Home Health Tech Market Size (2024 – 2030)

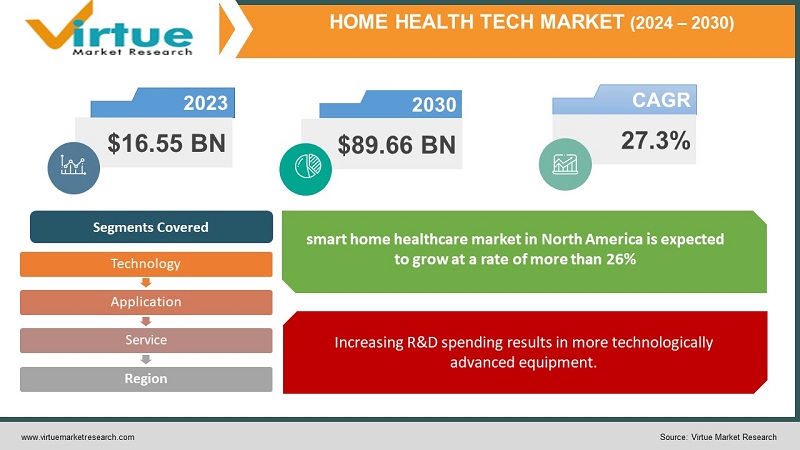

The Global Home Health tech Market was valued at USD 16.55 billion and is projected to reach a market size of USD 89.66 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 27.3%. The growing popularity of IoT devices encourages smart home healthcare market players to concentrate on developing such goods. The possibility of providing healthcare services in a smart home is growing alongside this trend.

Market Overview

During the projected period, the smart home healthcare market will be driven by rising demand for Internet-of-Things (IoT) in home healthcare. IoT technology integrates a variety of devices and systems, such as actuators, sensors, computers, appliances, and smartphones, to create a highly distributed intelligent system that can communicate with humans and other devices. IoT applications in-home healthcare will benefit from advancements in communication and processing technologies, as well as improved, low-cost actuators, sensors, and electrical components. IoT in healthcare, combined with integrated e-health and assisted living technologies, has the potential to revolutionise the healthcare system for the aged, boosting the growth of the smart home healthcare market.

Home healthcare technological improvements will have a beneficial impact rendering factor. The industry's focus on developing technologically advanced and innovative smart home healthcare products will help the industry thrive. However, patient health security and privacy concerns may stymie the smart home healthcare market growth over the projection period.

The portability and distribution of electronic patient records across the burgeoning home healthcare professionals provide a considerable health data risk to hackers, resulting in violations of the Health Insurance Portability and Accountability Act (HIPAA). Operators/device manufacturers and service providers in the smart home healthcare industry could face significant penalties and fines for such infractions. As home healthcare technology advances, providers and their parent businesses must weigh possible hazards against the benefits of new technologies.

Connected health and RPM (remote patient monitoring) became more prevalent during the COVID-19 epidemic. These tools and services allowed doctors to keep track of patients without having to touch them, avoiding the spread of the new coronavirus. This helped them by providing more bed space for individuals with serious illnesses. . Even in the post-pandemic era, hospitals have been aggressively pushing the use of linked health and RPM and fostering the same toward establishing a smart home healthcare lifestyle.

COVID-19 impact on Home Health Tech Market

The impact of the COVID-19 pandemic on the home healthcare business is ambiguous. Both products and services in the home healthcare sector have various consequences. COVID-19 has the potential to improve a variety of home healthcare monitoring devices, including blood glucose monitors, blood pressure monitors, pulse oximeters, and temperature monitors.

Because of the coronavirus pandemic, one may assume that the home healthcare service industry would thrive, as providers would be able to treat the weak and elderly population in the comfort of their own homes. The situation, however, is different. Many home health businesses and providers have experienced a drop in business. However, this slump in the home healthcare market is only expected to last a short time, since the industry is expected to grow up faster in the future as more patients recover from COVID-19.

MARKET DRIVERS:

The market is growing due to the rapid rise of the older population and the rising frequency of chronic diseases.

As the ageing population becomes more susceptible to chronic diseases, the demand for healthcare will rise, putting a greater strain on governments and healthcare systems. This will be beneficial to the home healthcare business. Home healthcare cuts down on unnecessary hospital admissions and readmissions, as well as the time and money spent commuting to see doctors.

Chronic illness is a disorder that can be managed but not cured over time. Chronic sickness treatment and management have become a serious concern. About half of all home healthcare patients have at least one chronic illness, and this percentage is anticipated to rise in the future. Chronic diseases, which disproportionately impact older people, cause disability, lower quality of life, and raise long-term care expenditures, creating a slew of opportunities for home healthcare providers.

Increasing R&D spending results in more technologically advanced equipment.

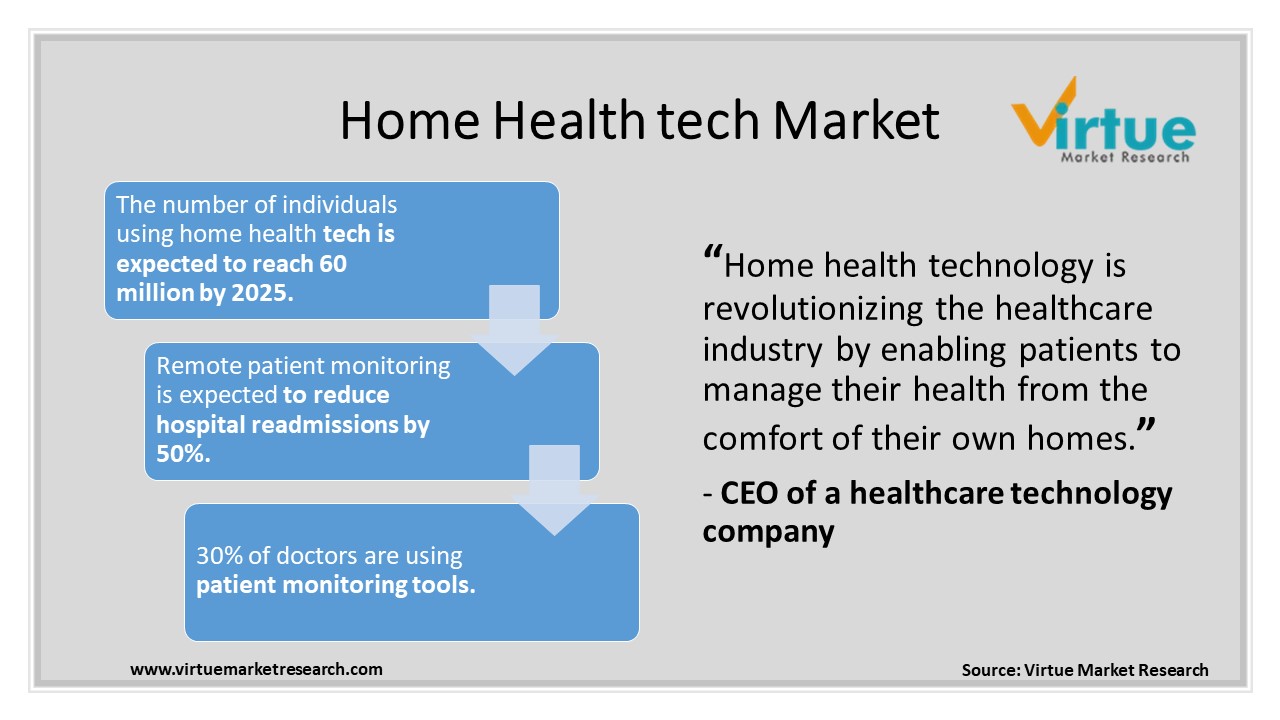

Newer technology has substantially improved the present communication flow between patients and healthcare providers, allowing for better, faster, and more effective care. Remote patient monitoring, for example, is based on the successful integration of medical devices and information and communication technology (ICT) into healthcare delivery over great distances. Physicians can share patient information with other doctors to give more efficient treatment to their patients. Patients can access their medical information and track medical issues in addition to healthcare providers. Patients can communicate their health state to medical practitioners by measuring their heart rate, blood pressure, and blood sugar levels.

Healthcare gadgets have become more portable, user-friendly, and handy for patients at home or on the go thanks to technological improvements. The efficacy of new technology in-home healthcare, as well as its ease of use and comfort, has sparked patient interest in this field.

MARKET RESTRAINTS

Patient safety concerns are limiting market expansion.

The nurse-physician relationship in in-home care involves less face-to-face contact, and the nurse is in charge of completing assessments and communicating findings. This variable has an impact on patient safety and results. Another feature of home healthcare is that professionals provide medical care to each patient in their location. Situational variables, on the other hand, may provide dangers to patients that are difficult to eliminate. Environmental safety departments in hospitals are well-equipped to handle such situations.

Insurance coverage is limited which is hampering the market growth

Although most North American countries support home healthcare services, the insurance coverage is limited to Medicare-certified home healthcare businesses. Insurance does not cover remote monitoring equipment, telemetric devices, rehabilitative equipment, or multiparameter monitors. Along with North American countries, European countries' insurance coverage for this equipment is likewise inconsistent. Home healthcare treatments are only covered by insurance in Asian nations like India if they are post-hospitalization therapies; in-home treatments for geriatric and chronic conditions are not covered. However, the rates for these plans are nearly three times that for standard health insurance. Insurance does not cover products for home healthcare in nations like Israel and China. As a result, limited insurance coverage of home healthcare products and services in all countries except North America may limit the market's growth.

HOME HEALTH TECH MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

27.3% |

|

Segments Covered |

By Technology, Service, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Apple, Companion Medical, F. Hoffmann-La Roche, General Electric Company, Google, Health Care Originals, Hocoma,Medical Guardian,Medtronic, Proteus Digital Health,Samsung Electronics, VitalConnect, Zanthion |

This research report is based on the home health tech market segmented by technology, service, application and region.

home health tech market - by Technology

-

Wired

-

Wireless

Based on technology, the market is segmented into wired and wireless technology.

Over the analysed period, the wireless segment is expected to rise by over 28.5 per cent. Growth prospects will be created by industry players focusing on the development of technologically advanced compact mobile devices that are connected via Bluetooth to portable communication and computing devices such as tablets and smartphones.

In 2021, the wired category had a revenue share of roughly 41% and is expected to expand significantly by 2030. Segmental growth is boosted by the requirement of wiring for the installation of smart home healthcare gadgets that run on batteries or require a wi-fi connection to operate.

home health tech market - by Service

-

Installation and Repair

-

Renovation

-

Customization

Based on service, the market is segmented into (Installation and Repair, Renovation and Customization. The installation and repair segment generated over USD 4 billion in 2021 and is expected to increase at a similar rate in the next years. The growing demand for technologically advanced smart home healthcare equipment would increase the demand for efficient installation and repair by qualified specialists, boosting segmental growth.

The renovation and customisation market accounted for a significant revenue share in 2021 and is expected to grow at a rate of over 27.5 per cent during the study period. Increased investment in R&D efforts has resulted in the development of innovative goods as well as upgrades to existing smart home healthcare equipment, resulting in segment growth.

home health tech market - by Application

-

Fall Prevention and Detection

-

Health Status Monitoring

-

Nutrition or Diet Monitoring

-

Memory Aids

Based on application, the market is segmented by Fall Prevention and Detection, Health Status Monitoring, Nutrition or Diet Monitoring and Memory Aids. The fall prevention and detection category accounted for over 41% of total revenue in 2021 and is expected to rise significantly during the projection period. The increasing number of accidents or injury cases around the world is attributable to segment expansion. The growing use of automatic fall monitoring devices will help businesses expand.

Due to rising awareness of personal health monitoring, the health status monitoring segment was valued at over USD 1.5 billion in 2021. The need for health status monitoring devices, which gather and monitor data and alert medical experts when necessary, is increasing, resulting in segmental growth.

Home health tech market - by region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

Throughout the study, the smart home healthcare market in North America is expected to grow at a rate of more than 26%. The primary reason driving demand for smart home devices is the rising prevalence of chronic diseases as a result of lifestyle changes and improper food habits. Increased healthcare spending, combined with the strong presence of major industry participants in North America, will propel the home healthcare tech sector forward.

In 2021, the Asia Pacific smart home healthcare industry was worth around USD 1 billion in revenue. Growing awareness of new and advanced smart home-based wireless gadgets is credited with regional growth. Furthermore, the region's vast patient pool, as well as expanding IT investments in the healthcare industry, will propel the Asia Pacific smart home healthcare market forward. In the Asia Pacific healthcare market, the digital revolution and explosion of IoT devices aim to modernise healthcare delivery. Furthermore, manufacturers have been supplying effective and economical solutions for Asian smart homes all over the world. Taiwan, South Korea, and Singapore are three Asian countries with excellent data connectivity. Furthermore, as the number of high-income households grows, smart home adoption is projected to increase.

Home health tech market by company:

The market for smart home healthcare has consolidated. To grow market share and profitability, the companies are releasing new goods and employing innovative joint activities.

-

Apple

-

Companion Medical

-

F. Hoffmann-La Roche

-

General Electric Company

-

Google

-

Health Care Originals

-

Hocoma

-

Medical Guardian

-

Medtronic

-

Proteus Digital Health

-

Samsung Electronics

-

VitalConnect,

-

Zanthion

In August 2021 - Eight Sleep, a sleep fitness firm based in New York, raised USD 86.0 million for its smart mattress and sleep fitness technology, with valuations approaching USD 500.0 million. Eight Sleep has now raised a total of USD 150.0 million through Series C. The founder's fund spearheaded the investment, which raised the company's total equity fund, with Craft Ventures, Y Combinator, and others joining in. The cash raised will be used to double the company's workforce, extend its retail footprint, and increase its R&D spending.

NOTABLE HAPPENINGS IN THE HOME HEALTH TECH MARKET IN THE RECENT PAST:

PRODUCT LAUNCH:

-

In December 2021, Fresenius Medical Care, a leading provider of products and services for people with kidney disease, announced the introduction of Carrie. In the Asia Pacific area, our custom-built mobile app connects, informs, and supports Fresenius Kidney Care nurses and clinical teams.

-

In August 2021, With the Awair Home app, Awair Inc. announced the availability of Awair AQI Maps, a new way to compare indoor and outdoor PM2.5 (particulate matter). While Awair's product offering concentrates on real-time interior air quality monitoring, it acknowledges the necessity of knowing the indoor-outdoor link

PARTNERSHIP AND COLLABORATIONS

-

In September 2021, Medtronic PLC and Stasis Health Private Limited, a wholly-owned subsidiary of Stasis Labs Inc, established a strategic alliance to grow and expand access to the state-of-the-art Stasis Monitor, a networked multi-parameter bedside monitoring device. This relationship is a solid strategic fit, leveraging both firms' strengths to significantly increase Stasis' reach across India while also improving Medtronic's position in remote monitoring.

Chapter 1.Home health tech Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.Home health tech Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-16 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.Home health tech Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.Home health tech Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Home health tech Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.Home health tech Market – By Technology

6.1. Wired

6.2. Wireless

Chapter 7.Home health tech Market – By Service

7.1. Installation and Repair

7.2. Renovation

7.3. Customization

Chapter 8.Home health tech Market – By Application

8.1. Fall Prevention and Detection

8.2. Health Status Monitoring

8.3. Nutrition or Diet Monitoring

8.4. Memory Aids

Chapter 9.Home health tech Market – By Region

9.1. North America

9.2. Europe

9.3. The Asia Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10.Home health tech Market – key players

10.1. Apple

10.2. Companion Medical

10.3. F. Hoffmann-La Roche

10.4. General Electric Company

10.5. Google

10.6. Health Care Originals

10.7. Hocoma

10.8. Medical Guardian

10.9. Medtronic

10.10. Proteus Digital Health

10.11. Samsung Electronics

10.12. VitalConnect

10.13. Zanthion

Download Sample

Choose License Type

2500

4250

5250

6900