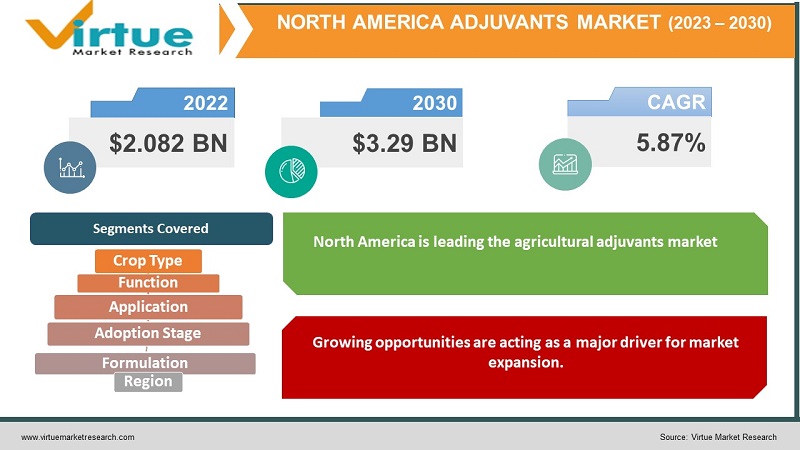

North America Adjuvants Market Size (2023-2030)

The adjuvants market in North America is believed to reach USD 3.29 billion by 2030 from USD 2.082. billion in 2022 growing with a CAGR of 5.87% during 2023-2030.

Recent Market Developments

On September 08, 2021, Corteva Agriscience signed an agreement with Gaiago for validating, advancing, and commercializing bio fungicides for farmers globally. https://www.agribusinessglobal.com/biologicals/corteva-agriscience-signs-agreement-with-gaiago-to-develop-and-distribute-biofungicide-solutions-globally/

Segment Analysis

The North American adjuvants market has been segmented and sub-segmented based on the function, formulation, adoption stage, application, type, crop type.

North America Adjuvants Market By - Crop Type

-

- Cereals & Grains

- Corn

- Wheat

- Rice

- Others

- Oilseeds & Pulses

- Soybean

- Others

- Fruits & Vegetables

- Others

By crop type, the cereals and grains segment is believed to be the quickest-growing segment in the adjuvants market.

North America Adjuvants Market By - Function

- Activator Adjuvant

- Surfactant

- Oil-based adjuvant

- Utility Adjuvant

- Compatibility Agent

- Buffers/ Acidifiers

- Antifoam agents

- Drift Control agents

- Water conditioners

- Others

North America Adjuvants Market By- Application

- Herbicides

- Fungicides

- Insecticides

By application, the herbicide segment is expected to dominate the adjuvants market in the agricultural sector. Cereals and grains account for the largest consumption of herbicides in North America.

North America Adjuvants Market By - Adoption Stage

- In-formulation

- Tank-mix

The tank-mix adoption stage segment is leading the adjuvants market in the agricultural field. The farmer's tank is added with tank-mix adjuvants along with pesticides for developing the performance of the active .ingredients.

North America Adjuvants Market By - Formulation

- Suspension concentrates

- Emulsifiable concentrates

By formulation, the suspension concentrates segment led the agricultural adjuvants market in North America. These are solid active ingredients and can be soluble in water. The segment has achieved familiarity because of its numerous advantages like the dearth of dust, easy use, and efficiency when compared to formulation types like wettable powder formulations. wettable

North America Adjuvants Market By Region

North America is leading the agricultural adjuvants market with the highest share globally. North America is one of the largest markets for developed crop protection technology.

United States In the U.S., the use of crop protection chemicals is high as 2.3kg/ hectare in 2018. As per the U.S population, the global human population has raised four times in the past 100 years and by the end of 2050, the value is projected to reach 9.5 billion.

The U.S Environmental protection agency act (EPA) regulates adjuvant formulations. The act doesn't strictly regulate the manufacture and utilization of adjuvant products.

Canada is the second most contributor in the adjuvants market in the agriculture field.

Top key players in the North American Adjuvants market

Corteva (US) is one leading vendor in the adjuvants market in North America.

COVID-19 Impact

The novel coronavirus (COVID-19) has originated in Wuhan, China in December 2019. The WHO has announced a world pandemic and an emergency public health issue. The pandemic is dropping among a few countries and regions. At the beginning of the pandemic in 2020, the cost of the commodities has shown an outcome in the highest adjuvant prices. However, the pandemic has created inequality in demand and supply inequality in both the demand and supply quantities. These factors obstructed the adjuvants market in the region.

Chapter 1. NORTH AMERICA ADJUVANTS MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. NORTH AMERICA ADJUVANTS MARKET– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. NORTH AMERICA ADJUVANTS MARKET– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. NORTH AMERICA ADJUVANTS MARKET- Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. NORTH AMERICA ADJUVANTS MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. NORTH AMERICA ADJUVANTS MARKET– By Crop Type

6.1. Cereals & Grains

6.1.1. Corn

6.1.2. Wheat

6.1.3. Rice

6.1.4. Others

6.2. Oilseeds & Pulses

6.2.1. Soybean

6.2.2. Others

6.3. Fruits & Vegetables

6.4. Others

Chapter 7. NORTH AMERICA ADJUVANTS MARKET– By Function

7.1. Activator Adjuvant

7.1.1. Surfactant

7.1.2. Oil-based adjuvant

7.2. Utility Adjuvant

7.2.1. Compatibility Agent

7.2.2. Buffers/ Acidifiers

7.2.3. Antifoam agents

7.2.4. Drift Control agents

7.2.5. Water conditioners

7.2.6. Others

Chapter 8. NORTH AMERICA ADJUVANTS MARKET– By Application

8.1 Herbicides

8.2. Fungicides

8.3. Insecticides

Chapter 9. NORTH AMERICA ADJUVANTS MARKET– By Adoption Stage

9.1 In-formulation

9.2. Tank-mix

Chapter 10. NORTH AMERICA ADJUVANTS MARKET– By Formulation

10.1 Suspension concentrates

10.2. Emulsifiable concentrates

Chapter 11. NORTH AMERICA ADJUVANTS MARKET– By Region

11.1. North America

Chapter 12. NORTH AMERICA ADJUVANTS MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

12.1. Corteva (US)

Download Sample

Choose License Type

2500

3400

3900

4600