving market growth: The rising demand for quick, accurate, and efficient data collection has been a significant driver for the drone services market. Industries such as construction, agriculture, and mining require comprehensive data to make informed decisions, and drones offer an ideal solution with their ability to cover large areas quickly and provide detailed aerial images and sensor data. Drone-based services enable real-time monitoring and mapping of construction sites, crop health assessment in agriculture, and 3D mapping in mining, significantly reducing the time and cost associated with traditional methods. The integration of AI and machine learning into drone systems enhances their capability to analyze data and provide actionable insights. These technological advancements make drones indispensable in applications where precision, safety, and efficiency are paramount.

Expansion of Drone Applications in Delivery Services is driving market growth: The logistics and e-commerce sectors are experiencing rapid growth, prompting the need for innovative delivery solutions. Drones have emerged as a game-changer in last-mile delivery, capable of reducing delivery times and reaching remote areas that are challenging for traditional vehicles. Leading companies such as Amazon and UPS have been investing heavily in drone delivery programs, showcasing the potential of drones to transform the logistics landscape. Drones not only expedite delivery times but also contribute to lower carbon emissions, aligning with global sustainability goals. Furthermore, advancements in drone payload capacities and flight range are expanding their applicability in various delivery scenarios, from medical supplies in remote regions to food delivery in urban settings.

Advancements in Drone Technology and Integration with AI is driving market growth: The integration of advanced technologies such as AI, machine learning, and IoT has propelled the evolution of drone capabilities. AI-powered drones can autonomously plan routes, identify obstacles, and make decisions in real-time, enhancing their utility in complex environments. Machine learning algorithms allow drones to adapt and learn from previous missions, improving performance and efficiency over time. These advancements are especially beneficial in industries that require repetitive tasks, such as infrastructure inspection and agriculture. For instance, drones equipped with AI can detect defects in structures, monitor crop health, and assess environmental changes with minimal human intervention. The seamless integration of AI also supports predictive maintenance in industries, reducing downtime and extending the lifespan of assets. This technological synergy has opened up new possibilities for drones, positioning them as essential tools for modern industry applications.

Global Drone Services Market Challenges and Restraints:

Regulatory Hurdles and Airspace Management Issues is restricting market growth: One of the most significant challenges facing the drone services market is navigating complex regulatory environments. Governments worldwide have imposed stringent regulations to ensure the safe operation of drones in commercial and public airspaces. These regulations often include restrictions on flight paths, altitudes, and the need for licenses or certifications, which can hinder the widespread adoption of drone services. For example, in some regions, obtaining permission for drone operations is a time-consuming process, requiring multiple clearances from aviation authorities. The lack of standardized global regulations also poses a problem for companies operating in multiple countries, as they need to adapt to each region's unique rules. Additionally, concerns about air traffic management and the integration of drones into controlled airspaces remain a challenge. Authorities and technology developers must collaborate to establish air traffic control systems that can accommodate both manned and unmanned aircraft safely.

Technical Limitations and Battery Life Concerns is restricting market growth: Despite advancements in drone technology, limitations such as short battery life and payload capacity continue to restrict their broader application. Most commercial drones currently on the market can only operate for 20-30 minutes on a single charge, limiting their use for extended missions or in remote areas where recharging is not feasible. While progress is being made in battery technology, with developments such as hydrogen fuel cells and solar-powered drones, these solutions are still in the early stages of commercialization. Payload limitations also restrict drones from carrying heavier equipment, which can be a constraint for specific applications such as firefighting, large-scale deliveries, or industrial inspections. These technical limitations necessitate continuous investment in R&D to enhance battery life, payload capacity, and the overall efficiency of drones. Until these challenges are resolved, certain applications will remain reliant on traditional methods or hybrid solutions.

Market Opportunities

The drone services market is brimming with opportunities as new applications and technological advancements continue to emerge. One significant opportunity lies in the field of disaster management and humanitarian aid. Drones can play a pivotal role in providing quick, real-time data and delivering essential supplies to areas affected by natural disasters or conflicts. Equipped with thermal cameras and advanced sensors, drones can be used to search for survivors and assess damage in hard-to-reach areas, offering a significant advantage over traditional methods. The agricultural sector also presents lucrative opportunities for drone services, particularly with the growing demand for precision agriculture solutions. Drones equipped with multispectral and thermal sensors can monitor crop health, optimize irrigation practices, and assess soil conditions, helping farmers improve yield and reduce waste. Additionally, the increasing focus on environmental monitoring and conservation has opened avenues for drone services in tracking wildlife, monitoring deforestation, and conducting pollution assessments. The rise of smart cities and the push for infrastructure development further amplify the demand for drones in urban planning, surveillance, and maintenance operations. Companies that can develop specialized, high-endurance drones and offer tailored solutions for niche applications stand to gain a competitive edge in the evolving market landscape.

DRONE SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

17.3% |

|

Segments Covered |

By Service Type, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DJI, Parrot Drones, Aerodyne Group, Terra Drone Corporation, PrecisionHawk, DroneDeploy, Flytrex SkySpecs, Wingcopter, Aerialtronics, Altitude Angel, Zipline International Inc., Kespry Inc., EHANG Holdings Limited, Cyberhawk Innovations Ltd. |

Drone Services Market Segmentation: By Service Type

-

Aerial Photography and Videography

-

Inspection and Monitoring

-

Mapping and Surveying

-

Drone Delivery Services

-

Precision Agriculture

-

Emergency Services

Inspection and monitoring services are the most dominant segment in the drone services market, largely due to their extensive use in the energy, utilities, and infrastructure sectors. These applications require frequent, detailed assessments of assets and conditions that drones can perform efficiently, saving both time and labor costs.

Drone Services Market Segmentation: By End-Use Industry

-

Construction and Infrastructure

-

Agriculture

-

Energy and Utilities

-

Media and Entertainment

-

Logistics and Warehousing

-

Healthcare and Emergency Services

The construction and infrastructure sector holds the leading position in the industry application segment. Drones are used for site surveys, progress tracking, and safety inspections, providing a high return on investment due to their ability to reduce time-consuming manual tasks and enhance accuracy.

Drone Services Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the dominant region in the global drone services market, driven by strong adoption across commercial and governmental sectors. The United States, in particular, has been at the forefront, investing heavily in drone technology for both civilian and defense purposes. The region benefits from a well-established regulatory framework that facilitates the use of drones for a variety of applications. Companies in North America are leading the way in integrating advanced technologies, such as AI and machine learning, into drone systems, which further supports their widespread use. The region’s extensive use of drones in industries such as media, construction, and agriculture has cemented its leading position. Additionally, significant investments in R&D and partnerships with tech companies to develop sophisticated drone solutions continue to propel market growth in North America.

COVID-19 Impact Analysis on the Drone Services Market

The COVID-19 pandemic had a profound impact on the drone services market, leading to both challenges and opportunities. During the initial stages of the pandemic, the market faced disruptions due to supply chain issues and the temporary halt of operations in industries that rely on drones, such as construction and manufacturing. However, as the pandemic continued, drones emerged as valuable tools in responding to the crisis. Governments and healthcare organizations utilized drones for various applications, including the delivery of medical supplies, broadcasting public health messages, and monitoring public spaces to ensure compliance with social distancing regulations. The pandemic accelerated the adoption of drones for delivery services, especially in areas where lockdowns and restrictions limited traditional logistics operations. Additionally, the need for contactless solutions boosted the demand for drone services in the food delivery and e-commerce sectors. The long-term impact of the pandemic has reinforced the importance of drones in enhancing operational resilience and safety. Companies are now more inclined to invest in drone services as part of their contingency plans for future disruptions, further solidifying the market's growth trajectory.

Latest Trends/Developments

The drone services market is witnessing rapid development, with several trends shaping its future. One of the most notable trends is the advancement in drone swarm technology, which allows multiple drones to coordinate and perform complex tasks collaboratively. This technology has applications in military operations, large-scale monitoring, and agricultural surveys. The integration of AI and machine learning continues to be a key development, enabling drones to make autonomous decisions, improve navigation, and optimize task performance. Another trend is the rise of drone-as-a-service (DaaS) models, where businesses can outsource drone operations to specialized service providers, allowing them to leverage drone capabilities without investing in the technology directly. This trend is particularly attractive for smaller companies and industries where drone usage may be seasonal or project-based. Additionally, sustainability has become a focal point, with companies developing eco-friendly drones that use renewable energy sources such as solar power. The use of lightweight, recyclable materials in drone manufacturing is also gaining traction, aligning with global environmental goals. The increasing popularity of 5G technology is expected to enhance drone capabilities further, enabling faster data transfer and more reliable real-time communication. These trends indicate a shift towards more sophisticated, autonomous, and environmentally conscious drone services that cater to a wide range of industry needs.

Key Players:

-

DJI

-

Parrot Drones

-

Aerodyne Group

-

Terra Drone Corporation

-

PrecisionHawk

-

DroneDeploy

-

Flytrex

-

SkySpecs

-

Wingcopter

-

Aerialtronics

-

Altitude Angel

-

Zipline International Inc.

-

Kespry Inc.

-

EHANG Holdings Limited

-

Cyberhawk Innovations Ltd.

Chapter 1. Drone Services Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Drone Services Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Drone Services Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Drone Services Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Drone Services Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Drone Services Market – By Service Type

6.1 Introduction/Key Findings

6.2 Aerial Photography and Videography

6.3 Inspection and Monitoring

6.4 Mapping and Surveying

6.5 Drone Delivery Services

6.6 Precision Agriculture

6.7 Emergency Services

6.8 Y-O-Y Growth trend Analysis By Service Type

6.9 Absolute $ Opportunity Analysis By Service Type, 2024-2030

Chapter 7. Drone Services Market – By End-Use Industry

7.1 Introduction/Key Findings

7.2 Construction and Infrastructure

7.3 Agriculture

7.4 Energy and Utilities

7.5 Media and Entertainment

7.6 Logistics and Warehousing

7.7 Healthcare and Emergency Services

7.8 Y-O-Y Growth trend Analysis By End-Use Industry

7.9 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 8. Drone Services Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Service Type

8.1.3 By End-Use Industry

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Service Type

8.2.3 By End-Use Industry

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Service Type

8.3.3 By End-Use Industry

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Service Type

8.4.3 By Service Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Service Type

8.5.3 By End-Use Industry

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Drone Services Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 DJI

9.2 Parrot Drones

9.3 Aerodyne Group

9.4 Terra Drone Corporation

9.5 PrecisionHawk

9.6 DroneDeploy

9.7 Flytrex

9.8 SkySpecs

9.9 Wingcopter

9.10 Aerialtronics

9.11 Altitude Angel

9.12 Zipline International Inc.

9.13 Kespry Inc.

9.14 EHANG Holdings Limited

9.15 Cyberhawk Innovations Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Drone Services Market was valued at USD 12 billion in 2023 and is projected to reach USD 36.6 billion by 2030, growing at a CAGR of 17.3% from 2024 to 2030.

Key drivers include the growing demand for efficient data collection, expansion of drone applications in delivery services, and advancements in drone technology with AI integration.

The market is segmented by type of service (aerial photography, inspection, mapping, drone delivery, precision agriculture, emergency services) and industry (construction, agriculture, energy, media, logistics, healthcare).

North America is the most dominant region, driven by widespread adoption in commercial and government sectors, advanced regulatory frameworks, and strong technological infrastructure.

Leading players include DJI, Parrot Drones, Aerodyne Group, Terra Drone Corporation, PrecisionHawk, DroneDeploy, Flytrex, SkySpecs, and Zipline International Inc., among others.