Power Optimizer Market Size (2024-2030)

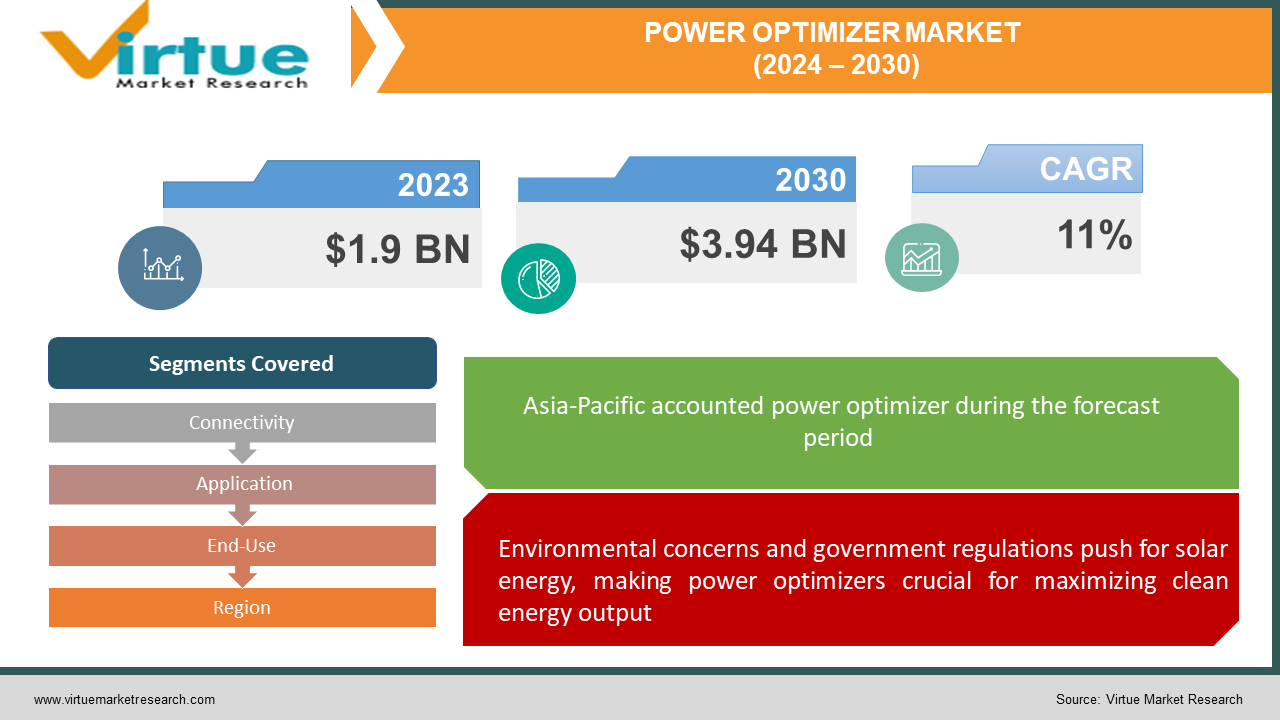

The power optimizer market was valued at USD 1.9 billion in 2023 and is projected to reach a market size of USD 3.94 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 11%.

The power optimizer market is thriving alongside the surge in solar energy adoption. These clever devices attached to individual solar panels act like tiny personal trainers, optimizing their efficiency and maximizing the entire system's performance. Several factors are fueling this growth. The push for renewable energy, with government regulations and growing environmental awareness taking center stage, is driving investment in solar farms and rooftop installations. Power optimizers play a crucial role here by ensuring each panel generates the most power possible, even if it is shaded or slightly mismatched with others. They achieve this through a technology called maximum power point tracking, essentially getting the most out of every ray of sunshine.

Key Market Insights:

By addressing issues like dust, shade, and small mismatches, power optimizers serve as individualized trainers for solar panels, optimizing efficiency and system performance and guaranteeing that every panel produces its maximum power through the use of technologies like maximum power point tracking. In particular, in the residential and commercial sectors where shading concerns are common, power optimizers have the opportunity to develop better features, integrate with cutting-edge monitoring systems, and fine-tune panel performance with the rise of smart grids and microgrids.

Due to government programs and massive solar installations, the Asia-Pacific region is leading the market in terms of growth. North America and Europe follow, while South America, the Middle East, and Africa also have strong development potential, pointing to a worldwide trend towards renewable energy solutions.

Power Optimizer Market Drivers:

Environmental concerns and government regulations push for solar energy, making power optimizers crucial for maximizing clean energy output.

Environmental concerns and government regulations are prioritizing clean energy sources like solar. This translates to increased investment in solar PV farms and rooftop installations. Power optimizers become even more crucial in these scenarios, ensuring each panel generates maximum power and contributes efficiently to the overall clean energy production.

Power optimizers address challenges like shading, dust, and mismatches, ensuring each solar panel performs at its peak.

Shading, dust buildup, or even slight variations in manufacturing can affect a solar panel's output. Power optimizers address these challenges by mitigating the effects of shading, dust, and minor mismatches between panels. This ensures each panel contributes its maximum potential, leading to increased overall energy production from your solar investment.

Maximum power point tracking technology continuously optimizes each panel's performance for maximum energy capture under any condition.

Maximum power point tracking (MPPT) is essential for power optimizers. This system constantly monitors each panel's ideal operating point to make sure it maximizes energy capture regardless of changing environmental factors like temperature swings and sunshine intensity. By constantly fine-tuning performance, MPPT maximizes the efficiency of your solar system.

Power optimizers isolate and optimize individual panels, minimizing system downtime and maximizing overall energy production.

Downtime in a solar system due to a single underperforming panel can significantly impact energy generation. Power optimizers play a crucial role here. By isolating and optimizing the performance of each panel, they ensure minimal system downtime and maximize overall energy production.

Built-in monitoring capabilities in power optimizers provide detailed data on each panel, simplifying maintenance and troubleshooting.

Power optimizers often come with built-in monitoring capabilities. This provides detailed data on the performance of each panel within the system. This makes monitoring and maintaining the solar installation significantly easier, allowing for proactive maintenance and troubleshooting, further improving system health and efficiency.

Power Optimizer Market Restraints and Challenges:

Despite the surge in popularity, the power optimization market faces some hurdles. The most significant challenge is cost. Power optimizers add extra expense to a solar panel installation compared to traditional inverters. This can be a major turn-off for budget-minded consumers, particularly in regions where price is a key factor. Additionally, integrating power optimizers can make the entire solar system design and installation more complex. This might require specialized knowledge and potentially lead to increased installation time and cost.

Another hurdle is awareness. Power optimizers are a relatively new technology compared to traditional inverters. There might be a knowledge gap among potential users, hindering wider adoption. People might not be fully aware of the benefits power optimizers offer in terms of maximizing energy production and system efficiency. Finally, competition from string inverter advancements is a factor to consider. String inverter manufacturers are constantly improving their technology, offering features that might address some of the advantages of power optimizers. This ongoing development could limit the market share for power optimizers if they fail to stay ahead of the curve.

Power Optimizer Market Opportunities:

The future of the power optimizer market looks bright, not just because it addresses current challenges but also due to exciting opportunities. The rise of smart grids and microgrids, with their emphasis on decentralized energy production, creates a perfect scenario for power optimizers. Their ability to fine-tune individual panel performance and isolate problems becomes even more critical in these distributed systems. Additionally, power optimizers can be seamlessly integrated with advanced monitoring systems, providing real-time data on each panel's health and overall system efficiency. This valuable information allows for proactive maintenance and performance optimization, making the technology even more attractive to a wider range of customers. In addition, manufacturers are always coming out with new and enhanced functions and communication protocols for their power optimizers. These advancements will further strengthen the value proposition for consumers. While utility-scale solar has been a major driver so far, significant growth is expected in the residential and commercial markets. Power optimizers' ability to tackle shading issues, a common problem in rooftop installations, makes them particularly appealing in these segments. Finally, with rising labor costs for solar installations, the cost advantage of traditional inverters might erode. In some cases, power optimizers can potentially simplify installations, making them a more cost-effective option in the long run.

POWER OPTIMIZER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11% |

|

Segments Covered |

By Connectivity, Application, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

SolarEdge Technologies, Inc., Enphase Energy, Tigo Energy, SunPower Corporation, Delta Energy Systems, Altenergy Power System, Inc., Kaco New Energy, Inc., Alencon Systems, LLC, I-Energy Co., Ltd. |

Power Optimizer Market Segmentation: By Connectivity

-

On-grid

-

Standalone

The on-grid connectivity segment is the largest and fastest-growing segment in the power optimizer market. It simplifies integrating solar panels into the main electricity grid through a central inverter. On-grid solar power systems are directly connected to the utility power grid and use a solar power system to generate electricity. Customers receive payment for the surplus electricity they feed back into the utility grid, while the excess power produced by the solar power system is sent there. Furthermore, the advantages include being relatively affordable, simple to install, and able to create passive revenue for both companies and homeowners from the excess energy produced by the system. The market will have plenty of opportunity to grow if the previously mentioned characteristics are there.

Power Optimizer Market Segmentation: By Application

-

Residential

-

Commercial

-

Utility-scale

Currently, the utility-scale segment holds the dominant position in the power optimizer market due to large-scale solar farm installations. However, the residential sector is expected to witness the fastest growth. The rising popularity of rooftop solar, particularly in regions with shading concerns, makes power optimizers highly attractive for homeowners. This shift is driven by increasing environmental awareness and growing investment in residential solar power solutions.

Power Optimizer Market Segmentation: By End-Use

-

Module-level MPPT (Maximum Power Point Tracking)

-

Advanced Power Line Communication

-

Monitoring components

-

Safety shutdown components

-

Others

Within the end-use segmentation, module-level MPPT (Maximum Power Point Tracking) is currently the most dominant segment, forming the core functionality of power optimizers and ensuring peak efficiency from each solar panel. However, the fastest-growing segment is expected to be advanced power line communication. This segment allows for real-time data monitoring and communication between individual panels and the system, becoming increasingly valuable as it integrates with advanced monitoring systems.

Power Optimizer Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Asia-Pacific is the largest and fastest-growing market. This dominance is fueled by the booming solar industry in giants like China and India. Government initiatives heavily promoting renewable energy, coupled with large-scale solar installations, create a significant demand for optimizers. These devices ensure each panel within these vast solar farms operates at peak efficiency, maximizing overall energy production. North America is poised for a significant surge in the power optimizer market. Government incentives and a growing appetite for solar energy, particularly in residential and commercial sectors, are key drivers. As homeowners and businesses embrace solar solutions, power optimizers become an attractive option due to their ability to address challenges like shading, often present in rooftop installations. Europe emerges as another major player in the power optimization market, driven by a strong focus on clean energy solutions. Stringent environmental regulations and rising energy costs across the continent make power optimizers an attractive proposition. These devices can significantly improve the efficiency of solar installations, contributing to Europe's clean energy goals and reducing dependence on fossil fuels. South America presents a developing market with vast solar potential. As investment in solar infrastructure increases across the region, power optimizers are likely to gain significant traction. Shading issues caused by geographical features are quite common in South America, and power optimizers offer an effective solution to mitigate their impact on solar energy generation. The Middle East and Africa show a growing focus on renewable energy and expanding economies; this region holds immense promise for future growth. As these regions prioritize sustainable energy solutions, power optimizers are likely to play a crucial role in maximizing the efficiency of solar power generation.

COVID-19 Impact Analysis on the Power Optimizer Market:

The COVID-19 pandemic impacted the power optimizer market. Lockdowns and travel restrictions disrupted global supply chains for the electronic components needed in these devices, leading to shortages and delays in production. This, coupled with the initial economic slowdown, caused a temporary dip in demand for solar energy solutions, including power optimizers. Businesses and individuals understandably held back on investments during this period of uncertainty. While overall demand dipped, the residential solar sector witnessed a relative increase. As people spent more time at home, interest in rooftop solar installations grew. Power optimizers became an attractive option for these projects due to their ability to address shading issues common in residential settings.

Looking ahead, the long-term outlook for the power optimizer market remains positive. As economies recover and the focus on clean energy intensifies, the demand for solar solutions is expected to rebound. Power optimizers will likely benefit from this renewed growth, driven by their efficiency-enhancing capabilities. The pandemic might have even opened doors to new opportunities. The increased focus on building resilience and self-sufficiency could lead to a rise in microgrid and off-grid solar applications, where power optimizers are particularly valuable due to their ability to enable optimal performance from individual panels. Overall, while the COVID-19 pandemic caused a temporary setback, the long-term trends suggest a bright future for the power optimizer market.

Latest Trends/ Developments:

The power optimizer market is a hotbed of innovation, constantly adapting to keep pace with the evolving landscape of solar energy. A key trend is the growing integration of smart grids and microgrids. Manufacturers are developing power optimizers that seamlessly communicate with these intelligent systems, allowing for real-time data exchange and optimized performance across the entire network. Artificial intelligence and machine learning are also making their mark. By analyzing data from power optimizers, these technologies can predict potential issues and optimize panel performance, maximizing system uptime through proactive maintenance. Security is paramount as power optimizers become more sophisticated, so manufacturers are prioritizing robust encryption and secure communication protocols to safeguard against cyber threats. The future might even see multi-functional power optimizers emerge, integrating functionalities like power storage management or even acting as built-in microinverters. Finally, sustainability is a growing concern throughout the entire lifecycle of these devices. Manufacturers are finding ways to incorporate recycled materials, develop energy-efficient production processes, and ensure proper end-of-life management for power optimizers. By embracing these trends and developments, the power optimizer market can ensure its products remain competitive and contribute to a future powered by clean and efficient solar energy.

Key Players:

-

SolarEdge Technologies, Inc.

-

Enphase Energy

-

Tigo Energy

-

SunPower Corporation

-

Delta Energy Systems

-

Altenergy Power System, Inc.

-

Kaco New Energy, Inc.

-

Alencon Systems, LLC

-

I-Energy Co., Ltd.

Chapter 1. POWER OPTIMIZER MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. POWER OPTIMIZER MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. POWER OPTIMIZER MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. POWER OPTIMIZER MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. POWER OPTIMIZER MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. POWER OPTIMIZER MARKET – By Connectivity

6.1 Introduction/Key Findings

6.2 On-grid

6.3 Standalone

6.4 Y-O-Y Growth trend Analysis By Connectivity

6.5 Absolute $ Opportunity Analysis By Connectivity, 2024-2030

Chapter 7. POWER OPTIMIZER MARKET – By Application

7.1 Introduction/Key Findings

7.2 Residential

7.3 Commercial

7.4 Utility-scale

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. POWER OPTIMIZER MARKET – By End-Use

8.1 Introduction/Key Findings

8.2 Module-level MPPT (Maximum Power Point Tracking)

8.3 Advanced Power Line Communication

8.4 Monitoring components

8.5 Safety shutdown components

8.6 Others

8.7 Y-O-Y Growth trend Analysis By End-Use

8.8 Absolute $ Opportunity Analysis By End-Use, 2024-2030

Chapter 9. POWER OPTIMIZER MARKET , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Connectivity

9.1.3 By Application

9.1.4 By End-Use

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Connectivity

9.2.3 By Application

9.2.4 By End-Use

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Connectivity

9.3.3 By Application

9.3.4 By End-Use

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Connectivity

9.4.3 By Application

9.4.4 By End-Use

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Connectivity

9.5.3 By Application

9.5.4 By End-Use

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. POWER OPTIMIZER MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 SolarEdge Technologies, Inc.

10.2 Enphase Energy

10.3 Tigo Energy

10.4 SunPower Corporation

10.5 Delta Energy Systems

10.6 Altenergy Power System, Inc.

10.7 Kaco New Energy, Inc.

10.8 Alencon Systems, LLC

10.9 I-Energy Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The power optimizer market was valued at USD 1.9 billion in 2023 and is projected to reach a market size of USD 3.94 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 11%.

Renewable energy push, optimizing performance for every panel, efficiency through technology, a focus on reliability and system uptime, and enhanced monitoring and maintenance are the main drivers.

Based on end-use, the market is divided into module-level MPPT (maximum power point tracking), advanced power line communication, monitoring components, safety shutdown components, and others.

Asia-Pacific region reigns supreme in the power optimizer market, driven by the booming solar industry in giants like China and India.

SolarEdge Technologies, Inc., Enphase Energy, Tigo Energy, SunPower Corporation, Delta Energy Systems, Altenergy Power System, Inc., Kaco New Energy, Inc., Alencon Systems, LLC, and I-Energy Co., Ltd. are the major players.