Global Automotive Lubricants Market Size (2024 – 2030)

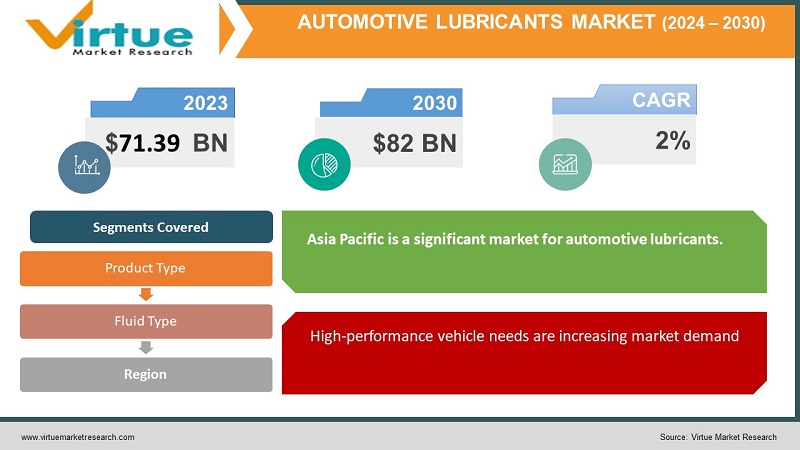

According to our research report, the Global automotive lubricants market was valued at USD 71.39 billion and is projected to reach a market size of USD 82 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 2%.

Industry Overview

Growing demand for lightweight and high-performance cars in emerging nations like China and India, as well as rising disposable income globally, are projected to drive market expansion. Engine oil is expected to expand at a quick rate due to increased passenger vehicles per 1,000 population, increased mobility due to urbanization, rising per capita income, rising ambition to own a vehicle, and increased demand for goods carriers from small and medium-sized businesses.

Engine oils are frequently used in engines to prevent corrosion, wear and tear, and to minimize friction. With diesel engines accounting for the vast bulk of engine output, there is an increasing demand for motor oils with shear resistance and a particular viscosity index. Over the projection period, this tendency is likely to supplement the market growth. Lubricants are created by combining base oil and additives sourced from petroleum sources such as crude oil, shale oil, and CBM. These are processed further to provide mineral oils such as paraffinic oils, naphthenic oils, and aromatic oils. These oils, when combined with additives, produce lubricants that are used in automobiles.

The sector has seen a raw material supply bottleneck as crude oil inventories have depleted. To overcome this barrier, major oil firms have begun to focus on creating alternative refining processes and sources. This tendency has resulted in the creation of proprietary refining methods that are only available to established corporations and their partnerships. Shell, ExxonMobil, and Kendall have developed technology for creating lubricating oils, primarily motor lubricants, known as PurePlus, Mobil 1, and Liquid Titanium.

The automotive lubricants industry is expanding as demand for engine oils, braking fluids, and transmission fluids rise in both consumer and commercial vehicles. Increased motorbike sales are also predicted to support this rise during the projection period. The market is also likely to be driven by a shift in the trend toward green derivatives throughout the forecast period. The presence of regulatory organizations such as the EPA and REACH is also expected to benefit the total bio-based lubricants business. Rising per capita wealth and a growing desire for personalized mobility alternatives have fueled vehicle sales in several countries. OEMs are thus increasing their manufacturing capacity to satisfy rising regional and export demand. It has increased demand at the OEM level.

Impact of Covid-19 on the Industry

The fast spread of coronavirus has had a detrimental impact on the worldwide automotive lubricant business, as it has on other sectors. Lubricants are used in automobiles to minimize friction and maintain the smooth operation of the vehicle. Automotive lubricants can also be used for heat transfer, power transmission, and corrosion and rust prevention. Business halting, rigorous lockdowns, travel and transit bans, and interrupted supply chains have impacted the global automotive lubricant market's growth. Businesses are recovering from losses and market participants are focusing on creative solutions to stay afloat in the market by taking a strategic strategy.

The increase in the number of on-road cars, reliance on private vehicles for mobility, growth in disposable income, economic stability, and consumer affordability are some of the reasons driving the worldwide automotive lubricant market. The presence of an aging vehicle fleet creates a need for maintenance, propelling the worldwide automotive lubricant industry.

Market Drivers

High-performance vehicle needs are increasing market demand

Automotive lubricants are critical to ensure the appropriate and improved operation of consumer and industrial vehicles in a variety of harsh climatic conditions. Tractor engine oils, for example, not only safeguard and assure high tractor performance in harsh environments and field circumstances but also enable superior hardware compatibility of unshakeable toughness and quality. These are designed to aid in the correct operation of a vehicle engine and system over-temperatures ranging from -40 °C to more than 250 °C. Furthermore, these lubricants must withstand severe pressures in the engine ranging from 105 to 109 Pascal, as well as fuel impurities like soot and metal particles.

The need for automotive lubricants is being driven by increased system lifespan and protection

One of the main objectives of car owners is to keep their vehicles on the road. This is where lubricants come into play. Automotive lubricants safeguard against wear and tear of numerous vehicle components and systems by drastically decreasing friction between the parts and extending their life. Furthermore, as smaller and more complicated automotive systems become more prevalent in the industry, the demand for low viscosity and high-performance lubricants grows. This is likely to aid in the creation and improvement of high-quality lubricants in the coming years.

Furthermore, OEMs and politicians are working on universal lubricant grade standards, which are expected to spur the development of high-quality lubricants, particularly synthetic lubricants. The lubricant must fulfill the performance levels necessary for specific applications as well as those established by the relevant authorities. Some diesel engine oil grades, for example, must meet API CI-4, SAE 15W-40, JASO DH-1, CH-4/SL, ACEA E7-08, SJ, Mack EO-M+, and several others. These lubricants help improve fuel economy, lowering greenhouse gas emissions in vehicles.

Market Restraints

Vehicle technology innovation is dwindling the market

Automotive lubricants greatly extend the life of a vehicle by minimizing friction and preserving the solid moving parts. However, as lubricants and technology improve, the rate of expansion slows significantly. Synthetic lubricants are expanding their presence in the automobile sector due to the numerous benefits they provide, including improved fuel economy. This has also increased the period between oil changes in automobiles from 6 to 12 months to 18 to 24 months. These prolonged oil drain intervals are convenient for the user, who desires high-quality lubricants to safeguard their car. However, this has limited market volume growth and is likely to result in poor volume growth during the projection period. Furthermore, increased sales of electric cars, which do not utilize engine oil, are likely to threaten market growth in the future years.

The rising adoption of EV vehicles is dwindling the market

The growing popularity of electric vehicles poses a danger to the automotive lubricant sector. Because of its highly desirable properties, engine oil is a commonly consumed lubricant in the lubricant industry. The electric motor replaces the engine in electric cars. Furthermore, the existence of fewer components than in IC engine cars is expected to stymie the automotive lubricant industry.

AUTOMOTIVE LUBRICANTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

2% |

|

Segments Covered |

By Product Type, Fluid Type and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Shell International B.V.,Chevron Corporation, China National Petroleum Corporation, Exxon Mobil Corporation, Phillips 66 Company, Valvoline Corporation, B.P. PLC, Kluber Lubrication Munchen SE & Co. KG, FUCHS Petrolub SE, Petroleo Brasileiro S.A |

This research report on the global automotive lubricants market has been segmented and sub-segmented based on Product type, Fluid Type, Geography & region.

Global Automotive Lubricants Market- By Product Type

- Engine Oil

- Gear Oil

- Transmission Fluids

- Brake Fluids

- Coolants

- Greases

The industry has been divided into product categories such as engine oil, gear oil, transmission fluids, braking fluids, coolants, and greases. In 2021, engine oil was the largest category, accounting for more than 54.5 percent of total sales. Engine oil is often used in automobiles, diesel vehicles, and light-duty trucks. It aids in the preservation of viscosity, the maintenance of reliability, and the reduction of engine wear. It also helps keep the engine cool, corrosion-free, and clean.

It is critical to use the right engine oil for the vehicle, as using the wrong oil will harm the engine, use more gasoline, and raise carbon emissions. Major industry companies are investing much in research and development to create novel engine oils with higher-performing additives.

Gear oil, on the other hand, is a high viscosity lubricant that is commonly used to preserve gear and enable smooth lubrication transfer through the gear train. ABRO Industries, Inc., for example, has created gear oils with high-quality base stocks to give greater oxidation stability and extended service life. The oil has several outstanding features, including anti-foaming, corrosion, and metal wear resistance in cars. Furthermore, gear oils are used to give greater performance by increasing oxidation resistance, providing longer drain intervals, avoiding gear scuffing and scoring, and simplifying start-up even in frigid conditions.

During the predicted period, brake fluids will be the fastest-growing product. It is a hydraulic fluid that is frequently used in car hydraulic brake and clutch applications. The fundamental function of brake fluid is to provide an incompressible channel for conveying the driver's foot pressure on the brake pedal to lock friction material against the discs. The most common types of braking fluids on the market in the United States are DOT3, DOT4, and DOT5. Furthermore, for the braking system to function effectively, brake fluids must have particular qualities, such as a high boiling point, steady viscosity, corrosion resistance, and low compressibility.

Global Automotive Lubricants Market- By Fluid Type

- Conventional

- Semi-synthetic

- Synthetic

In 2020, conventional oil accounted for a sizable portion of the automotive lubricant industry. Furthermore, synthetic lubricant use is fast expanding, however, due to high costs, semi-synthetic and synthetic lubricants are mostly used in developed nations such as North America and Europe.

Global Automotive Lubricants Market- By Geography & Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

The worldwide automotive lubricant market has been divided into five regions: North America, Asia Pacific, Europe, South America, and the Middle East and Africa. Due to the enormous number of on-road cars in countries such as China, India, Japan, and South Korea, the Asia Pacific is a significant market for automotive lubricants. Consumption varies by nation and region; for example, semi-synthetic and synthetic lubricants are consumed more in South Korea than in India, and they are mostly used in commercial and passenger cars, but in India, they are primarily used in commercial vehicles and two-wheelers. Europe and North America are the second-and third-largest automotive lubricant users, respectively.

Global Automotive Lubricants Market- By Companies

- Shell International B.V.

- Chevron Corporation

- China National Petroleum Corporation

- Exxon Mobil Corporation

- Phillips 66 Company

- Valvoline Corporation

- B.P. PLC

- Kluber Lubrication Munchen SE & Co. KG

- FUCHS Petrolub SE

- Petroleo Brasileiro S.A

NOTABLE HAPPENINGS IN THE GLOBAL AUTOMOTIVE LUBRICANTS MARKET IN THE RECENT PAST:

- Product Launch: - In 2021, Euro Lubricants has introduced a synthetic engine oil RNT 5W-30 for IC engine cars, which has improved thermal stability and resistance to dust and corrosion. Kia Motors, Hyundai, Mitsubishi, Nissan, and Mazda are among the firms that use the product.

- Product Launch: - In 2021, Steelbird International debuted engine oils, grease, and fork oils in the automotive lubricants market. The company's primary goal in India is to supply lubricants for four-stroke two-wheelers. These oils meet all international and national requirements and have the ability to provide excellent value to customers.

- Business Expansion: - In 2021, Duckhams entered the Middle East market with the introduction of their vehicle lubricants in the UAE. Duckhams will be distributed in the UAE by Emirates for Universal Tyres. Both firms intend to extend their product offers in the Middle East, owing to their well-established market coverage and marketing capabilities.

- Business Expansion: - In 2020, Royal Dutch Shell PLC announced plans to expand the manufacturing capacity of its lubricant blending plant in Bekasi, Indonesia, to 300 million liters per year by 2022, helping to satisfy the rising local lubricant market in the coming years.

Chapter 1. GLOBAL AUTOMOTIVE LUBRICANTS MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL AUTOMOTIVE LUBRICANTS MARKET– Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. GLOBAL AUTOMOTIVE LUBRICANTS MARKET– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. GLOBAL AUTOMOTIVE LUBRICANTS MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5.GLOBAL AUTOMOTIVE LUBRICANTS MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL AUTOMOTIVE LUBRICANTS MARKET– By Product Type

6.1. Engine Oil

6.2. Gear Oil

6.3. Transmission Fluids

6.4. Brake Fluids

6.5. Coolants

6.6. Greases

Chapter 7. GLOBAL AUTOMOTIVE LUBRICANTS MARKET– By Fluid Type

7.1. Conventional

7.2. Semi-synthetic

7.3. Synthetic

Chapter 8. GLOBAL AUTOMOTIVE LUBRICANTS MARKET– By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. GLOBAL AUTOMOTIVE LUBRICANTS MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Shell International B.V.

9.2. Chevron Corporation

9.3. China National Petroleum Corporation

9.4. Exxon Mobil Corporation

9.5. Phillips 66 Company

9.6. Valvoline Corporation

9.7. B.P. PLC

9.8. Kluber Lubrication Munchen SE & Co. KG

9.9. FUCHS Petrolub SE

9.10. Petroleo Brasileiro S.A

Download Sample

Choose License Type

2500

4250

5250

6900