North America Agricultural Pheromones Market Size (2022 – 2030)

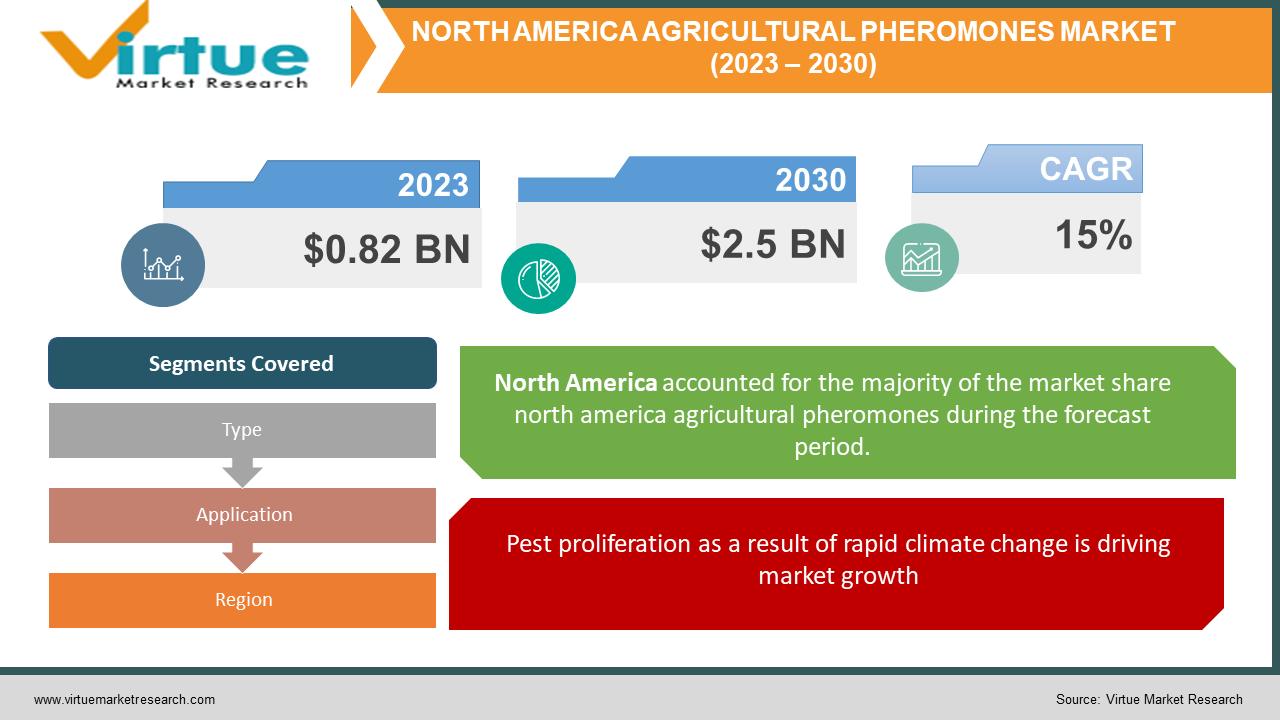

The North American Agricultural Pheromones Market is estimated to be worth USD 0.82 billion in 2022 and is projected to reach a value of USD 2.5 billion by 2030. The market is projected to grow with a CAGR of 15% per annum during the period of analysis (2023 - 2030).

Industry Overview

Agricultural pheromones are substances that insects often make to communicate with one another and are employed in several pest management strategies. All kinds of agricultural pheromones are now consumed more due to the growing development of pheromones and their beneficial effects on human health. The market for agricultural pheromones in North America has expanded thanks to the introduction of novel pheromone kinds.

The market for agricultural pheromones will be driven by favourable semiochemical regulations, expanding demand for environmentally friendly crop protection strategies, and rising consumption of high-value crops. Biochemical insecticides that are organic in composition and safe for the environment include semiochemicals like pheromones and allelochemicals. Semiochemicals, such as pheromones that are registered for use in the disruption of arthropod mating behaviour and other applications, have not been linked to any negative effects on human health or the environment, according to regulatory agencies like the United States Environmental Protection Agency (EPA), Canada's Pest Management Regulatory Agency (PMRA), and the regulatory authorities in the European Union. The use of pheromones and traps for monitoring purposes is generally unregulated. The market for agricultural pheromones will be driven by all of these factors during the forecast period.

Pheromone producers have been planning to provide cutting-edge, reasonably priced products for the market due to the surge in demand and preference for a clean, pest- and insect-free environment. Another significant factor propelling the agricultural pheromones industry in terms of value sales is the rise in internet usage around the world. Manufacturers and distributors utilize the internet to its fullest potential for educating potential customers about their goods and services while also generating sales money.

As a result, over the past three decades, pheromone products have been widely used in the production of high-value crops like fruits, vegetables, and cotton. Important market companies are also investing in the development of cutting-edge and novel agricultural pheromones, including trap designs, microencapsulation, and pheromones, with various ways to offer solutions for the mass capture of insects without the use of insecticides. Manufacturers who made use of cutting-edge research on the various pheromones released by major insect pests can be seen as beneficial strategies to reduce the use of insecticides. Growing market trends, like the bio-organic production of pheromone molecules by bacteria and yeasts, are anticipated to expand the market for crop protection producers.

Impact of Covid-19 on the industry

Since the COVID-19 epidemic began, consumers now choose to eat wholesome, organic foods to retain their health and boost their immunity. The use of safe, natural, clean-label, and pesticide-free products is another major industry trend that has altered the agricultural landscape. On the market's expansion, COVID-19 is estimated to have a substantial impact. In the best-case scenario, it is envisioned that the impact would be favorable, and crop protection companies are eager to purchase agricultural pheromones given the surge in consumer demand for hygienic organic products and pest- and insect-free settings. Trading will also be simpler if trade restrictions are lowered to restore economies.

Market Drivers

Pest proliferation as a result of rapid climate change is driving market growth

Plant diseases and pests are more common because of the climatic circumstances' rapid changes. Climate variability is a significant factor in agricultural output and pest vulnerability. Changing climatic circumstances make crops more vulnerable to various illnesses and pests, which reduces crop production as a whole. As a result, climate change not only causes farming practices to diverge but also lowers crop output. These elements have increased farmers' reliance on premium crop protection chemicals for efficient pest avoidance, which will drive up demand for agricultural pheromones over the coming years.

Rising consumption of high-value crops is propelling the market growth

Agricultural items with a high economic value per kilogram (or pound), per hectare, or calorie are often referred to as high-value agricultural products. These products include fruits, vegetables, meat, eggs, milk, and fish. The rise in consumer income increased urbanization, and growing knowledge of the health advantages of these high-yield crops are the main drivers of demand for high-value crops. Since the COVID-19 epidemic began, consumers now choose to eat wholesome, organic foods to retain their health and boost their immunity. The use of safe, natural, clean-label, and pesticide-free products is another major industry trend that has altered the agricultural landscape.

Market Restraints

High maintenance and production cost of agricultural pheromones is hampering the market growth

The primary goal of an integrated pest management plan is to prevent pests over the long term by putting into practice tactics like biological control, altering cultural norms, and using resistant varieties. The use of various pest control techniques along with an in-depth understanding of the pest life cycle and interactions leads to effective pest management with the least risk to human and animal health. Farmers all around the world are concentrating on such approaches as a result to reduce the environmental dangers associated with pest management.

Need for development of multi-target insect pheromone dispensers acts as a market restraint

Since pheromones are target-specific, they only affect one species while being applied. When codling moths are targeted on an apple farm by observation and trapping, other secondary pests like stink bugs may go undiscovered, which could result in greater pest outbreaks and more frequent pesticide application. This thus raises the growers' production expenses. A solution that targets many species at once must be developed to address the issue of secondary pest management. Many integrated pest control businesses find it difficult to develop multi-target pest pheromone dispensers.

NORTH AMERICA AGRICULTURAL PHEROMONES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

15% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Russell IPM, Shin-Etsu Chemical Company, Isagro S.p.A., Biobest Group, SEDQ Healthy Crops SL, ISCA Global, Suterra LLC, Provivi, Inc., Koppert Biological Systems, Pacific Biocontrol Corporation |

This research report on the north America agricultural pheromones market has been segmented and sub-segmented based on type, application and Geography & region.

North America Agricultural Pheromones Market- By Type

-

Sex pheromones

-

Aggregation pheromones

-

Other types (alarm pheromones, host-marking pheromones, and trail pheromones)

The identification and monitoring of the insect population using insect sex pheromones. Males are typically drawn to the sex pheromones that female insects generate. To do this, trap baits are created to closely resemble the chemical composition ratio and emission rates of female insects. Pheromone traps are used to find adult pest species that have spread from one area to another. These traps are used to monitor the influxes of different insect pests, such as pink bollworm, black cutworm, and gypsy moth. The traps aid in anticipating the start of a lifecycle stage in the insect population for monitoring.

North America Agricultural Pheromones Market- By Application

-

Dispensers

-

Traps

-

Sprays

Dispensers are used to apply insect pheromones to various kinds of crops at predetermined dosages. For the dispensers to be a useful source, they must be positioned at a specific height. The most typical use of dispensers is to keep an eye on insect populations in crops, food storage, and forest ecosystems. A perfect dispenser would be affordable, made of cheap organic materials that can be recycled, and toxicologically inert. Pests including codling moths, tomato pinworms, pink bollworms, and oriental fruit moths can all be successfully controlled with pheromone-based devices. Different types of pheromone dispensers exist, including passive, high emission, and retrievable polymeric pheromone dispensers as well as hollow fibres.

North America Agricultural Pheromones Market- By Geography & Region

-

The United States of America

-

Canada

-

Mexico

Due to their expanding range of uses in forestry, food, pharmaceutical, and other industrial fields in addition to agriculture, pheromones are seeing a rise in popularity in North America. The US Forest Service uses a formulation made by ISCA to manage noctuid moths on row crops because it prevents the gypsy moth from mating. Cotton, tomatoes, grapes, corn, pome fruits, and stone fruits are some of the major agricultural crops farmed in the area. The pink bollworm, leaf miner, codling moth, and berry moth are just a few of the insect species that can damage these crops. Pheromones are employed to prevent mating in North America.

North America Agricultural Pheromones Market- By Companies

-

Russell IPM

-

Shin-Etsu Chemical Company

-

Isagro S.p.A.

-

Biobest Group

-

SEDQ Healthy Crops SL

-

ISCA Global

-

Suterra LLC

-

Provivi, Inc.

-

Koppert Biological Systems

-

Pacific Biocontrol Corporation

NOTABLE HAPPENINGS IN THE NORTH AMERICA AGRICULTURAL PHEROMONES MARKET IN THE RECENT PAST:

- Business Collaboration: - In 2021, Arugga received funding from Biobest Group NV in order to sell their pollination robots in the US and Canada. The partnership will assist Biobest in continuing to be the world's most dependable supplier of solutions for pollination and biological management for growers.

- Business Agreement: - In 2020, With the help of a contract inked between Bom Futuro and ISCA Technologies, soybeans, cotton, corn, and other significant row crops will now have access to pheromone- and semiochemical-based insect treatments that are safe for the environment. The business's presence in Latin America will grow as a result.

- Merger & Acquisition: - In 2020, The ownership of California's Beneficial Insectary Inc. was purchased by Biobest Group NV. The acquisition will enable Biobest Group NV to meet the biocontrol and pollination demands of growers of high-value crops globally.

- Merger & Acquisition: - In 2019, In order to leverage on 25 years of extensive research and development of ecologically safe pest control technologies that would be essential to the sustainability of global agriculture, ISCA Technologies (US), ISCA Tecnologias, Ltda. (Brazil), and ATGC Biotech (India) amalgamated. This combination contributes to the global market launch of the next generation of pest control.

Chapter 1. North America Agricultural Pheromones Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Agricultural Pheromones Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. North America Agricultural Pheromones Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. North America Agricultural Pheromones Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. North America Agricultural Pheromones Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Agricultural Pheromones Market – By Type

6.1. Sex Pheromones

6.2. Aggregation Pheromones

6.3. Other Types (alarm pheromones, host-marking pheromones, and trail pheromones)

Chapter 7. North America Agricultural Pheromones Market – By Application

7.1. Dispensers

7.2. Traps

7.3. Sprays

Chapter 8. North America Agricultural Pheromones Market- By Region

8.1. The United States of America

8.2. Canada

8.3. Mexico

Chapter 9. North America Agricultural Pheromones Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Russell IPM

9.2. Shin-Etsu Chemical Company

9.3. Isagro S.p.A.

9.4. Biobest Group

9.5. SEDQ Healthy Crops SL

9.6. ISCA Global

9.7. Suterra LLC

9.8. Provivi, Inc.

9.9. Koppert Biological Systems

9.10. Pacific Biocontrol Corporation

Download Sample

Choose License Type

2500

3400

3900

4600