Equity Management Software Market Size (2024 – 2030)

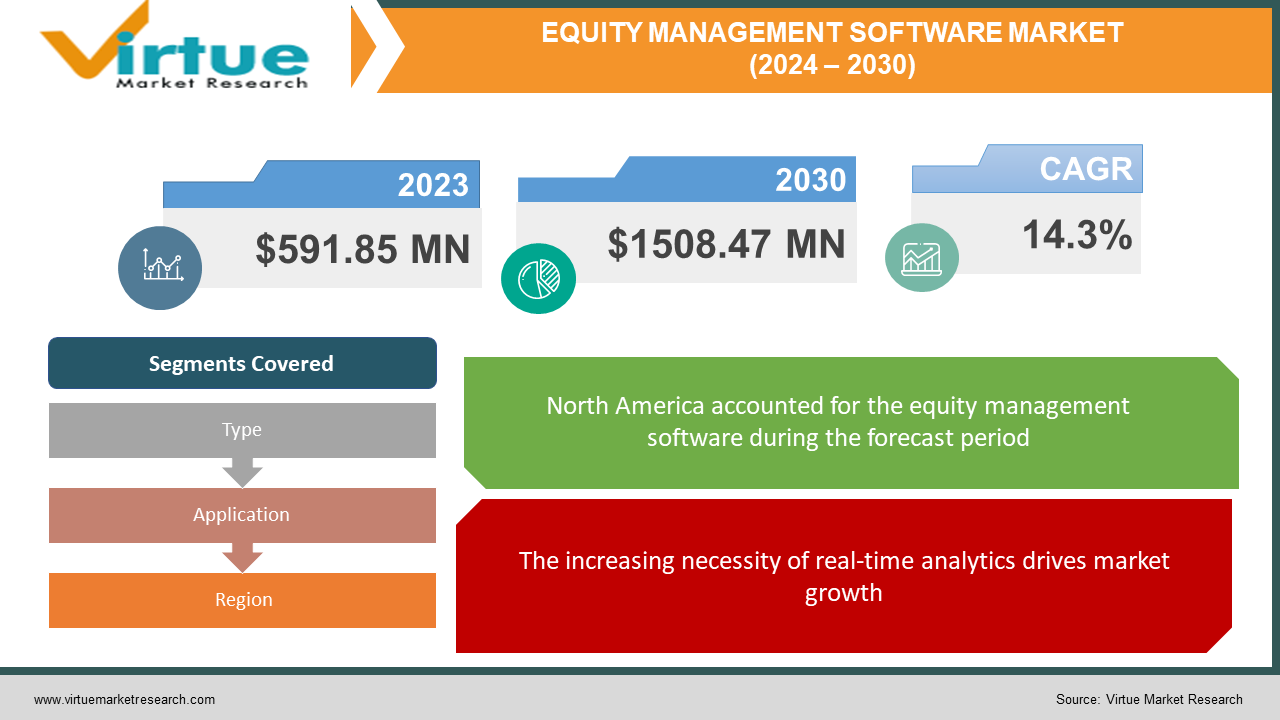

The Equity Management Software Market was valued at USD 591.85 million in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 1508.47 million by 2030, growing at a CAGR of 14.3%.

Key Market Insights:

Equity management entails the establishment and administration of ownership stakes within a company. Various functionalities and capabilities embedded in these software solutions enable users to monitor, evaluate, and oversee their stock portfolios. The evolution of equity management software has been spurred by diverse trends and influences. Initially, the escalating intricacies of financial markets and the proliferation of investment avenues underscored the significance of robust tools for managing equity holdings to investors. Equity management software now offers a centralized platform to aid users in making informed decisions by tracking and assessing investments comprehensively. Furthermore, technological advancements and the availability of real-time data have transformed the landscape of equity management significantly. By interfacing with multiple data sources, these software solutions afford users access to up-to-date financial reports, market news, and data.

The escalating demand for real-time analytics, coupled with increased adoption of equity management software among large and medium-sized enterprises, streamlines organizational processes and benefits from expert advisory support. Additionally, the ongoing trend toward digitization and technological innovation, alongside the development of software with enhanced customization features, is poised to present lucrative growth prospects for the market in the forecast period. Conversely, potential system failures and diminished reliance on physical audits serve as constraints to the expansion of the equity management software market.

Equity Management Software Market Drivers:

The increasing necessity of real-time analytics drives market growth.

The growth of the equity management software market is significantly propelled by the increasing demand for real-time analytics solutions. Real-time analytics, defined as the ability to gather, process, and interpret data instantaneously to provide timely and actionable insights to organizations, plays a pivotal role in equity management. By monitoring and analyzing equity plans, grants, and transactions in real time, businesses can enhance decision-making processes and efficiently manage equity-related activities. Real-time analytics facilitates the continuous tracking and monitoring of equity performance and valuation, offering businesses clear and accurate insights into the current worth of their stock holdings. With access to fast information on the value of stock options and equity grants, organizations can make informed decisions regarding equity-based incentives and employee compensation, allowing them to adapt their equity plans according to the dynamic conditions of the equity management software market.

Moreover, real-time analytics enables firms to swiftly identify and address potential risks or issues associated with their stock management processes. By monitoring equity-related operations in real time, companies can promptly detect inconsistencies, errors, or compliance issues and take immediate corrective actions. This proactive approach helps businesses maintain the integrity and reliability of their equity data while mitigating adverse consequences such as regulatory fines or reputational damage. Additionally, real-time analytics provides valuable insights into the effectiveness and outcomes of grants and equity initiatives, allowing organizations to optimize their equity management strategies by uncovering trends, patterns, and correlations through the analysis of real-time data.

Equity Management Software Market Restraints and Challenges:

High costs and maintenance hinder market growth.

The implementation and upkeep of Equity Management Software can incur significant expenses for businesses. This entails the initial investment in purchasing the software, integrating it with its current systems, and potentially hiring specialized personnel to oversee its management. Such expenditures pose a considerable challenge for small businesses, limiting their ability to afford and adopt this technology. Consequently, many small businesses may opt to abstain from entering the market altogether due to financial constraints associated with accessing Equity Management Software.

Limited scalability negatively hampers market growth.

A notable limitation of numerous current Equity Management Software solutions lies in their lack of scalability. This implies that businesses might encounter difficulties in expanding their user base or incorporating new features without upgrading their current system. Such upgrades can entail substantial expenses and time investments, potentially deterring businesses from pursuing entry into the market. Consequently, the lack of scalability in existing Equity Management Software solutions may prompt businesses to altogether avoid engaging with the market.

Equity Management Software Market Opportunities:

Equity management encompasses the establishment and administration of ownership interests within large and medium-sized enterprises. Employed as a pivotal tool for managing a company's equity, equity management software is increasingly embraced by organizations of this scale. Its functionalities include tracking and documenting ownership changes, generating reports, engaging with stakeholders, advising senior management, and ensuring compliance. Moreover, it is designed to streamline revenue management processes, offering a solution to the challenges posed by using spreadsheets for corporate capitalization tables and the time-consuming paperwork typical in enterprises. The remarkable growth of the equity management software market can be attributed to the evolving needs of businesses worldwide. Consequently, the escalating adoption of equity management software among large and medium-sized corporations is driving global market expansion.

EQUITY MANAGEMENT SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

14.3% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Certent, Carta, Solium, Capdesk, Imagineer Technology Group, Computershare , Preqin Solutions, Koger, Altvia Solutions, Global Shares |

Equity Management Software Market Segmentation: By Type

-

Basic ($Under 50/Month)

-

Standard ($50-100/Month)

-

Senior ($Above 100/Month)

The basic segment, priced under $50 per month, currently holds the largest market share and is anticipated to maintain its dominance throughout the forecast period in the equity management software market. This is primarily attributed to businesses utilizing basic equity management software tools to track and oversee their company shares, thus driving growth within this segment on a global scale. Conversely, the senior segment, priced above $100 per month, is projected to experience the most substantial growth during the forecast period. This growth is anticipated because senior equity management software, priced above $100 per month, offers comprehensive features on a unified platform, enabling companies to efficiently manage shareholder communication, conduct meetings, and generate reports.

Equity Management Software Market Segmentation: By Application

-

Private Corporation

-

Start-ups

-

Listed Company

-

Others

Start-ups often face the challenge of efficiently managing their equity assets, and Global Equity Management Software provides a solution by facilitating the monitoring of equity shares, analysis of financial data, and handling of investor relations. This software serves as a valuable tool for start-ups, enabling them to efficiently oversee their equity assets with access to up-to-date financial information and comprehensive tracking capabilities.

Private companies acknowledge the importance of their equity assets; however, many lack the necessary resources for effective management. Global Equity Management Software emerges as a practical solution for evaluating a company's performance and expansion, monitoring current market positions, evaluating the effectiveness of promotional strategies, ensuring the accuracy of financial data, and assessing investor relations.

Equity Management Software Market Segmentation- By Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America has achieved the highest growth in the equity management software market, primarily driven by the increasing adoption of equity management software within administrative spheres, thereby fueling overall market expansion in the region. The growing interest in equity management software among large-scale organizations is observed to enhance operational efficiency. Conversely, Asia-Pacific is poised to exhibit the most significant growth during the forecast period, attributed to the proliferation of advanced technologies such as digital financial systems and cloud computing, among others, thereby contributing to the global growth of the equity management software market.

In Latin America, the equity management software market is experiencing rapid growth due to the escalating demand for digital solutions to manage equity investments across the region. Additionally, the growing presence of venture capital firms and private equity firms in Latin America further propels the expansion of the market in the region.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has heightened financial concerns for both companies and individuals. In response to this, many organizations have turned to equity management software to better track their net worth and maximize profits. This increased focus on managing equity effectively is expected to drive growth in the equity management software market in the coming years.

Latest Trends/ Developments:

-

In June 2023, beqom introduced an innovative solution tailored for large organizations to manage pay equity effectively. With the proliferation of equal pay regulations globally and the increasing emphasis on fair and competitive compensation to attract talent, beqom's new software aims to address pay disparities comprehensively. Similar initiatives by market players operating on both global and regional scales are anticipated to drive significant growth in the equity management software market during the forecast period.

-

In November 2023, Lunate successfully secured $50 billion in assets under management to develop a specialized wealth management technology platform catering to wealth and asset managers in the Middle East and North Africa (MENA) region. This new financial technology venture addresses the escalating demand for equity management platforms in the Middle East, serving wealth and asset managers, private banks, and investment firms. The platform offers an end-to-end digital solution encompassing various services such as client onboarding, financial planning, portfolio construction, trading and rebalancing, risk management reporting, and analytics.

Key Players:

These are the top 10 players in the Equity Management Software Market: -

-

Certent

-

Carta

-

Solium

-

Capdesk

-

Imagineer Technology Group

-

Computershare

-

Preqin Solutions

-

Koger

-

Altvia Solutions

-

Global Shares

Chapter 1. EQUITY MANAGEMENT SOFTWARE MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. EQUITY MANAGEMENT SOFTWARE MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. EQUITY MANAGEMENT SOFTWARE MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. EQUITY MANAGEMENT SOFTWARE MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. EQUITY MANAGEMENT SOFTWARE MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. EQUITY MANAGEMENT SOFTWARE MARKET – By Type

6.1 Introduction/Key Findings

6.2 Basic ($Under 50/Month)

6.3 Standard ($50-100/Month)

6.4 Senior ($Above 100/Month)

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. EQUITY MANAGEMENT SOFTWARE MARKET – By Application

7.1 Introduction/Key Findings

7.2 Private Corporation

7.3 Start-ups

7.4 Listed Company

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. EQUITY MANAGEMENT SOFTWARE MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. EQUITY MANAGEMENT SOFTWARE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Certent

9.2 Carta

9.3 Solium

9.4 Capdesk

9.5 Imagineer Technology Group

9.6 Computershare

9.7 Preqin Solutions

9.8 Koger

9.9 Altvia Solutions

9.10 Global Shares

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Equity management entails the establishment and administration of ownership stakes within a company. Various functionalities and capabilities embedded in these software solutions enable users to monitor, evaluate, and oversee their stock portfolios. The evolution of equity management software has been spurred by diverse trends and influences.

The top players operating in the Equity Management Software Market are - Certent, Carta, Solium, Capdesk, Imagineer Technology Group, Computershare, Preqin Solutions, Koger, Altvia Solutions, and Global Shares.

The COVID-19 pandemic has heightened financial concerns for both companies and individuals. In response to this, many organizations have turned to equity management software to better track their net worth and maximize profits.

Equity management encompasses the establishment and administration of ownership interests within large and medium-sized enterprises. Employed as a pivotal tool for managing a company's equity, equity management software is increasingly embraced by organizations of this scale.

In Latin America, the equity management software market is experiencing rapid growth due to the escalating demand for digital solutions to manage equity investments across the region. Factors such as the region's expanding population, rising disposable income, and increasing awareness of the advantages of equity management software are all driving market growth.