Phosphate Market Size (2024 - 2030)

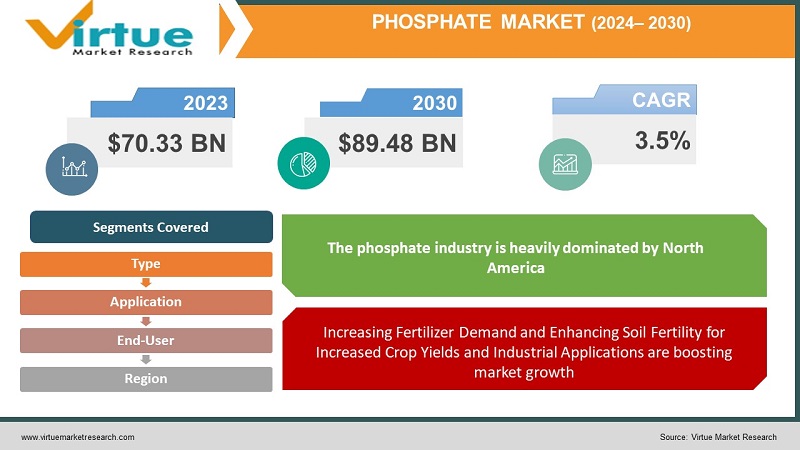

In 2023, the Global Phosphate Market was valued at $70.33 billion, and is projected to reach a market size of $89.48 billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 3.5%.

The term "phosphate market" refers to the world market for phosphate minerals, which are phosphorus-containing natural substances. Because of their desirable qualities and adaptability, phosphoric acids are fundamental resources employed in a wide range of industries and applications. Phosphates are mostly utilized as fertilizers in agriculture to promote plant development and increase agricultural yields. They are frequently applied to soils to restore phosphorus levels and offer the crucial phosphorus nutrient required for plant growth. The world's greatest user of phosphates is the agriculture industry. Phosphates are used in a variety of different sectors. Phosphates are utilized as food additives in the food industry for several functions, including increasing flavor, improving texture, and serving as preservatives. Phosphates are used in wastewater treatment procedures in the water treatment industry to prevent the formation of scale and lessen corrosion. Phosphates are also utilized in the creation of phosphoric acid, detergents, animal feed additives, and industrial chemicals. The size and dynamics of the phosphate market are impacted by several variables, including population expansion, agricultural practices, need for food production, environmental laws, and industrial development. The demand, supply, and cost of phosphate minerals on the world market can all be impacted by changes in these variables.

Global Phosphate Market Drivers:

Increasing Fertilizer Demand and Enhancing Soil Fertility for Increased Crop Yields and Industrial Applications are boosting market growth:

Fertilizer manufacture, especially phosphate-based fertilizers, makes extensive use of phosphates. Growing agricultural operations have fuelled demand for fertilizers and, ultimately, phosphate products due to the growing global population and rising food consumption. Phosphates are essential for improving soil fertility and encouraging strong plant development. They offer vital minerals, like phosphorus that are important for plant growth and higher agricultural harvests. The need for phosphates as a soil supplement is always rising as farmers try to increase output. Phosphates are used in a wide range of industrial processes, including those that produce detergents, water purifiers, animal feed, and other chemicals. The requirement for phosphates in various applications expands as industrial sectors develop and consumer demand rises, propelling market expansion. Housing, infrastructure, and consumer products are in higher demand as a result of urbanization and rapid population expansion. Phosphates are used to make a variety of consumer items, including detergents, toothpaste, and flame retardants, as well as building materials like cement and plasterboard. The rising demand for phosphates in these industries is largely attributed to the growing urban population.

Technological Advancements and Emerging Markets Fuelling Growth in the Phosphate Industry:

Globally, governments are enacting laws and policies to support environmentally sound resource management, sustainable agriculture, and environmental preservation. These programs frequently stress the correct use of fertilizers and promote the use of phosphate-based products with minimal negative environmental effects. By influencing fertilizer selection and promoting phosphate product innovation, these laws can promote market growth. The development of novel technologies and procedures to enhance phosphate extraction, production effectiveness, and product performance is the subject of ongoing research and development. The development of novel phosphate-based products, cost reductions, and expanded manufacturing capacity brought on by technological improvements can boost market growth and competitiveness. Rapid economic expansion in developing nations has boosted agricultural production and accelerated industrialization. The need for phosphates is expanding as these areas work to fulfill the increasing demand for food and consumer products. Significant prospects exist in emerging markets for phosphate suppliers and manufacturers.

Global Phosphate Market Challenges:

The principal source of phosphates, phosphate rock, is a limited resource, and there are fewer and fewer high-quality deposits left. As mining operations continue, it becomes harder to access commercially viable resources, which raises costs and might result in future supply shortages. Environmentally harmful effects from phosphate mining and fertilizer production operations include habitat destruction, water pollution, and greenhouse gas emissions. To lessen these consequences, governments and regulatory agencies are enacting stronger environmental laws, which might limit the spread of phosphate plants and raise the cost of compliance. The phosphate market is subject to price swings caused by variables including shifts in the world's demand for fertilizer, interruptions in supply, and currency exchange rates. Both producers and consumers are challenged by price volatility, which makes it challenging to efficiently plan and manage production costs and pricing strategies. Alternative fertilizers, such as those based on nitrogen and potassium as well as organic and bio-based fertilizers, compete with phosphate-based fertilizers. While technology developments spur market expansion, the sector must also overcome the difficulty of properly applying new technologies. It may be expensive and time-consuming to update current infrastructure and production methods to integrate new technology.

COVID-19 Impact on Global Phosphate Market:

The phosphate sector, like many other industries, had delays in the world's supply chains as a result of travel bans, lockdown procedures, and a shortage of labor. Production and delivery timelines were impacted as a result of the delays in phosphate product distribution and transportation. There were swings in the demand for phosphate goods as a result of the pandemic's effects on many industries, including agriculture and construction. Global trade disruptions decreased consumer spending, and future uncertainty led to changes in consumer behavior and decreased demand in some regions. During the epidemic, the price of phosphate fluctuated. Phosphate prices were impacted by fluctuating demand, supply chain problems, and economic uncertainty on a worldwide scale. The management of expenses and production planning was made difficult by price unpredictability for both consumers and companies. During the pandemic, the agriculture industry, a significant consumer of phosphate-based fertilizers, suffered difficulties. Planting and fertilization activities were impacted, which in turn hampered the demand for phosphates. These factors included disruptions in farming operations, restricted access to agricultural supplies, and manpower shortages.

Global Phosphate Market Recent Developments:

-

In October 2022, in the agricultural sector, Nutrien has been actively involved in promoting sustainable methods. The firm has established objectives to improve fertilizer management, lower greenhouse gas emissions, and promote sustainable agricultural methods. These programs follow the global trend of conserving the environment and using fertilizers responsibly.

-

In July 2022, Agrium may have kept enhancing its phosphate fertilizer product line to cater to the distinct requirements and tastes of farmers and agricultural markets. This can entail creating novel formulations, boosting nutritional content, or increasing product functionality.

-

In August 2022, to improve its capacity for producing phosphate, OCP Group has been working on several expansion projects. The Jorf Lasfar complex in Morocco, which entails the creation of new manufacturing units and the refurbishment of existing facilities, is one of the key projects. With this development, the Group hopes to better its position in the worldwide market and satisfy the rising phosphate demand.

PHOSPHATE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4% |

|

Segments Covered |

By Type, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nutrien Ltd., The Mosaic Company, OCP Group, PhosAgro, EuroChem Group AG, Israel Chemicals Ltd., Jordan Phosphate Mines Co. PLC, Ma'aden (Saudi Arabian Mining Company), Yara International ASA, SQM (Sociedad Química y Minera de Chile) |

Global Phosphate Market Segmentation: By Type

-

Diammonium Phosphate (DAP)

-

Monoammonium Phosphate (MAP)

-

Superphosphate

-

Triple Superphosphate (TSP)

-

Ammonium Phosphate

-

Others

A common phosphate-based fertilizer is DAP. It is ideal for a variety of crops and soil types because of its high nitrogen and phosphorus content. Another widely used phosphate-based fertilizer is MAP. It is renowned for its capacity to promote early plant growth and root development and for having a balanced nitrogen and phosphorus content. A phosphate fertilizer called superphosphate is created by processing phosphate rock with sulfuric acid. Compared to DAP and MAP, it normally has a lower phosphorus concentration, but it is prized for its quick availability of nutrients to plants. TSP is a phosphate fertilizer that is highly concentrated and has a greater phosphorus content than superphosphate. It is frequently used in areas with alkaline soils and for crops with high phosphorus requirements. Products like mono ammonium phosphate (MAP) and diammonium phosphate (DAP) are examples of ammonium phosphate fertilizers. They give plants both nitrogen and phosphorus, fostering wholesome development and output. DAP was the most commonly used type of phosphate in 2022.

Global Phosphate Market Segmentation: By Application

-

Fertilizers

-

Animal Feed and Nutrition

-

Food and Beverages

-

Water Treatment

-

Detergents and Cleaners

-

Flame Retardants

-

Others

Phosphates are frequently used in agriculture as fertilizers to give crops vital nutrients, notably phosphorus. They promote crop yields, plant growth, and overall agricultural production. Applications for both large- and small-scale farming are covered in this part. Phosphates are required for skeletal growth, energy metabolism, and general growth in animals, making them an important part of their diet. To guarantee correct phosphorus levels and maximize animal health and production, phosphate-based additives are added to animal feed. Applications for feed used in cattle, poultry, aquaculture, and pets are included in this sector. There are several uses for phosphorus in the food and beverage sector. They serve as emulsifiers, pH regulators, preservatives, and food additives. Phosphates help with food safety and shelf life extension while enhancing food texture and taste stability. Applications in processed foods, dairy goods, bread items, drinks, and meat processing are all included in this area.

Global Phosphate Market Segmentation: By End-User

-

Agriculture

-

Pharmaceuticals

-

Personal Care

-

Others

The major end market for phosphate products is agriculture. To supply vital elements, particularly phosphorus, for plant development and agricultural production, phosphates are utilized as fertilizers. This covers a wide range of crops, including grains, fruits, vegetables, and oilseeds. Due to their ability to re-mineralize teeth, phosphates are employed in the pharmaceutical sector as excipients in the formulation of drugs and oral care products like toothpaste. Detergents and cleansers, notably those used in laundry and dishwashing, are made with phosphoric acid. They aid in removing dirt from water, softening it, and enhancing cleaning performance. They are used to make flame retardants, polish metal, make ceramics and glass, and function as catalysts in chemical processes. One important phosphate derivative, phosphoric acid, is used to make industrial chemicals, food additives, and fertilizers.

Global Phosphate Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

Middle East and Africa

-

South America

The phosphate industry is heavily dominated by North America, with an emphasis on agricultural applications, animal feed, and industrial uses. The area is well-known for both its extensive phosphate mining activities and its cutting-edge farming techniques. The area has a thriving agriculture industry and a high need for phosphate fertilizers. Sustainable agricultural methods and the usage of phosphate-based products in industrial and water treatment applications are also becoming more and more important. The need for phosphate fertilizers is driven by the region's substantial agricultural activity and huge population. The phosphate market is expanding as a result of nations like China and India's rapid urbanization and industrialization. Significant phosphate deposits are located in the Middle East and Africa, notably Saudi Arabia, the United Arab Emirates, and South Africa. The mining and manufacture of phosphate are extremely important to the economies of several nations in this region. The Middle East and Africa's phosphate markets provide both home and foreign demand.

Global Phosphate Market Key Players:

-

Nutrien Ltd.

-

The Mosaic Company

-

OCP Group

-

PhosAgro

-

EuroChem Group AG

-

Israel Chemicals Ltd.

-

Jordan Phosphate Mines Co. PLC

-

Ma'aden (Saudi Arabian Mining Company)

-

Yara International ASA

-

SQM (Sociedad Química y Minera de Chile)

Chapter 1. Phosphate Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Phosphate Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Phosphate Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Phosphate Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Phosphate Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Phosphate Market - By Type

6.1 Diammonium Phosphate (DAP)

6.2 Monoammonium Phosphate (MAP)

6.3 Superphosphate

6.4 Triple Superphosphate (TSP)

6.5 Ammonium Phosphate

6.6 Others

Chapter 7. Phosphate Market - By Application

7.1 Fertilizers

7.2 Animal Feed and Nutrition

7.3 Food and Beverages

7.4 Water Treatment

7.5 Detergents and Cleaners

7.6 Flame Retardants

7.7 Others

Chapter 8. Phosphate Market - By End-User

8.1 Agriculture

8.2 Pharmaceuticals

8.3 Personal Care

8.4 Others

Chapter 9. Phosphate Market - By Region

9.1 North America

9.2 Europe

9.3 Asia-Pacific

9.4 Rest of the World

Chapter 10. Phosphate Market - Key Players

10.1 Nutrien Ltd.

10.2 The Mosaic Company

10.3 OCP Group

10.4 PhosAgro

10.5 EuroChem Group AG

10.6 Israel Chemicals Ltd.

10.7 Jordan Phosphate Mines Co. PLC

10.8 Ma'aden (Saudi Arabian Mining Company)

10.9 Yara International ASA

10.10 SQM (Sociedad Química y Minera de Chile)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

In 2023, the Global Phosphate Market was valued at $70.33 billion, and is projected to reach a market size of $89.48 billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 3.5%.

The Global Phosphate Market is driven by the Increasing Population and Food Demand, Government Support and Regulations, Water Treatment and Environmental Applications, and Growing Demand for Animal Feed.

The Segments under the Global Phosphate Market by the application are Fertilizers, Animal Feed and Nutrition, Food and Beverages, Water Treatment, Detergents and Cleaners, Flame Retardants, and Others.

China, Japan, South Korea, Singapore, and India are the most dominating countries in the Asia Pacific region for the Global Phosphate Market.

Nutrien Ltd., The Mosaic Company, and OCP Group are the three major leading players in the Global Phosphate Market.